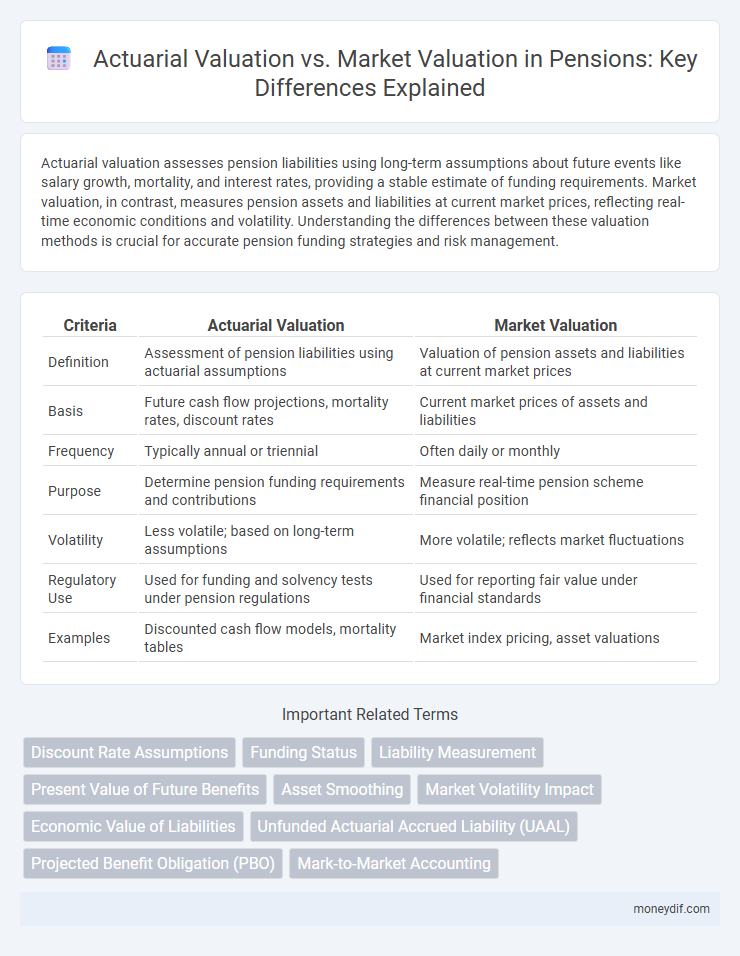

Actuarial valuation assesses pension liabilities using long-term assumptions about future events like salary growth, mortality, and interest rates, providing a stable estimate of funding requirements. Market valuation, in contrast, measures pension assets and liabilities at current market prices, reflecting real-time economic conditions and volatility. Understanding the differences between these valuation methods is crucial for accurate pension funding strategies and risk management.

Table of Comparison

| Criteria | Actuarial Valuation | Market Valuation |

|---|---|---|

| Definition | Assessment of pension liabilities using actuarial assumptions | Valuation of pension assets and liabilities at current market prices |

| Basis | Future cash flow projections, mortality rates, discount rates | Current market prices of assets and liabilities |

| Frequency | Typically annual or triennial | Often daily or monthly |

| Purpose | Determine pension funding requirements and contributions | Measure real-time pension scheme financial position |

| Volatility | Less volatile; based on long-term assumptions | More volatile; reflects market fluctuations |

| Regulatory Use | Used for funding and solvency tests under pension regulations | Used for reporting fair value under financial standards |

| Examples | Discounted cash flow models, mortality tables | Market index pricing, asset valuations |

Introduction to Pension Fund Valuation Methods

Actuarial valuation estimates pension liabilities using demographic assumptions and projected cash flows, reflecting the long-term sustainability of the pension fund. Market valuation assesses the current market value of pension assets and liabilities, providing a real-time snapshot of the fund's financial position. Combining both methods helps pension managers balance future obligations with present financial conditions for effective fund management.

Defining Actuarial Valuation in Pension Context

Actuarial valuation in the pension context involves assessing the present value of future pension liabilities using assumptions about demographics, such as mortality and employee turnover, along with economic factors like discount rates and salary growth. This method calculates the funding status of a pension plan by estimating the cost of benefits earned to date and predicting future obligations. The actuarial valuation ensures the plan's long-term financial health by aligning contributions with projected liabilities, differing from market valuation which reflects current asset market values only.

Understanding Market Valuation for Pensions

Market valuation for pensions reflects the current market value of pension plan assets, providing a real-time snapshot of the fund's financial status based on prevailing asset prices. Unlike actuarial valuation, which uses long-term assumptions about future obligations and contributions, market valuation emphasizes short-term fluctuations and liquidity. This approach helps trustees and sponsors assess the immediate solvency and potential funding risks of the pension plan.

Key Differences: Actuarial vs Market Valuation

Actuarial valuation assesses a pension plan's liabilities based on demographic assumptions, such as life expectancy and employee turnover, while market valuation determines the plan's asset value at current market prices. Actuarial valuation emphasizes long-term obligations and expected future cash flows, whereas market valuation reflects real-time asset performance and market volatility. The key difference lies in actuarial valuation's reliance on projected assumptions versus market valuation's focus on present market conditions.

