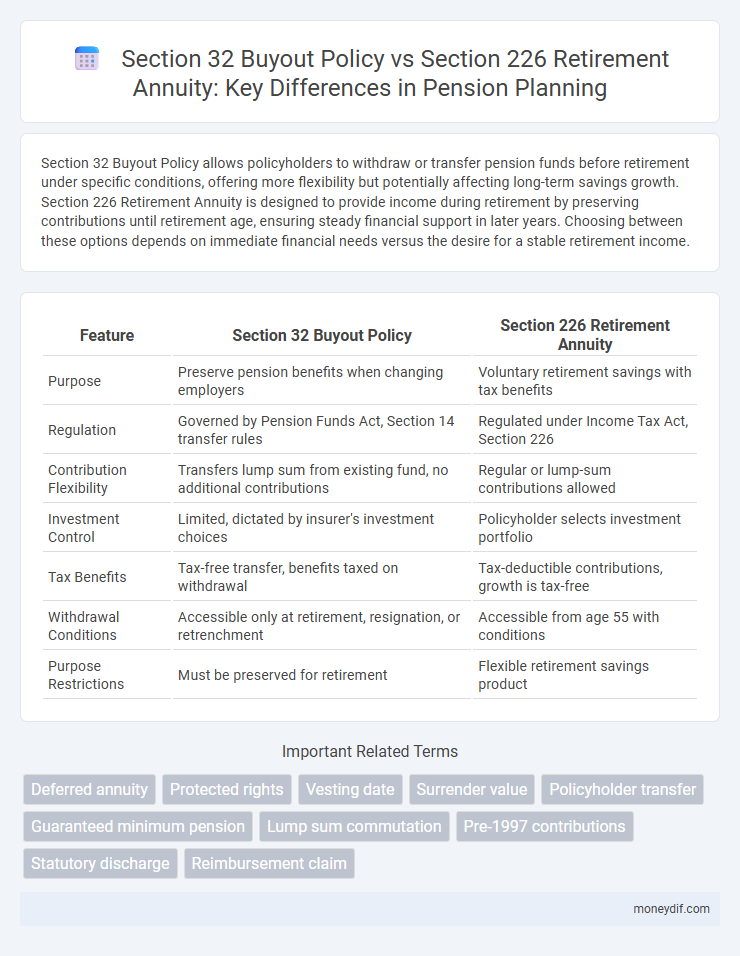

Section 32 Buyout Policy allows policyholders to withdraw or transfer pension funds before retirement under specific conditions, offering more flexibility but potentially affecting long-term savings growth. Section 226 Retirement Annuity is designed to provide income during retirement by preserving contributions until retirement age, ensuring steady financial support in later years. Choosing between these options depends on immediate financial needs versus the desire for a stable retirement income.

Table of Comparison

| Feature | Section 32 Buyout Policy | Section 226 Retirement Annuity |

|---|---|---|

| Purpose | Preserve pension benefits when changing employers | Voluntary retirement savings with tax benefits |

| Regulation | Governed by Pension Funds Act, Section 14 transfer rules | Regulated under Income Tax Act, Section 226 |

| Contribution Flexibility | Transfers lump sum from existing fund, no additional contributions | Regular or lump-sum contributions allowed |

| Investment Control | Limited, dictated by insurer's investment choices | Policyholder selects investment portfolio |

| Tax Benefits | Tax-free transfer, benefits taxed on withdrawal | Tax-deductible contributions, growth is tax-free |

| Withdrawal Conditions | Accessible only at retirement, resignation, or retrenchment | Accessible from age 55 with conditions |

| Purpose Restrictions | Must be preserved for retirement | Flexible retirement savings product |

Understanding Section 32 Buyout Policy

Section 32 Buyout Policy allows policyholders to transfer their accumulated retirement annuity or pension fund benefits into a single lump sum before retirement, providing immediate access to funds. This policy is governed by the South African Income Tax Act, which ensures tax-efficient preservation of retirement savings while offering flexibility in managing retirement portfolios. Understanding the specific conditions and tax implications of a Section 32 Buyout Policy is crucial for optimizing retirement fund withdrawals and maintaining long-term financial security.

Overview of Section 226 Retirement Annuity

Section 226 Retirement Annuity offers a tax-efficient solution for individuals seeking long-term retirement savings through regular contributions managed by approved pension funds. This policy provides a structured payout option upon retirement, designed to ensure steady income while offering potential tax benefits under retirement fund legislation. Unlike the Section 32 Buyout Policy, which typically consolidates pension benefits from previous employers, Section 226 focuses on continuous annuity accumulation and payout for individual retirement planning.

Key Differences Between Section 32 and Section 226

Section 32 Buyout Policy allows policyholders to transfer pension benefits from a retirement fund into an insurance policy, often providing more control over investment options and the potential for higher returns. Section 226 Retirement Annuity involves contributions made to a retirement annuity fund, which accumulates over time and offers tax deductions and secure retirement income options. Key differences include the portability of funds with Section 32 and the structured, ongoing contributions typical of Section 226, impacting flexibility, tax benefits, and retirement planning strategies.

Eligibility Criteria for Section 32 and Section 226

Section 32 Buyout Policy eligibility requires an individual to have an existing retirement fund that can be transferred upon resignation, retrenchment, or changing employment, ensuring continuity of pension benefits. Section 226 Retirement Annuity eligibility mandates that the individual must be a South African resident with a retirement annuity policy established independently for retirement savings, without needing a prior pension fund. Both policies serve different purposes in retirement planning, with Section 32 focused on preserving existing pension rights and Section 226 promoting voluntary long-term retirement savings.

