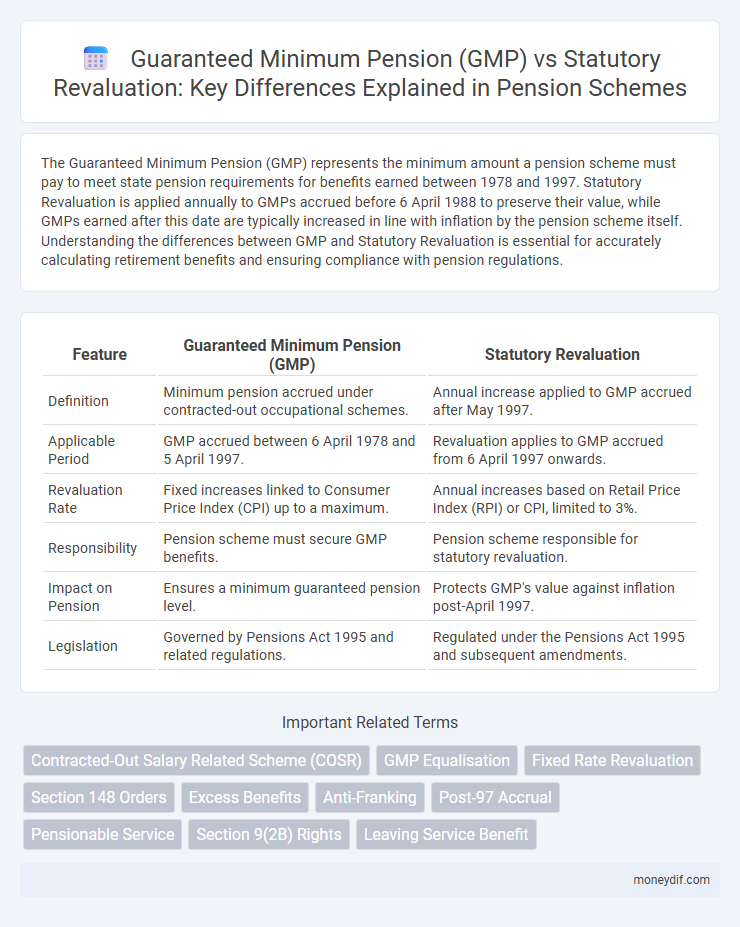

The Guaranteed Minimum Pension (GMP) represents the minimum amount a pension scheme must pay to meet state pension requirements for benefits earned between 1978 and 1997. Statutory Revaluation is applied annually to GMPs accrued before 6 April 1988 to preserve their value, while GMPs earned after this date are typically increased in line with inflation by the pension scheme itself. Understanding the differences between GMP and Statutory Revaluation is essential for accurately calculating retirement benefits and ensuring compliance with pension regulations.

Table of Comparison

| Feature | Guaranteed Minimum Pension (GMP) | Statutory Revaluation |

|---|---|---|

| Definition | Minimum pension accrued under contracted-out occupational schemes. | Annual increase applied to GMP accrued after May 1997. |

| Applicable Period | GMP accrued between 6 April 1978 and 5 April 1997. | Revaluation applies to GMP accrued from 6 April 1997 onwards. |

| Revaluation Rate | Fixed increases linked to Consumer Price Index (CPI) up to a maximum. | Annual increases based on Retail Price Index (RPI) or CPI, limited to 3%. |

| Responsibility | Pension scheme must secure GMP benefits. | Pension scheme responsible for statutory revaluation. |

| Impact on Pension | Ensures a minimum guaranteed pension level. | Protects GMP's value against inflation post-April 1997. |

| Legislation | Governed by Pensions Act 1995 and related regulations. | Regulated under the Pensions Act 1995 and subsequent amendments. |

Understanding Guaranteed Minimum Pension (GMP)

Guaranteed Minimum Pension (GMP) represents the minimum pension amount accrued by employees under contracted-out occupational pension schemes between 1978 and 1997, ensuring it matches the National Insurance contributions made. This pension element is subject to statutory revaluation, a government-mandated increase rate applied annually during the deferment period to preserve its value against inflation. Understanding GMP requires recognizing its link to state pension rights and the differences in revaluation rules compared to other pension savings within the scheme.

What Is Statutory Revaluation?

Statutory Revaluation is a government-mandated increase applied annually to the Guaranteed Minimum Pension (GMP) accrued between 1978 and 1997 to protect its value against inflation. This revaluation ensures GMP keeps pace with price rises up to the State Pension Age, after which different rules may apply depending on whether the pension is in payment. Understanding the statutory revaluation process is essential for accurately calculating pension benefits and planning retirement income.

Key Differences: GMP vs Statutory Revaluation

Guaranteed Minimum Pension (GMP) represents the minimum pension accrued by employees under contracted-out defined benefit schemes between 1978 and 1997, ensuring alignment with state pension benefits. Statutory Revaluation applies to GMP accrued before April 1997, increasing its value annually in line with government-set inflation rates or a capped percentage to preserve its real value until retirement. The key difference lies in GMP providing a baseline pension amount, while Statutory Revaluation ensures that this amount maintains purchasing power by adjusting for inflation prior to pension payment.

How GMP Accrual Works

Guaranteed Minimum Pension (GMP) accrual is based on an employee's pensionable service between 1978 and 1997 under contracted-out pension schemes, ensuring a minimum pension linked to National Insurance contributions. The GMP amount is calculated separately and is then incorporated into the overall pension, with its value adjusted each year through Statutory Revaluation to maintain its purchasing power until retirement. Statutory Revaluation applies a government-mandated rate to increase the GMP annually from the end of the tax year when accrual stops until the pension is paid, preventing erosion of the GMP's real value over time.

