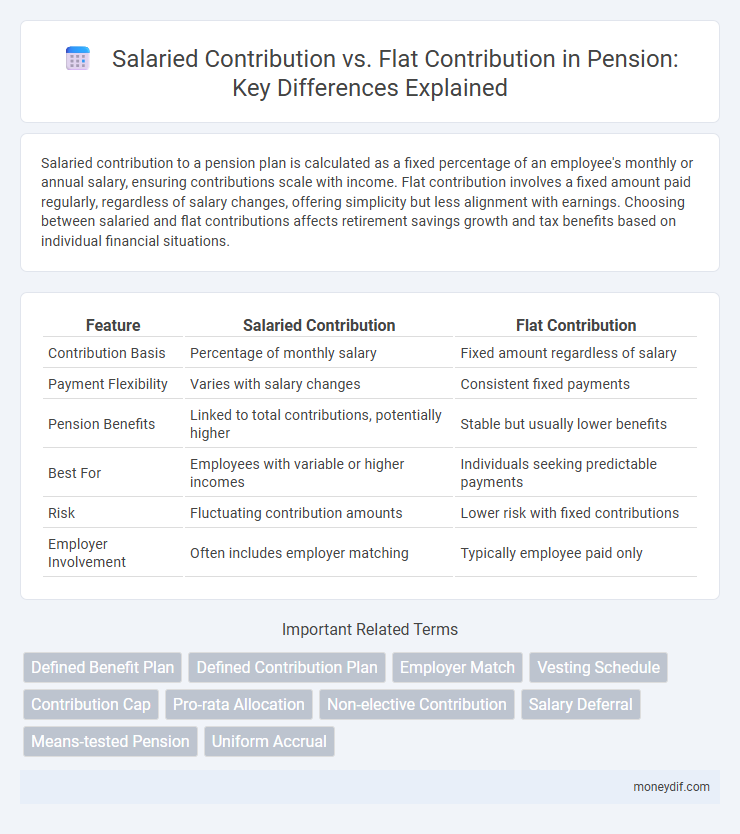

Salaried contribution to a pension plan is calculated as a fixed percentage of an employee's monthly or annual salary, ensuring contributions scale with income. Flat contribution involves a fixed amount paid regularly, regardless of salary changes, offering simplicity but less alignment with earnings. Choosing between salaried and flat contributions affects retirement savings growth and tax benefits based on individual financial situations.

Table of Comparison

| Feature | Salaried Contribution | Flat Contribution |

|---|---|---|

| Contribution Basis | Percentage of monthly salary | Fixed amount regardless of salary |

| Payment Flexibility | Varies with salary changes | Consistent fixed payments |

| Pension Benefits | Linked to total contributions, potentially higher | Stable but usually lower benefits |

| Best For | Employees with variable or higher incomes | Individuals seeking predictable payments |

| Risk | Fluctuating contribution amounts | Lower risk with fixed contributions |

| Employer Involvement | Often includes employer matching | Typically employee paid only |

Understanding Salaried Contribution in Pension Plans

Salaried contribution in pension plans involves deductions based on a fixed percentage of an employee's monthly salary, ensuring that pension benefits grow proportionally with income over time. This method provides a more equitable accumulation of retirement funds compared to flat contributions, which require a constant amount regardless of earnings. Understanding the impact of salaried contributions helps employees and employers optimize retirement savings aligned with financial capacity and long-term goals.

What is Flat Contribution in Pension Schemes?

Flat contribution in pension schemes refers to a fixed amount paid regularly by contributors regardless of their income level, contrasting with salaried contributions that are calculated as a percentage of salary. This method simplifies contribution calculations and ensures predictability for both employers and employees, making it easier to budget retirement savings. Flat contributions are common in defined benefit plans or government pension systems where uniform contributions support pooled benefits.

Key Differences: Salaried vs Flat Pension Contributions

Salaried pension contributions are calculated as a percentage of an employee's fixed monthly salary, resulting in variable contribution amounts aligned with income variations. Flat contributions involve a predetermined, fixed payment amount irrespective of the salary, ensuring consistent monthly pension contributions. Understanding these key differences helps in selecting the optimal pension scheme tailored to income stability and retirement goals.

Pros and Cons of Salaried Contribution Models

Salaried contribution models in pension schemes adjust contributions based on a percentage of an employee's salary, providing a direct correlation between income and retirement savings, which ensures fairness and scalability. However, these models may introduce complexity in administration and variability in contribution amounts, potentially complicating budgeting for both employers and employees. While salaried contributions promote equity by aligning pension benefits with earnings, they can also lead to increased costs during periods of salary growth or inflation.

