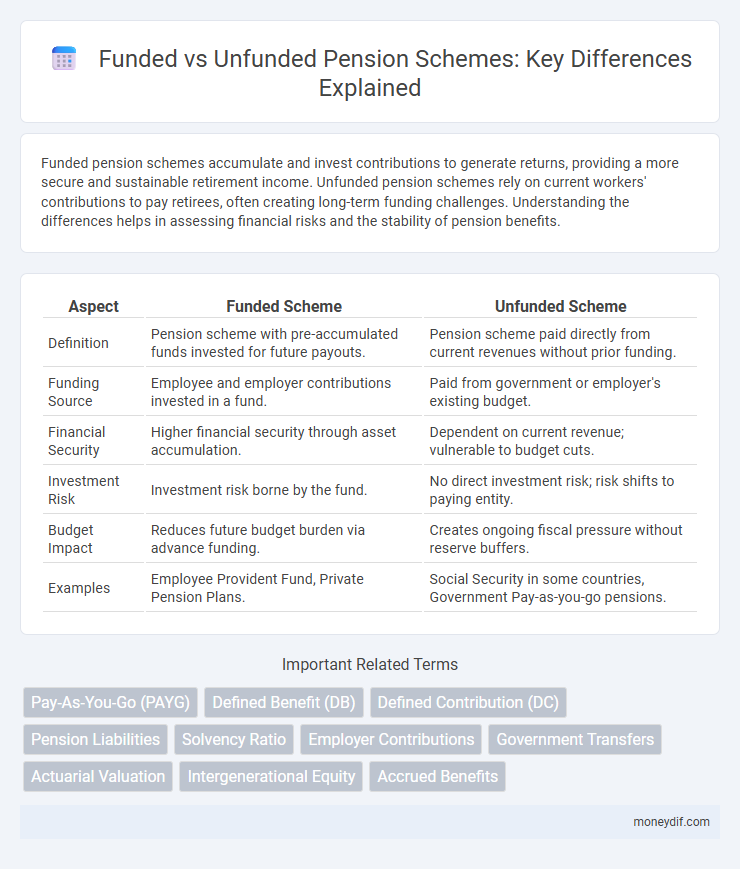

Funded pension schemes accumulate and invest contributions to generate returns, providing a more secure and sustainable retirement income. Unfunded pension schemes rely on current workers' contributions to pay retirees, often creating long-term funding challenges. Understanding the differences helps in assessing financial risks and the stability of pension benefits.

Table of Comparison

| Aspect | Funded Scheme | Unfunded Scheme |

|---|---|---|

| Definition | Pension scheme with pre-accumulated funds invested for future payouts. | Pension scheme paid directly from current revenues without prior funding. |

| Funding Source | Employee and employer contributions invested in a fund. | Paid from government or employer's existing budget. |

| Financial Security | Higher financial security through asset accumulation. | Dependent on current revenue; vulnerable to budget cuts. |

| Investment Risk | Investment risk borne by the fund. | No direct investment risk; risk shifts to paying entity. |

| Budget Impact | Reduces future budget burden via advance funding. | Creates ongoing fiscal pressure without reserve buffers. |

| Examples | Employee Provident Fund, Private Pension Plans. | Social Security in some countries, Government Pay-as-you-go pensions. |

Introduction to Pension Schemes: Funded vs Unfunded

Funded pension schemes accumulate assets in a dedicated fund to finance future retirement benefits, ensuring a direct link between contributions and payouts. Unfunded pension schemes rely on current revenue, such as government taxes or employer contributions, to pay retirees, often creating intergenerational financial obligations. The choice between these schemes impacts sustainability, funding security, and risk management within pension system frameworks.

Definitions: What Are Funded and Unfunded Schemes?

Funded pension schemes accumulate and invest contributions in a dedicated fund to finance future retirement benefits, ensuring a pool of assets backing the payouts. Unfunded pension schemes rely on current contributions or government revenues to directly pay beneficiaries, lacking a reserved investment fund. These definitions highlight the key structural difference between the asset-backed security of funded schemes and the pay-as-you-go nature of unfunded schemes.

Key Differences Between Funded and Unfunded Pension Schemes

Funded pension schemes accumulate contributions in a dedicated investment fund, generating returns to finance future benefits, ensuring greater sustainability and potential for higher payouts. Unfunded pension schemes rely on current workers' contributions to pay retirees, creating a pay-as-you-go system vulnerable to demographic shifts and fiscal pressures. The key differences center on funding sources, risk allocation, and long-term viability, with funded schemes offering asset-backed security while unfunded schemes depend on ongoing government or employer commitments.

Advantages of Funded Pension Schemes

Funded pension schemes offer the advantage of accumulating a dedicated investment pool that grows over time, ensuring financial security and greater benefit predictability for retirees. These schemes reduce the fiscal burden on governments by pre-financing pension obligations, enhancing sustainability and stability within pension systems. Investment returns generated from the fund can increase pension payouts and adjust for inflation, providing enhanced income protection for beneficiaries.

