Lump sum distribution provides a one-time payment that offers immediate access to the entire pension amount, enabling flexibility in investment or debt repayment. Periodic payments deliver a steady income stream, ensuring financial stability and consistent budgeting over retirement. Choosing between these options depends on individual financial goals, risk tolerance, and cash flow needs.

Table of Comparison

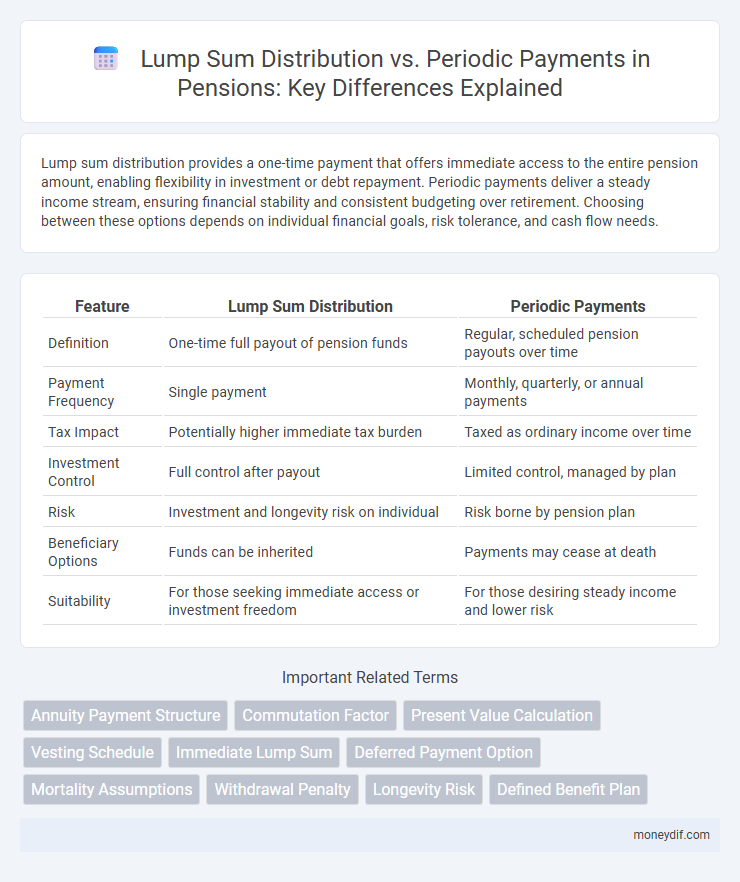

| Feature | Lump Sum Distribution | Periodic Payments |

|---|---|---|

| Definition | One-time full payout of pension funds | Regular, scheduled pension payouts over time |

| Payment Frequency | Single payment | Monthly, quarterly, or annual payments |

| Tax Impact | Potentially higher immediate tax burden | Taxed as ordinary income over time |

| Investment Control | Full control after payout | Limited control, managed by plan |

| Risk | Investment and longevity risk on individual | Risk borne by pension plan |

| Beneficiary Options | Funds can be inherited | Payments may cease at death |

| Suitability | For those seeking immediate access or investment freedom | For those desiring steady income and lower risk |

Understanding Lump Sum Distribution and Periodic Payments

Lump sum distribution provides retirees with a one-time payout of their entire pension balance, offering immediate access to funds but requiring careful management to avoid tax penalties and outliving assets. Periodic payments deliver a steady income stream over time, ensuring financial stability and reducing longevity risk but limiting access to the full pension amount at once. Understanding these options helps retirees balance liquidity needs with long-term income security in retirement planning.

Key Differences Between Lump Sum and Periodic Options

Lump sum distribution provides a one-time payment of the entire pension balance, offering immediate access to funds but exposing retirees to potential investment and longevity risks. Periodic payments, often structured as annuities, deliver regular income over a set period or for life, ensuring steady cash flow and reducing the chance of outliving assets. Key differences include tax treatment, control over investment decisions, and the financial security that periodic payments typically afford compared to the flexible but riskier lump sum option.

Pros and Cons of Lump Sum Payouts

Lump sum distributions offer immediate access to the entire pension amount, providing financial flexibility and control over investments. However, this option carries the risk of poor investment decisions and potential tax liabilities due to large withdrawals in a single year. Unlike periodic payments, lump sum payouts lack guaranteed income streams, increasing the risk of outliving retirement funds.

Pros and Cons of Periodic Pension Payments

Periodic pension payments provide a steady income stream, ensuring consistent financial support throughout retirement and reducing the risk of outliving assets. This payment method offers tax advantages by spreading income over multiple years, often resulting in lower annual tax liabilities. However, periodic payments may limit liquidity and flexibility, making it difficult to access large sums for unexpected expenses or investment opportunities.

