Commutation refers to the process of converting a future pension income into a lump sum payment at retirement, allowing pensioners immediate access to part of their retirement savings. The commutation factor is a crucial numerical value used to calculate the lump sum amount based on the pensioner's age and expected life expectancy, effectively determining the present value of the pension foregone. Understanding the difference between commutation and the commutation factor helps retirees make informed decisions about balancing immediate cash needs against long-term income security.

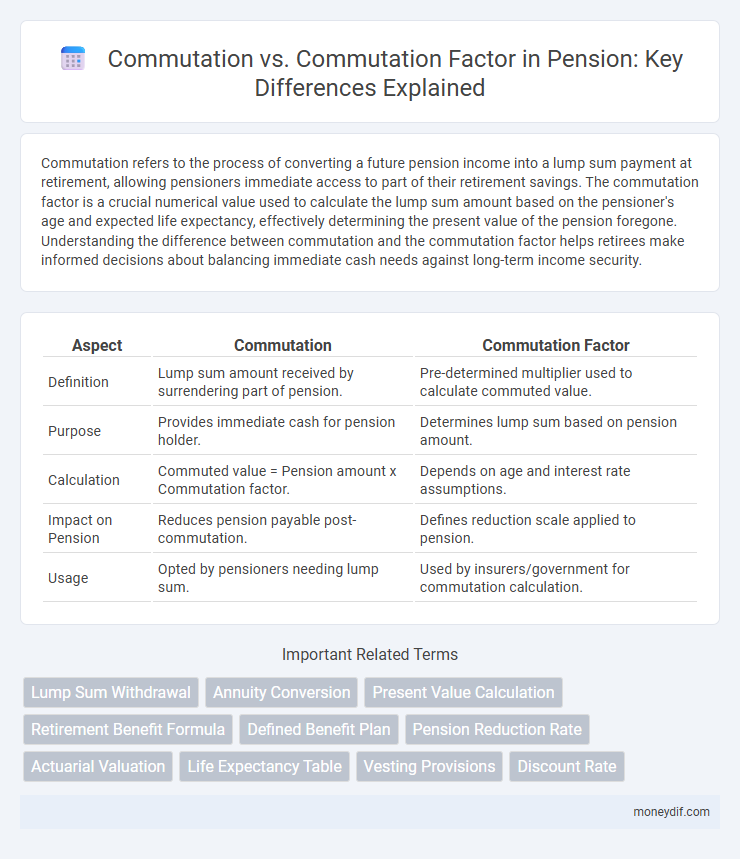

Table of Comparison

| Aspect | Commutation | Commutation Factor |

|---|---|---|

| Definition | Lump sum amount received by surrendering part of pension. | Pre-determined multiplier used to calculate commuted value. |

| Purpose | Provides immediate cash for pension holder. | Determines lump sum based on pension amount. |

| Calculation | Commuted value = Pension amount x Commutation factor. | Depends on age and interest rate assumptions. |

| Impact on Pension | Reduces pension payable post-commutation. | Defines reduction scale applied to pension. |

| Usage | Opted by pensioners needing lump sum. | Used by insurers/government for commutation calculation. |

Understanding Pension Commutation

Pension commutation involves converting a portion of the future pension income into a lump sum amount at retirement. The commutation factor is a critical numerical value used to calculate the lump sum payable by multiplying it with the portion of the pension being commuted. Understanding the commutation factor helps retirees assess the trade-off between immediate lump sum benefits and reduced monthly pension payments.

What is a Commutation Factor?

The commutation factor is a numerical value used to calculate the lump sum amount an employee receives when opting to commute a portion of their pension. It reflects the present value of future pension payments and varies based on age, interest rates, and life expectancy. Understanding the commutation factor helps employees make informed decisions about balancing immediate lump sum benefits against regular pension income.

Differences Between Commutation and Commutation Factor

Commutation refers to the process of converting a portion of a pension into a lump sum payment, while the commutation factor is the multiplier used to calculate the lump sum amount based on the pension value. The key difference lies in their roles: commutation is the action or option taken by the pensioner, whereas the commutation factor is a fixed numerical value set by pension authorities or actuarial tables to determine the lump sum. Understanding this distinction is crucial for accurately assessing pension benefits and financial planning.

How Commutation Impacts Pension Benefits

Commutation in pension plans refers to the option of converting a portion of the future pension income into a lump sum payment at retirement. The commutation factor determines the amount of lump sum receivable based on pension corpus, age, and interest rates, directly influencing the balance between immediate cash and ongoing monthly benefits. Opting for higher commutation reduces the monthly pension payout permanently, affecting overall retirement income sustainability.