Advantages of Unfunded Pension Schemes

Unfunded pension schemes offer government-backed financial security without requiring pre-collected funds, ensuring steady pension payments directly from current revenues. These schemes reduce the need for large capital reserves, lowering administrative complexity and allowing greater flexibility in fiscal management. Predominantly used in public sector pensions, unfunded plans provide dependable benefits even during economic downturns by relying on ongoing government income.

Financial Sustainability and Long-Term Security

Funded pension schemes accumulate assets through employer and employee contributions invested to generate returns, ensuring financial sustainability by building a reserve that supports long-term payment obligations. Unfunded pension schemes rely on current workers' contributions to pay retirees directly, often creating fiscal stress and risks to long-term security due to demographic shifts and economic fluctuations. Governments and organizations prefer funded schemes for their ability to offer more stable and predictable retirement benefits, reducing dependency on future revenue streams.

Impact on Employers and Employees

Funded pension schemes require employers to contribute to a dedicated fund, which secures future employee benefits and reduces long-term financial risk for businesses. In contrast, unfunded schemes rely on current employer contributions to pay pensions as they fall due, increasing the employer's immediate fiscal burden and exposure to demographic changes. Employees benefit from the security and potential growth of funded schemes, while unfunded schemes may face sustainability challenges impacting future payouts.

Government Role in Pension Scheme Management

Government plays a pivotal role in managing both funded and unfunded pension schemes, ensuring financial stability and social security for retirees. In funded schemes, the government oversees the accumulation and investment of contributions to generate returns for future payments, while in unfunded schemes, pensions are paid directly from current government revenues without pre-funding. Effective governance and regulatory frameworks are essential for maintaining the sustainability and adequacy of pension benefits in both models.

Real-World Examples: Countries with Funded and Unfunded Schemes

Countries like the Netherlands and Australia operate well-funded pension schemes characterized by substantial investment assets supporting retirement benefits, enhancing financial sustainability. In contrast, nations such as the United Kingdom and India rely on unfunded pension systems where current workers' contributions finance retirees' payouts directly, posing demographic and fiscal challenges. These real-world examples highlight how funded schemes mitigate long-term liabilities through asset accumulation, whereas unfunded schemes face increasing pressure from aging populations.

Choosing the Right Pension Scheme: Factors to Consider

Choosing the right pension scheme depends on key factors such as funding status, risk tolerance, and long-term financial goals. Funded schemes, which accumulate assets to pay future benefits, offer investment growth potential but are subject to market volatility. Unfunded schemes rely on current contributions to meet obligations, providing fiscal stability but limited asset growth, making assessment of employer reliability and demographic trends essential.

Important Terms

Pay-As-You-Go (PAYG)

Pay-As-You-Go (PAYG) systems primarily support unfunded schemes by using current contributions to pay existing benefits, unlike funded schemes that accumulate assets to finance future obligations.

Defined Benefit (DB)

Defined Benefit (DB) plans offer predetermined retirement benefits typically funded through employer contributions in funded schemes, whereas unfunded schemes rely on current revenues to pay retirees without a dedicated fund.

Defined Contribution (DC)

Defined Contribution (DC) plans are typically associated with Funded Schemes where contributions are invested to build individual retirement accounts, unlike Unfunded Schemes which rely on current cash flows to meet obligations without accumulating assets.

Pension Liabilities

Pension liabilities in funded schemes are supported by dedicated assets invested to meet future obligations, resulting in a funded status that reflects the plan's financial health. Unfunded schemes rely on employer or government promises to pay benefits as they become due, creating long-term obligations without corresponding assets, increasing fiscal risk and budgetary pressure.

Solvency Ratio

The solvency ratio measures the financial stability of funded schemes by comparing available assets to liabilities, whereas unfunded schemes often lack sufficient assets, increasing solvency risk.

Employer Contributions

Employer contributions in funded schemes are pre-allocated to dedicated funds for future employee benefits, while in unfunded schemes, contributions are paid on a pay-as-you-go basis without pre-funding.

Government Transfers

Government transfers in funded schemes provide designated financial resources with specific allocation, while unfunded schemes rely on periodic budgetary appropriations without pre-allocated funds.

Actuarial Valuation

Actuarial valuation of funded schemes assesses the assets held to meet future liabilities, ensuring sufficient contributions and investment returns, whereas unfunded schemes rely solely on future revenue or employer contributions without accumulated assets. The valuation process for funded schemes focuses on funding ratios and asset-liability matching, while unfunded schemes emphasize estimating long-term liabilities and required government or sponsor funding levels.

Intergenerational Equity

Intergenerational equity favors funded pension schemes as they accumulate assets to meet future liabilities, unlike unfunded schemes that rely on current contributions, potentially burdening future generations.

Accrued Benefits

Accrued benefits in a funded scheme are backed by dedicated assets ensuring payment security, whereas in an unfunded scheme they rely solely on employer obligations without pre-allocated funds.

Funded Scheme vs Unfunded Scheme Infographic

moneydif.com

moneydif.com