Final salary schemes calculate pensions based on the employee's salary at retirement, often resulting in higher benefits for those with significant pay increases late in their careers. Career average schemes determine pension benefits using the average of earnings throughout the entire working life, creating a more stable and predictable outcome. Employers and employees often weigh the potential for higher end-of-career rewards against fairness and sustainability when choosing between these schemes.

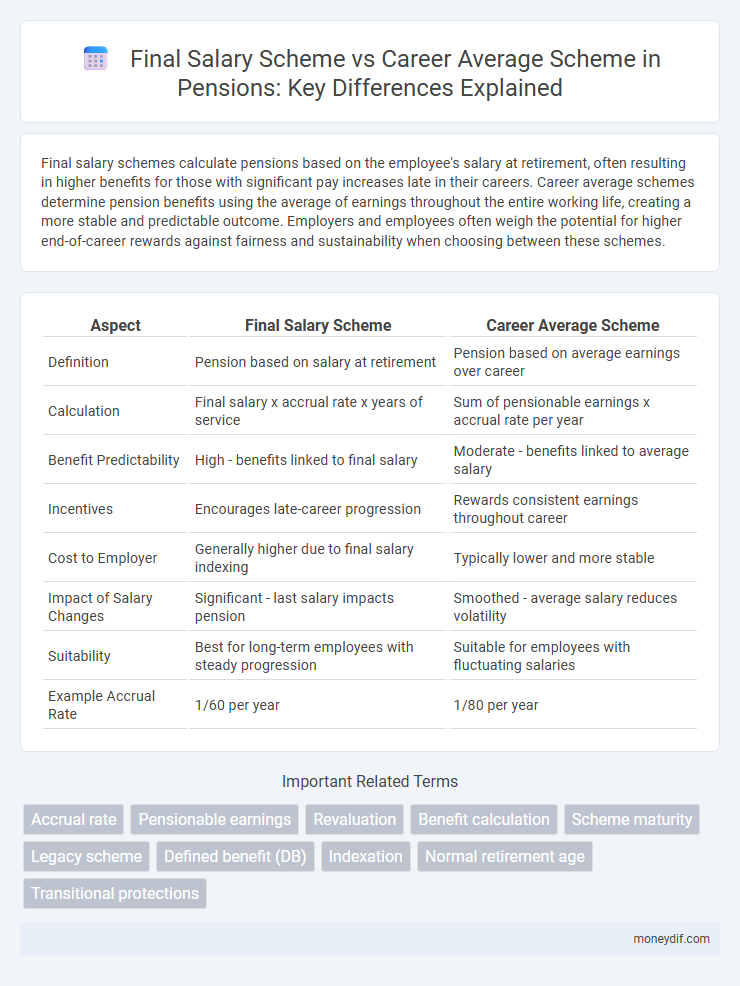

Table of Comparison

| Aspect | Final Salary Scheme | Career Average Scheme |

|---|---|---|

| Definition | Pension based on salary at retirement | Pension based on average earnings over career |

| Calculation | Final salary x accrual rate x years of service | Sum of pensionable earnings x accrual rate per year |

| Benefit Predictability | High - benefits linked to final salary | Moderate - benefits linked to average salary |

| Incentives | Encourages late-career progression | Rewards consistent earnings throughout career |

| Cost to Employer | Generally higher due to final salary indexing | Typically lower and more stable |

| Impact of Salary Changes | Significant - last salary impacts pension | Smoothed - average salary reduces volatility |

| Suitability | Best for long-term employees with steady progression | Suitable for employees with fluctuating salaries |

| Example Accrual Rate | 1/60 per year | 1/80 per year |

Understanding Final Salary Pension Schemes

Final salary pension schemes calculate retirement benefits based on the employee's salary at the end of their career, often reflecting the highest earnings period. This type of scheme typically offers greater financial security, as the pension amount correlates directly with final or peak salary levels. Career average schemes, however, base pension benefits on an average of earnings throughout the entire working life, which can result in lower payouts compared to final salary schemes for employees with late-career salary increases.

What is a Career Average Pension Scheme?

A Career Average Pension Scheme calculates retirement benefits based on the average earnings an employee has accrued throughout their entire working life, rather than their final salary at retirement. Each year's pensionable earnings are recorded and revalued to keep pace with inflation, providing a fair reflection of lifetime earnings. This scheme tends to offer more stability and fairness for employees whose salaries do not significantly increase towards the end of their careers.

Key Differences Between Final Salary and Career Average Schemes

Final salary schemes calculate pension benefits based on an employee's salary at retirement, often rewarding long-term service with higher payouts, whereas career average schemes determine pensions using the average earnings throughout the entire career, promoting fairness across fluctuating income periods. Final salary schemes typically provide more predictable benefits linked to seniority, but career average schemes offer greater stability against salary spikes and changes in job roles. Pension fund valuations and contribution rates differ between the two, with career average schemes often requiring more complex tracking but potentially lower financial risks for employers.

How Each Scheme Calculates Your Pension

Final salary schemes calculate your pension based on your salary at retirement or near retirement, typically using a fixed accrual rate multiplied by years of service and your final salary figure. Career average schemes determine your pension by averaging earnings across your entire career, applying a set accrual rate each year to build up the pension pot, adjusted for inflation. The key difference lies in how income variations impact benefits, with final salary schemes favoring those with substantial salary growth and career average schemes providing a more balanced accumulation over time.

