Section 32 buyout involves transferring a lump sum from a pension fund to another, allowing individuals to preserve their retirement savings while gaining control over future investments. Bulk transfer entails the movement of entire pension scheme assets from one fund to another, typically executed by employers to consolidate employee retirement benefits. Understanding the key differences ensures optimal decisions for managing pension assets and securing retirement income.

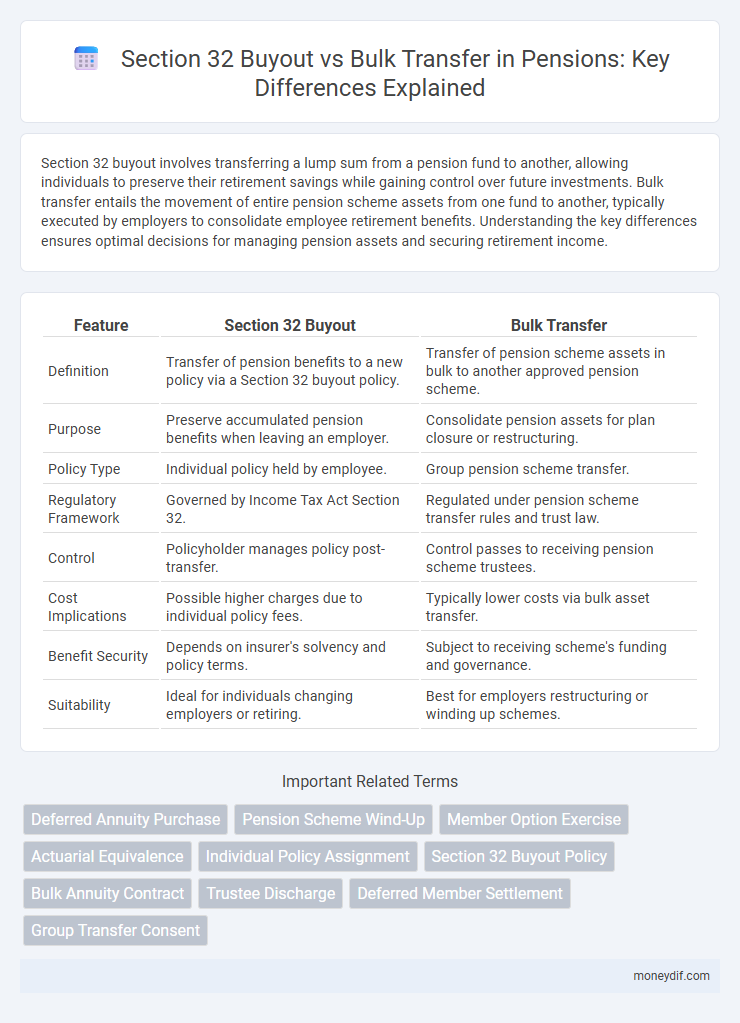

Table of Comparison

| Feature | Section 32 Buyout | Bulk Transfer |

|---|---|---|

| Definition | Transfer of pension benefits to a new policy via a Section 32 buyout policy. | Transfer of pension scheme assets in bulk to another approved pension scheme. |

| Purpose | Preserve accumulated pension benefits when leaving an employer. | Consolidate pension assets for plan closure or restructuring. |

| Policy Type | Individual policy held by employee. | Group pension scheme transfer. |

| Regulatory Framework | Governed by Income Tax Act Section 32. | Regulated under pension scheme transfer rules and trust law. |

| Control | Policyholder manages policy post-transfer. | Control passes to receiving pension scheme trustees. |

| Cost Implications | Possible higher charges due to individual policy fees. | Typically lower costs via bulk asset transfer. |

| Benefit Security | Depends on insurer's solvency and policy terms. | Subject to receiving scheme's funding and governance. |

| Suitability | Ideal for individuals changing employers or retiring. | Best for employers restructuring or winding up schemes. |

Introduction to Pension Transfers

Section 32 buyouts involve an individual pension transfer where funds from a retirement annuity or pension preservation fund are moved to a new retirement annuity or preservation fund. Bulk transfers refer to the movement of pension assets in aggregate from one fund to another, typically initiated by an employer when restructuring or switching pension administrators. Understanding the differences between Section 32 buyouts and bulk transfers is essential for members to make informed decisions about pension preservation and future retirement benefits.

What is a Section 32 Buyout?

A Section 32 Buyout is a pension fund transfer option allowing an individual to move their accumulated retirement benefits from a pension fund into a preservation fund or retirement annuity. This option provides flexibility by enabling early access to pension savings under specific conditions while preserving tax advantages. It is distinct from a bulk transfer, which involves moving the entire group's pension liabilities between funds or employers.

What is a Bulk Transfer?

A Bulk Transfer is a pension scheme transaction where the entire fund or a significant portion of pension liabilities is transferred from one pension scheme to another, typically within corporate groups or between employers. This process consolidates pension obligations and assets, reducing administrative complexity and ensuring continuity of member benefits under one scheme. Bulk Transfers require regulatory approval and actuarial valuation to safeguard members' accrued rights and maintain compliance with pension regulations.

Key Differences Between Section 32 Buyout and Bulk Transfer

Section 32 Buyout involves an individual withdrawing their accumulated pension corpus from the fund, typically used when switching jobs or opting for early retirement. Bulk Transfer refers to the transfer of the entire pension fund balance of multiple employees from one provident fund to another, usually carried out by employers during organizational restructuring or mergers. Key differences include the scope of transfer--individual versus multiple accounts--and the regulatory processes governing each, with Bulk Transfer requiring adherence to Provident Fund Authority guidelines, while Section 32 Buyout is subject to specific conditions under the Pension Fund regulations.

