Defined benefit plans guarantee a fixed retirement income based on salary and years of service, offering predictable and stable benefits for employees. Defined contribution plans depend on individual contributions and investment performance, making retirement income variable and less predictable. Understanding the differences helps employees and employers choose the pension type that best aligns with financial goals and risk tolerance.

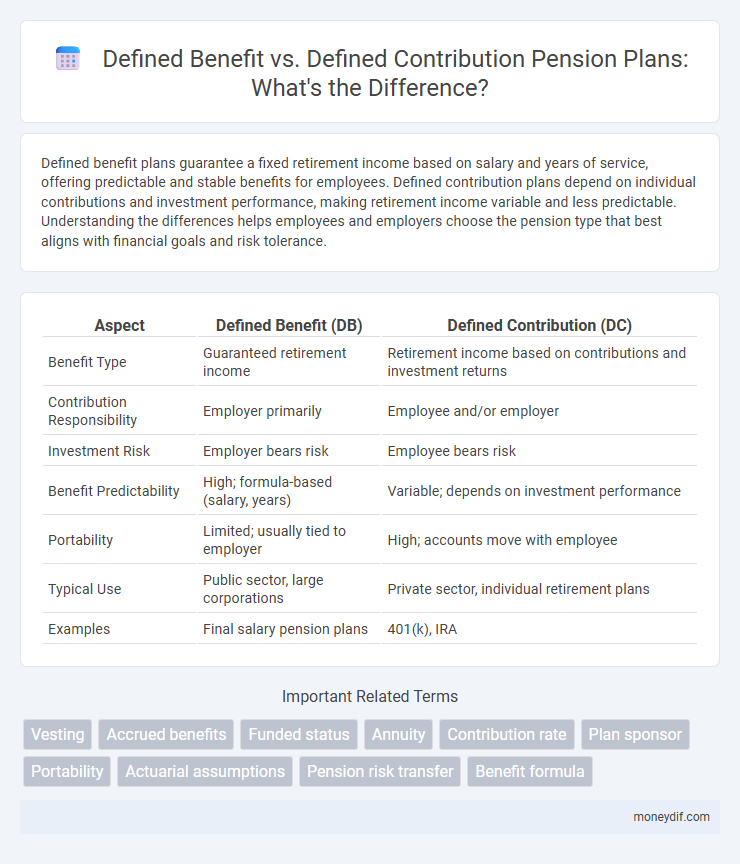

Table of Comparison

| Aspect | Defined Benefit (DB) | Defined Contribution (DC) |

|---|---|---|

| Benefit Type | Guaranteed retirement income | Retirement income based on contributions and investment returns |

| Contribution Responsibility | Employer primarily | Employee and/or employer |

| Investment Risk | Employer bears risk | Employee bears risk |

| Benefit Predictability | High; formula-based (salary, years) | Variable; depends on investment performance |

| Portability | Limited; usually tied to employer | High; accounts move with employee |

| Typical Use | Public sector, large corporations | Private sector, individual retirement plans |

| Examples | Final salary pension plans | 401(k), IRA |

Understanding Defined Benefit and Defined Contribution Plans

Defined benefit plans provide retirees with a predetermined monthly income based on salary history and years of service, offering predictable retirement security. Defined contribution plans allow employees to invest contributions in individual accounts, with retirement benefits depending on investment performance and contributions made over time. Understanding the fundamental differences between these plans helps employees and employers make informed decisions about retirement savings strategies.

Key Differences Between Defined Benefit and Defined Contribution

Defined benefit plans guarantee a specified monthly benefit at retirement, calculated through a formula involving salary history and years of service, offering predictable income to retirees. Defined contribution plans, such as 401(k)s, depend on individual contributions and investment performance, resulting in variable retirement income based on market returns. Key differences include who bears investment risk--employers in defined benefit plans versus employees in defined contribution plans--and the level of benefit certainty provided.

How Defined Benefit Plans Work

Defined Benefit Plans provide a guaranteed retirement income based on a formula considering factors such as salary history, years of service, and age at retirement. Employers bear the investment risk and are responsible for ensuring sufficient funds to pay future benefits. These plans offer predictable payouts, making them a secure option for employees seeking stable retirement income.

How Defined Contribution Plans Operate

Defined contribution plans operate by allowing employees and employers to contribute a fixed amount or percentage of salary into individual accounts, which are then invested to grow over time. The retirement benefit depends on the total contributions made and the investment performance, transferring the investment risk to the employee. Unlike defined benefit plans, defined contribution plans do not guarantee a specific retirement payout, making accumulated savings and market returns crucial for the final pension amount.

Employer and Employee Roles in Pension Contributions

In defined benefit pension plans, employers bear the primary responsibility for funding and guaranteeing a specific retirement payout, while employees typically contribute a fixed percentage of their salary. Defined contribution plans shift more responsibility to employees, who make regular contributions and assume investment risks, whereas employer contributions may be fixed or match a portion of employee contributions. This fundamental distinction influences retirement income security, with employers managing funding risks in defined benefit plans and employees facing investment performance risks in defined contribution plans.

