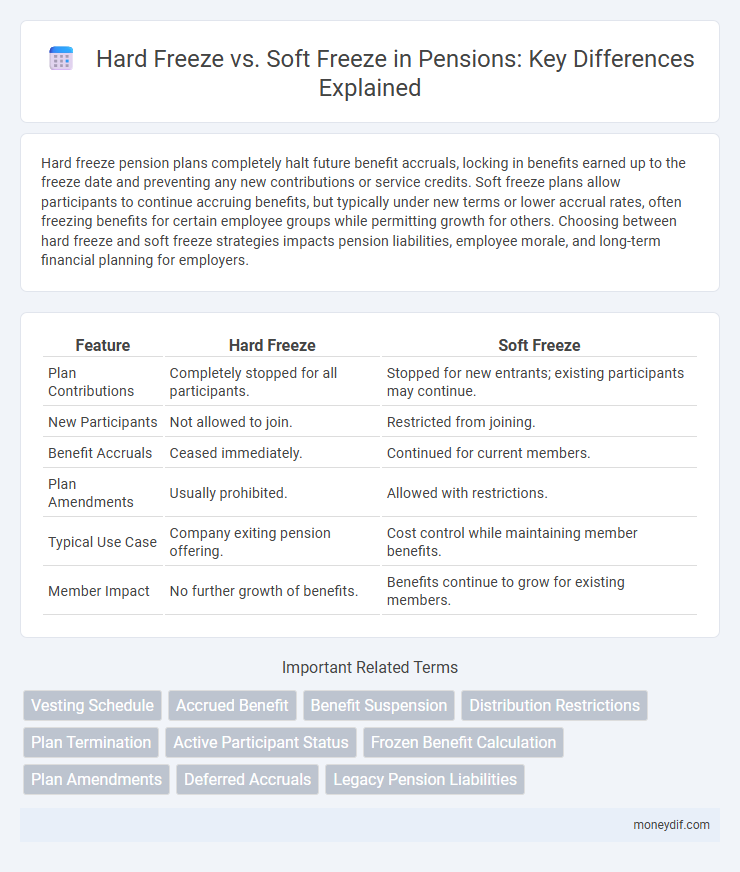

Hard freeze pension plans completely halt future benefit accruals, locking in benefits earned up to the freeze date and preventing any new contributions or service credits. Soft freeze plans allow participants to continue accruing benefits, but typically under new terms or lower accrual rates, often freezing benefits for certain employee groups while permitting growth for others. Choosing between hard freeze and soft freeze strategies impacts pension liabilities, employee morale, and long-term financial planning for employers.

Table of Comparison

| Feature | Hard Freeze | Soft Freeze |

|---|---|---|

| Plan Contributions | Completely stopped for all participants. | Stopped for new entrants; existing participants may continue. |

| New Participants | Not allowed to join. | Restricted from joining. |

| Benefit Accruals | Ceased immediately. | Continued for current members. |

| Plan Amendments | Usually prohibited. | Allowed with restrictions. |

| Typical Use Case | Company exiting pension offering. | Cost control while maintaining member benefits. |

| Member Impact | No further growth of benefits. | Benefits continue to grow for existing members. |

Understanding Pension Freezes: Hard vs Soft

A hard freeze in pension plans permanently halts benefit accruals and closes the plan to new participants, effectively locking in earned benefits without future increases. A soft freeze stops benefit accruals for certain employee groups while still allowing others to participate, maintaining partial plan activity. Understanding the distinction between hard and soft freezes helps organizations manage pension liabilities and comply with regulatory requirements efficiently.

Key Differences Between Hard and Soft Freezes

Hard freeze plans completely halt all contributions and accruals, preserving the plan's benefits at their current levels without allowing further increases. Soft freeze plans stop new participants from joining while allowing current participants to continue accruing benefits, often at a reduced rate. The key difference lies in benefit accrual: hard freezes freeze all accruals entirely, whereas soft freezes permit ongoing, albeit limited, benefit growth.

Impact on Employees: Hard Freeze vs Soft Freeze

A hard freeze on a pension plan halts all new accruals, preventing employees from earning additional benefits, often leading to decreased retirement security and lower future payouts. In contrast, a soft freeze permits current employees to continue accruing benefits based on existing service, minimizing disruption while restricting new hires from participating. Employees in a soft freeze experience less immediate financial impact and maintain incentive alignment, whereas hard freeze participants may need to seek alternative retirement savings options to compensate.

Employer Motivations for Pension Freezes

Employers implement hard freezes to immediately cap pension liabilities by halting benefit accruals and preventing future benefit increases, thereby stabilizing long-term funding costs. Soft freezes allow existing employees to continue accruing benefits while restricting new hires from joining the plan, balancing cost control with employee retention incentives. Both strategies aim to manage pension risk and reduce financial volatility amid growing regulatory and funding pressures.

Financial Implications for Retirement Planning

A hard freeze in a pension plan completely stops future benefit accruals, which can limit employees' retirement savings growth but may reduce the sponsor's financial liabilities. A soft freeze allows new employees to be excluded from benefit accruals while existing participants continue to earn benefits, balancing cost control with ongoing retirement savings. Retirement planning must account for these differences, as hard freezes eliminate future accrual potential, potentially requiring higher personal savings to compensate for reduced pension income.

