Portability in pensions allows employees to transfer their accrued benefits from one employer's plan to another, enhancing flexibility and continuity in retirement savings. Non-portable pensions restrict benefits to the current employer, potentially limiting mobility and causing loss of accumulated rights if an employee changes jobs. Choosing portable pension schemes can significantly improve long-term financial security by preserving pension value across career moves.

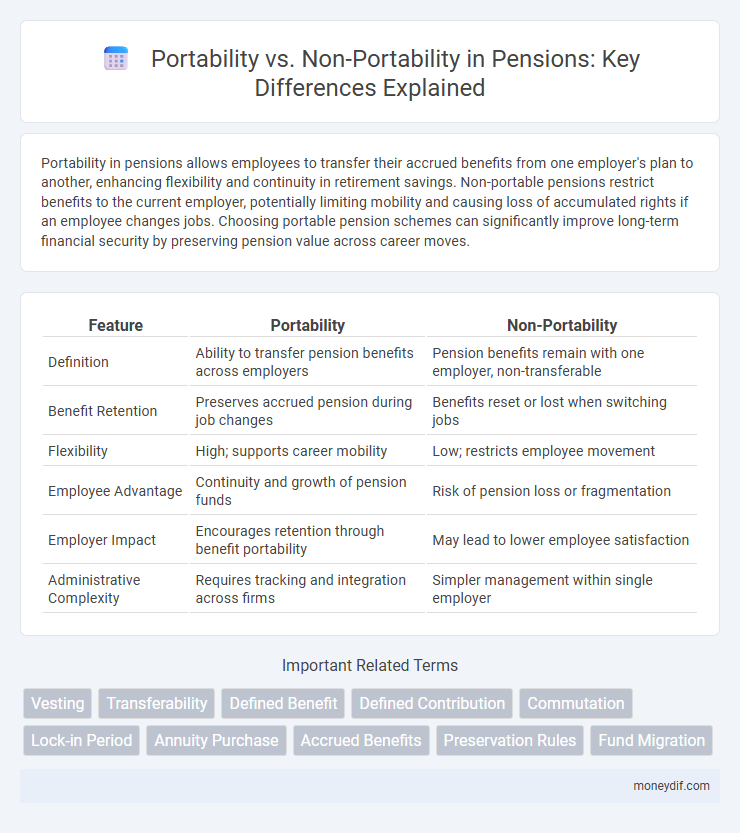

Table of Comparison

| Feature | Portability | Non-Portability |

|---|---|---|

| Definition | Ability to transfer pension benefits across employers | Pension benefits remain with one employer, non-transferable |

| Benefit Retention | Preserves accrued pension during job changes | Benefits reset or lost when switching jobs |

| Flexibility | High; supports career mobility | Low; restricts employee movement |

| Employee Advantage | Continuity and growth of pension funds | Risk of pension loss or fragmentation |

| Employer Impact | Encourages retention through benefit portability | May lead to lower employee satisfaction |

| Administrative Complexity | Requires tracking and integration across firms | Simpler management within single employer |

Understanding Pension Portability: Key Concepts

Pension portability allows employees to transfer their accumulated retirement benefits seamlessly from one employer's pension plan to another, preserving their pension rights and avoiding benefit fragmentation. Understanding key concepts such as vesting periods, transfer options, and tax implications is essential for maximizing retirement savings and ensuring financial security. Non-portability restricts benefit transfers, often resulting in separate pension accounts that can complicate retirement planning and reduce overall benefit accumulation.

Non-Portable Pension Plans: An Overview

Non-portable pension plans restrict the transfer of pension benefits between employers, limiting employees' ability to consolidate retirement savings when changing jobs. These plans are often tied to specific employers or industries, where benefits accumulate solely under one pension scheme, potentially reducing flexibility for workers in dynamic career paths. Non-portable pension plans may provide stability but can result in fragmented retirement income and challenges in maintaining continuity of pension contributions.

Major Differences Between Portable and Non-Portable Pensions

Portable pensions allow employees to transfer their pension benefits seamlessly across different employers, ensuring continuity in retirement savings. Non-portable pensions are tied to a single employer, often requiring employees to forfeit benefits if they leave the company before retirement. Portability enhances flexibility and long-term wealth accumulation, while non-portability may limit retirement planning options and reduce overall pension value.

Pros and Cons of Pension Portability

Pension portability allows individuals to transfer their pension funds across different employers or schemes, providing flexibility and continuous growth of retirement savings without interruptions. It reduces the risk of losing accumulated benefits when changing jobs but may involve administrative complexities and variability in fund performance across schemes. Non-portability limits pensions to a single fund, potentially simplifying management but risking fragmented savings and reduced returns due to lack of consolidation.

