Longevity risk poses a significant challenge for pension plans as retirees may outlive their savings, requiring careful management to ensure sustainable income throughout an extended lifespan. Inflation risk erodes the purchasing power of pension benefits, making fixed payouts less valuable over time and necessitating inflation-protected adjustments. Balancing these risks demands strategic asset allocation and the incorporation of inflation-linked investments to safeguard retirees' financial security.

Table of Comparison

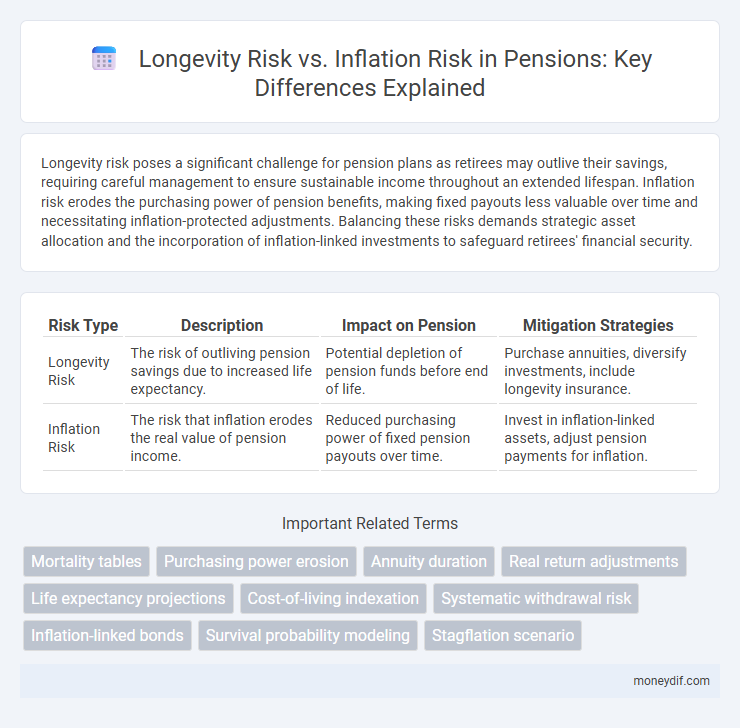

| Risk Type | Description | Impact on Pension | Mitigation Strategies |

|---|---|---|---|

| Longevity Risk | The risk of outliving pension savings due to increased life expectancy. | Potential depletion of pension funds before end of life. | Purchase annuities, diversify investments, include longevity insurance. |

| Inflation Risk | The risk that inflation erodes the real value of pension income. | Reduced purchasing power of fixed pension payouts over time. | Invest in inflation-linked assets, adjust pension payments for inflation. |

Understanding Longevity Risk in Pensions

Longevity risk in pensions refers to the uncertainty that retirees will live longer than expected, potentially outlasting their pension savings and income. This risk challenges pension fund sustainability by increasing the period over which benefits must be paid, requiring careful actuarial assumptions and funding strategies. Effective management of longevity risk involves dynamic adjustments to pension plans and incorporating longevity-linked financial instruments to protect against unforeseen lifespan increases.

Defining Inflation Risk for Retirees

Inflation risk for retirees refers to the danger that rising prices will erode the purchasing power of fixed income streams, diminishing their ability to maintain a desired standard of living. Unlike longevity risk, which concerns outliving one's savings, inflation risk specifically impacts the real value of pension benefits and savings over time. Managing inflation risk requires strategies such as investing in inflation-protected securities or adjusting withdrawal rates to preserve financial security throughout retirement.

Key Differences: Longevity Risk vs Inflation Risk

Longevity risk refers to the possibility of outliving retirement savings due to increased life expectancy, whereas inflation risk involves the erosion of purchasing power as the cost of goods and services rises over time. Longevity risk impacts the duration a pension fund must support an individual, often requiring sustained or increased withdrawals, while inflation risk affects the real value of retirement income, necessitating adjustments for rising expenses. Effective pension planning must address both risks to ensure financial security throughout retirement.

Impact of Longevity Risk on Pension Planning

Longevity risk significantly impacts pension planning by increasing the uncertainty of payout duration, requiring larger retirement funds to sustain longer life expectancies. Failure to account for extended lifespan can lead to underfunded pensions and compromised financial security during retirement. Effective pension strategies must integrate longevity risk models to ensure adequate income streams throughout retirees' extended lifespans.

How Inflation Risk Erodes Pension Value

Inflation risk erodes pension value by diminishing the purchasing power of fixed retirement incomes over time, leading to a significant reduction in retirees' standard of living. As inflation rises, the real value of fixed pension payments declines, causing retirees to afford fewer goods and services than initially anticipated. This contrasts with longevity risk, which concerns outliving one's savings, emphasizing the critical need for inflation-adjusted pensions or cost-of-living adjustments to preserve pension wealth.

