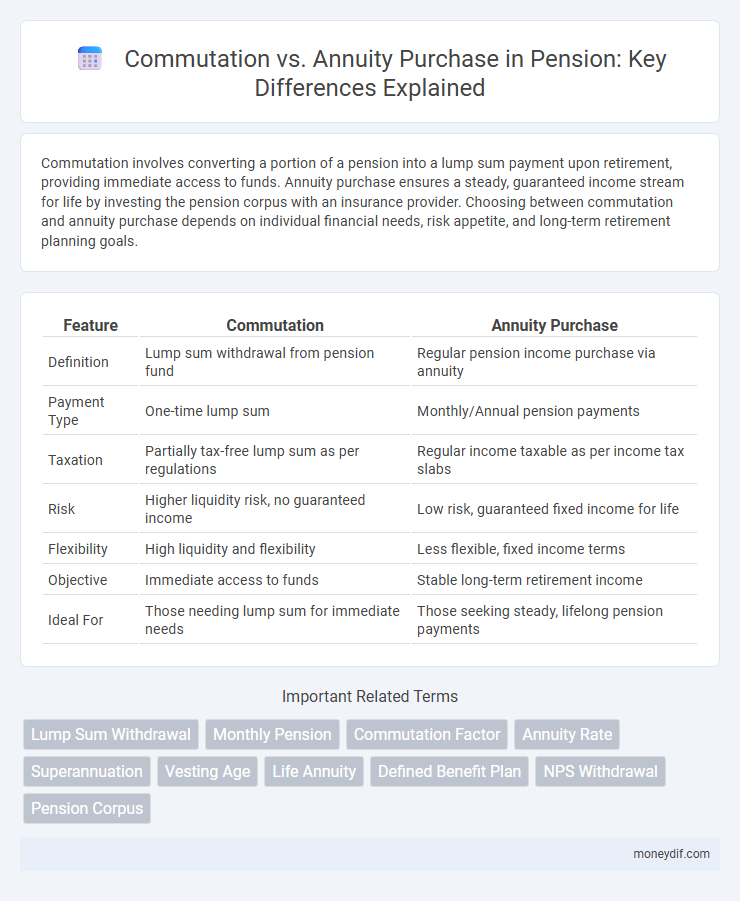

Commutation involves converting a portion of a pension into a lump sum payment upon retirement, providing immediate access to funds. Annuity purchase ensures a steady, guaranteed income stream for life by investing the pension corpus with an insurance provider. Choosing between commutation and annuity purchase depends on individual financial needs, risk appetite, and long-term retirement planning goals.

Table of Comparison

| Feature | Commutation | Annuity Purchase |

|---|---|---|

| Definition | Lump sum withdrawal from pension fund | Regular pension income purchase via annuity |

| Payment Type | One-time lump sum | Monthly/Annual pension payments |

| Taxation | Partially tax-free lump sum as per regulations | Regular income taxable as per income tax slabs |

| Risk | Higher liquidity risk, no guaranteed income | Low risk, guaranteed fixed income for life |

| Flexibility | High liquidity and flexibility | Less flexible, fixed income terms |

| Objective | Immediate access to funds | Stable long-term retirement income |

| Ideal For | Those needing lump sum for immediate needs | Those seeking steady, lifelong pension payments |

Understanding Pension Commutation and Annuity Purchase

Pension commutation allows retirees to convert a portion of their future pension payments into a lump sum, providing immediate liquidity but reducing the regular monthly pension amount. Annuity purchase involves using a lump sum to buy an annuity plan, ensuring a guaranteed steady income stream for life or a specified period. Understanding the trade-offs between commutation and annuity purchase helps optimize retirement income and meet individual financial needs.

What is Pension Commutation?

Pension commutation is the process of converting a portion of a retiree's future pension payments into a lump sum amount payable immediately. This option allows individuals to receive cash upfront by giving up part of their regular monthly pension income, typically calculated based on actuarial factors like age and prevailing interest rates. Pension commutation balances immediate liquidity needs against reduced ongoing annuity payments, impacting long-term retirement income planning.

What is Annuity Purchase?

An annuity purchase involves using a lump sum of pension savings to buy a guaranteed stream of income for life or a fixed period, providing financial stability during retirement. This option ensures predictable monthly payments, eliminating the risk of outliving your funds compared to lump-sum withdrawals. Annuity products are offered by insurance companies and can be tailored with features like inflation protection or survivor benefits.

Key Differences Between Commutation and Annuity

Commutation involves converting a portion of the pension into a lump sum payment, reducing the future monthly pension amount, whereas annuity purchase refers to buying an annuity plan to receive regular pension payouts. The key difference lies in liquidity and income stability: commutation offers immediate cash but lowers ongoing pension benefits, while annuity purchase provides consistent periodic income without upfront lump sum withdrawal. Tax implications also differ, as commuted pension amounts up to a specified limit may be tax-free, contrasting with annuity payments that are taxable as income.

