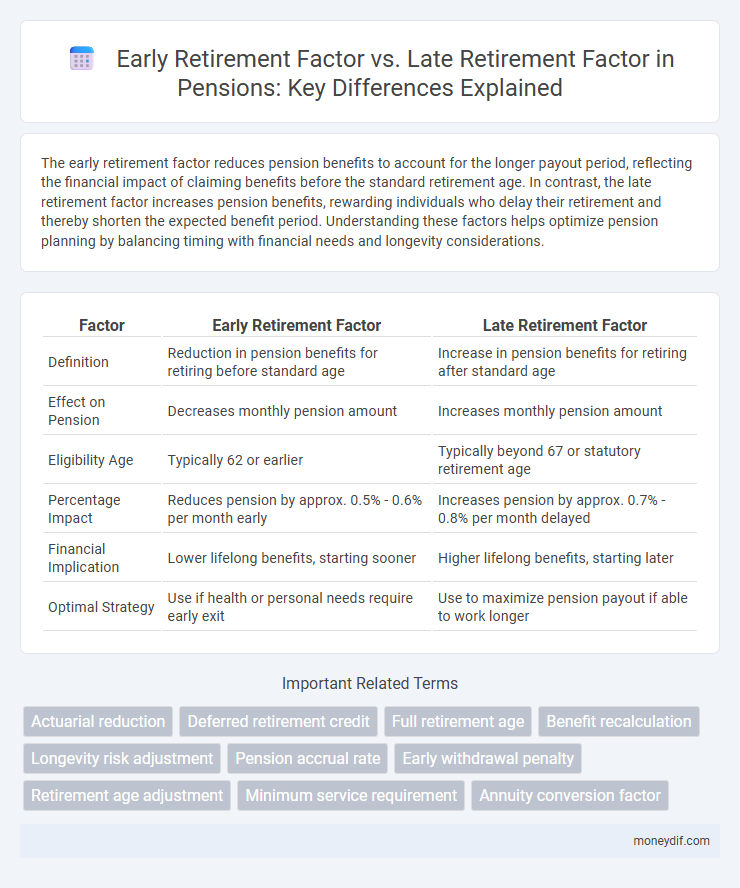

The early retirement factor reduces pension benefits to account for the longer payout period, reflecting the financial impact of claiming benefits before the standard retirement age. In contrast, the late retirement factor increases pension benefits, rewarding individuals who delay their retirement and thereby shorten the expected benefit period. Understanding these factors helps optimize pension planning by balancing timing with financial needs and longevity considerations.

Table of Comparison

| Factor | Early Retirement Factor | Late Retirement Factor |

|---|---|---|

| Definition | Reduction in pension benefits for retiring before standard age | Increase in pension benefits for retiring after standard age |

| Effect on Pension | Decreases monthly pension amount | Increases monthly pension amount |

| Eligibility Age | Typically 62 or earlier | Typically beyond 67 or statutory retirement age |

| Percentage Impact | Reduces pension by approx. 0.5% - 0.6% per month early | Increases pension by approx. 0.7% - 0.8% per month delayed |

| Financial Implication | Lower lifelong benefits, starting sooner | Higher lifelong benefits, starting later |

| Optimal Strategy | Use if health or personal needs require early exit | Use to maximize pension payout if able to work longer |

Understanding Early Retirement Factor

Early retirement factor reduces the pension benefits to reflect the longer payout period when retiring before the normal retirement age, typically resulting in a percentage decrease per year taken early. This factor is calculated based on actuarial assumptions, including life expectancy and discount rates, to ensure the pension fund remains financially sustainable. Understanding the early retirement factor is crucial for individuals planning their retirement timing to balance reduced monthly benefits against longer benefit duration.

The Mechanics of Late Retirement Factor

The Late Retirement Factor (LRF) increases pension benefits by applying a percentage multiplier for each year a retiree delays claiming benefits past the normal retirement age, enhancing the monthly payout. This factor is calculated based on actuarial principles that consider life expectancy and expected benefit duration, aiming to balance longer payment periods with higher individual monthly amounts. In contrast, early retirement factors reduce benefits to account for longer payout periods, making the mechanics of LRF crucial for optimizing retirement planning and maximizing lifetime income.

Impact on Pension Benefits: Early vs Late Retirement

Choosing early retirement typically reduces pension benefits due to the early retirement factor, which applies a permanent reduction to monthly payouts to account for the longer payout period. In contrast, delaying retirement increases pension benefits through the late retirement factor, which applies credit or bonuses for each month worked beyond the standard retirement age, boosting monthly payments. These adjustments ensure actuarial fairness by balancing pension plan sustainability with individual retirement timing choices.

Financial Pros and Cons of Early Retirement

Early retirement factors often reduce pension benefits due to fewer contribution years and longer payment periods, resulting in lower monthly income. Late retirement factors typically increase pension payouts by extending contributions and shortening payout duration, enhancing overall financial stability. Choosing early retirement requires careful consideration of reduced cash flow versus the benefit of more leisure time and potential health savings.