Pros and Cons: Final Salary Scheme

Final Salary Schemes offer pension benefits based on the employee's salary at retirement, providing predictable and typically higher income compared to Career Average Schemes, which calculate benefits based on average earnings throughout the career. The main advantage is financial security, as pensions rise with final salary increases, benefiting long-serving employees with salary growth near retirement. However, these schemes can be costly for employers and less flexible, potentially leading to higher contributions and exposure to inflation risks if not properly indexed.

Pros and Cons: Career Average Scheme

Career Average Scheme calculates pension benefits based on the average earnings throughout an employee's entire working career, offering flexibility and fairness in reflecting fluctuating salaries. It allows for easier pension adjustments to reflect changing economic conditions, but may result in lower overall benefits compared to Final Salary Schemes for employees with significant salary increases late in their careers. This scheme mitigates the risk for employers by spreading pension liabilities more evenly over time, though it can be perceived as less generous by long-serving employees with substantial final salary growth.

Impact on Retirement Income

Final salary schemes calculate retirement income based on the employee's salary at or near retirement, often resulting in higher, more predictable pension benefits for long-serving employees with rising earnings. Career average schemes build pensions based on the average salary earned throughout the employee's working life, providing more equitable benefits across varying career paths but potentially lower retirement income for those with significant late-career salary increases. The impact on retirement income depends heavily on salary growth patterns, with final salary schemes favoring steady or increasing wages, while career average schemes offer stability regardless of late earnings spikes.

Transitioning from Final Salary to Career Average Schemes

Transitioning from Final Salary to Career Average pension schemes involves recalibrating benefit calculations from a single end-of-career salary to averaged earnings throughout employment. This change impacts accrual rates and retirement projections, requiring clear communication to employees on how their pensions will be calculated and potential effects on retirement income. Employers must ensure systems and policies are updated to handle career average record-keeping and benefit calculations accurately.

Which Scheme is More Beneficial for You?

Final salary schemes calculate your pension based on your salary at retirement, often benefiting those with consistent or rising earnings and long service, while career average schemes base pensions on the average earnings over your entire career, favoring employees with fluctuating or late-career salary growth. Choosing the more beneficial scheme depends on your salary trajectory, career length, and contribution flexibility; final salary schemes typically offer higher benefits for stable, long-term earners, whereas career average schemes provide more balanced benefits. Evaluating your individual career pattern and expected salary changes helps determine which pension scheme maximizes your retirement income.

Frequently Asked Questions About Pension Schemes

Final salary schemes calculate pension benefits based on the employee's salary at retirement, often providing higher payouts but with greater risk for employers. Career average schemes build pension benefits on the average earnings throughout an employee's career, offering more predictable costs and fairness for those with fluctuating incomes. Common questions include differences in benefit calculations, impact of changing jobs, and how inflation adjustments affect each scheme.

Important Terms

Accrual rate

The accrual rate in a final salary scheme typically increases with salary and service length, while in a career average scheme, it remains constant, accruing benefits based on average earnings over the entire career.

Pensionable earnings

Pensionable earnings in Final Salary schemes are based on the employee's salary at retirement, whereas in Career Average schemes, they are calculated as an average of earnings throughout the entire career.

Revaluation

Revaluation is a critical factor differentiating Final Salary and Career Average pension schemes, where Career Average schemes regularly adjust accrued benefits to reflect inflation or wage growth, ensuring pensions maintain their purchasing power over time. In contrast, Final Salary schemes calculate the pension based on the member's salary at retirement, often providing higher benefits for late-career earnings but less flexibility in reflecting ongoing economic changes during the accrual period.

Benefit calculation

Benefit calculation in a Final Salary scheme is based on the employee's salary at retirement, typically resulting in higher pensions for long service, whereas the Career Average scheme calculates benefits using an average of earnings throughout the employee's career, providing more balanced pensions for variable wage patterns.

Scheme maturity

Final salary schemes typically offer higher retirement benefits based on the last salary earned, while career average schemes calculate pensions on the average salary earned throughout an employee's career, affecting scheme maturity and long-term sustainability.

Legacy scheme

The Legacy scheme often refers to pension arrangements established under older final salary schemes, which calculate retirement benefits based on an employee's salary at or near retirement, contrasting with career average schemes that accumulate benefits based on average earnings throughout the career. Final salary schemes typically offer higher benefits for long service and salary growth, while career average schemes provide more predictable, steadily accrued benefits aligned with earnings over time.

Defined benefit (DB)

Defined benefit (DB) pensions calculate retirement income based on either the final salary scheme, which uses the employee's salary at retirement, or the career average scheme, which averages earnings over their entire career to determine benefits.

Indexation

Indexation in final salary schemes typically adjusts pension benefits in line with inflation or salary growth to protect accrued entitlements, ensuring retirees receive a predictable income based on their last salary. Career average schemes calculate pension benefits by indexing each year's accrued pension amount, usually linked to inflation rather than final salary, promoting fairness across an entire career span but potentially resulting in lower ultimate benefits compared to final salary schemes.

Normal retirement age

Normal retirement age under Final Salary Scheme typically aligns with 60-65 years, whereas Career Average Scheme often adjusts retirement age based on inflation and earnings, affecting pension value over time.

Transitional protections

Transitional protections in pension schemes safeguard accrued benefits by allowing members to retain final salary scheme advantages when moving to a career average scheme.

Final salary scheme vs Career average scheme Infographic

moneydif.com

moneydif.com