Cliff vesting requires employees to complete a specific period of service before gaining full rights to their pension benefits, resulting in an all-or-nothing approach. Graded vesting allows employees to earn partial ownership of their pension benefits incrementally over time, providing gradual access to funds. Understanding the differences between cliff and graded vesting helps employees plan retirement savings and employers design competitive benefits packages.

Table of Comparison

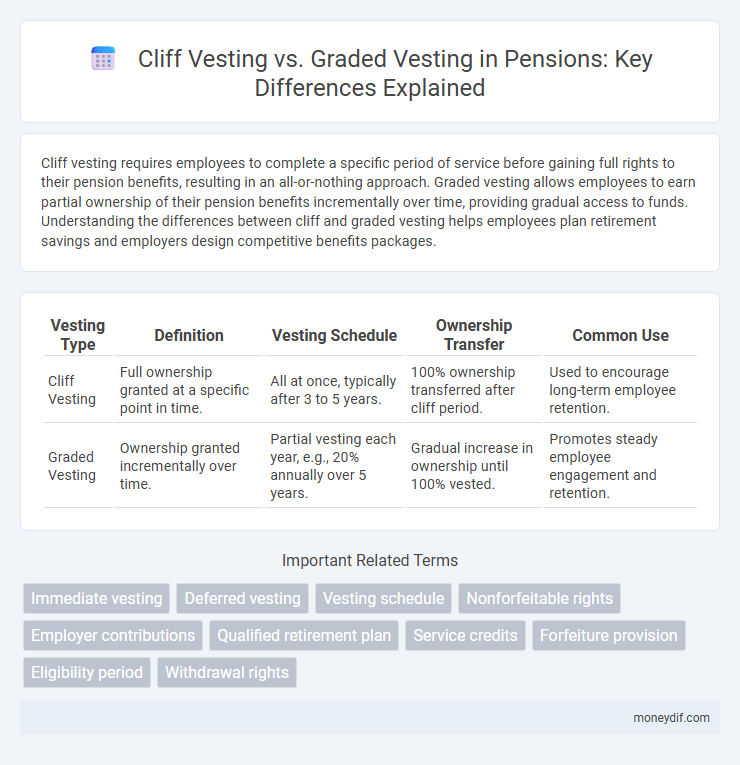

| Vesting Type | Definition | Vesting Schedule | Ownership Transfer | Common Use |

|---|---|---|---|---|

| Cliff Vesting | Full ownership granted at a specific point in time. | All at once, typically after 3 to 5 years. | 100% ownership transferred after cliff period. | Used to encourage long-term employee retention. |

| Graded Vesting | Ownership granted incrementally over time. | Partial vesting each year, e.g., 20% annually over 5 years. | Gradual increase in ownership until 100% vested. | Promotes steady employee engagement and retention. |

Introduction to Pension Vesting

Pension vesting determines the employee's ownership of accrued retirement benefits, with cliff vesting granting full rights after a specific period, typically three to five years. Graded vesting allows employees to earn partial ownership incrementally over several years, enhancing retention and gradual benefit accumulation. Understanding these vesting schedules is crucial for optimizing retirement planning and ensuring compliance with fiduciary standards.

What is Cliff Vesting?

Cliff vesting refers to a pension plan feature where employees gain full ownership of employer-contributed benefits only after completing a specific period of service, typically three to five years. If the employee leaves before this period, they forfeit all employer contributions, ensuring a clear cutoff point for benefit eligibility. This contrasts with graded vesting, which provides incremental ownership of benefits over time.

What is Graded Vesting?

Graded vesting is a pension plan feature where employees earn ownership of their employer's contributions gradually over a set period, typically increasing annually until fully vested. Unlike cliff vesting, which grants full ownership all at once after a specific period, graded vesting provides incremental ownership, such as 20% per year over five years. This method encourages employee retention by rewarding tenure with progressively increasing pension benefits.

Key Differences: Cliff vs Graded Vesting

Cliff vesting requires employees to reach a specified period of service before gaining any pension benefits, resulting in 100% vesting all at once after the cliff period. Graded vesting gradually increases the employee's pension benefits over time, often in increments such as 20% per year until fully vested. The key difference lies in the timing and structure of benefit acquisition, with cliff vesting offering a lump-sum vesting point and graded vesting providing progressive ownership.

Pros and Cons of Cliff Vesting

Cliff vesting guarantees full pension rights after a specific period, providing employees with clear ownership and strong retention incentives. It may disadvantage workers who leave before the cliff period ends, resulting in forfeiture of all accrued benefits. Cliff vesting simplifies plan administration but lacks the flexibility of graded vesting, which grants gradual ownership over time.

