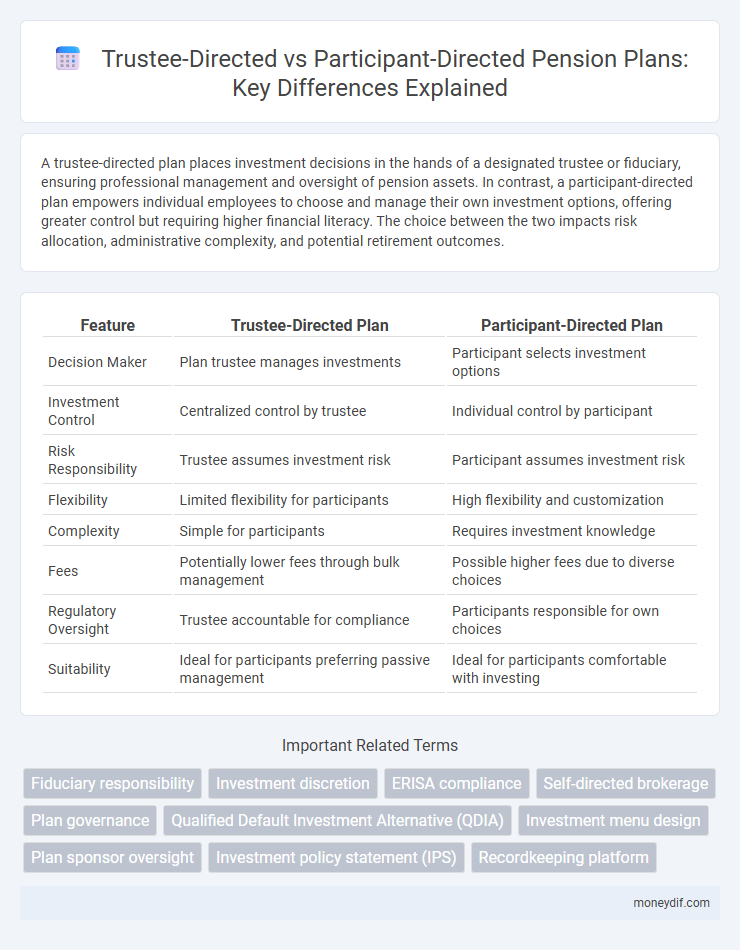

A trustee-directed plan places investment decisions in the hands of a designated trustee or fiduciary, ensuring professional management and oversight of pension assets. In contrast, a participant-directed plan empowers individual employees to choose and manage their own investment options, offering greater control but requiring higher financial literacy. The choice between the two impacts risk allocation, administrative complexity, and potential retirement outcomes.

Table of Comparison

| Feature | Trustee-Directed Plan | Participant-Directed Plan |

|---|---|---|

| Decision Maker | Plan trustee manages investments | Participant selects investment options |

| Investment Control | Centralized control by trustee | Individual control by participant |

| Risk Responsibility | Trustee assumes investment risk | Participant assumes investment risk |

| Flexibility | Limited flexibility for participants | High flexibility and customization |

| Complexity | Simple for participants | Requires investment knowledge |

| Fees | Potentially lower fees through bulk management | Possible higher fees due to diverse choices |

| Regulatory Oversight | Trustee accountable for compliance | Participants responsible for own choices |

| Suitability | Ideal for participants preferring passive management | Ideal for participants comfortable with investing |

Understanding Trustee-Directed and Participant-Directed Pension Plans

Trustee-directed pension plans entrust fund management decisions to designated trustees responsible for investment choices and plan administration, ensuring professional oversight and regulatory compliance. Participant-directed pension plans empower employees to make their own investment decisions within available options, promoting personalized retirement strategies and greater control over individual accounts. Understanding the distinctions between these models is essential for evaluating risk management, fiduciary responsibilities, and participant engagement in retirement planning.

Key Differences Between Trustee-Directed and Participant-Directed Plans

Trustee-directed plans place investment control and decision-making authority in the hands of plan trustees, who manage the portfolio to meet the plan's financial objectives, while participant-directed plans empower individual employees to select and oversee their own investments within the plan's options. In trustee-directed plans, fiduciary responsibility lies primarily with the trustees, minimizing participant investment risk, whereas participant-directed plans shift investment risk and responsibility onto individual participants. The level of participant engagement and investment flexibility is significantly higher in participant-directed plans, impacting plan administration and regulatory compliance requirements.

Advantages of Trustee-Directed Pension Plans

Trustee-directed pension plans offer enhanced fiduciary oversight, ensuring professional management of assets aligned with regulatory standards and long-term financial goals. These plans reduce participant burden by centralizing investment decisions, minimizing the risk of poor individual choices that could jeopardize retirement security. The structured governance also promotes consistency and accountability, often resulting in stable investment performance and protection against market volatility.

Benefits of Participant-Directed Pension Plans

Participant-directed pension plans empower employees with control over their retirement investments, allowing for personalized asset allocation that aligns with individual risk tolerance and financial goals. This autonomy can lead to increased engagement and potentially higher returns through informed decision-making. Flexible investment options and the ability to adjust contributions or strategies over time offer participants the advantage of tailoring their pension savings to changing life circumstances.

Investment Control: Trustee vs Participant

In a Trustee-directed plan, investment control resides primarily with the trustee who makes all decisions to manage and allocate retirement funds based on fiduciary responsibilities, ensuring professional oversight and regulatory compliance. Conversely, a Participant-directed plan grants individual participants the autonomy to select, manage, and adjust their own investment portfolios, offering personalized control but requiring greater financial literacy and active engagement. The distinction in investment control impacts risk allocation, potential returns, and administrative complexity across pension fund management models.

