Commutation involves converting a portion of a pension into a lump sum payment at retirement, providing immediate access to funds but reducing future monthly pension benefits. Vesting refers to the process by which an employee earns non-forfeitable rights to their pension benefits after meeting certain service requirements. Understanding the differences between commutation and vesting is essential for effective retirement planning and maximizing pension outcomes.

Table of Comparison

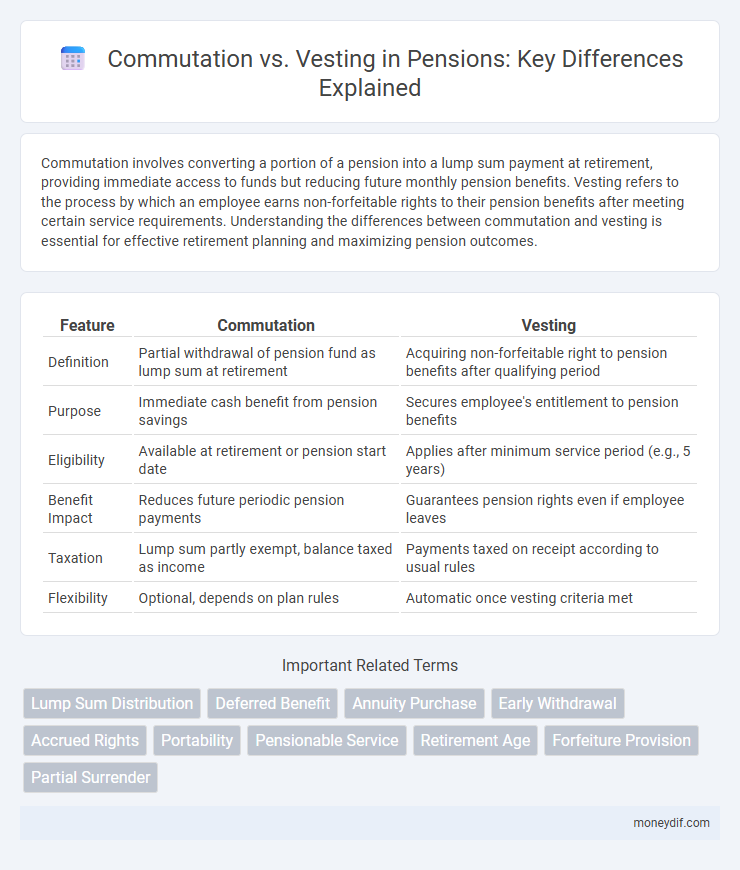

| Feature | Commutation | Vesting |

|---|---|---|

| Definition | Partial withdrawal of pension fund as lump sum at retirement | Acquiring non-forfeitable right to pension benefits after qualifying period |

| Purpose | Immediate cash benefit from pension savings | Secures employee's entitlement to pension benefits |

| Eligibility | Available at retirement or pension start date | Applies after minimum service period (e.g., 5 years) |

| Benefit Impact | Reduces future periodic pension payments | Guarantees pension rights even if employee leaves |

| Taxation | Lump sum partly exempt, balance taxed as income | Payments taxed on receipt according to usual rules |

| Flexibility | Optional, depends on plan rules | Automatic once vesting criteria met |

Introduction to Pension Options: Commutation vs Vesting

Commutation in pensions allows policyholders to convert a portion of their future pension benefits into a lump sum payment at retirement, providing immediate access to funds. Vesting refers to the employee's right to retain accumulated pension benefits after meeting specific service requirements, ensuring eligibility for future payouts regardless of job status. Understanding the distinctions between commutation and vesting is essential for maximizing retirement income strategies and legal entitlements.

Defining Commutation in Pension Schemes

Commutation in pension schemes refers to the option for retirees to convert a portion of their future pension income into a lump sum payment at the time of retirement. This allows pensioners to receive immediate cash instead of receiving periodic pension payments, offering financial flexibility. Commutation values are calculated based on actuarial factors, including age, interest rates, and life expectancy, impacting the reduced monthly pension benefit after lump sum withdrawal.

Understanding Vesting in Pension Plans

Vesting in pension plans refers to the employee's right to retain earned pension benefits even after leaving the employer, ensuring that the accrued benefits are protected and non-forfeitable. Unlike commutation, which involves converting a portion of the pension annuity into a lump sum payment, vesting determines the eligibility and percentage of pension benefits an employee is entitled to receive based on their years of service. Understanding vesting schedules and rules is crucial for employees to optimize their retirement benefits and secure long-term financial stability.

Key Differences Between Commutation and Vesting

Commutation allows pensioners to convert a portion of their future pension into a lump sum payment immediately upon retirement, whereas vesting refers to the right of an employee to receive pension benefits after meeting specified service or age criteria. The key difference lies in timing and entitlement: commutation deals with early payment options impacting pension amounts, while vesting guarantees the employee's eligibility to the pension based on tenure. Understanding these distinctions is crucial for retirement planning and maximizing pension benefits under schemes like the Employee Provident Fund or National Pension System.