Pros and Cons of Graded Vesting

Graded vesting allows employees to gradually earn ownership of pension benefits over time, promoting retention and long-term commitment. One advantage is that it provides a clear, incremental path to full vesting, which can motivate employees to stay with the company longer. However, its complexity compared to cliff vesting may lead to misunderstandings about benefit entitlements and requires more administrative tracking by employers.

Impact on Employee Retention

Cliff vesting, which grants employees full ownership of pension benefits after a specific period, often encourages longer tenure by motivating employees to stay until fully vested. Graded vesting, offering incremental ownership over time, helps improve retention by rewarding continuous service and reducing the risk of sudden benefit loss. Companies leveraging graded vesting typically experience steadier employee retention due to the gradual accumulation of pension rights.

Legal and Regulatory Considerations

Cliff vesting requires employees to become fully vested in their pension benefits after a specific period, typically three years, complying with the Employee Retirement Income Security Act (ERISA) regulations. Graded vesting mandates gradual accrual of pension rights over time, often allowing partial ownership after two years with full vesting by six years, aligning with Department of Labor enforcement standards. Legal frameworks ensure both vesting methods protect employees' retirement benefits while balancing employer contributions and regulatory compliance.

Choosing the Right Vesting Schedule

Choosing the right vesting schedule depends on balancing employee retention goals with company financial planning; cliff vesting offers full ownership after a specific period, encouraging long-term commitment, while graded vesting provides gradual ownership that rewards incremental service. Employers aiming to incentivize loyalty with clear milestones often prefer cliff vesting, whereas those seeking to reduce turnover risk through continuous engagement may opt for graded vesting. Analyzing workforce demographics, industry standards, and financial forecasts helps determine which vesting schedule aligns best with organizational objectives and pension plan compliance requirements.

FAQs about Vesting in Pension Plans

Cliff vesting in pension plans requires employees to be fully vested after a specific period, typically five years, ensuring no partial ownership before this point. Graded vesting grants employees partial pension rights incrementally, often over a span of three to seven years, increasing ownership percentage each year. Frequently asked questions about vesting include how long the waiting period is, what happens to benefits if employees leave early, and the differences in pension benefits between cliff and graded vesting schedules.

Important Terms

Immediate vesting

Immediate vesting grants full ownership of benefits or stock options instantly, unlike cliff vesting which requires a specific period before full rights, and graded vesting which gradually awards ownership over time.

Deferred vesting

Deferred vesting allows employees to gain ownership of benefits over time, with cliff vesting granting full ownership at a specific date and graded vesting providing incremental ownership annually.

Vesting schedule

Cliff vesting grants full employee benefits after a set period, while graded vesting gradually awards benefits over time according to a predefined schedule.

Nonforfeitable rights

Nonforfeitable rights in retirement plans determine employee ownership of benefits, with cliff vesting granting full rights after a set period, while graded vesting provides incremental rights over time.

Employer contributions

Employer contributions under cliff vesting become fully owned by employees after a set period, whereas graded vesting grants ownership gradually over time.

Qualified retirement plan

Qualified retirement plans use cliff vesting to grant full employee benefits after a set service period, while graded vesting gradually increases ownership percentages each year.

Service credits

Service credits accelerate full ownership under graded vesting schedules, whereas cliff vesting grants complete service credit only after a specific period without partial ownership increments.

Forfeiture provision

Forfeiture provisions in equity compensation plans define the conditions under which unvested shares or options are lost if an employee leaves before the vesting schedule is complete, with cliff vesting delaying any ownership until a specific date, often one year, creating an all-or-nothing scenario. In contrast, graded vesting allows partial ownership to accumulate incrementally over time, reducing the risk of forfeiture proportionally as the employee remains with the company.

Eligibility period

The eligibility period for cliff vesting requires employees to complete a fixed duration, typically one year, before acquiring 100% ownership of benefits, whereas graded vesting allows partial ownership incrementally over multiple years.

Withdrawal rights

Withdrawal rights in cliff vesting plans typically permit employees to access 100% of their benefits only after a specified period, often resulting in no rights until the cliff is reached; graded vesting, by contrast, provides incremental withdrawal rights as employees accumulate service time, enhancing early access to vested benefits. Employers use these vesting schedules to balance employee retention with benefit distribution, where cliff vesting enforces a waiting period and graded vesting allows for gradual ownership, impacting withdrawal timing and eligibility.

Cliff vesting vs Graded vesting Infographic

moneydif.com

moneydif.com