Advantages and Drawbacks of Flat Contribution Systems

Flat contribution systems offer simplicity and predictability by requiring a fixed payment amount from all participants, ensuring straightforward budgeting for both contributors and administrators. However, they may disproportionately burden low-income earners since the contribution amount does not adjust based on income, potentially reducing equity and adequacy in retirement benefits. The lack of income sensitivity can lead to limited redistributive effects and may discourage participation among lower-wage workers.

Impact on Retirement Benefits: Salaried vs Flat Contributions

Salaried contributions, calculated as a percentage of monthly earnings, directly increase the retirement benefits by aligning payouts with income levels, ensuring higher benefits for higher earners. Flat contributions, fixed amounts regardless of income, often result in uniform benefits that may not adequately reflect the contributor's earning capacity, potentially limiting retirement income. Understanding the impact on retirement benefits is crucial for optimizing pension plans that balance fairness and adequacy based on contribution methods.

Which Contribution Model Suits Different Income Groups?

Salaried contribution models, based on a percentage of monthly income, are ideal for middle to high-income earners as they scale contributions with earnings, ensuring proportional retirement savings. Flat contribution models, offering fixed monthly amounts, better suit low-income groups by providing affordability and simplicity without income fluctuations. Choosing the right pension contribution model depends on individual income stability, financial capacity, and long-term retirement goals.

Employer Perspectives: Choosing the Right Pension Contribution Method

Employers face a strategic decision between salaried contributions, which vary proportionally with employee wages, and flat contributions, offering a fixed amount regardless of salary. Salaried contributions align pension benefits with income levels, promoting fairness and potentially attracting higher-skilled talent by emphasizing long-term financial security. Flat contributions simplify budgeting and administrative processes, providing predictability in employer expenses but may create disparities in benefit adequacy across the workforce.

Regulation and Tax Implications for Each Contribution Type

Salaried contributions to pensions are regulated based on a percentage of the employee's monthly income, subject to statutory limits that ensure compliance with national social security laws, which often allow tax deductions on these contributions up to a specified ceiling. Flat contributions involve fixed payment amounts regardless of salary, typically attracting limited or no tax benefits since they do not adjust with income variations, impacting the overall tax efficiency for contributors. Regulatory frameworks mandate reporting and withholding requirements for salaried contributions, while flat contributions may follow simplified administrative rules but lack proportional tax advantages.

Trends and Future Outlook in Pension Contribution Methods

Salaried contribution models dominate pension systems in developed economies due to their direct link to income and ability to reflect earnings variability, supporting more equitable retirement savings. Flat contribution methods, often seen in emerging markets, provide simplicity and broad coverage but face challenges in adequacy and sustainability as demographic shifts increase pension burdens. Future trends suggest hybrid approaches combining income-based flexibility with flat-rate baseline contributions to balance fairness, administrative efficiency, and long-term funding stability.

Important Terms

Defined Benefit Plan

Defined Benefit Plans calculate retirement benefits based on salaried contributions, which vary with employee salary, rather than flat contributions that remain constant regardless of income.

Defined Contribution Plan

Defined Contribution Plans with salaried contributions adjust employee contributions based on income levels, whereas flat contribution plans require a fixed amount regardless of salary.

Employer Match

Employer match programs often tie employer contributions to a percentage of salaried contributions rather than offering a fixed flat contribution amount.

Vesting Schedule

A vesting schedule defines the timeline employees must complete to earn full ownership of employer contributions, influencing the benefits received whether contributions are based on salaried percentages or flat amounts.

Contribution Cap

The contribution cap limits the maximum amount that can be contributed, where salaried contributions are calculated as a percentage of income up to the cap, while flat contributions remain fixed regardless of salary.

Pro-rata Allocation

Pro-rata allocation calculates contribution amounts proportionally based on salaried earnings, ensuring fair distribution compared to a fixed flat contribution amount.

Non-elective Contribution

Non-elective Contribution is a mandatory employer contribution calculated as a fixed percentage of employees' salaries, distinct from salaried contributions which vary with wages, and flat contributions which are uniform amounts regardless of salary.

Salary Deferral

Salary deferral allows employees to contribute a percentage of their earnings through salaried contributions, which scale with income, whereas flat contributions require a fixed amount regardless of salary.

Means-tested Pension

Means-tested pensions provide financial support based on income and assets, with eligibility and benefit amounts influenced by salaried contributions that reflect actual earnings, promoting fairness in benefits distribution. Flat contributions, offering uniform payments irrespective of income, simplify administration but may reduce equity by not accounting for individual salary variations in pension calculations.

Uniform Accrual

Uniform accrual methods ensure consistent benefit accumulation for employees regardless of the contribution type, whether salaried contributions based on income percentages or flat contributions set as fixed amounts. Salaried contributions vary with earnings, providing proportional accrual, while flat contributions maintain uniformity, often simplifying administrative processes.

Salaried Contribution vs Flat Contribution Infographic

moneydif.com

moneydif.com