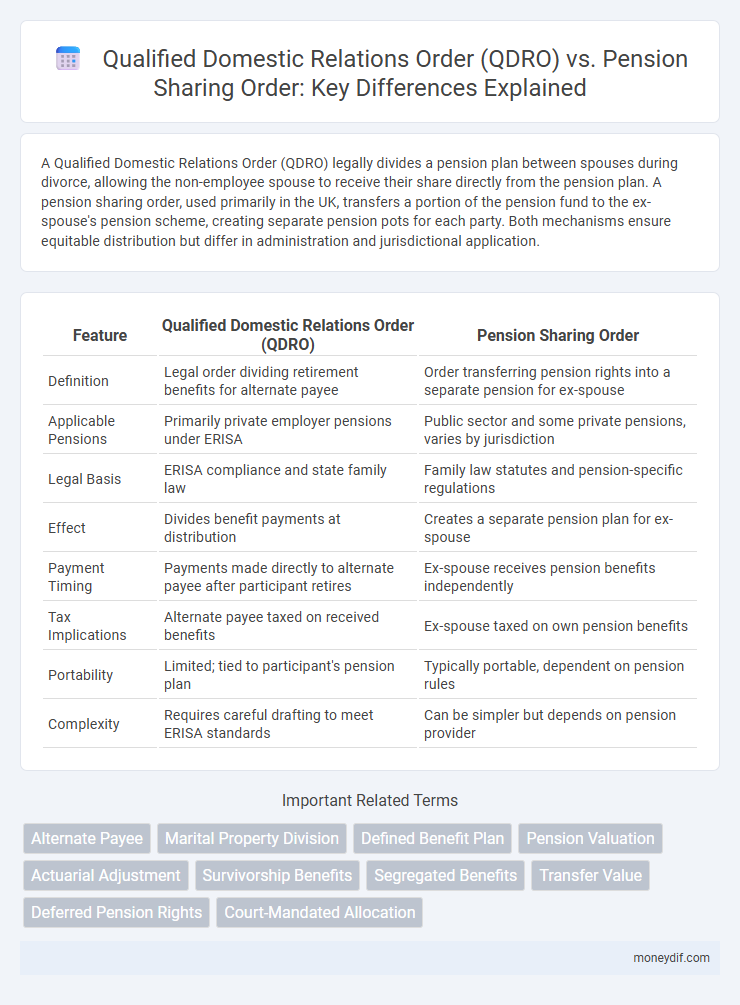

A Qualified Domestic Relations Order (QDRO) legally divides a pension plan between spouses during divorce, allowing the non-employee spouse to receive their share directly from the pension plan. A pension sharing order, used primarily in the UK, transfers a portion of the pension fund to the ex-spouse's pension scheme, creating separate pension pots for each party. Both mechanisms ensure equitable distribution but differ in administration and jurisdictional application.

Table of Comparison

| Feature | Qualified Domestic Relations Order (QDRO) | Pension Sharing Order |

|---|---|---|

| Definition | Legal order dividing retirement benefits for alternate payee | Order transferring pension rights into a separate pension for ex-spouse |

| Applicable Pensions | Primarily private employer pensions under ERISA | Public sector and some private pensions, varies by jurisdiction |

| Legal Basis | ERISA compliance and state family law | Family law statutes and pension-specific regulations |

| Effect | Divides benefit payments at distribution | Creates a separate pension plan for ex-spouse |

| Payment Timing | Payments made directly to alternate payee after participant retires | Ex-spouse receives pension benefits independently |

| Tax Implications | Alternate payee taxed on received benefits | Ex-spouse taxed on own pension benefits |

| Portability | Limited; tied to participant's pension plan | Typically portable, dependent on pension rules |

| Complexity | Requires careful drafting to meet ERISA standards | Can be simpler but depends on pension provider |

Understanding QDROs and Pension Sharing Orders

Qualified Domestic Relations Orders (QDROs) are legal orders that recognize the right of an alternate payee, such as a former spouse, to receive a portion of a participant's pension benefits without triggering tax penalties. Pension Sharing Orders, primarily used in the UK, divide pension assets between spouses or civil partners at the point of divorce, creating separate pension pots based on an agreed percentage. Understanding the distinctions between QDROs and Pension Sharing Orders is crucial for accurate pension division and compliance with jurisdiction-specific regulations.

