Pensionable service refers to the specific period during which an employee's work counts towards the calculation of their pension benefits, often including only paid employment or certain approved leaves. Qualifying service encompasses the total time an employee has been eligible for pension membership, which may include periods of unpaid leave or other recognized absences. Understanding the distinction between pensionable service and qualifying service is essential for accurately determining pension entitlements and benefit calculations.

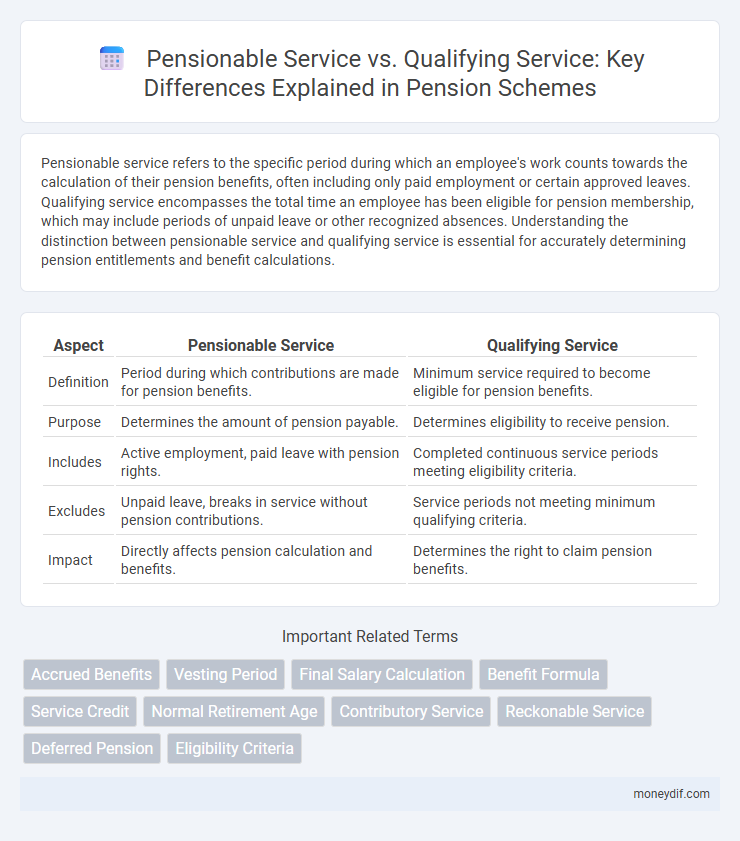

Table of Comparison

| Aspect | Pensionable Service | Qualifying Service |

|---|---|---|

| Definition | Period during which contributions are made for pension benefits. | Minimum service required to become eligible for pension benefits. |

| Purpose | Determines the amount of pension payable. | Determines eligibility to receive pension. |

| Includes | Active employment, paid leave with pension rights. | Completed continuous service periods meeting eligibility criteria. |

| Excludes | Unpaid leave, breaks in service without pension contributions. | Service periods not meeting minimum qualifying criteria. |

| Impact | Directly affects pension calculation and benefits. | Determines the right to claim pension benefits. |

Understanding Pensionable Service

Pensionable service refers to the period during which an employee's work counts toward earning pension benefits according to the specific pension scheme rules. It typically includes continuous employment time during which contributions are made, while qualifying service may cover additional periods recognized for pension purposes, such as transferred service or certain leaves. Understanding pensionable service is crucial for accurately calculating pension entitlements and retirement benefits.

Defining Qualifying Service

Qualifying service refers to the specific period of employment or service time that counts towards eligibility for pension benefits, often requiring continuous or contributory service under set rules. Pensionable service, by contrast, is the length of service used to calculate the pension amount, which may exclude certain breaks or non-contributory periods. Defining qualifying service is crucial as it determines whether an employee meets the minimum criteria to receive pension entitlements.

Key Differences Between Pensionable and Qualifying Service

Pensionable service refers to the period of employment during which an employee earns pension benefits under a specific pension scheme, while qualifying service includes any service recognized for pension eligibility but may not always accrue benefits. Key differences include eligibility criteria, as pensionable service typically requires active contributions or employer confirmation, whereas qualifying service may encompass prior employment, probation, or transferred service without contributions. Understanding these distinctions is crucial for accurate pension calculations and determining entitlement.

How Pensionable Service Impacts Retirement Benefits

Pensionable service directly determines the amount of retirement benefits an employee will receive, as it represents the period during which pension contributions are actively accumulated. Qualifying service may include periods that count towards eligibility but do not always contribute to the pension calculation, such as unpaid leave or certain suspensions. Understanding the distinction between pensionable and qualifying service is crucial for maximizing retirement income and ensuring accurate benefit projections.

The Role of Qualifying Service in Pension Eligibility

Qualifying service determines an employee's eligibility for pension benefits by establishing the minimum period of continuous employment required to qualify for pension entitlement. Unlike pensionable service, which counts all periods that accrue benefits, qualifying service specifically tracks service periods that meet criteria such as minimum length or type of employment. Employers and pension schemes often set qualifying service thresholds to control access to pension benefits and ensure financial sustainability.