How Late Retirement Increases Pension Payouts

Late retirement increases pension payouts by applying a higher late retirement factor, which multiplies the base pension amount to account for the extended contribution period and shorter expected payout duration. This factor reflects actuarial adjustments that enhance monthly benefits, compensating for the delayed claiming of benefits. Consequently, individuals who retire later receive significantly larger pension payments compared to those retiring early.

Age-Related Adjustments in Pension Calculations

Early retirement factors typically reduce pension benefits by applying a negative age-related adjustment, reflecting the longer payout period due to starting withdrawals before the standard retirement age. Late retirement factors increase pension benefits through positive age-related adjustments, compensating for delayed benefit claims and shorter expected payout durations. These age-related adjustments play a critical role in pension calculations by balancing actuarial fairness and incentivizing retirement timing choices.

Tax Implications of Early vs Late Retirement

Early retirement typically results in lower pension benefits, which may reduce overall taxable income but can also limit the ability to maximize tax-deferred growth and increase exposure to ordinary income tax rates on withdrawals. Late retirement allows for increased pension benefits, potentially leading to higher taxable income but also greater tax deferral opportunities and larger tax-advantaged accumulations before required minimum distributions (RMDs). Understanding the tax implications of timing retirement decisions is essential to optimizing income streams and minimizing tax liabilities over the retirement horizon.

Longevity Risk and Retirement Timing

Early retirement factors increase longevity risk by extending the payout period, potentially depleting pension funds prematurely. Late retirement factors mitigate longevity risk by shortening the benefit duration, allowing more accumulation and fewer payment years. Optimal retirement timing balances these factors to ensure sustainable income throughout an individual's lifespan.

Decision Factors: Choosing When to Retire

Early retirement factor reduces monthly pension benefits by a specific percentage for each year retired before the normal retirement age, directly impacting lifetime income. Late retirement factor increases benefits by a set percentage for each year delayed beyond the normal retirement age, enhancing monthly payouts and overall retirement funds. Key decision factors include health status, financial needs, life expectancy, and employment satisfaction, influencing the optimal timing to maximize pension benefits.

Strategies for Maximizing Your Pension Benefits

Maximizing pension benefits involves understanding the early retirement factor, which reduces monthly payments when benefits are claimed before the full retirement age, and the late retirement factor, which increases payments for deferring benefits beyond that age. Strategic planning considers life expectancy, financial needs, and alternative income sources to determine the optimal claiming age. Evaluating Social Security's actuarial adjustments helps retirees balance immediate income needs against higher long-term payouts.

Important Terms

Actuarial reduction

Actuarial reduction quantifies the decrease in retirement benefits due to early retirement, while the late retirement factor represents an increase in benefits earned by delaying retirement beyond the normal retirement age. These factors adjust pension payouts to reflect the actuarial fairness based on life expectancy and timing of benefit commencement.

Deferred retirement credit

Deferred retirement credit increases Social Security benefits by a fixed percentage for each month retirement is delayed past full retirement age, whereas early retirement factor reduces benefits for each month taken before full retirement age.

Full retirement age

Full retirement age marks the point where claiming Social Security benefits results in neither early retirement reductions nor late retirement increases, with early retirement factors decreasing benefits and late retirement factors enhancing them based on the claimant's age.

Benefit recalculation

Benefit recalculation adjusts retirement payouts by applying the Early Retirement Factor to reduce benefits for early claims or the Late Retirement Factor to increase benefits for delayed claims.

Longevity risk adjustment

Longevity risk adjustment quantifies financial impact by comparing early retirement factors, which increase pension liabilities due to longer payout periods, against late retirement factors that decrease liabilities as payouts shorten.

Pension accrual rate

The pension accrual rate adjusts based on the early retirement factor, which reduces benefits for retiring before normal retirement age, and the late retirement factor, which increases benefits for delaying retirement beyond the standard age.

Early withdrawal penalty

Early withdrawal penalties increase significantly when paired with a high early retirement factor but decrease if the late retirement factor is applied, reflecting the timing impact on retirement benefits.

Retirement age adjustment

Retirement age adjustment balances Early Retirement Factor reductions and Late Retirement Factor increases to optimize pension benefits based on the chosen retirement timing.

Minimum service requirement

Minimum service requirement ensures eligibility for pension benefits, with early retirement factors typically reducing monthly payments due to shorter contribution periods, whereas late retirement factors increase benefits by accounting for prolonged service and delayed claim initiation. Actuarial adjustments reflect the trade-off between receiving benefits earlier with reduced amounts and postponing retirement to maximize pension income.

Annuity conversion factor

The annuity conversion factor decreases with an early retirement factor, resulting in lower monthly payouts, while it increases with a late retirement factor, providing higher monthly benefits.

Early retirement factor vs Late retirement factor Infographic

moneydif.com

moneydif.com