Impact on Pension Funding Status

Actuarial valuation assesses pension funding status using long-term assumptions about mortality, salary growth, and discount rates, providing a stable estimate of liabilities and assets. Market valuation reflects the current market value of plan assets and liabilities based on prevailing interest rates and market conditions, resulting in more volatile funding status. Differences between these valuations directly impact funding decisions, contribution requirements, and the perceived financial health of pension plans.

Assumptions in Actuarial Valuation Explained

Actuarial valuation relies on key assumptions such as discount rates, mortality rates, salary growth, and employee turnover to estimate future pension liabilities accurately. These assumptions are based on long-term expectations and statistical models tailored to the specific pension plan's demographics. Market valuation, in contrast, reflects current asset values without projecting future obligations, making actuarial assumptions essential for determining a pension plan's funded status and required contributions.

Market Volatility and Its Effect on Pension Values

Market valuation of pension assets reflects current market prices, causing significant fluctuations in reported pension values due to market volatility. Actuarial valuation smooths these effects by using assumptions about future earnings, interest rates, and demographic factors to estimate pension liabilities more consistently. Pension funds relying heavily on market valuation may experience greater funding ratio instability, impacting contribution requirements and financial planning.

Regulatory Requirements for Pension Valuation

Regulatory requirements for pension valuation mandate actuarial valuation as the standard method to assess the pension plan's funding status using projected benefit obligations and demographic assumptions. Market valuation, based on current market prices of assets and liabilities, is often supplementary but does not fulfill formal regulatory criteria for pension funding and solvency assessments. Regulatory bodies emphasize actuarial valuations to ensure consistent, long-term plan sustainability and compliance with pension funding standards.

Decision-Making: Choosing the Right Valuation Method

Actuarial valuation incorporates demographic assumptions and future projections, providing a long-term view essential for strategic pension funding decisions, while market valuation reflects current asset prices and liabilities for immediate financial status assessment. Organizations prioritizing stable contribution rates and regulatory compliance often favor actuarial valuation due to its comprehensive risk analysis. In contrast, market valuation is preferred for short-term decision-making, liquidity planning, and evaluating pension plan solvency in fluctuating markets.

Future Trends in Pension Fund Valuation

Actuarial valuation incorporates demographic assumptions and discount rates based on projected cash flows, providing a long-term perspective on pension liabilities, while market valuation reflects current asset prices and market conditions for a more immediate assessment. Future trends in pension fund valuation emphasize the integration of advanced predictive analytics and real-time data to enhance accuracy and responsiveness to economic shifts. Increasing regulatory demands and the rise of environmental, social, and governance (ESG) considerations are also shaping the evolution of pension valuation methodologies.

Important Terms

Discount Rate Assumptions

Discount rate assumptions in actuarial valuation primarily reflect long-term expected returns on assets, while market valuation uses current market interest rates to discount liabilities.

Funding Status

Actuarial valuation assesses long-term pension liabilities using projected assumptions, while market valuation reflects current asset values, together determining an accurate funding status for retirement plans.

Liability Measurement

Liability measurement in actuarial valuation relies on projected cash flows and discount rates based on expected future experience, while market valuation determines liabilities using current market prices and interest rates reflecting immediate settlement values.

Present Value of Future Benefits

Present Value of Future Benefits in actuarial valuation is calculated based on expected cash flows and discount rates reflecting long-term assumptions, while market valuation uses current market prices and prevailing interest rates to assess liabilities.

Asset Smoothing

Asset smoothing in actuarial valuation spreads investment gains and losses over multiple periods to reduce volatility in reported asset values, providing a more stable basis for pension liability calculations. Market valuation reflects the current fair market value of assets, capturing real-time fluctuations but often causing significant swings in funding status and contribution requirements.

Market Volatility Impact

Market volatility significantly impacts actuarial valuation accuracy by causing discrepancies between projected liabilities and fluctuating market valuations of assets.

Economic Value of Liabilities

Economic value of liabilities in actuarial valuation reflects the present value of future obligations considering risk-adjusted discount rates, while market valuation emphasizes current market prices and liquidity of liabilities.

Unfunded Actuarial Accrued Liability (UAAL)

Unfunded Actuarial Accrued Liability (UAAL) represents the difference between a pension plan's actuarial accrued liabilities and its actuarial value of assets, serving as a key metric in actuarial valuations that smooth asset values over time to reflect long-term funding status. Market valuation contrasts by using the current market value of assets, which can cause more volatility in UAAL measurements due to short-term market fluctuations.

Projected Benefit Obligation (PBO)

Projected Benefit Obligation (PBO) represents the actuarially estimated present value of pension benefits earned to date based on actuarial valuation, while market valuation assesses the current market value of plan assets for funding status comparisons.

Mark-to-Market Accounting

Mark-to-Market Accounting requires valuing assets and liabilities based on current market prices, ensuring real-time reflection of financial status, which contrasts with Actuarial Valuation that relies on long-term assumptions and models to estimate liabilities. The discrepancy between Market Valuation and Actuarial Valuation highlights differences in risk assessment, with market valuation emphasizing liquidity and immediate market conditions, while actuarial approaches focus on expected future cash flows and demographic factors.

Actuarial Valuation vs Market Valuation Infographic

moneydif.com

moneydif.com