Key Differences Between QDROs and Pension Sharing Orders

Qualified Domestic Relations Orders (QDROs) specifically apply to retirement plans governed by ERISA, allowing a non-employee spouse to receive a portion of the employee's pension benefits without altering the plan itself. Pension sharing orders, used primarily in the UK, divide the pension fund at the time of divorce, creating separate individual pension pots for each party. The key difference lies in QDROs functioning as an entitlement to future benefits, whereas pension sharing orders transfer ownership of pension assets immediately.

Legal Framework: QDROs vs Pension Sharing Orders

Qualified Domestic Relations Orders (QDROs) are governed by the Employee Retirement Income Security Act (ERISA) and specifically apply to private-sector retirement plans, enabling the division of pension benefits without violating federal law. Pension Sharing Orders operate under state pension laws and court orders, typically used for public-sector pensions, allowing courts to divide pension assets directly between spouses upon divorce. The key legal distinction lies in jurisdiction: QDROs require federal compliance and approval by the pension plan administrator, whereas Pension Sharing Orders are state-mandated and enforceable under local family law statutes.

Eligibility Criteria for QDROs and Pension Sharing Orders

Eligibility criteria for Qualified Domestic Relations Orders (QDROs) require the order to be part of a divorce or legal separation agreement, specifying how retirement benefits from employer-sponsored plans like 401(k)s or pensions are divided. Pension Sharing Orders, primarily used in UK jurisdictions, must be issued by a court or recognized tribunal and stipulate the division of pension assets between spouses or civil partners upon divorce or dissolution. Both orders demand precise identification of parties, compliance with plan or scheme rules, and clear instructions on benefit allocation to ensure enforceability and accurate benefit distribution.

Process for Obtaining a QDRO

Obtaining a Qualified Domestic Relations Order (QDRO) involves a legal procedure where a court order is issued to divide and recognize pension benefits for a non-employee spouse during divorce proceedings. The process requires careful drafting to comply with the specific pension plan's rules and federal regulations under ERISA (Employee Retirement Income Security Act). After court approval, the QDRO is submitted to the pension plan administrator for validation and implementation, ensuring accurate benefit allocation.

Process for Securing a Pension Sharing Order

The process for securing a Pension Sharing Order involves submitting an application to the court during divorce proceedings, where detailed financial disclosures are required to assess the pension's value. The court evaluates the pension assets and issues the order, specifying the percentage or amount to be allocated to the non-member spouse, which is then implemented by the pension scheme administrator. Unlike a Qualified Domestic Relations Order (QDRO) primarily used in the U.S., the Pension Sharing Order is a UK-specific legal mechanism that requires strict adherence to the Pension Act 1995 regulations and court procedures.

Tax Implications of QDROs and Pension Sharing Orders

Qualified Domestic Relations Orders (QDROs) allow the non-employee spouse to receive a portion of the pension benefits directly, typically deferring tax liability until distributions are made. Pension Sharing Orders, common in the UK, divide pension assets at the point of divorce, and each party handles taxes independently upon withdrawal. Unlike QDROs, Pension Sharing Orders generally result in immediate division of pension funds, affecting tax treatment based on the rules governing each party's pension scheme.

Impact on Retirement Benefits: QDROs vs Pension Sharing Orders

Qualified Domestic Relations Orders (QDROs) specifically apply to private sector pensions governed by ERISA and allow a portion of the participant's pension benefits to be paid directly to an alternate payee, typically a former spouse, without altering the participant's total retirement benefit. Pension sharing orders, commonly used in public sector pensions, divide the pension benefits into two separate accounts, resulting in a permanent reduction of the participant's future retirement benefits while granting the alternate payee independent ownership. The impact on retirement benefits differs fundamentally: QDROs create a payment obligation without diminishing the original benefit pool, whereas pension sharing orders adjust and reduce the participant's accrued benefits to fund the alternate payee's share.