Transfer and Portability Options

Section 32 Buyout Policy allows pension fund members to transfer a lump sum to another retirement fund or annuity, offering flexibility in managing retirement savings. Section 226 Retirement Annuity emphasizes portability by enabling regular contributions to be maintained while switching providers without losing accrued benefits. Understanding the transfer and portability options under both sections is crucial for optimizing retirement fund consolidation and long-term pension growth.

Tax Implications for Each Policy

Section 32 Buyout Policy allows tax-free transfer of accumulated pension funds upon resignation or retrenchment, but withdrawals before retirement attract income tax at the individual's marginal rate. Section 226 Retirement Annuity offers tax deductions on annual contributions up to a certain limit, with tax-free growth within the policy, while withdrawals at retirement are taxed more favorably compared to early withdrawals. Understanding the specific tax benefits and penalties associated with each policy aids in optimizing retirement savings and minimizing tax liabilities.

Investment Choices and Growth Potential

Section 32 Buyout Policy offers limited investment choices, often restricted to guaranteed returns and conservative funds, resulting in stable but modest growth potential. Section 226 Retirement Annuity provides a wider range of investment options, including equities, bonds, and multi-asset portfolios, enabling higher growth potential tailored to individual risk tolerance. Consequently, Retirement Annuities under Section 226 typically allow for greater capital appreciation through diversified market-linked investments.

Accessing Benefits: Rules and Flexibility

Section 32 Buyout Policy allows policyholders to transfer their retirement funds from a pension or provident fund into an individual policy, granting access to benefits with limited flexibility until retirement, where only a portion can be taken as a lump sum and the remainder must be annuitized. In contrast, Section 226 Retirement Annuity offers more structured access rules, restricting withdrawals before retirement age except under specific circumstances like disability, with benefits primarily paid as a retirement annuity. Understanding these differences is crucial for optimizing retirement planning strategies and maximizing benefit utilization within South African pension frameworks.

Risks and Protections for Policyholders

Section 32 Buyout Policies expose policyholders to investment risk as the lump-sum payment depends on the underlying fund's performance, potentially resulting in lower retirement benefits if the market declines. Section 226 Retirement Annuities provide enhanced protection through regulated contributions and tax incentives, reducing the risk of fund depletion before retirement age. Both products require careful consideration of fees, investment options, and the insurer's solvency to safeguard future pension benefits.

Choosing the Right Pension Option

Section 32 Buyout Policy allows individuals to transfer retirement funds from a previous employer's pension or provident fund into a policy, providing flexibility and continued tax advantages without immediate tax penalties. Section 226 Retirement Annuity is a tax-efficient savings vehicle designed for self-employed individuals or those without access to an employer's fund, offering controlled investment choices and tax deductions on contributions. Choosing the right pension option depends on factors like employment status, liquidity needs, and long-term retirement goals to maximize tax benefits and ensure financial security.

Important Terms

Deferred annuity

Deferred annuity under Section 32 Buyout Policy allows policyholders to convert accumulated funds into a lump sum or pension, whereas Section 226 Retirement Annuity provides continuous retirement income through regular annuity payments.

Protected rights

Section 32 Buyout Policy allows for tax-free lump-sum withdrawals from retirement annuities under specific conditions, while Section 226 Retirement Annuity protects contributors' rights by ensuring funds remain preserved until retirement or specified events.

Vesting date

The vesting date determines when employees gain non-forfeitable rights to benefits under Section 32 Buyout Policy, allowing buyout of accumulated savings, while under Section 226 Retirement Annuity, the vesting date establishes eligibility to receive retirement annuities without early penalties. Understanding these timelines is crucial for maximizing benefits from severance packages under Section 32 and securing retirement income streams under Section 226.

Surrender value

Section 32 Buyout Policy typically offers a surrender value based on accumulated premiums and interest, whereas Section 226 Retirement Annuity's surrender value is subject to retirement annuity withdrawal rules and tax implications under South African retirement legislation.

Policyholder transfer

Section 32 Buyout Policy enables policyholders to withdraw retirement annuity funds as a lump sum while transferring outstanding benefits, whereas Section 226 Retirement Annuity emphasizes preservation of retirement savings through regulated annuity payouts. Transfer of policyholder benefits under Section 32 facilitates immediate access to funds, contrasting with Section 226's focus on sustaining retirement income over time.

Guaranteed minimum pension

The Guaranteed Minimum Pension ensures a baseline retirement income under Section 32 Buyout Policies, whereas Section 226 Retirement Annuities accumulate investment returns without a fixed minimum pension guarantee.

Lump sum commutation

Section 32 Buyout Policy enables lump sum commutation of retirement benefits by surrendering the policy value, whereas Section 226 Retirement Annuity allows partial withdrawal or commutation of annuity income under specified conditions governed by the Income Tax Act.

Pre-1997 contributions

Pre-1997 contributions under Section 32 Buyout Policy involve lump-sum withdrawals allowed for retirement benefits, whereas Section 226 Retirement Annuity mandates structured payments primarily for employees retiring after prolonged service. Differences in tax treatment and withdrawal conditions significantly impact the valuation and timing of benefits under both policies.

Statutory discharge

Section 32 buyout policy allows tax-free withdrawal of life insurance proceeds as a lump sum under specified conditions, while Section 226 retirement annuity mandates structured payouts to provide lifelong income, ensuring compliance with statutory discharge requirements.

Reimbursement claim

Section 32 Buyout Policy allows tax-free repayment of life insurance premiums while Section 226 Retirement Annuity secures tax-deductible retirement savings withdrawals, both influencing reimbursement claim strategies.

Section 32 Buyout Policy vs Section 226 Retirement Annuity Infographic

moneydif.com

moneydif.com