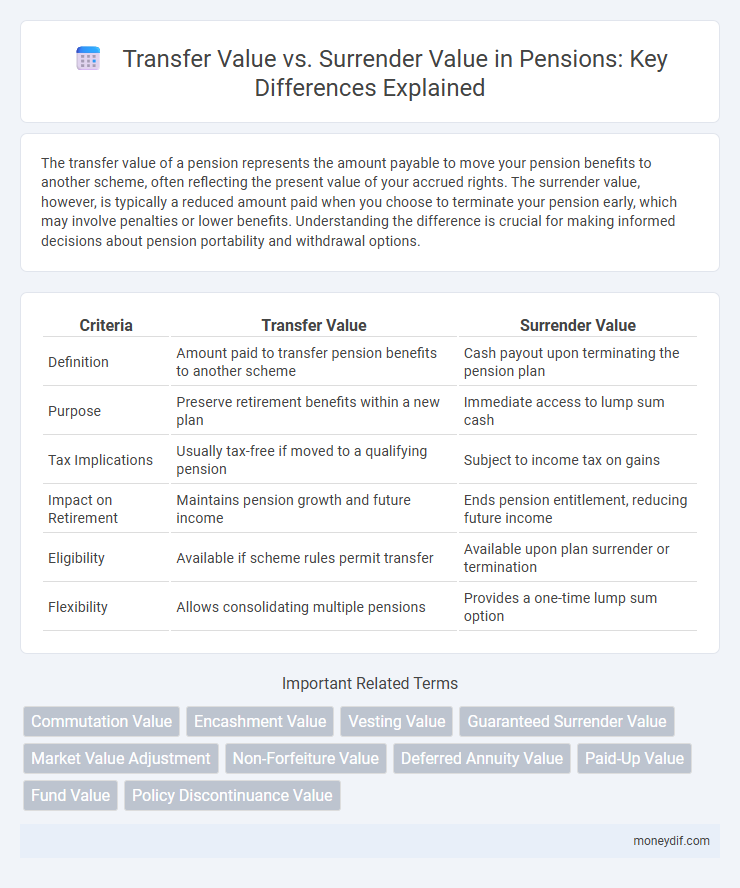

The transfer value of a pension represents the amount payable to move your pension benefits to another scheme, often reflecting the present value of your accrued rights. The surrender value, however, is typically a reduced amount paid when you choose to terminate your pension early, which may involve penalties or lower benefits. Understanding the difference is crucial for making informed decisions about pension portability and withdrawal options.

Table of Comparison

| Criteria | Transfer Value | Surrender Value |

|---|---|---|

| Definition | Amount paid to transfer pension benefits to another scheme | Cash payout upon terminating the pension plan |

| Purpose | Preserve retirement benefits within a new plan | Immediate access to lump sum cash |

| Tax Implications | Usually tax-free if moved to a qualifying pension | Subject to income tax on gains |

| Impact on Retirement | Maintains pension growth and future income | Ends pension entitlement, reducing future income |

| Eligibility | Available if scheme rules permit transfer | Available upon plan surrender or termination |

| Flexibility | Allows consolidating multiple pensions | Provides a one-time lump sum option |

Understanding Pension Transfer Value

Pension Transfer Value represents the lump sum amount offered to a member who opts to move their pension benefits from one scheme to another, reflecting the actuarial value of their accrued rights. This value is influenced by factors such as the member's age, salary, service length, and current market conditions, aiming to provide an accurate monetary equivalent for future pension income. Unlike Surrender Value, which is typically lower and used when a pension is cashed out early, the Transfer Value preserves the pension's potential growth within another registered scheme.

What Is Pension Surrender Value?

Pension surrender value is the amount a policyholder receives when opting to terminate their pension plan before maturity, reflecting the accumulated lump sum after deductions. It differs from the transfer value, which represents the sum transferable to another pension scheme without incurring surrender penalties. Understanding surrender value is crucial for evaluating early pension exit options and its financial implications on retirement benefits.

Key Differences Between Transfer and Surrender Values

Transfer value represents the amount payable when moving pension benefits into another pension scheme, preserving the accrued pension rights. Surrender value is the lump sum received if the pension scheme is terminated early, often lower as it factors in penalties or reduced benefits. Key differences include the impact on future benefits, with transfer values maintaining pension growth potential, while surrender values typically forfeit ongoing entitlements.

How Is Transfer Value Calculated?

Transfer value in pensions is calculated based on the current value of your accumulated pension benefits, reflecting factors such as your age, salary, service length, and the scheme's actuarial assumptions. It considers future pension payments discounted to present value using interest rates and life expectancy data. This valuation often differs from surrender value, which is typically lower and represents a lump sum paid if you give up your pension benefits early.