Fiduciary Responsibilities in Pension Plan Management

Trustee-directed plans assign fiduciary responsibilities primarily to trustees, who manage plan assets and make investment decisions on behalf of participants, ensuring adherence to fiduciary duties under ERISA regulations. Participant-directed plans shift fiduciary responsibility to participants, who select and manage their own investment options from a predefined menu, while trustees maintain oversight and ensure the plan offers suitable investment choices and proper disclosures. The distinction impacts liability exposure, as trustees in participant-directed plans must mitigate imprudent investment options and provide comprehensive education to participants to fulfill their fiduciary obligations.

Risk Management in Trustee-Directed vs Participant-Directed Plans

Trustee-directed plans centralize risk management by allowing professional fiduciaries to oversee investment decisions and ensure compliance with regulatory standards, reducing the likelihood of participant errors and investment missteps. In participant-directed plans, individuals assume the responsibility for managing their own investment risks, which can lead to varied outcomes depending on the participant's financial knowledge and decision-making skills. Trustee oversight in directed plans often results in more consistent risk mitigation, while participant-directed plans require robust education and support tools to help manage potential risks effectively.

Cost and Fee Structures: Comparing Both Plan Types

Trustee-directed plans typically involve higher administrative costs due to centralized management, resulting in fixed fees that cover professional oversight and fiduciary responsibilities. Participant-directed plans often feature lower base fees but may incur additional charges tied to individual investment choices and transaction volumes. Evaluating cost structures requires analyzing fee transparency, potential hidden expenses, and the impact on long-term pension fund growth.

Suitability: Which Plan Type Fits Your Organization?

Trustee-directed plans feature professional management where trustees oversee investment choices, ensuring fiduciary responsibility and reducing risks for participants, making them suitable for organizations seeking expert oversight. Participant-directed plans empower employees to choose their own investments, promoting personalized retirement strategies but requiring participant financial literacy and engagement. Organizations must assess their workforce's investment knowledge and willingness to manage portfolios when deciding between these plan types to ensure alignment with both fiduciary duties and participant needs.

Regulatory and Compliance Considerations for Pension Plans

Trustee-directed pension plans require trustees to manage investments in compliance with fiduciary standards under ERISA, ensuring duty of prudence and loyalty, while participant-directed plans shift investment responsibility to plan participants, subjecting plan administrators to disclosure and compliance obligations under Department of Labor regulations. Both plan types must adhere to IRS qualification rules and annual reporting requirements, with trustee-directed plans emphasizing prudential investment oversight and participant-directed plans focusing on providing adequate investment options, education, and safeguards against conflicts of interest. Regulatory scrutiny includes adherence to the Employee Retirement Income Security Act (ERISA) sections 404 and 406, and the Investment Company Act where applicable, ensuring protection of plan assets and participant interests.

Important Terms

Fiduciary responsibility

Fiduciary responsibility in trustee-directed plans mandates trustees to manage assets prudently on behalf of participants, whereas in participant-directed plans, fiduciary duties primarily focus on providing unbiased information and maintaining plan compliance while participants assume investment decision control.

Investment discretion

Investment discretion in trustee-directed plans grants fiduciaries full control over asset management, whereas participant-directed plans empower individuals to select and manage their own investment options.

ERISA compliance

Trustee-directed plans under ERISA require fiduciaries to manage investments exclusively, while participant-directed plans mandate providing participants with control over their individual investment choices within regulatory compliance.

Self-directed brokerage

Self-directed brokerage within Trustee-directed Plans often limits investment choices to a preselected menu, whereas Participant-directed Plans empower employees to actively manage their portfolios through a wider array of brokerage options. This flexibility in Participant-directed Plans enhances personalized retirement strategies by enabling access to diverse assets beyond traditional offerings.

Plan governance

Trustee-directed plans centralize decision-making authority in fiduciaries who select and manage investment options, ensuring professional oversight and compliance with regulations, whereas participant-directed plans empower individuals to choose and control their own investments from a predefined menu, promoting personalized retirement strategies. Understanding the governance differences is crucial for balancing fiduciary responsibility with participant autonomy to optimize plan performance and regulatory adherence.

Qualified Default Investment Alternative (QDIA)

A Qualified Default Investment Alternative (QDIA) provides default investment options in trustee-directed plans, ensuring fiduciary protection when participants in participant-directed plans fail to make investment decisions.

Investment menu design

Investment menu design in Trustee-directed Plans emphasizes curated, professionally managed options tailored to meet fiduciary standards, ensuring risk and diversification align with participants' best interests. Participant-directed Plans provide a broader range of self-selected investments, requiring robust educational resources and tools to empower individual decision-making while managing potential risks.

Plan sponsor oversight

Plan sponsor oversight differs significantly between Trustee-directed Plans, where fiduciaries manage investments, and Participant-directed Plans, which require sponsors to ensure participant education and compliance with regulatory guidelines.

Investment policy statement (IPS)

An Investment Policy Statement (IPS) for Trustee-directed Plans centralizes fiduciary investment decisions by trustees, whereas Participant-directed Plans empower individual participants to manage their own investment choices within predefined options.

Recordkeeping platform

A recordkeeping platform for Trustee-directed Plans prioritizes centralized control and oversight by trustees, while Participant-directed Plans emphasize individual account management and self-directed investment choices.

Trustee-directed Plan vs Participant-directed Plan Infographic

moneydif.com

moneydif.com