Pay-as-you-go pension systems finance current retirees' benefits through contributions from the working population, making them sensitive to demographic changes and economic cycles. Fully funded pension plans accumulate and invest contributions to finance future benefits, offering more stability but requiring disciplined long-term investment strategies. Each system presents distinct risks and benefits, influencing retirement security and fiscal sustainability differently.

Table of Comparison

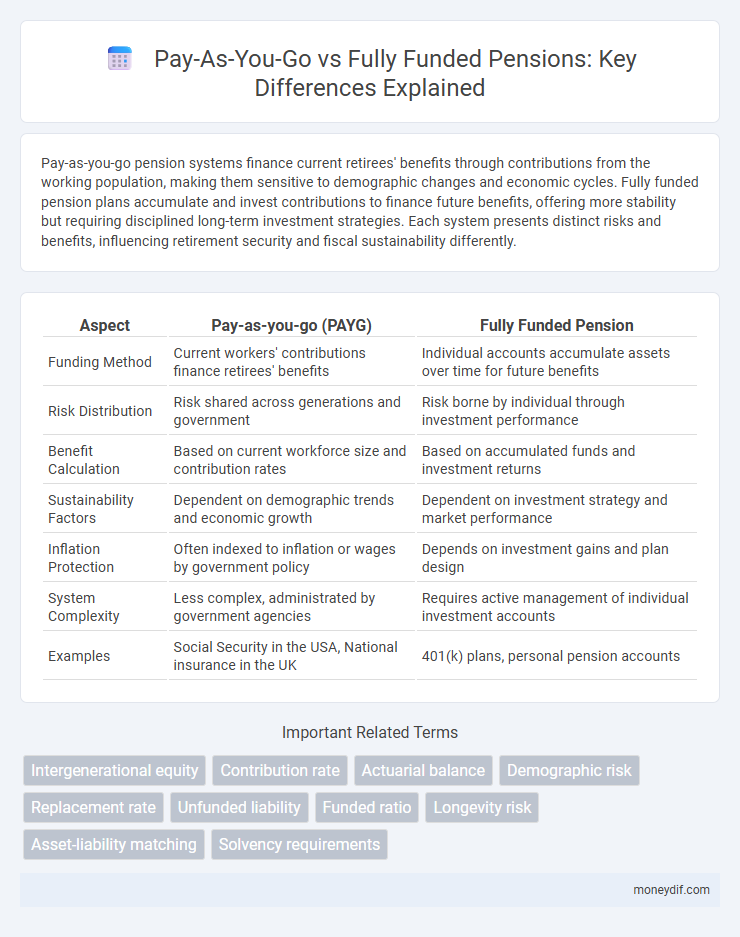

| Aspect | Pay-as-you-go (PAYG) | Fully Funded Pension |

|---|---|---|

| Funding Method | Current workers' contributions finance retirees' benefits | Individual accounts accumulate assets over time for future benefits |

| Risk Distribution | Risk shared across generations and government | Risk borne by individual through investment performance |

| Benefit Calculation | Based on current workforce size and contribution rates | Based on accumulated funds and investment returns |

| Sustainability Factors | Dependent on demographic trends and economic growth | Dependent on investment strategy and market performance |

| Inflation Protection | Often indexed to inflation or wages by government policy | Depends on investment gains and plan design |

| System Complexity | Less complex, administrated by government agencies | Requires active management of individual investment accounts |

| Examples | Social Security in the USA, National insurance in the UK | 401(k) plans, personal pension accounts |

Understanding Pay-as-You-Go and Fully Funded Pension Systems

Pay-as-you-go pension systems finance current retirees' benefits through the contributions of active workers, relying on a stable ratio of workers to retirees for sustainability. Fully funded pension systems accumulate and invest contributions over time to build a reserve that covers future retirement payments, offering more predictability and potential for growth. Understanding the demographic and economic factors influencing each system's viability is crucial for effective pension policy design.

Key Differences Between Pay-as-You-Go and Fully Funded Pensions

Pay-as-you-go pensions rely on current workers' contributions to pay retirees, creating immediate cash flow dependency without accumulating a dedicated fund. Fully funded pensions accumulate and invest funds over time, ensuring sufficient assets to cover future retirement benefits independently of incoming contributions. The key difference lies in financial sustainability: pay-as-you-go faces demographic risks like aging populations, while fully funded plans mitigate these risks through investment returns and asset management.

Financial Sustainability of Pension Systems

Pay-as-you-go pension systems rely on current workers' contributions to pay retirees, making their financial sustainability vulnerable to demographic shifts like aging populations and declining birth rates. Fully funded pension systems accumulate and invest funds over time to meet future obligations, enhancing long-term financial stability but requiring effective asset management and market performance. Balancing demographic trends and investment risks is crucial for ensuring the financial sustainability of pension schemes worldwide.

Demographic Impact on Pension Funding Models

Pay-as-you-go pension systems rely on current workers' contributions to fund retirees' benefits, making them highly sensitive to demographic shifts such as aging populations and declining birth rates, which strain sustainability by increasing the dependency ratio. Fully funded pension models accumulate assets during an individual's working life to finance future retirement, offering more insulation from demographic changes but exposing funds to market risks and the need for accurate longevity projections. Demographic trends like increased life expectancy intensify funding challenges in pay-as-you-go systems, while fully funded plans must adjust investment strategies and contribution rates to remain solvent amid fluctuating population dynamics.