Managing Longevity Risk in Retirement Solutions

Managing longevity risk in retirement solutions involves designing strategies that ensure retirees do not outlive their savings, emphasizing the importance of lifetime income products like annuities. Unlike inflation risk, which erodes purchasing power over time, longevity risk requires actuarial precision to balance guaranteed payouts with sustainable asset growth. Incorporating diverse investment portfolios alongside inflation-protected securities helps address both risks, but prioritizing longevity risk ensures financial security throughout an extended retirement period.

Strategies to Hedge Against Inflation Risk

Strategies to hedge against inflation risk in pensions include investing in inflation-protected securities like Treasury Inflation-Protected Securities (TIPS) and Real Return Bonds, which adjust principal and interest payments based on inflation rates. Diversifying pension portfolios with real assets such as real estate and commodities can also preserve purchasing power as these assets tend to appreciate during inflationary periods. Incorporating cost-of-living adjustments (COLAs) in pension plans ensures benefit payments increase with rising consumer prices, directly mitigating the erosion of retirees' income due to inflation.

Integrating Longevity and Inflation Risks in Pension Funds

Integrating longevity and inflation risks in pension funds requires dynamic strategies that address the extended life expectancy and rising cost of living simultaneously. Utilizing inflation-indexed annuities and longevity swaps can hedge against these intertwined risks effectively, ensuring sustainable payout streams. Advanced actuarial models combining mortality improvements and inflation forecasts enhance pension funds' resilience in delivering real value over retirees' lifetimes.

Policy Responses to Longevity and Inflation Challenges

Policy responses to longevity and inflation risks in pensions include adjusting contribution rates and retirement ages to account for longer life expectancies. Implementing inflation-linked pension benefits or cost-of-living adjustments helps protect retirees' purchasing power against rising prices. Governments and pension funds increasingly adopt diversified investment strategies and dynamic actuarial models to mitigate these intertwined risks effectively.

Future Trends in Pension Risk Management

Longevity risk and inflation risk remain critical challenges in pension risk management as retirees live longer and costs of living escalate. Advanced actuarial models and dynamic hedging strategies are increasingly employed to mitigate these risks by projecting life expectancy trends and inflation rates more accurately. Future trends highlight the integration of artificial intelligence and real-time data analytics to enhance the precision of pension fund risk assessments and optimize asset-liability matching.

Important Terms

Mortality tables

Mortality tables provide critical data for assessing longevity risk by predicting life expectancy, which directly impacts financial planning against inflation risk in retirement portfolios.

Purchasing power erosion

Longevity risk erodes purchasing power over time by increasing the duration of retirement expenses, while inflation risk directly reduces the real value of fixed income streams, making combined management essential for sustainable income planning.

Annuity duration

Annuity duration measures the sensitivity of annuity cash flows to interest rate changes, playing a crucial role in managing longevity risk by aligning payments with extended life expectancy. Inflation risk, however, erodes the real value of fixed annuity payouts, making it essential to consider inflation-adjusted or indexed annuities to preserve purchasing power over time.

Real return adjustments

Real return adjustments critically account for longevity risk by ensuring investment income outpaces lifespan extensions, preserving purchasing power despite prolonged retirement periods. Inflation risk reduces real returns by eroding asset value over time, requiring higher nominal returns or inflation-indexed investments to maintain financial stability.

Life expectancy projections

Life expectancy projections significantly impact longevity risk, which refers to the financial uncertainty of individuals living longer than expected, potentially outlasting their retirement savings. Inflation risk exacerbates this challenge by eroding the purchasing power of fixed income sources, making it critical for retirement planning models to integrate both extended lifespan data and anticipated inflation rates to ensure sustainable financial security.

Cost-of-living indexation

Cost-of-living indexation adjusts retirement benefits to maintain purchasing power amid rising inflation, directly mitigating inflation risk by linking payouts to consumer price changes. However, longevity risk remains challenging as indexation does not address the extended duration retirees may live, potentially requiring benefits to last longer than anticipated.

Systematic withdrawal risk

Systematic withdrawal risk increases when longevity risk and inflation risk coincide, as prolonged lifespan combined with rising costs erodes retirement savings.

Inflation-linked bonds

Inflation-linked bonds protect against inflation risk by adjusting principal and interest payments with inflation, but they do not hedge longevity risk, which requires separate financial strategies to manage the uncertainty of lifespan.

Survival probability modeling

Survival probability modeling quantifies the likelihood of individuals outliving their financial resources, critically balancing longevity risk against inflation risk to optimize retirement portfolio sustainability.

Stagflation scenario

Stagflation intensifies longevity risk by eroding real retirement savings due to inflation while simultaneously limiting income growth in a stagnant economy.

Longevity risk vs Inflation risk Infographic

moneydif.com

moneydif.com