Eligibility Criteria for Commutation and Vesting

Eligibility criteria for commutation require the pensioner to have a minimum qualifying service period, typically five years, and have attained a specific minimum retirement age. Vesting eligibility mandates continuous employment for a stipulated duration, often two to five years, ensuring the employee earns a non-forfeitable right to pension benefits. Both criteria are essential to determine the entitlement and quantum of pension benefits under different pension schemes.

Tax Implications: Commutation vs Vesting

Commutation of pension involves converting a portion of the future pension into a lump sum, which is often tax-free up to a specified limit under Section 10(10C) of the Income Tax Act. Vesting, on the other hand, refers to acquiring non-forfeitable rights to pension benefits, with tax implications primarily occurring at the time of pension receipt or withdrawal. Understanding the differential tax treatments, such as exemption limits on commuted amounts versus taxable pension income upon vesting, is critical for effective retirement planning.

Advantages and Disadvantages of Commutation

Commutation in pensions allows retirees to convert a portion of their future pension payments into a lump sum, providing immediate liquidity and financial flexibility to address urgent expenses or invest elsewhere. However, this reduces the monthly pension amount, potentially diminishing long-term income security and increasing the risk of outliving retirement savings. While commutation offers upfront financial benefits, it requires careful consideration of future cash flow needs and life expectancy.

Pros and Cons of Vesting Your Pension

Vesting your pension guarantees the right to retain employer contributions and accrued benefits even if you change jobs, offering long-term financial security. However, full vesting requirements can vary by plan and may require several years of service, which could limit access to funds if you leave early. While vesting ensures guaranteed benefits, it may restrict flexibility in accessing your pension compared to commutation options that allow lump-sum withdrawals with potential tax implications.

Factors to Consider Before Choosing Commutation or Vesting

Factors to consider before choosing commutation or vesting include the immediate need for lump sum cash versus long-term financial security, the expected retirement duration, and the impact on future pension payouts. Assessing tax implications, current health status, and inflation rates also plays a crucial role in making an informed decision. Evaluating personal financial goals alongside available pension scheme rules ensures optimal retirement planning and benefit utilization.

Frequently Asked Questions: Commutation and Vesting in Pension

Commutation in pension refers to the lump sum amount received by a retiree in exchange for a portion of their future pension benefits, allowing immediate access to funds while reducing monthly payouts. Vesting defines the minimum period an employee must work to earn the right to pension benefits, ensuring eligibility for pension payouts regardless of future employment status. Common questions address the impact of commutation on pension amount, vesting period requirements, and conditions under which pension rights become non-forfeitable.

Important Terms

Lump Sum Distribution

A Lump Sum Distribution allows an employee to receive the full balance of their retirement account at once, where commutation involves converting a future pension payment into a single upfront payment, often reducing the total benefit; vesting determines the employee's entitlement to the pension benefits accrued, impacting eligibility for lump sum payouts. Understanding the differences between commutation and vesting is crucial for optimizing the timing and value of a lump sum distribution in retirement planning.

Deferred Benefit

Deferred benefit plans allow employees to accumulate retirement savings over time, with vesting schedules determining the percentage of benefits they own at specific periods, while commutation enables the conversion of future pension payments into a lump sum at retirement. Understanding the interplay between commutation options and vesting rules is crucial for optimizing retirement income and financial planning.

Annuity Purchase

An annuity purchase involves deciding between commutation, which converts future pension payments into a lump sum, and vesting, which secures the right to receive pension benefits after a qualifying service period.

Early Withdrawal

Early withdrawal from a pension plan often involves comparing commutation, which allows a lump-sum payout by converting future annuity payments, versus vesting, which determines the employee's non-forfeitable right to accrued benefits after a qualifying period.

Accrued Rights

Accrued rights refer to benefits or entitlements earned by an employee over time, with vesting signifying the point when these rights become non-forfeitable. Commutation involves converting a portion of these vested benefits into a lump sum, allowing immediate access to a monetary value rather than receiving periodic payments.

Portability

Portability in retirement plans allows employees to transfer vested benefits when changing jobs, contrasting with vesting which determines ownership rights to employer contributions over time. Commutation involves converting future pension benefits into a lump-sum payment, affecting the portability and timing of accessing vested funds.

Pensionable Service

Pensionable service directly influences commutation calculations by determining the length of time an employee's earnings contribute to the pension fund, thereby affecting the lump-sum amount available upon retirement. In contrast, vesting relates to the employee's right to retain pension benefits after a specified period of pensionable service, ensuring entitlement regardless of future employment status.

Retirement Age

Retirement age significantly impacts pension benefits by influencing the balance between commutation options and vesting periods, where earlier retirement may increase commutation value but reduce overall vested benefits.

Forfeiture Provision

Forfeiture provisions dictate the loss of unvested benefits, distinguishing commutation where vested rights are exchanged or settled early, while vesting secures irrevocable ownership of entitlements over time.

Partial Surrender

Partial surrender involves withdrawing a portion of a life insurance policy's cash value, impacting commutation calculations which determine the exchange of future benefits for a lump sum, whereas vesting refers to the policyholder's right to retain acquired benefits without forfeiture. Understanding the distinction is crucial for optimizing financial decisions related to policy liquidity and guaranteed benefits retention.

Commutation vs Vesting Infographic

moneydif.com

moneydif.com