Longevity risk refers to the possibility that retirees live longer than expected, potentially outlasting their pension savings and creating financial shortfalls. Investment risk involves the uncertainty of returns on pension fund assets, which can fluctuate due to market volatility and affect the fund's ability to meet future obligations. Balancing these risks is crucial for pension plans to ensure sustainable payouts and financial security for beneficiaries.

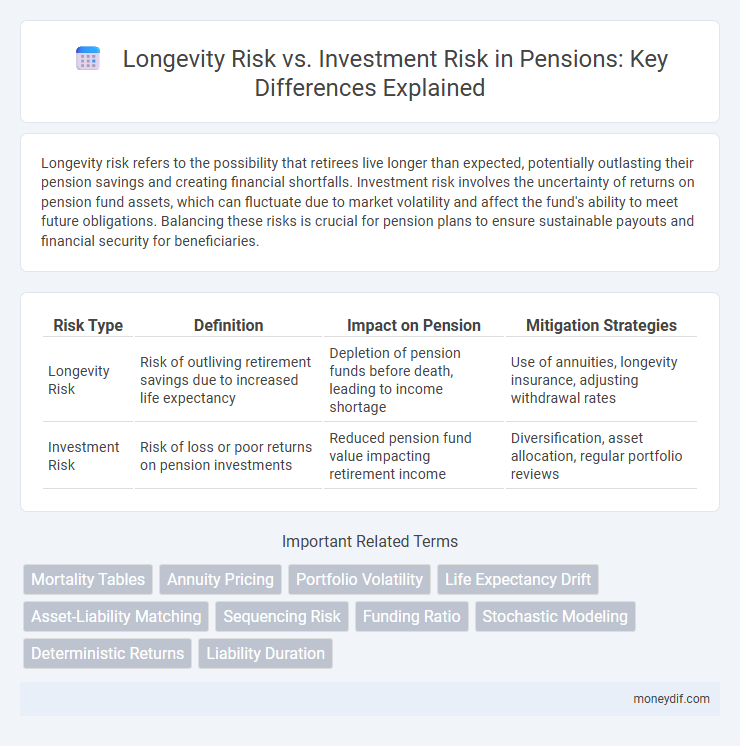

Table of Comparison

| Risk Type | Definition | Impact on Pension | Mitigation Strategies |

|---|---|---|---|

| Longevity Risk | Risk of outliving retirement savings due to increased life expectancy | Depletion of pension funds before death, leading to income shortage | Use of annuities, longevity insurance, adjusting withdrawal rates |

| Investment Risk | Risk of loss or poor returns on pension investments | Reduced pension fund value impacting retirement income | Diversification, asset allocation, regular portfolio reviews |

Understanding Longevity Risk in Pensions

Longevity risk in pensions refers to the possibility that retirees live longer than expected, causing pension funds to exhaust their assets prematurely. This risk challenges actuarial assumptions and necessitates more conservative funding approaches to ensure sufficient payouts throughout retirement. Managing longevity risk is essential to maintaining pension solvency, differentiating it from investment risk, which relates to market performance fluctuations.

What Is Investment Risk in Retirement Planning?

Investment risk in retirement planning refers to the potential for financial losses or lower-than-expected returns on retirement assets due to market volatility, economic downturns, or poor investment choices. This risk affects the ability to maintain a stable income throughout retirement, making it crucial to balance asset allocation and diversify investments. Managing investment risk involves strategies such as adjusting portfolio risk tolerance as retirement approaches and incorporating low-risk, income-generating assets to protect capital.

Key Differences: Longevity Risk vs Investment Risk

Longevity risk refers to the possibility that pensioners outlive their retirement savings, posing a challenge for sustainable pension payouts, whereas investment risk involves potential losses from fluctuations in asset values impacting the pension fund's financial health. Longevity risk primarily affects the duration and adequacy of pension benefits, while investment risk influences the growth and stability of the pension portfolio. Effective pension management requires balancing these risks through strategies like annuities and diversified asset allocation to ensure long-term retirement security.

How Longevity Risk Impacts Retirement Funds

Longevity risk significantly impacts retirement funds by increasing the probability that retirees will outlive their savings, thereby straining pension plan reserves and necessitating larger initial contributions or reduced payouts. This risk forces pension fund managers to adopt conservative investment strategies and consider annuities or longevity insurance to mitigate potential shortfalls. Failure to address longevity risk can lead to underfunded pension plans and jeopardize retirees' financial security over an extended lifespan.

Investment Risk: Effects on Pension Outcomes

Investment risk significantly influences pension outcomes by affecting the growth and stability of retirement funds, where market volatility can lead to unpredictable returns and potential shortfalls. Poor investment performance reduces the accumulation of pension assets, threatening individuals' ability to sustain income throughout retirement. Effective risk management strategies, including diversification and prudent asset allocation, are essential to mitigating investment risk and securing reliable pension benefits.

