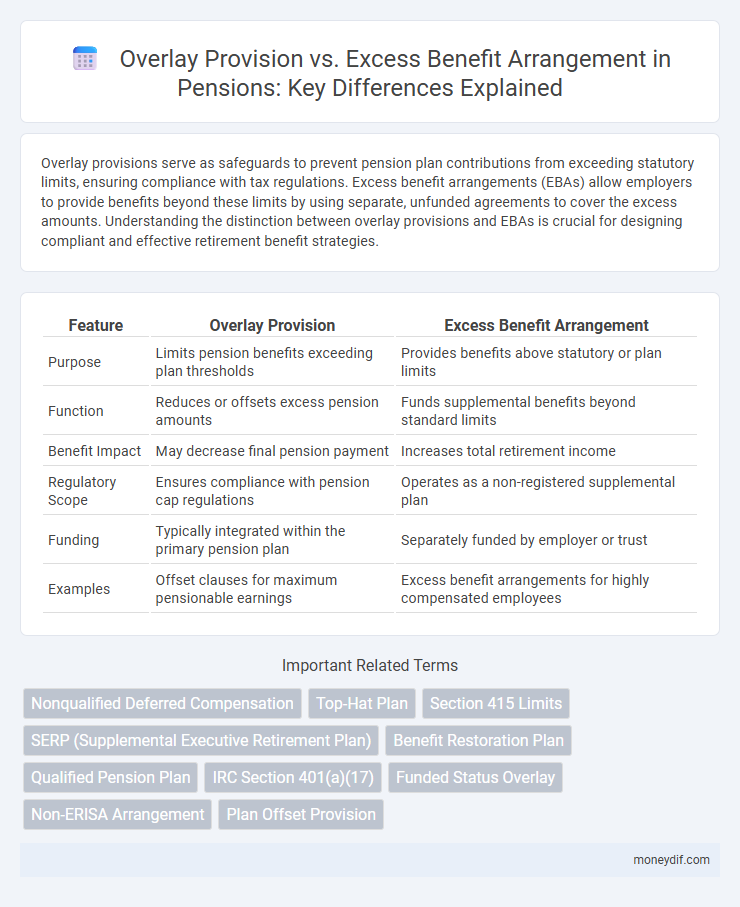

Overlay provisions serve as safeguards to prevent pension plan contributions from exceeding statutory limits, ensuring compliance with tax regulations. Excess benefit arrangements (EBAs) allow employers to provide benefits beyond these limits by using separate, unfunded agreements to cover the excess amounts. Understanding the distinction between overlay provisions and EBAs is crucial for designing compliant and effective retirement benefit strategies.

Table of Comparison

| Feature | Overlay Provision | Excess Benefit Arrangement |

|---|---|---|

| Purpose | Limits pension benefits exceeding plan thresholds | Provides benefits above statutory or plan limits |

| Function | Reduces or offsets excess pension amounts | Funds supplemental benefits beyond standard limits |

| Benefit Impact | May decrease final pension payment | Increases total retirement income |

| Regulatory Scope | Ensures compliance with pension cap regulations | Operates as a non-registered supplemental plan |

| Funding | Typically integrated within the primary pension plan | Separately funded by employer or trust |

| Examples | Offset clauses for maximum pensionable earnings | Excess benefit arrangements for highly compensated employees |

Overview of Overlay Provision and Excess Benefit Arrangement

Overlay Provision allows pension plans to temporarily adjust benefit accruals or contribution limits to comply with regulatory caps, ensuring plan flexibility without permanently reducing participant benefits. Excess Benefit Arrangement operates as a supplemental plan designed to provide benefits exceeding qualified plan limits, maintaining tax advantages while delivering promised retirement income above IRS thresholds. Both mechanisms address restrictions imposed by Internal Revenue Code Section 415, optimizing retirement benefits within regulatory frameworks.

Key Differences Between Overlay Provision and Excess Benefit Arrangement

Overlay provision and excess benefit arrangement differ primarily in their approach to managing pension plan limits under Internal Revenue Service (IRS) regulations. Overlay provision adjusts contributions or benefits to comply with IRS rules without causing disqualification, while excess benefit arrangements provide supplemental benefits that exceed IRS limits, often as non-qualified deferred compensation. The key difference lies in overlay provisions maintaining plan qualification status, whereas excess benefit arrangements allow employers to provide additional benefits beyond qualified plan caps.

Legal Framework Governing Pension Supplements

Overlay Provisions and Excess Benefit Arrangements (EBAs) are governed by specific legal frameworks designed to ensure compliance with pension regulations and tax laws. Overlay Provisions typically operate under Internal Revenue Code Section 415, limiting contributions and benefits to prevent excessive pension distributions, while EBAs address amounts exceeding these limits by offering deferred compensation without violating IRS rules. Both mechanisms must adhere to ERISA standards and Treasury regulations, minimizing fiduciary risk and safeguarding plan qualification status.

Eligibility Criteria for Each Pension Enhancement Method

Eligibility criteria for Overlay Provisions typically require a defined benefit plan participant to have reached a specific age or service milestone before receiving enhancements, ensuring adjustments are made within regulatory limits. Excess Benefit Arrangements, often established as non-qualified plans, allow high-earning employees to receive benefits exceeding Internal Revenue Code limits, with eligibility based on compensation thresholds and executive status. Both methods necessitate adherence to plan-specific rules and IRS guidelines, differentiating them by scope of benefit enhancement and participant qualifications.

