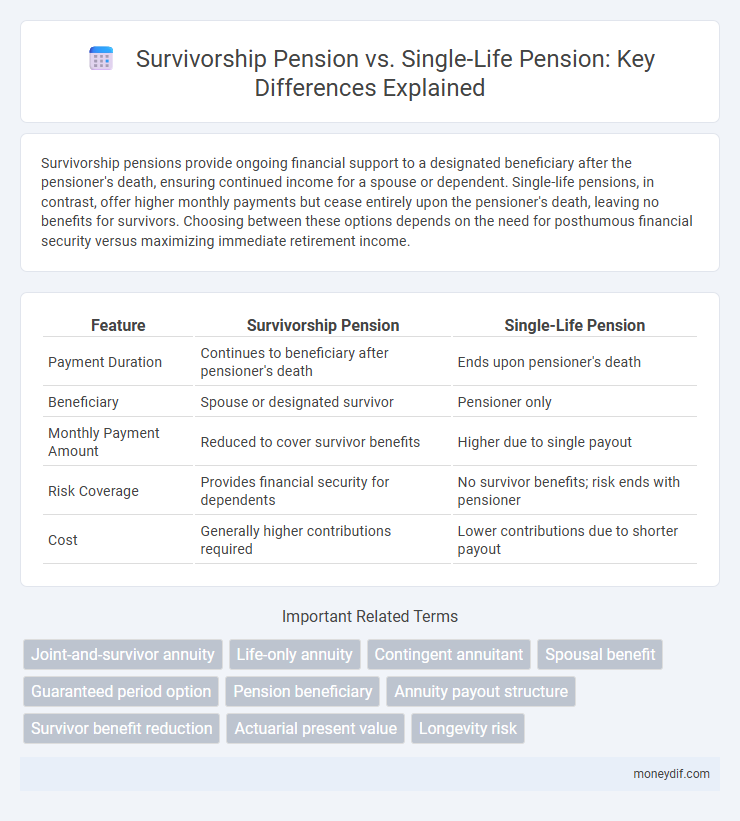

Survivorship pensions provide ongoing financial support to a designated beneficiary after the pensioner's death, ensuring continued income for a spouse or dependent. Single-life pensions, in contrast, offer higher monthly payments but cease entirely upon the pensioner's death, leaving no benefits for survivors. Choosing between these options depends on the need for posthumous financial security versus maximizing immediate retirement income.

Table of Comparison

| Feature | Survivorship Pension | Single-Life Pension |

|---|---|---|

| Payment Duration | Continues to beneficiary after pensioner's death | Ends upon pensioner's death |

| Beneficiary | Spouse or designated survivor | Pensioner only |

| Monthly Payment Amount | Reduced to cover survivor benefits | Higher due to single payout |

| Risk Coverage | Provides financial security for dependents | No survivor benefits; risk ends with pensioner |

| Cost | Generally higher contributions required | Lower contributions due to shorter payout |

Understanding Survivorship Pension and Single-Life Pension

Survivorship pension provides ongoing financial support to a designated beneficiary, typically a spouse, after the pensioner's death, ensuring income continuity for dependents. Single-life pension offers regular payments only for the lifetime of the pensioner, ceasing upon their death, which generally results in higher monthly benefits compared to survivorship options. Choosing between survivorship and single-life pensions depends on balancing lifetime income needs with the desire to provide for survivors after death.

Key Differences Between Survivorship and Single-Life Pensions

Survivorship pensions provide continued income to a beneficiary, usually a spouse, after the pensioner's death, ensuring financial security for dependents. Single-life pensions cease payments upon the pensioner's death, offering higher monthly benefits but no survivor payouts. The choice between these pension types hinges on the trade-off between lifetime income amounts and posthumous financial support.

Eligibility Criteria for Each Pension Type

Survivorship pensions require the pensioner to have a qualified beneficiary, typically a spouse or dependent, who will continue to receive benefits after the pensioner's death, with eligibility often dependent on marital status and dependent relationship verification. Single-life pensions provide benefits solely to the pensioner without survivor benefits, requiring no beneficiary designation but usually mandating age and service criteria to qualify. Eligibility criteria for survivorship pensions often include minimum years of marriage or dependency, whereas single-life pensions focus strictly on the pensioner's retirement qualifications.

Pros and Cons of Survivorship Pension

Survivorship pensions provide continuous income to a beneficiary after the pensioner's death, ensuring financial security for a surviving spouse or dependent, which is a key advantage over single-life pensions that cease payments upon the pensioner's death. However, survivorship pensions often result in lower initial monthly payments compared to single-life pensions due to the extended payment period. This trade-off between a reduced payout and financial protection for survivors highlights the primary consideration when choosing between these pension types.