Investment Risks in Defined Benefit vs Defined Contribution

Defined benefit pension plans carry investment risks predominantly borne by the employer, as they guarantee a fixed payout regardless of asset performance, creating potential funding shortfalls if investments underperform. Defined contribution plans shift investment risk to employees, with retirement benefits directly tied to account investment returns, thereby exposing individuals to market volatility and longevity risk. Understanding these risk allocations is crucial for retirement planning and pension fund management.

Retirement Income Predictability

Defined benefit plans guarantee a fixed retirement income based on salary and years of service, ensuring predictable monthly payments. Defined contribution plans, such as 401(k)s, depend on investment performance and contributions, resulting in variable retirement income. Predictability in retirement income is higher with defined benefit plans due to their structured payout formulas.

Portability and Flexibility of Pension Plans

Defined contribution pension plans offer greater portability, allowing employees to transfer accumulated funds between employers or into individual retirement accounts, enhancing flexibility across career changes. Defined benefit plans typically lack portability, as promised benefits are based on employer-specific formulas and tenure, limiting access to funds outside the plan's structure. Flexibility is higher in defined contribution plans due to variable investment options and control over contributions, while defined benefit plans provide fixed payouts but minimal customization.

Financial Security and Longevity Risks

Defined benefit plans provide predictable, lifetime income, offering strong financial security by mitigating longevity risk through employer guarantees. Defined contribution plans place investment risk and longevity risk on individuals, potentially resulting in unpredictable retirement income. Managing longevity risk in defined contribution plans requires strategic withdrawal strategies and investment decisions to ensure sustained financial security.

Choosing the Right Pension Plan for Your Retirement

Defined benefit plans guarantee a fixed retirement income based on salary and years of service, providing financial security through predictable payments. Defined contribution plans allow individuals to invest contributions, with retirement benefits dependent on investment performance and market fluctuations. Choosing the right pension plan requires evaluating risk tolerance, financial goals, and the desire for stable income versus potential growth.

Important Terms

Vesting

Vesting in defined benefit plans guarantees employees a non-forfeitable right to promised retirement benefits after a specified period, while in defined contribution plans, vesting applies to employer contributions, ensuring employees retain ownership of accumulated funds. The difference impacts retirement security, as defined benefit vesting secures predictable income, whereas defined contribution vesting secures account balance access based on contribution schedules.

Accrued benefits

Accrued benefits in defined benefit plans represent the guaranteed retirement income earned by an employee based on salary and years of service, while in defined contribution plans, accrued benefits reflect the total contributions plus investment returns accumulated in the employee's individual account. Defined benefit plans shift investment risk to the employer, whereas defined contribution plans place investment risk on the employee.

Funded status

Funded status measures the financial health of defined benefit plans by comparing plan assets to liabilities, whereas defined contribution plans do not have a funded status as benefits depend solely on individual account balances.

Annuity

Defined benefit annuities guarantee a fixed income based on salary and years of service, providing retirees with predictable payouts, whereas defined contribution annuities depend on individual contributions and investment performance, resulting in variable retirement income. The risk in defined benefit plans lies with the employer, while in defined contribution plans, the retiree assumes investment risk and potential for growth.

Contribution rate

Defined contribution plans have a fixed contribution rate determined by employee and employer input, while defined benefit plans require actuarially calculated contribution rates to ensure promised retirement benefits.

Plan sponsor

Plan sponsors of defined benefit plans assume investment risk and are responsible for ensuring sufficient funding to meet future pension obligations, whereas sponsors of defined contribution plans primarily handle plan administration while participants bear the investment risk. Defined benefit plans require actuarial assessments and long-term funding strategies, contrasting with defined contribution plans that focus on participant-directed investments and individual account balances.

Portability

Defined benefit plans offer limited portability as retirement benefits are based on tenure and salary history within a single employer, often requiring complex transfers when changing jobs. Defined contribution plans enhance portability by allowing employees to roll over accumulated account balances into new employer plans or individual retirement accounts, facilitating continuity in retirement savings.

Actuarial assumptions

Defined benefit plans rely on actuarial assumptions such as mortality rates, employee turnover, salary growth, and discount rates to estimate future pension liabilities, ensuring accurate funding requirements. In contrast, defined contribution plans shift investment risk to employees, requiring fewer actuarial assumptions since benefits depend on account balances rather than predetermined payouts.

Pension risk transfer

Pension risk transfer shifts liabilities from defined benefit plans, which guarantee fixed payments, to defined contribution plans, where investment risk is borne by employees.

Benefit formula

The benefit formula in defined benefit plans guarantees a predetermined retirement payout based on factors like salary and years of service, unlike defined contribution plans where benefits depend on investment performance and contributions.

Defined benefit vs Defined contribution Infographic

moneydif.com

moneydif.com