Risk Distribution: PAYG vs Fully Funded Approaches

Pay-as-you-go (PAYG) pension systems distribute risk across current and future generations by using present workers' contributions to pay retirees, creating intergenerational financial dependencies that may become unsustainable with demographic shifts. Fully funded pension plans allocate risk to individuals by investing accumulated funds to finance their own retirement, which exposes participants to market volatility and investment performance uncertainties. PAYG systems face demographic and political risks, while fully funded schemes bear investment and longevity risks, affecting the stability and predictability of retirement income.

Intergenerational Equity and Pension Funding

Pay-as-you-go pension systems finance current retirees' benefits through contributions from the working generation, creating intergenerational equity challenges as demographic shifts increase the burden on younger workers. Fully funded pension plans accumulate assets in advance, reducing intergenerational transfers and enhancing sustainability by aligning contributions with future liabilities. Effective pension funding strategies must balance these approaches to maintain fairness and financial stability across generations.

Economic Effects of Pension Financing Methods

Pay-as-you-go pension systems stimulate current consumption by redistributing income from workers to retirees, potentially increasing short-term demand but risking intergenerational equity and fiscal burdens as populations age. Fully funded pension schemes accumulate savings invested in financial markets, promoting capital formation and long-term economic growth but exposing retirement incomes to market volatility. The economic effects of these pension financing methods influence national savings rates, labor supply incentives, and overall macroeconomic stability.

Pension System Resilience to Economic Shocks

Pay-as-you-go pension systems face higher vulnerability to economic shocks due to their reliance on current workforce contributions, which can decline during recessions. Fully funded pension systems accumulate individual savings, providing greater resilience as funds are invested and insulated from immediate economic fluctuations. Diversified investment portfolios within fully funded plans enhance long-term stability and reduce the risk of pension shortfalls during financial downturns.

Policy Considerations for Reforming Pension Models

Pay-as-you-go pension systems rely on current workers' contributions to fund retirees' benefits, creating fiscal pressure amid aging populations and declining worker-to-retiree ratios. Fully funded pension models accumulate individual savings over time, promoting sustainability but requiring robust financial markets and long-term investment strategies. Policy reforms must balance intergenerational equity, fiscal sustainability, and market stability to optimize pension system resilience and adequacy.

International Case Studies: PAYG and Fully Funded Examples

Pay-as-you-go (PAYG) pension systems, exemplified by Germany and Japan, rely on current workers' contributions to fund retirees, highlighting sustainability challenges due to demographic shifts. Fully funded pension schemes, such as those in Chile and Australia, accumulate investment assets to finance future benefits, offering greater resilience against aging populations but requiring robust financial markets and governance. Comparative international case studies reveal that hybrid models combining PAYG's social insurance aspects with funded elements may enhance long-term pension security.

Important Terms

Intergenerational equity

Intergenerational equity ensures that pay-as-you-go pension systems distribute costs fairly across generations, whereas fully funded systems require current savings to finance individual future benefits, impacting the financial burden on successive cohorts.

Contribution rate

The contribution rate in a Pay-as-you-go system is typically lower initially but may increase over time to cover current retirees' benefits, while a Fully funded system requires consistently higher rates to accumulate sufficient assets for future liabilities. Actuarial assumptions and demographic trends directly influence the sustainability and adjustment of these rates in both pension funding methods.

Actuarial balance

Actuarial balance compares the long-term financial sustainability of pay-as-you-go pension systems, which rely on current contributions to pay benefits, versus fully funded systems that accumulate assets to finance future obligations.

Demographic risk

Demographic risk in a pay-as-you-go pension system arises when the ratio of active workers to retirees declines, causing funding shortfalls as current contributions must cover existing benefits. In contrast, fully funded systems are less exposed to demographic shifts since benefits are pre-financed through accumulated assets, although investment performance becomes a critical risk factor.

Replacement rate

Replacement rate tends to be higher in fully funded pension systems compared to pay-as-you-go systems due to accumulated individual savings generating greater retirement income.

Unfunded liability

Unfunded liability occurs when pay-as-you-go pension systems rely on current contributions to cover benefits without accumulating reserves, unlike fully funded systems that maintain pre-funded assets to meet future obligations.

Funded ratio

Funded ratio measures a pension plan's financial health by comparing its assets to liabilities, where pay-as-you-go systems typically have low funded ratios due to immediate benefit payments, while fully funded plans maintain higher funded ratios by accumulating assets to cover future obligations.

Longevity risk

Longevity risk in pay-as-you-go pension systems arises from insufficient contributions to meet retirees' needs over increasing lifespans, whereas fully funded systems mitigate this risk by accumulating assets during the working years to cover future benefits.

Asset-liability matching

Asset-liability matching in pay-as-you-go systems relies on current contributions to cover liabilities, while fully funded schemes invest assets to meet future obligations, optimizing intertemporal risk management.

Solvency requirements

Solvency requirements for pay-as-you-go systems focus on maintaining sufficient current revenue inflows to cover liabilities, while fully funded systems require accumulating assets equal to future obligations to ensure long-term financial sustainability.

Pay-as-you-go vs Fully funded Infographic

moneydif.com

moneydif.com