Factors Affecting Surrender Value

Surrender value in pensions is influenced primarily by the policyholder's age, the duration of the policy, and the prevailing interest rates at the time of surrender. Market conditions and the specific terms of the pension contract also play a critical role in determining the amount paid out. Unlike transfer value, surrender value often involves penalties or fees that reduce the final amount received.

Pros and Cons of Pension Transfer Value

Pension transfer value represents the lump sum amount offered to transfer benefits from a defined benefit scheme to a defined contribution plan, providing flexibility and potential for higher growth but exposing the individual to market risks and loss of guaranteed income. The main advantage is the ability to invest the lump sum according to personal risk tolerance and retirement goals, potentially increasing retirement funds. However, the downside includes the risk of poor investment performance and the loss of valuable benefits like spouse's pension or inflation protection inherent in defined benefit schemes.

Risks Associated With Surrendering Your Pension

Surrendering your pension typically involves accepting a surrender value, which is often significantly lower than the transfer value, reflecting immediate cash payout at the expense of future growth potential. The risks associated with surrendering include losing out on compound interest, tax benefits, and guaranteed income streams that a pension plan might offer. Choosing to surrender can also expose you to financial insecurity in retirement due to depleted funds and reduced long-term returns.

Tax Implications: Transfer vs. Surrender

Transfer value in pensions often allows tax-free rollover into another registered plan, preserving the pension's growth potential without immediate tax liabilities. Surrender value, by contrast, usually triggers a taxable event, where the lump sum is subject to income tax at the time of withdrawal. Understanding the differing tax implications between transfer and surrender options is crucial for effective retirement planning and minimizing tax burdens.

When to Choose Transfer Value Over Surrender Value

Choose transfer value over surrender value when the pension plan offers significant investment growth potential and the individual has a longer time horizon before retirement. Transfer value allows more control over investment choices, potentially leading to higher returns compared to the often lower surrender value paid out immediately. Evaluating fees, tax implications, and future retirement goals is essential before opting for a transfer to maximize pension benefits.

Expert Tips for Maximizing Pension Value

Maximizing pension value requires a clear understanding of transfer value versus surrender value, where transfer value often represents the lump sum available to move to another scheme, while surrender value is typically the amount received if the pension is cashed out early. Experts recommend carefully assessing transfer value statements, considering long-term growth potential, tax implications, and scheme guarantees before deciding. Consulting a pension specialist can help tailor strategies that optimize retirement income through informed choices between transfer and surrender options.

Important Terms

Commutation Value

Commutation value represents the lump sum amount paid instead of future pension benefits, typically higher than surrender value but lower than transfer value in retirement plans.

Encashment Value

Encashment value represents the amount payable to a policyholder upon early termination, typically falling between the lower surrender value and the higher transfer value. Unlike surrender value, which is often a fixed portion of the policy's accumulated value, transfer value accounts for the total benefits transferable to another scheme, making encashment value a critical metric for understanding policy liquidity and fund accessibility.

Vesting Value

Vesting Value determines the portion of the Transfer Value accessible to the policyholder upon policy maturity or retirement, reflecting accumulated benefits minus any applicable charges. Transfer Value represents the amount transferred to another pension scheme, typically higher than Surrender Value, which is the lump sum received if the policy is terminated before maturity and may incur penalties or reduced returns.

Guaranteed Surrender Value

The Guaranteed Surrender Value is the minimum amount payable by an insurer when a policyholder surrenders a policy, typically lower than the Transfer Value, which represents the accumulated benefits transferable to another scheme or policy.

Market Value Adjustment

Market Value Adjustment (MVA) adjusts the Transfer Value to reflect fluctuations between the Transfer Value and the typically lower Surrender Value at the time of policy withdrawal.

Non-Forfeiture Value

Non-Forfeiture Value represents the minimum cash value guaranteed to a policyholder upon policy termination, often calculated as the higher amount between the Transfer Value and Surrender Value. Transfer Value reflects the amount a policyholder can transfer to another insurer or plan, while Surrender Value is the cash amount available if the policy is voluntarily terminated before maturity.

Deferred Annuity Value

Deferred Annuity Value represents the projected worth of an annuity contract at a future date, reflecting accumulated interest and premiums paid. Transfer Value typically refers to the amount transferable to another plan or provider, often higher than the Surrender Value, which is the cash amount available upon contract termination after penalties and deductions.

Paid-Up Value

Paid-Up Value represents the reduced policy sum assured after premiums stop, differing from Transfer Value, which is the amount receivable upon policy assignment, and Surrender Value, the cash payout upon policy cancellation before maturity.

Fund Value

The Fund Value represents the total worth of an investment, usually compared to the Transfer Value, which is the amount transferable to another scheme, and the Surrender Value, which is the cash received upon policy termination.

Policy Discontinuance Value

Policy Discontinuance Value measures the financial difference between Transfer Value and Surrender Value, highlighting potential gains or losses when a policyholder transfers or terminates an insurance contract early.

Transfer Value vs Surrender Value Infographic

moneydif.com

moneydif.com