Eligibility Criteria for Each Option

Section 32 Buyout eligibility requires individuals to have a vested pension benefit and typically applies when changing jobs or opting out of the pension scheme. Bulk Transfer is available only to employers transferring entire pension fund liabilities to another registered pension scheme, requiring a certified transfer agreement between schemes. Both options demand compliance with regulatory standards set by pension authorities to safeguard member benefits during the transfer process.

Advantages of Section 32 Buyout

Section 32 Buyout offers pension members direct control over their retirement savings by transferring accumulated benefits into a personal provident fund, allowing for greater investment flexibility and tax efficiency. It provides members with liquidity options and the ability to tailor their retirement planning according to individual financial goals. Unlike bulk transfers, Section 32 Buyouts minimize dependency on the original pension scheme's solvency and administrative risks, ensuring personal ownership of the funds.

Benefits of Bulk Transfer

Bulk transfer of pension funds consolidates liabilities by transferring multiple members' accrued benefits in one transaction, resulting in reduced administrative costs and streamlined record-keeping. This method minimizes ongoing management fees and eases regulatory compliance compared to individual Section 32 buyouts. Employers benefit from enhanced cash flow predictability and lower financial risk by transferring future pension obligations to a single insurer.

Risks and Considerations

Section 32 Buyout carries risks such as potential loss of future investment growth, surrender penalties, and the impact of market volatility on the purchased policy. Bulk Transfer poses considerations including legal complexities, potential tax implications, and challenges in coordinating multiple member transfers simultaneously. Evaluating the financial stability of the receiving fund and understanding member consent requirements are critical in both options.

Regulatory and Tax Implications

Section 32 buyouts involve transferring pension benefits out of a superannuation fund into a retirement savings account, triggering specific tax concessions under Australian superannuation law, including capped tax-free components and concessional tax treatment on earnings. Bulk transfers refer to the movement of a group of members' benefits from one complying superannuation fund to another, often subject to strict regulatory oversight ensuring the preserving of accrued benefits and meeting the requirements under the Australian Prudential Regulation Authority (APRA) and Australian Taxation Office (ATO) guidelines. Compliance with these regulations is critical as improper bulk transfers can lead to adverse tax consequences and penalties, while Section 32 buyouts offer distinct advantages for individuals seeking liquidity or retirement income options.

Choosing the Right Pension Transfer Option

Choosing between a Section 32 buyout and a bulk transfer depends on the individual's retirement goals and financial security needs. A Section 32 buyout offers a lump sum payment, allowing for flexible investment and control over funds, whereas a bulk transfer moves the accumulated pension benefits directly to another registered fund, preserving tax advantages and employer contributions. Evaluating factors such as tax implications, retirement timeline, and risk tolerance is crucial to selecting the most beneficial pension transfer option.

Important Terms

Deferred Annuity Purchase

Deferred annuity purchase through Section 32 buyout offers policyholders a lump sum settlement option upon exiting a pension scheme, whereas bulk transfer involves transferring accumulated pension benefits in bulk to another pension arrangement without individual buyout settlements.

Pension Scheme Wind-Up

Section 32 buyout involves transferring accumulated pension benefits into a guaranteed annuity purchased by an insurance company, ensuring secure individual retirement income during a pension scheme wind-up. Bulk transfer, by contrast, moves the entire pension fund's liabilities to another registered superannuation fund, maintaining members' entitlements within a collective scheme structure.

Member Option Exercise

Member option exercise under Section 32 Buyout grants individual rights to purchase shares, whereas Bulk Transfer involves the collective sale of all member interests in a single transaction.

Actuarial Equivalence

Section 32 Buyout and Bulk Transfer methods differ in actuarial equivalence by applying distinct valuation assumptions and discount rates to ensure comparable pension value transfer while managing funding risks.

Individual Policy Assignment

Section 32 Buyout transfers individual policy assignments by purchasing policies individually, while Bulk Transfer involves moving multiple policies collectively under a single assignment framework.

Section 32 Buyout Policy

Section 32 Buyout Policy allows individual claim settlements under workers' compensation, contrasting with Bulk Transfer which involves transferring multiple claims or liabilities collectively to another insurer or entity.

Bulk Annuity Contract

A Bulk Annuity Contract secures pension liabilities through an insurance buyout under Section 32, whereas a Bulk Transfer involves transferring pension scheme assets and liabilities to another approved scheme without insurance.

Trustee Discharge

Section 32 Buyout allows individual tenant purchases with trustee discharge upon completion, whereas Bulk Transfer involves transferring multiple leases simultaneously, often requiring separate trustee approvals for discharge.

Deferred Member Settlement

Deferred Member Settlement allows pension plan members to retain accrued benefits after leaving an employer, contrasting with a Section 32 Buyout, which transfers the lump sum value directly to the member's pension or retirement savings account. Bulk Transfer involves moving the entire group's pension assets to another fund or plan, streamlining management but requiring regulatory compliance to protect members' accrued rights.

Group Transfer Consent

Group Transfer Consent under Section 32 Buyout requires individual shareholder approval, whereas Bulk Transfer consolidates multiple assets or liabilities without separate consents.

Section 32 Buyout vs Bulk Transfer Infographic

moneydif.com

moneydif.com