Normal cost represents the annual expense required to fund a pension plan's benefits earned by employees during the current year. Amortization cost refers to the periodic payments made to cover unfunded pension liabilities or past service costs over a set period. Understanding the distinction between normal cost and amortization cost is essential for accurately assessing a pension plan's financial health and funding strategy.

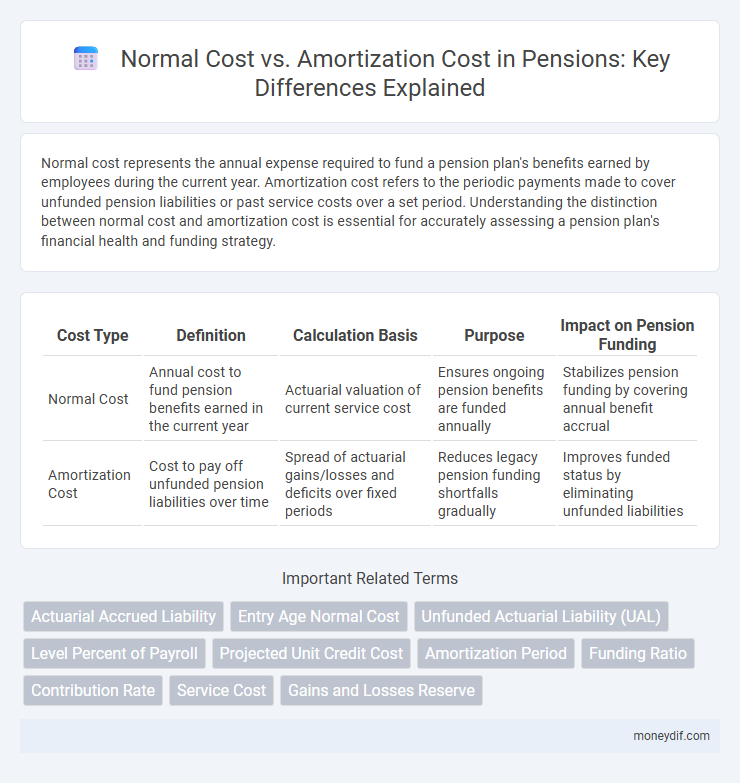

Table of Comparison

| Cost Type | Definition | Calculation Basis | Purpose | Impact on Pension Funding |

|---|---|---|---|---|

| Normal Cost | Annual cost to fund pension benefits earned in the current year | Actuarial valuation of current service cost | Ensures ongoing pension benefits are funded annually | Stabilizes pension funding by covering annual benefit accrual |

| Amortization Cost | Cost to pay off unfunded pension liabilities over time | Spread of actuarial gains/losses and deficits over fixed periods | Reduces legacy pension funding shortfalls gradually | Improves funded status by eliminating unfunded liabilities |

Introduction to Pension Costs: Normal vs Amortization

Pension costs consist of normal cost, representing the annual expense for benefits earned by employees during the year, and amortization cost, which covers the repayment of unfunded actuarial liabilities over time. Normal cost is calculated using actuarial assumptions regarding salary growth, mortality, and employee turnover, directly impacting the pension plan's current expense. Amortization cost addresses past service costs and actuarial gains or losses, spreading these adjustments across reporting periods to stabilize pension funding requirements.

Defining Normal Cost in Pension Plans

Normal cost in pension plans refers to the annual expense required to fund the benefits earned by employees during the current year, reflecting the present value of promised future benefits allocated to that period. It excludes costs related to past service liabilities, which are covered separately through amortization payments designed to reduce unfunded actuarial accrued liabilities over time. Accurately calculating normal cost is crucial for maintaining plan solvency and ensuring consistent funding aligned with actuarial assumptions.

Understanding Amortization Cost in Pension Funding

Amortization cost in pension funding represents the gradual repayment of unfunded liabilities or past service costs over a set period, stabilizing contribution rates for employers. Unlike normal cost, which covers the present value of benefits earned in the current year, amortization cost addresses the funding shortfall from prior years. Accurately calculating amortization cost ensures the pension plan maintains long-term solvency and meets its future obligations.

Key Differences: Normal Cost vs Amortization Cost

Normal cost represents the annual expense attributed to pension benefits earned by employees during the current year, reflecting ongoing service costs. Amortization cost, on the other hand, accounts for the systematic recognition of past service liabilities or gains, spreading prior funding shortfalls or surpluses over a specified period. The key difference lies in normal cost addressing current service accruals, while amortization cost manages adjustments from historical funding discrepancies.