Tax Implications of Commutation and Annuity

Commutation of pension involves receiving a lump sum payment, which is partially or fully taxable depending on the portion exempt under Section 10(10A) of the Income Tax Act, while the remaining sum is taxed as per the individual's income slab. Annuity purchase from a pension fund offers periodic payments subject to tax as income, without the benefit of tax-free lumpsum withdrawal. Understanding the tax treatment under Income Tax provisions is crucial in choosing between commutation and annuity purchase for optimizing retirement income.

Factors to Consider Before Choosing Commutation or Annuity

Factors to consider before choosing commutation or annuity include the tax implications, with commutation often attracting a lump sum tax, while annuity payments are taxable as income. Evaluate life expectancy and financial dependents, since commutation provides immediate funds but reduces future pension security, whereas annuity ensures a steady income for life. Assess financial needs and inflation impact, as commuting the pension might provide liquidity for urgent expenses, whereas annuities typically offer inflation-adjusted or fixed returns over time.

Pros and Cons of Pension Commutation

Pension commutation allows retirees to convert a portion of their future pension into a lump sum, offering immediate liquidity and financial flexibility for urgent expenses or investments. However, it reduces the regular monthly pension payments, potentially impacting long-term income security during retirement. While commutation can address short-term needs, it may lead to financial challenges if not managed prudently, highlighting the trade-off between lump sum access and steady retirement income.

Pros and Cons of Annuity Purchase

Annuity purchase converts a lump sum into a steady stream of income for life, providing financial security and protection against longevity risk. It offers predictable monthly payments but lacks liquidity and flexibility, as funds are locked in and inaccessible for emergencies. The downside includes potential lower returns compared to market investments and reduced inheritance potential for beneficiaries.

How to Decide: Commutation vs Annuity

When deciding between commutation and annuity purchase in pension planning, evaluate your immediate cash needs against long-term income security. Commutation offers a lump sum payout by surrendering a portion of the pension, suitable for urgent expenses or debt repayment, while annuity purchase ensures a steady, guaranteed income for life, protecting against longevity risk. Assess factors like current financial obligations, health status, and life expectancy to make an informed decision that balances liquidity and sustained retirement income.

Frequently Asked Questions on Pension Commutation and Annuity Purchase

Pension commutation allows retirees to receive a lump sum by surrendering a portion of their future monthly pension, while annuity purchase involves using a lump sum to secure a guaranteed periodic income for life. Common questions address tax implications, calculation methods, eligibility criteria, and the impact on monthly payouts after commutation or annuity acquisition. Understanding the difference helps pensioners optimize financial planning based on their retirement goals and liquidity needs.

Important Terms

Lump Sum Withdrawal

Lump sum withdrawal allows pensioners to choose between commutation, which provides a one-time payment by converting a portion of the pension, and annuity purchase, which ensures a steady income stream for life.

Monthly Pension

Choosing between commutation and annuity purchase for monthly pension impacts retirement income stability and tax efficiency.

Commutation Factor

The commutation factor determines the lump sum amount payable in lieu of future annuity payments when opting for commutation in annuity purchase decisions.

Annuity Rate

Annuity rate reflects the periodic payment amount received from a lump sum based on factors like age, interest rates, and mortality assumptions. Comparing commutation and annuity purchase methods reveals that commutation values use actuarial present values to estimate payments, while annuity purchases directly convert lump sums into guaranteed income streams at prevailing market rates.

Superannuation

Superannuation commutation allows partial lump-sum withdrawal from the retirement corpus, while annuity purchase converts the corpus into a regular income stream for life.

Vesting Age

Vesting age significantly impacts the financial outcome of commutation versus annuity purchase decisions, as opting for commutation at an earlier vesting age often results in a lower lump sum compared to annuity benefits accrued with increased age. Annuity purchase benefits escalate with advancing vesting age due to higher immediate payouts reflecting reduced life expectancy and risk for insurers.

Life Annuity

Life annuity involves a series of payments made for the duration of an individual's life, contrasting with commutation, which calculates a lump sum equivalent to the present value of future annuity payments. Commutation factors and survival probabilities are critical in assessing the fair price of an annuity purchase versus opting for a commuted lump sum.

Defined Benefit Plan

Defined Benefit Plans allow employees to convert a portion of their pension benefits through commutation, receiving a lump sum payment instead of a lifetime annuity. The choice between commutation and annuity purchase depends on factors such as present value interest rates, life expectancy assumptions, and personal financial goals for retirement income stability.

NPS Withdrawal

NPS withdrawal allows partial lump sum withdrawal, but opting for commutation enables a tax-free lump sum payout up to one-third of the corpus, while the remaining two-thirds must be used to purchase an annuity providing regular pension income. Choosing annuity purchase over commutation ensures a steady post-retirement income stream, as commuted amounts reduce the pension payable from the annuity, affecting long-term financial security.

Pension Corpus

Pension corpus represents the total retirement savings accumulated either through commutation, where a lump sum is withdrawn by surrendering part of the pension, or annuity purchase, where the corpus is used to buy an annuity providing regular income. Commutation reduces the pension amount but offers immediate liquidity, while annuity purchase ensures a steady, lifelong payout enhancing financial security during retirement.

Commutation vs Annuity Purchase Infographic

moneydif.com

moneydif.com