Statutory Revaluation Rates Explained

Statutory Revaluation is a government-mandated adjustment to the GMP, ensuring that pension benefits keep pace with inflation and wage growth. These rates are calculated annually based on changes in the Retail Price Index (RPI) or other official inflation measures, guaranteeing that the deferred GMP amount increases over time before retirement. Understanding the statutory revaluation rates is crucial for accurately projecting future pension income and comparing it against the fixed nature of GMP accruals.

Impact on Pension Benefits

Guaranteed Minimum Pension (GMP) reflects the minimum pension amount accrued during contracted-out service, subject to statutory revaluation to maintain its value against inflation. Statutory revaluation increases GMP annually before retirement, directly impacting the pension benefits by preserving their real worth over time. Differences between GMP and statutory revaluation rates can affect the total pension amount received, influencing both the employee's retirement income and scheme liabilities.

Employer and Trustee Responsibilities

Employers must accurately calculate GMP liabilities to ensure pension schemes meet the statutory requirements for minimum benefits, while trustees are responsible for overseeing the correct application of statutory revaluation rates on GMPs to preserve the fund's value against inflation. Trustees also coordinate with employers to reconcile GMP data and implement adjustments reflecting legislative changes, maintaining scheme compliance and protecting member interests. Failure in these duties can lead to funding shortfalls and regulatory penalties, highlighting the critical role of precise administration in pension scheme governance.

Adjustments for Inflation: Comparing Methods

Guaranteed Minimum Pension (GMP) adjustments for inflation differ significantly from statutory revaluation methods, as GMP inflation uprates apply only until State Pension Age, often using the Consumer Price Index (CPI) or fixed rates capped at 3%. Statutory revaluation, however, increases deferred pension benefits for active scheme members between leaving and retirement by the CPI rate or 5%, whichever is lower, ensuring preservation of real value against inflation. This distinction impacts retirement income projections, particularly for those with GMP entitlements, affecting the overall pension inflation protection strategy.

Tax Implications for GMP and Revaluation

Guaranteed Minimum Pension (GMP) is subject to specific tax rules distinct from regular pension income, often affecting the taxable amount due to its indexation and funding. Statutory revaluation applies to GMP accrued before April 6, 1997, increasing benefits to preserve purchasing power, but these increases are typically non-taxable adjustments within the pension fund. Understanding tax implications requires distinguishing GMP income, which may be taxable upon payment, from statutory revaluation adjustments that usually do not attract immediate tax but impact the overall pension amount.

Choosing the Right Approach for Your Pension Scheme

Selecting between Guaranteed Minimum Pension (GMP) and Statutory Revaluation requires assessing the impact on scheme liabilities and member benefits. GMP ensures a minimum pension amount linked to National Insurance contributions, whereas Statutory Revaluation adjusts GMP benefits annually to counteract inflation. Pension scheme trustees must evaluate actuarial valuations and legal obligations to determine the optimal strategy that balances cost efficiency and member security.

Important Terms

Contracted-Out Salary Related Scheme (COSR)

The Contracted-Out Salary Related Scheme (COSR) integrates Guaranteed Minimum Pension (GMP) calculations, which are subject to Statutory Revaluation to ensure inflation-adjusted pension benefits for scheme members.

GMP Equalisation

GMP Equalisation ensures that Guaranteed Minimum Pensions receive statutory revaluation adjustments to maintain pension value parity between genders.

Fixed Rate Revaluation

Fixed Rate Revaluation applies a predetermined percentage increase to GMP benefits, whereas Statutory Revaluation adjusts GMP based on official inflation indices to preserve pension value.

Section 148 Orders

Section 148 Orders clarify that Guaranteed Minimum Pension (GMP) must be increased in line with Statutory Revaluation requirements to ensure pension benefits keep pace with inflation.

Excess Benefits

Excess benefits in pension schemes arise when Guaranteed Minimum Pension (GMP) amounts exceed statutory revaluation rates, leading to complex adjustments to ensure compliance with pension regulations.

Anti-Franking

Anti-Franking rules limit the tax efficiency of Guaranteed Minimum Pension (GMP) benefits by restricting credit for Statutory Revaluation against dividend tax offsets.

Post-97 Accrual

Post-97 Accrual in pension schemes often involves comparing Guaranteed Minimum Pension (GMP) rights, which receive statutory revaluation to preserve value against inflation, with non-GMP pension benefits that typically follow scheme-specific revaluation rules.

Pensionable Service

Pensionable service determines the Guaranteed Minimum Pension (GMP) accrued, which is adjusted annually through Statutory Revaluation to maintain its value before retirement.

Section 9(2B) Rights

Section 9(2B) Rights pertain to the statutory protection of Guaranteed Minimum Pension (GMP) benefits, ensuring that increases to GMP are aligned with statutory revaluation rates rather than discretionary pension scheme increments. This legal framework guarantees that pensions accrued before April 6, 1997, receive annual revaluation in line with inflation or prescribed statutory limits, preserving the value of GMP entitlements amidst pension fund adjustments.

Leaving Service Benefit

Leaving Service Benefit calculations involve adjusting the Guaranteed Minimum Pension (GMP) to reflect Statutory Revaluation rates, ensuring pension benefits keep pace with inflation between leaving employment and retirement. Statutory Revaluation specifically applies to GMP accrued after 1988, increasing the GMP in line with government-mandated uprating rates, whereas benefits accrued before 1988 are typically linked to leaving service benefit terms without statutory adjustments.

Guaranteed Minimum Pension (GMP) vs Statutory Revaluation Infographic

moneydif.com

moneydif.com