Legal Considerations in Pension Freezes

Hard freeze in pension plans legally prohibits any new benefit accruals while preserving existing benefits untouched, often requiring strict compliance with Employee Retirement Income Security Act (ERISA) regulations to avoid fiduciary breaches. Soft freeze allows limited accruals for certain employee groups, necessitating precise plan amendment documentation and participant notification under Department of Labor (DOL) guidelines to ensure transparency and legal conformity. Employers must evaluate applicable state laws and collective bargaining agreements to mitigate litigation risks and maintain plan qualification status during either freeze type.

Transition Strategies for Affected Employees

Hard freeze pension plans completely halt benefit accruals, requiring employees to adjust to fixed retirement benefits without further growth opportunities. Soft freeze plans allow current employees to continue accruing benefits under existing terms, while new hires receive different or reduced benefits, easing the transition. Effective transition strategies include clear communication about changes, phased implementation, and offering financial counseling to help employees navigate their retirement planning.

Communicating Pension Changes Effectively

Clear communication regarding pension plan changes is crucial when implementing a hard freeze or soft freeze to mitigate employee concerns and legal risks. Hard freeze stops benefit accrual entirely, requiring detailed explanations about the impact on future benefits, while soft freeze limits accrual for certain employee groups, necessitating tailored communication for affected parties. Utilizing transparent, consistent messaging and multiple communication channels improves understanding and supports smoother transitions in pension plan management.

Case Studies: Companies with Hard and Soft Freezes

Companies like IBM have implemented hard freezes, fully halting pension benefit accruals to control long-term liabilities, resulting in significant cost savings but reduced employee benefits. Conversely, companies such as Boeing opted for soft freezes, allowing limited pension accruals to continue while closing plans to new entrants, balancing cost management with ongoing employee incentives. Case studies reveal that hard freezes often lead to immediate financial relief, whereas soft freezes maintain partial benefits and employee retention efforts.

Future Trends in Pension Plan Freezes

Hard freeze pension plans permanently close benefit accruals, preventing any future increases in participants' benefits, while soft freeze plans allow new hires but restrict benefit growth for existing employees. Emerging trends indicate a shift towards hybrid plan freezes combining elements of both approaches to manage long-term liabilities and regulatory compliance more effectively. Future pension strategies emphasize flexible freeze options that balance cost control with retention incentives amid evolving workforce demographics and financial uncertainties.

Important Terms

Vesting Schedule

A vesting schedule determines when employees earn full ownership of their equity, with a hard freeze typically halting vesting entirely during a company's restructuring or financial downturn, ensuring no additional shares are earned. In contrast, a soft freeze allows limited or modified vesting to continue, maintaining some incentive for employees while managing equity dilution.

Accrued Benefit

Accrued benefit under a Hard Freeze remains fixed and is not subject to future benefit accruals, while under a Soft Freeze, the accrued benefit is preserved but future accruals may continue for certain participants.

Benefit Suspension

Benefit suspension during a hard freeze completely halts all benefit payments and eligibility reviews, whereas a soft freeze temporarily pauses benefit changes without stopping current payments or eligibility updates.

Distribution Restrictions

Distribution restrictions during a hard freeze prohibit any changes or releases, enforcing a complete halt on software updates to ensure stability, while a soft freeze allows limited modifications, typically critical bug fixes and minor adjustments, maintaining operational flexibility without full suspension. This distinction impacts deployment schedules and development workflows by balancing risk management with the need for ongoing maintenance.

Plan Termination

Plan Termination involves a Hard Freeze that immediately stops all contributions and transactions, while a Soft Freeze allows limited transactions but restricts new contributions.

Active Participant Status

Active Participant Status determines user engagement levels during Hard Freeze, restricting functionality completely, versus Soft Freeze, which allows limited interactions.

Frozen Benefit Calculation

Frozen benefit calculation distinguishes between hard freeze and soft freeze by determining how pension accruals are managed when plan benefits are frozen; in a hard freeze, no further benefit accruals occur, effectively locking pension benefits at a specific date, whereas a soft freeze allows continued accrual but restricts new entrants or limits increases for certain employee groups. This differentiation impacts actuarial valuations, funding strategies, and employee retirement planning by defining the pension plan's ongoing obligations and potential liabilities.

Plan Amendments

Plan amendments during a hard freeze are restricted to critical compliance changes, whereas a soft freeze allows limited modifications to accommodate evolving business needs.

Deferred Accruals

Deferred accruals during a hard freeze are completely suspended, preventing any new accrual entries, while a soft freeze allows limited accrual activity with restrictions to control financial reporting adjustments.

Legacy Pension Liabilities

Legacy pension liabilities increase significantly under a hard freeze due to halted benefit accruals and ongoing obligations, whereas a soft freeze allows continued accruals for existing members, moderating the growth of liabilities.

Hard Freeze vs Soft Freeze Infographic

moneydif.com

moneydif.com