Calculating Pension with Commutation Factor

Commutation in pension refers to converting a portion of the monthly pension into a lump sum payment at retirement. The commutation factor is a predetermined multiplier used to calculate the lump sum amount based on the pensionable salary and the commuted portion of the pension. Accurately calculating pension with the commutation factor ensures a precise lump sum amount is derived, balancing immediate funds and reduced monthly pension payouts.

Tax Implications of Pension Commutation

Pension commutation involves converting a portion of the pension into a lump sum, which is subject to distinct tax implications compared to regular pension income. The commutation factor determines the lump sum amount received for giving up future pension payments and influences the tax liability, as lump sums may be partially or fully taxable depending on prevailing tax laws. Understanding the interplay between the commutation amount and applicable tax exemptions or deductions is crucial for optimizing retirement income and minimizing tax burden.

Pros and Cons of Pension Commutation

Pension commutation allows retirees to receive a lump sum payment by exchanging a portion of their future monthly pension benefits, providing immediate financial flexibility. The commutation factor determines the lump sum amount based on actuarial calculations, influencing the trade-off between upfront cash and reduced monthly payouts. While commutation offers liquidity and financial planning options, it reduces long-term retirement income, potentially impacting financial security in later years.

Factors Affecting the Commutation Factor

Factors affecting the commutation factor include the retiree's age, interest rates, and mortality assumptions, which determine the lump sum payout from a pension. Younger pensioners generally have lower commutation factors due to longer expected payment periods, while higher interest rates increase the factor by raising the present value of future payments. Mortality tables and actuarial assumptions also significantly influence the commutation factor, reflecting the estimated lifespan and risk profiles of pensioners.

Regulatory Guidelines on Pension Commutation

Regulatory guidelines on pension commutation specify the maximum permissible commutation factor, which determines the lump sum amount a retiree can receive by converting a portion of their pension. The commutation factor is calculated based on actuarial assumptions such as age, life expectancy, and prevailing interest rates, ensuring fair and standardized lump sum payouts. Compliance with these regulations guarantees retirees' rights while maintaining the financial stability of pension funds.

Making the Right Choice: Commutation or Higher Pension?

Choosing between pension commutation and a higher monthly pension depends on individual financial needs and life expectancy. Commutation allows a lump sum withdrawal by surrendering a part of the pension, calculated using the commutation factor, which is influenced by age and actuarial tables. Evaluating the commutation factor against personal circumstances ensures an optimal balance between immediate funds and long-term retirement income.

Important Terms

Lump Sum Withdrawal

Lump sum withdrawal in pension plans involves converting a portion of the pension corpus into a one-time payment, with the commutation factor determining the lump sum amount by multiplying it with the commuted pension value. Commutation reduces the monthly pension amount since the lump sum is extracted upfront, and a higher commutation factor results in a larger lump sum and correspondingly lower pension payments.

Annuity Conversion

Annuity conversion involves calculating the commutation factor, which determines the lump sum value of future annuity payments by discounting them using commutation functions.

Present Value Calculation

Present value calculation involves discounting future cash flows using a commutation factor, which simplifies the computation by consolidating interest and mortality rates into a single value. The commutation table provides these factors, enabling actuaries to efficiently determine the lump sum equivalent of a series of payments without repetitive calculation of each discounted term.

Retirement Benefit Formula

The Retirement Benefit Formula calculates the commuted value of a pension by multiplying the commutation factor with the commuted portion of the pension to determine the lump sum payable at retirement.

Defined Benefit Plan

The commutation factor determines the lump-sum payment amount when converting a defined benefit plan's future pension payments into a present value commutation.

Pension Reduction Rate

The pension reduction rate quantifies the decrease in retirement benefits when opting for commutation, calculated using the commutation factor that standardizes lump sum conversions.

Actuarial Valuation

Actuarial valuation uses the commutation factor to simplify pension liabilities by converting future cash flows into their present value for accurate financial assessment.

Life Expectancy Table

The Life Expectancy Table quantitatively compares commutation values to commutation factors, enabling actuaries to accurately calculate present values of life-contingent benefits.

Vesting Provisions

Vesting provisions determine the employee's right to benefits or stock ownership, influencing how commutation values are calculated in pension plans. The commutation factor converts future pension payments into a lump-sum amount based on actuarial assumptions, directly affecting the vested benefits available for early payout or transfer.

Discount Rate

The Discount Rate directly affects the Commutation Factor, which determines the lump sum value in Commutation calculations for pension benefits.

Commutation vs Commutation Factor Infographic

moneydif.com

moneydif.com