Managing Longevity Risk: Strategies for Retirees

Longevity risk, the uncertainty of outliving one's retirement savings, can be managed through strategies such as purchasing annuities, which provide guaranteed income for life, and adopting a systematic withdrawal plan tailored to individual life expectancy. Diversifying investments to balance growth and income ensures retirees maintain sufficient funds while mitigating market volatility. Incorporating longevity risk insurance products and regular financial reviews enhances income stability throughout retirement's extended horizon.

Mitigating Investment Risk in Pension Portfolios

Mitigating investment risk in pension portfolios involves diversifying assets across equities, bonds, and alternative investments to balance return potential and volatility. Employing dynamic asset allocation strategies and incorporating liability-driven investments align portfolio risks with pension liabilities, reducing sensitivity to market fluctuations. Utilizing risk management tools like derivatives and regularly stress-testing portfolios enhances resilience against adverse market conditions, ensuring sustainable pension fund growth.

Balancing Longevity and Investment Risks

Balancing longevity risk and investment risk in pension planning requires precise actuarial modeling to ensure sustainable payouts over retirees' lifespans while achieving target returns. Incorporating dynamic asset allocation strategies and longevity hedging instruments, such as longevity swaps or annuities, can mitigate the financial impact of unexpected lifespan increases. Effective risk management integrates demographic uncertainty with market volatility, aligning investment portfolios with expected mortality trends and funding status.

The Role of Annuities in Addressing Longevity Risk

Longevity risk poses a significant challenge in pension planning as individuals may outlive their retirement savings, leading to inadequate income during later years. Annuities play a crucial role in mitigating this risk by providing a guaranteed income stream for life, effectively transferring the longevity risk from retirees to insurance providers. Unlike investment risk, which involves market fluctuations impacting portfolio values, annuities offer stability by ensuring consistent payments regardless of market performance.

Pension Planning: Navigating Longevity and Investment Challenges

Longevity risk in pension planning refers to the uncertainty of outliving retirement savings, posing a critical challenge for ensuring sustainable income throughout extended lifespans. Investment risk involves market volatility and asset allocation uncertainties that can impact the growth and preservation of pension funds. Effective pension strategies balance these risks through diversified portfolios and longevity insurance products to secure steady retirement income.

Important Terms

Mortality Tables

Mortality tables, which provide statistical data on life expectancy and death rates, are essential for assessing longevity risk in pension planning and insurance. Accurate mortality projections enable investors to balance longevity risk-- the uncertainty of lifespan extension-- against investment risk, ensuring sustainable payouts and optimized asset allocation.

Annuity Pricing

Annuity pricing primarily balances longevity risk, which is the uncertainty of lifespan duration, against investment risk, reflecting market return variability, to ensure sustainable payout streams.

Portfolio Volatility

Portfolio volatility directly impacts longevity risk by influencing the uncertainty of investment returns needed to sustain withdrawals over an extended retirement period compared to the typically shorter timeframe of investment risk.

Life Expectancy Drift

Life Expectancy Drift increases longevity risk by extending projected lifespans beyond initial models, challenging investment risk management strategies for pension funds and annuity providers.

Asset-Liability Matching

Asset-liability matching mitigates longevity risk by aligning investment strategies with projected liabilities to optimize returns while ensuring sufficient funds to cover extended life expectancies.

Sequencing Risk

Sequencing risk significantly impacts retirees by exacerbating longevity risk through early losses in investment portfolios, reducing the funds available to sustain income over extended lifespans.

Funding Ratio

The funding ratio reflects the balance between assets and liabilities, with longevity risk increasing needed reserves due to longer life expectancies and investment risk affecting asset returns and portfolio stability.

Stochastic Modeling

Stochastic modeling quantifies Longevity Risk by simulating uncertain future lifespans and mortality trends, providing probabilistic forecasts essential for pension funds and insurance companies to manage payouts over extended periods. It contrasts with Investment Risk modeling, which focuses on asset return volatility and market fluctuations, enabling balanced strategies that hedge against both lifespan uncertainties and financial market dynamics.

Deterministic Returns

Deterministic returns reduce investment risk by providing fixed income streams, helping to mitigate longevity risk linked to uncertain lifespan and financial needs.

Liability Duration

Liability duration measures the sensitivity of pension or insurance liabilities to interest rate changes, crucial for managing longevity risk which affects the timing and magnitude of payouts, while investment risk influences asset returns but does not directly alter liability cash flows.

Longevity Risk vs Investment Risk Infographic

moneydif.com

moneydif.com