Calculating Pension Based on Service Types

Pensionable service refers to the period during which an employee's work counts towards their pension benefits, typically including paid employment under pension scheme rules. Qualifying service often encompasses a broader timeframe, including periods like unpaid leave or part-time work that meet minimum criteria to qualify for pension rights but may not count fully toward benefit calculations. Calculating pension benefits requires careful distinction between these service types since pensionable service directly influences the accrual rate and final pension amount, while qualifying service primarily affects eligibility.

Inclusion and Exclusion Rules for Pensionable Service

Pensionable Service includes periods of employment that count towards pension benefits, typically encompassing active work, paid leave, and authorized absences as defined by pension plan rules. Exclusions from Pensionable Service often cover unpaid leaves, certain types of temporary employment, and periods when contributions were not made, which differ from Qualifying Service that might include broader periods for eligibility but not necessarily for benefit calculation. Understanding these inclusion and exclusion criteria is crucial for accurate pension benefit determination and eligibility assessments.

Common Mistakes in Interpreting Service Years

Confusing pensionable service with qualifying service is a common mistake that can lead to inaccurate pension calculations and benefit expectations. Pensionable service typically refers to the actual years of employment recognized for pension accrual, while qualifying service includes periods that meet minimum criteria for eligibility but may not accumulate pension benefits. Misinterpreting these distinctions often results in employees overestimating their retirement benefits or misunderstanding their eligibility for pension schemes.

Legal Framework Governing Service Calculations

Pensionable service refers to the period recognized under pension schemes for calculating benefits, defined by specific statutory regulations or employment contracts. Qualifying service, often broader, includes all periods counted towards pension eligibility as per legal frameworks such as the Pensions Act or employment law provisions. Legal frameworks establish clear distinctions, ensuring accurate service calculations for entitlement, vesting, and benefit determination within pension schemes.

Optimizing Your Service Record for Maximum Pension

Maximizing your pension benefits requires a clear understanding of pensionable service versus qualifying service, as pensionable service directly impacts the calculation of your retirement income. Qualifying service establishes eligibility to join the pension scheme, while only pensionable service counts towards the pension formula and final payout. Regularly reviewing and consolidating your service records, including transferred or partially credited periods, ensures you optimize your pension calculation and secure the highest possible retirement benefits.

Important Terms

Accrued Benefits

Accrued benefits in pension plans are primarily calculated based on pensionable service, which includes periods counted for benefit accrual, whereas qualifying service encompasses broader eligibility criteria that may not directly increase benefit entitlements.

Vesting Period

The vesting period determines the minimum pensionable service required for an employee to qualify for pension benefits, whereas qualifying service includes all periods of employment that count towards pension accrual under the plan rules.

Final Salary Calculation

Final salary calculation for pensions prioritizes pensionable service over qualifying service as it directly impacts the accurate determination of retirement benefits.

Benefit Formula

The Benefit Formula calculates retirement benefits by multiplying pensionable service, which includes all credited employment periods, by a fixed accrual rate and final average salary, whereas qualifying service determines eligibility but may exclude certain service types not counted toward benefit accrual.

Service Credit

Service Credit represents the recognized duration used to calculate Pensionable Service, which directly affects retirement benefits, while Qualifying Service determines eligibility for pension participation based on continuous employment criteria.

Normal Retirement Age

Normal Retirement Age often determines eligibility based on Pensionable Service, which typically excludes certain periods counted in Qualifying Service for pension calculations.

Contributory Service

Contributory Service refers to the period during which an employee actively makes pension contributions, directly impacting their Pensionable Service, which determines pension benefits eligibility and amount. Qualifying Service encompasses all service periods considered for pension calculations, including both Contributory and certain non-contributory periods, influencing overall pension entitlement.

Reckonable Service

Reckonable Service refers to the total period recognized for pension calculations, encompassing both Pensionable Service and Qualifying Service; Pensionable Service is the actual time during which an employee's contributions count towards pension benefits, while Qualifying Service includes periods recognized for eligibility, such as approved leave or transferred service. Understanding the distinction between these terms is critical for accurate pension entitlement assessments and retirement planning.

Deferred Pension

Deferred pension benefits are calculated based on pensionable service, which includes all employment periods eligible for pension accrual, whereas qualifying service refers to the specific duration that meets the minimum criteria for pension entitlement. Understanding the distinction between pensionable and qualifying service is essential for accurately determining deferred pension amounts and eligibility.

Eligibility Criteria

Pensionable Service refers to the actual period of employment counted towards pension benefits, while Qualifying Service includes both pensionable periods and any additional recognized service required to meet eligibility criteria for pension entitlement.

Pensionable Service vs Qualifying Service Infographic

moneydif.com

moneydif.com