Pros and Cons of Single-Life Pension

Single-life pensions provide retirees with a fixed income for their lifetime, ensuring financial stability without the complexity of beneficiary management. The main advantage lies in higher monthly payments compared to survivorship pensions, as benefits cease upon the pensioner's death, reducing long-term insurer risk. However, the lack of survivor benefits poses a significant drawback, potentially leaving spouses or dependents without continued income after the pensioner's death.

How Spousal Benefits Influence Pension Choice

Spousal benefits significantly impact the choice between survivorship pension and single-life pension options by ensuring continued income for a surviving spouse. A survivorship pension guarantees a portion of the retiree's benefit is paid to the spouse after death, providing financial security and peace of mind. In contrast, a single-life pension typically offers higher monthly payments but ceases upon the retiree's death, leaving no spousal benefits.

Financial Impact on Beneficiaries

Survivorship pensions provide ongoing financial support to beneficiaries after the pensioner's death, ensuring income continuity for spouses or dependents, which can significantly reduce financial vulnerability. Single-life pensions offer higher monthly payments during the retiree's lifetime but cease upon death, leaving beneficiaries without further benefits and potentially increasing their financial risk. Choosing survivorship pensions typically results in a lower initial payout but offers crucial long-term financial security for survivors.

Tax Implications of Pension Options

Survivorship pensions often have lower monthly payouts but provide ongoing benefits to a spouse or beneficiary after the retiree's death, which can impact overall taxable income over time. Single-life pensions typically offer higher initial payments but cease upon the retiree's death, potentially resulting in a different tax bracket during retirement years. Understanding the tax implications of these options is crucial for retirement planning, as survivorship benefits may lead to extended tax liabilities for heirs, while single-life pensions may optimize individual tax efficiency.

Factors to Consider When Choosing Your Pension

When choosing between a survivorship pension and a single-life pension, consider factors such as your spouse's financial dependence, life expectancy, and the need for ongoing income after your death. Survivorship pensions provide continued payments to your beneficiary but often at a reduced monthly benefit, while single-life pensions offer higher payments but cease upon death. Evaluating your financial goals, health status, and family situation ensures the selected pension aligns with your retirement security needs.

Frequently Asked Questions About Pension Types

Survivorship pensions provide ongoing financial support to a beneficiary, typically a spouse, after the pensioner's death, while single-life pensions cease payments upon the pensioner's passing, often resulting in higher monthly benefits during the pensioner's lifetime. Frequently asked questions about these pension types include how each impacts monthly payment amounts, eligibility criteria for beneficiaries, and tax implications. Understanding the differences helps retirees choose the appropriate option based on their financial security goals and family circumstances.

Important Terms

Joint-and-survivor annuity

A joint-and-survivor annuity provides payments for the lifetime of the retiree and continues to pay a percentage to the surviving spouse, ensuring financial security beyond the retiree's death, unlike a single-life pension which ceases upon death. Survivorship pension options typically offer reduced monthly benefits compared to single-life pensions due to the extended payout period covering both lives.

Life-only annuity

Life-only annuities provide income until death, with survivorship pensions offering continued payments to a beneficiary after the annuitant's death, unlike single-life pensions which cease upon the annuitant's death.

Contingent annuitant

A contingent annuitant ensures ongoing payments in a survivorship pension by receiving benefits after the primary annuitant's death, unlike a single-life pension which ceases payments upon the annuitant's death.

Spousal benefit

Survivorship pension provides ongoing spousal benefits after the pensioner's death, whereas a single-life pension offers higher monthly payments but ends upon the pensioner's death.

Guaranteed period option

The Guaranteed Period option in survivorship pensions ensures continuous payments to beneficiaries for a specified timeframe after the primary pensioner's death, unlike single-life pensions that cease payments immediately upon death.

Pension beneficiary

Survivorship pension provides continuous benefits to designated beneficiaries after the pensioner's death, whereas a single-life pension ceases payments upon the pensioner's passing.

Annuity payout structure

The annuity payout structure for a survivorship pension provides continued payments to a beneficiary after the annuitant's death, ensuring long-term financial security for surviving dependents, while a single-life pension ceases payments upon the annuitant's death, offering higher monthly benefits during the annuitant's lifetime but no survivor benefits. Choosing between survivorship and single-life pensions depends on prioritizing either maximizing lifetime income or providing ongoing support to a beneficiary.

Survivor benefit reduction

Survivor benefit reduction occurs when choosing a survivorship pension that provides ongoing payments to beneficiaries, resulting in lower monthly benefits compared to a higher single-life pension paid solely during the retiree's lifetime.

Actuarial present value

The actuarial present value of a survivorship pension is typically higher than that of a single-life pension due to the extended payment period contingent on both lives surviving.

Longevity risk

Longevity risk increases with survivorship pensions compared to single-life pensions due to extended payout periods covering multiple beneficiaries.

Survivorship pension vs Single-life pension Infographic

moneydif.com

moneydif.com