Impact on Employer Contributions

Normal cost represents the annual expense required to fund pension benefits earned by employees during the current year, directly influencing regular employer contributions. Amortization cost covers the repayment of unfunded pension liabilities over a specified period, significantly increasing employer contribution rates when past deficits exist. The combined effect of normal cost and amortization cost determines the total required employer contributions to maintain the pension plan's financial health.

Effect on Pension Plan Funding Status

Normal cost reflects the annual expense required to fund a pension plan's benefits earned during the year, directly influencing the ongoing funding status by ensuring steady accumulation of assets. Amortization cost addresses the repayment of unfunded liabilities over a specified period, impacting funding status by systematically reducing deficits and improving plan solvency. Both components are critical for maintaining a balanced pension funding status and meeting long-term benefit obligations.

Role in Actuarial Valuations

Normal cost represents the annual expense attributed to benefits earned by employees during the current year, serving as a fundamental component in actuarial valuations. Amortization cost covers payments required to reduce unfunded pension liabilities over a predetermined period, ensuring that past funding shortfalls are systematically addressed. Together, these costs provide a comprehensive measure of a pension plan's funding requirements, balancing ongoing benefit accruals with legacy obligations.

Budgeting Implications for Organizations

Normal cost reflects the projected annual expense to fund pension benefits earned by employees during the current year, serving as a predictable baseline for organizational budgeting. Amortization cost represents the systematic repayment of unfunded pension liabilities or actuarial losses over a set period, adding variability and potential volatility to budget forecasts. Organizations must balance these costs carefully in financial planning to ensure pension sustainability while maintaining fiscal stability.

Regulatory and Reporting Perspectives

Normal cost represents the annual expense allocated to pension benefits earned by employees in the current year, reflecting the ongoing funding requirement under regulatory standards such as GASB or IAS 19. Amortization cost pertains to the systematic repayment of unfunded pension liabilities or past service costs over a specified period, impacting long-term pension obligations reported in financial statements. Regulatory frameworks mandate detailed disclosures of both normal and amortization costs to ensure transparency and accurate actuarial valuation in pension plan reporting.

Best Practices in Managing Pension Costs

Normal cost represents the annual expense attributed to pension benefits earned by employees during the current year, while amortization cost covers the repayment of unfunded pension liabilities over a specified period. Best practices in managing pension costs emphasize maintaining a clear distinction between these two components to ensure transparent financial reporting and effective budgeting. Regular actuarial assessments and strategic funding policies help optimize the balance between normal cost contributions and amortization payments, minimizing volatility and long-term fiscal risk.

Important Terms

Actuarial Accrued Liability

Actuarial Accrued Liability represents the present value of benefits earned to date, where Normal Cost reflects the annual cost of new benefits accrued each year and Amortization Cost covers payments allocated to reducing unfunded liabilities over time.

Entry Age Normal Cost

Entry Age Normal Cost allocates pension expenses evenly by spreading the projected benefit costs over an employee's working career, contrasting with Amortization Cost which addresses past unfunded liabilities through periodic payments.

Unfunded Actuarial Liability (UAL)

Unfunded Actuarial Liability (UAL) arises when the amortization cost of past pension obligations exceeds the normal cost of benefits accrued during the current period.

Level Percent of Payroll

Level Percent of Payroll amortizes the unfunded actuarial liability by applying a constant percentage of payroll over the amortization period, balancing Normal Cost and Amortization Cost to stabilize employer contributions.

Projected Unit Credit Cost

The Projected Unit Credit Cost method calculates pension liabilities by allocating normal cost for future service and amortization cost for past service obligations based on projected benefits.

Amortization Period

Amortization period refers to the length of time over which an asset's cost is gradually expensed or an obligation is paid off, directly impacting both normal cost and amortization cost calculations in accounting and actuarial valuations. Normal cost represents the annual expense attributed to current service, while amortization cost accounts for spreading past costs or actuarial gains and losses over the amortization period, ensuring systematic recognition of expenses.

Funding Ratio

The funding ratio improves when normal cost contributions consistently exceed amortization cost payments, ensuring pension plan solvency and reducing unfunded liabilities.

Contribution Rate

Contribution rate reflects the proportion of normal cost, which covers the annual expense of benefits earned, compared to amortization cost, which addresses spreading unfunded liabilities over a set period.

Service Cost

Service cost represents the annual expense associated with employee benefits earned during a period, typically calculated using actuarial valuations. Normal cost reflects the portion attributed to current service, while amortization cost accounts for spreading past service costs and actuarial gains or losses over a predefined period.

Gains and Losses Reserve

Gains and Losses Reserve reflects the cumulative differences between Normal Cost, representing expected expenses, and Amortization Cost, which spreads recognized gains or losses over time to smooth financial impact.

Normal Cost vs Amortization Cost Infographic

moneydif.com

moneydif.com