Common Mistakes in Pension Division Orders

Common mistakes in pension division orders include misclassifying a Qualified Domestic Relations Order (QDRO) as a pension sharing order or vice versa, leading to improper pension division and tax implications. Failing to clearly define the pension interest type and timing results in disputes over benefits and administrative delays. Ensuring precise language and compliance with plan-specific rules prevents costly errors and protects parties' retirement assets.

Choosing the Right order: QDRO or Pension Sharing Order

Choosing the right order between a Qualified Domestic Relations Order (QDRO) and a Pension Sharing Order depends on jurisdiction and specific pension plan rules. A QDRO allows the alternate payee to receive a portion of the participant's pension benefits directly from the plan, often used in U.S. federal systems. Pension Sharing Orders, common in UK pensions, split the pension fund at divorce, creating separate entitlements for each party, impacting how benefits are accumulated and paid.

Important Terms

Alternate Payee

An Alternate Payee under a Qualified Domestic Relations Order (QDRO) receives pension benefits as defined by federal law, whereas a Pension Sharing Order, governed by state law, transfers actual ownership of pension assets to the alternate payee.

Marital Property Division

Marital property division involving retirement benefits requires distinguishing between a Qualified Domestic Relations Order (QDRO), which divides defined benefit or contribution plans, and a pension sharing order, which transfers a portion of pension rights as a separate asset to the ex-spouse.

Defined Benefit Plan

Defined Benefit Plans require a Qualified Domestic Relations Order (QDRO) to legally divide pension benefits in divorce, whereas pension sharing orders involve court-mandated splitting of pension rights without QDRO formalities, impacting benefit distribution and payment timing.

Pension Valuation

Pension valuation in the context of Qualified Domestic Relations Orders (QDROs) specifically addresses dividing retirement benefits for federal and private plans, while pension sharing orders primarily apply to UK pensions by allocating a defined portion of pension assets between parties upon divorce.

Actuarial Adjustment

An actuarial adjustment in a Qualified Domestic Relations Order (QDRO) reallocates pension benefits based on present value calculations, while a pension sharing order divides the pension fund at the time of divorce, creating separate entitlements for each party.

Survivorship Benefits

Survivorship benefits under a Qualified Domestic Relations Order (QDRO) ensure continued pension payments to a former spouse after the pension holder's death, whereas a pension sharing order transfers a portion of the pension plan ownership to the former spouse, granting them independent survivorship rights.

Segregated Benefits

A Qualified Domestic Relations Order (QDRO) legally divides Segregated Benefits from retirement plans between spouses during divorce, whereas a Pension Sharing Order allocates pension rights as distinct assets immediately upon divorce finalization.

Transfer Value

Transfer value in a Qualified Domestic Relations Order (QDRO) allows the allocation of pension benefits without immediate lump-sum payment, whereas a Pension Sharing Order typically involves dividing the pension fund's transfer value for direct distribution between spouses.

Deferred Pension Rights

Deferred pension rights can be divided under a Qualified Domestic Relations Order (QDRO) allowing separate payments to ex-spouses, whereas a pension sharing order transfers a specific portion of the pension benefits directly to the former spouse as a standalone asset.

Court-Mandated Allocation

Court-mandated allocation in retirement benefits often involves a Qualified Domestic Relations Order (QDRO) or a pension sharing order, each serving distinct legal functions. A QDRO permits the division of employer-sponsored retirement plans like 401(k)s while pension sharing orders, primarily used in defined benefit plans, transfer actual pension rights between spouses, impacting the planholder's future payments directly.

Qualified Domestic Relations Order (QDRO) vs Pension sharing order Infographic

moneydif.com

moneydif.com