Funding Mechanisms: Overlay Provision vs Excess Benefit Arrangement

Overlay provisions rely on employer contributions to cover funding shortfalls beyond regular pension plan limits, creating a flexible safety net for promised benefits. Excess Benefit Arrangements (EBAs) are typically funded through separate, often non-qualified, plans that address benefits exceeding IRS limits, offering tax-efficient strategies for high earners. While overlay provisions adjust the main plan's funding, EBAs operate independently, requiring distinct actuarial assessments and funding commitments.

Tax Implications and Compliance Considerations

Overlay Provision allows employers to correct excess contributions by applying them against other plan benefits, potentially avoiding immediate tax penalties but requiring strict adherence to IRS correction procedures under Section 411. Excess Benefit Arrangements, which provide benefits exceeding qualified plan limits, must comply with nondiscrimination rules and are subject to taxation under Section 83, necessitating careful documentation and reporting to the IRS. Both mechanisms involve complex compliance considerations to mitigate adverse tax consequences and ensure conformity with ERISA and IRS regulations.

Administrative Complexity and Implementation Challenges

Overlay Provision often results in higher administrative complexity due to the need for continuous monitoring and frequent adjustments to comply with pension limits, increasing operational burden. Excess Benefit Arrangement requires meticulous record-keeping and coordination with multiple stakeholders, complicating implementation and raising the risk of compliance errors. Both approaches demand robust systems and specialized expertise to manage regulatory requirements and avoid costly penalties.

Impact on Participant Retirement Benefits

Overlay Provisions adjust pension benefits by temporarily limiting payouts to prevent plan funding deficits, which can reduce a participant's immediate retirement income. Excess Benefit Arrangements provide supplemental payments that restore benefits exceeding IRS limits, preserving the participant's expected retirement benefits without penalty. The key impact lies in balancing regulatory compliance and maintaining the participant's total retirement income security.

Employer Perspectives: Choosing the Right Approach

Employers evaluating overlay provisions versus excess benefit arrangements must consider regulatory compliance, administrative complexity, and cost-effectiveness in managing pension liabilities. Overlay provisions often provide streamlined integration with existing pension plans, minimizing additional reporting burdens, while excess benefit arrangements offer targeted solutions for high earners exceeding IRS limits, enhancing retention of key talent. Careful assessment of organizational goals, workforce demographics, and financial constraints guides employers in selecting the most suitable method to optimize pension benefits and tax outcomes.

Future Trends in Pension Plan Enhancements

Overlay provisions are expected to become more prevalent in pension plans as companies seek flexible methods to address funding shortfalls without triggering immediate tax penalties. Excess Benefit Arrangements (EBAs) offer tailored solutions for managing benefits that exceed tax-qualified limits, with future trends pointing towards more sophisticated integration of EBAs and overlay provisions to optimize participant outcomes. Advances in regulatory frameworks and technology will drive the adoption of hybrid models combining overlay provisions and EBAs, enhancing pension plan sustainability and compliance.

Important Terms

Nonqualified Deferred Compensation

Nonqualified Deferred Compensation plans utilize Overlay Provisions to integrate benefits without violating IRS excess benefit rules, contrasting with Excess Benefit Arrangements which specifically address limits by providing supplemental retirement benefits beyond qualified plan restrictions.

Top-Hat Plan

The Top-Hat Plan is a nonqualified deferred compensation arrangement designed for key executives, contrasting with Overlay Provision and Excess Benefit Arrangement which manage plan funding and tax implications under ERISA and IRS rules.

Section 415 Limits

Section 415 limits restrict contributions and benefits in qualified plans, while the Overlay Provision modifies these limits by allowing certain excess contributions to be treated under an Excess Benefit Arrangement to comply with IRS regulations.

SERP (Supplemental Executive Retirement Plan)

The Overlay Provision in a Supplemental Executive Retirement Plan (SERP) limits benefits to prevent excess compensation deductions, while the Excess Benefit Arrangement specifically addresses benefits exceeding Internal Revenue Code limits to maintain tax compliance.

Benefit Restoration Plan

The Benefit Restoration Plan utilizes an Overlay Provision to cap benefits and prevent Excess Benefit Arrangements that trigger tax penalties under IRS rules.

Qualified Pension Plan

A Qualified Pension Plan uses an Overlay Provision to coordinate benefits and avoid tax penalties, while an Excess Benefit Arrangement provides non-qualified supplemental benefits exceeding IRS limits.

IRC Section 401(a)(17)

IRC Section 401(a)(17) limits annual compensation for qualified plans, necessitating overlay provisions or excess benefit arrangements to manage contributions and benefits exceeding these limits.

Funded Status Overlay

Funded Status Overlay assesses pension plan solvency by comparing Overlay Provision allocations to Excess Benefit Arrangement liabilities, optimizing financial risk management.

Non-ERISA Arrangement

A Non-ERISA arrangement with an Overlay Provision modifies plan benefits without triggering ERISA coverage, whereas an Excess Benefit Arrangement specifically addresses payouts exceeding ERISA limits to avoid penalties.

Plan Offset Provision

Plan Offset Provision reduces employer liability by adjusting benefits when an Overlay Provision applies, while an Excess Benefit Arrangement specifically addresses benefits exceeding IRS limits to avoid penalties.

Overlay Provision vs Excess Benefit Arrangement Infographic

moneydif.com

moneydif.com