Impact of Career Mobility on Pension Portability

Career mobility significantly affects pension portability by determining how seamlessly pension benefits can be transferred between different employers' plans. High portability allows employees to consolidate pension funds, enhancing retirement security and reducing administrative complexity. Non-portable pensions often lead to fragmented retirement savings, impacting financial stability due to lost benefits or reduced pension value when changing jobs.

Legal Framework Governing Pension Portability

The legal framework governing pension portability establishes the conditions under which pension rights can be transferred across different jurisdictions or employers, ensuring the protection of accrued benefits. Portability laws vary significantly by country, with some regions mandating full transferability to enhance worker mobility and retirement security, while others restrict transfers to maintain pension fund integrity. Non-portability often leads to fragmented pension savings, complicating retirement planning and potentially reducing the total benefits available to the retiree.

Challenges Associated with Non-Portable Pension Schemes

Non-portable pension schemes present significant challenges, including limited career mobility as employees face difficulties transferring accrued benefits between employers or regions. These restrictions often result in fragmented retirement savings, potentially leading to lower overall pension accumulation and reduced financial security in retirement. Administrative complexities and increased costs for fund management further hinder efficiency and participant satisfaction in non-portable pension systems.

How Pension Portability Affects Retirement Planning

Pension portability allows individuals to transfer their accrued pension benefits between different employers or pension schemes, enhancing flexibility in retirement planning by preserving the value of accumulated funds. Non-portable pensions restrict benefit movement, potentially leading to fragmented retirement savings and reduced overall pension wealth. Understanding the implications of portability is crucial for optimizing retirement outcomes and ensuring seamless benefit continuity across employment changes.

International Perspectives on Pension Portability

International perspectives on pension portability highlight significant variations in regulatory frameworks and bilateral agreements that influence the ease of transferring pension benefits across borders. Countries with robust pension portability policies facilitate workforce mobility by allowing workers to consolidate contributions from multiple jurisdictions, ensuring continuous retirement savings and reducing the risk of benefit fragmentation. Non-portability often results in locked-in funds or forfeited benefits, disproportionately affecting expatriates and migrant workers, thereby emphasizing the need for harmonized global pension transfer mechanisms.

Making an Informed Choice: Portable vs Non-Portable Pensions

Choosing between portable and non-portable pensions significantly impacts financial flexibility and retirement planning. Portable pensions allow individuals to transfer accumulated benefits across different employers or pension schemes, ensuring continuity and maximizing long-term value. Non-portable pensions, while sometimes offering higher immediate benefits, may limit options and create challenges when changing jobs or relocating.

Important Terms

Vesting

Vesting determines the employee's ownership rights in benefits, with portability allowing vested benefits to be transferred between employers while non-portability restricts benefits to the original plan.

Transferability

Transferability refers to the ease of moving skills or assets between contexts, with portability enabling seamless transition while non-portability restricts such movement.

Defined Benefit

Defined Benefit plans with portability allow employees to transfer vested retirement benefits between employers, while non-portability restricts benefits to the original pension plan, limiting flexibility.

Defined Contribution

Defined Contribution plans with portability allow employees to transfer their retirement savings across employers, enhancing fund growth opportunities compared to non-portable plans that restrict asset movement and limit long-term financial flexibility.

Commutation

Commutation in the context of portability refers to the process of converting non-portable benefits into a lump-sum payment, enabling policyholders to transfer or cash out their entitlements without forfeiting value.

Lock-in Period

Lock-in period affects portability by restricting the transfer of funds or assets before a specified time, unlike non-portability which allows immediate transfer without time constraints.

Annuity Purchase

Annuity purchase with portability enables seamless transfer of accumulated benefits between providers, enhancing flexibility compared to non-portability, which restricts funds to the original issuer.

Accrued Benefits

Accrued benefits with portability allow employees to transfer their earned pension rights when changing jobs, whereas non-portability restricts benefits to the original employer's plan.

Preservation Rules

Preservation rules determine which CPU registers must be saved and restored across function calls, directly impacting portability by ensuring consistent behavior on different architectures. Non-portability arises when preservation conventions vary between platforms, causing incompatible assumptions about register usage and function call integrity.

Fund Migration

Fund migration efficiency significantly increases with portability, enabling seamless transfer of assets across accounts, while non-portability restricts movements, causing delays and additional costs.

Portability vs Non-portability Infographic

moneydif.com

moneydif.com