Tax Implications: Lump Sum vs Periodic Payments

Lump sum distributions from pensions can result in significant immediate tax liabilities, often taxed at the recipient's ordinary income tax rate, potentially pushing them into a higher tax bracket. Periodic payments spread the tax burden over multiple years, allowing for more manageable taxable income and potential tax deductions annually. Understanding the tax implications of each option aids in optimizing retirement income and minimizing overall tax impact.

Impact on Retirement Planning and Security

Lump sum distributions from pensions offer immediate access to a large amount of capital, enabling flexible investment options but increasing the risk of premature depletion, which can jeopardize long-term retirement security. Periodic payments provide a steady income stream, ensuring consistent financial support throughout retirement and aiding in budgeting and risk management. Effective retirement planning must weigh the trade-offs between liquidity benefits of lump sums and the guaranteed income stability of periodic payouts.

How Inflation Affects Your Pension Choice

Lump sum distributions provide immediate access to your entire pension amount, but inflation can rapidly diminish its purchasing power over time. Periodic payments offer steady income streams that may be adjusted or invested to partially hedge against inflation, preserving financial stability. Understanding inflation trends and your spending needs is crucial in selecting the most secure pension payment method.

Factors to Consider When Choosing Your Pension Payout

Choosing between lump sum distribution and periodic payments depends on factors such as financial goals, tax implications, and risk tolerance. Lump sum distributions offer immediate access to funds but may trigger significant tax liabilities, while periodic payments provide steady income and tax deferral advantages. Evaluating longevity, investment discipline, and beneficiary needs ensures an optimal pension payout strategy aligned with individual retirement plans.

Real-Life Scenarios: Lump Sum vs Periodic Payments

Lump sum distributions offer immediate access to the full pension amount, beneficial for those needing large upfront capital for investments or debt repayment, but they carry risks like tax implications and potential depletion of retirement funds. Periodic payments provide steady income streams, ideal for retirees seeking financial stability and predictable budgeting with reduced risk of outliving savings. Real-life cases show that choosing lump sum suits individuals with strong financial discipline and alternative income sources, whereas periodic payments favor those prioritizing long-term security and consistent cash flow.

Expert Tips for Making the Right Pension Distribution Choice

Evaluate tax implications and long-term financial goals when deciding between lump sum distribution and periodic payments. Consider factors such as life expectancy, investment risk tolerance, and potential penalties for early withdrawal to optimize pension benefits. Consulting a financial advisor can provide personalized strategies ensuring the pension distribution aligns with retirement needs and estate planning.

Important Terms

Annuity Payment Structure

Annuity payment structures offer a choice between lump sum distributions and periodic payments, where lump sum distributions provide immediate full payout, often impacting tax liabilities and investment control, while periodic payments ensure steady income streams over time, helping to manage longevity risk and provide financial stability. Understanding the tax implications, inflation adjustments, and personal financial goals is crucial for selecting the optimal distribution method in retirement planning.

Commutation Factor

The commutation factor quantifies the present value of periodic payments to compare the financial equivalence between lump sum distributions and annuity-based periodic payments.

Present Value Calculation

Present Value Calculation determines the current worth of future cash flows by discounting lump sum distributions or periodic payments at a specified interest rate. Comparing lump sum amounts to periodic payments involves discounting each payment to present value terms to assess the financial equivalence or preference between receiving money all at once or over time.

Vesting Schedule

A vesting schedule determines the timeline for employees to gain full ownership of lump sum distributions or periodic payments from retirement plans, affecting the timing and amount of funds they can access.

Immediate Lump Sum

Immediate lump sum distributions provide beneficiaries with a full payout of retirement plan funds at once, offering maximum liquidity and control over the assets. This contrasts with periodic payments, which disburse funds in scheduled intervals, potentially offering tax advantages and ensuring a steady income stream over time.

Deferred Payment Option

Deferred Payment Option enables recipients to strategically choose between receiving a Lump Sum Distribution for immediate tax impact or Periodic Payments to spread income and potentially reduce tax liability over time.

Mortality Assumptions

Mortality assumptions critically impact the valuation and risk assessment of lump sum distributions versus periodic payments by determining the expected lifespan and influencing the present value calculations of future benefits.

Withdrawal Penalty

Withdrawal penalty typically applies to lump sum distributions from retirement accounts, whereas periodic payments often reduce or eliminate such penalties by spreading taxable income over time.

Longevity Risk

Longevity risk significantly increases with lump sum distributions compared to periodic payments, as lump sums require individuals to manage funds efficiently over an uncertain lifespan.

Defined Benefit Plan

Defined Benefit Plans provide retirees with a guaranteed monthly income based on salary and years of service, while Lump Sum Distributions offer a one-time payment option that can be invested independently. Choosing between Lump Sum Distributions and Periodic Payments involves evaluating factors such as tax implications, investment risk, and the retiree's financial goals.

Lump Sum Distribution vs Periodic Payments Infographic

moneydif.com

moneydif.com