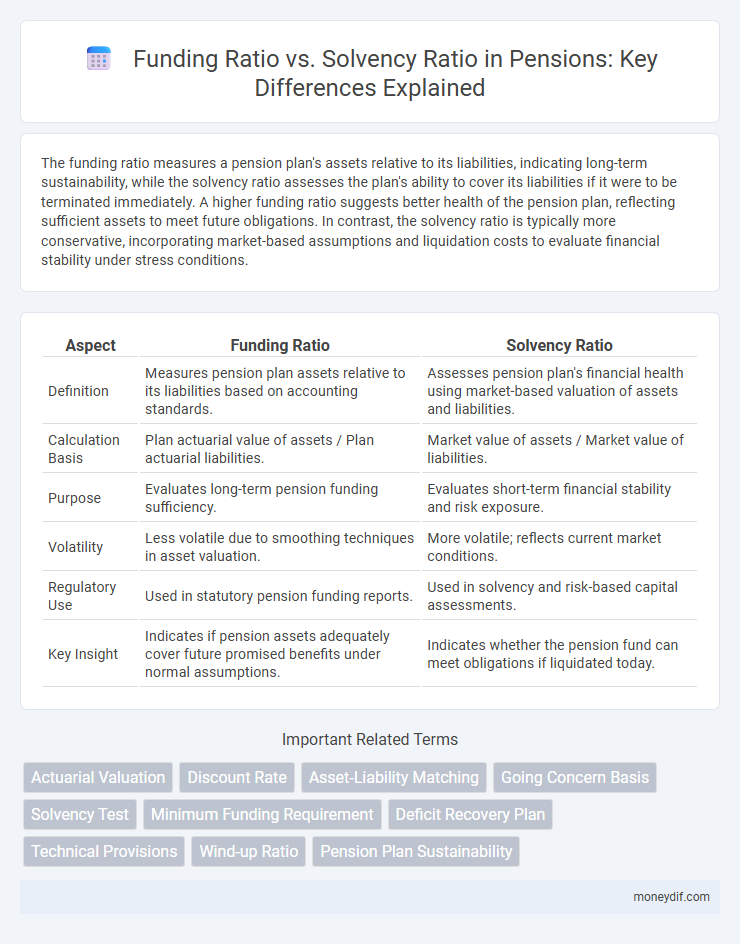

The funding ratio measures a pension plan's assets relative to its liabilities, indicating long-term sustainability, while the solvency ratio assesses the plan's ability to cover its liabilities if it were to be terminated immediately. A higher funding ratio suggests better health of the pension plan, reflecting sufficient assets to meet future obligations. In contrast, the solvency ratio is typically more conservative, incorporating market-based assumptions and liquidation costs to evaluate financial stability under stress conditions.

Table of Comparison

| Aspect | Funding Ratio | Solvency Ratio |

|---|---|---|

| Definition | Measures pension plan assets relative to its liabilities based on accounting standards. | Assesses pension plan's financial health using market-based valuation of assets and liabilities. |

| Calculation Basis | Plan actuarial value of assets / Plan actuarial liabilities. | Market value of assets / Market value of liabilities. |

| Purpose | Evaluates long-term pension funding sufficiency. | Evaluates short-term financial stability and risk exposure. |

| Volatility | Less volatile due to smoothing techniques in asset valuation. | More volatile; reflects current market conditions. |

| Regulatory Use | Used in statutory pension funding reports. | Used in solvency and risk-based capital assessments. |

| Key Insight | Indicates if pension assets adequately cover future promised benefits under normal assumptions. | Indicates whether the pension fund can meet obligations if liquidated today. |

Understanding Pension Funding Ratio

The pension funding ratio measures a pension plan's assets relative to its liabilities, indicating its ability to meet future obligations using current resources. A ratio above 100% signifies the plan is fully funded, while a lower ratio highlights potential shortfalls and funding risks. Understanding this metric helps stakeholders assess the pension's financial health and the adequacy of contributions to cover promised benefits.

Defining Pension Solvency Ratio

Pension Solvency Ratio measures a pension plan's ability to meet all future obligations if it were to be terminated immediately, reflecting the plan's assets relative to the present value of its liabilities calculated on a solvency basis. Unlike the Funding Ratio, which uses ongoing valuation assumptions, the Solvency Ratio incorporates conservative assumptions such as annuity purchase costs and market-based discount rates. This ratio provides a stringent assessment of the pension plan's financial health, emphasizing long-term sustainability and risk management.

Key Differences Between Funding Ratio and Solvency Ratio

The Funding Ratio measures a pension plan's assets relative to its liabilities, indicating the plan's ability to cover promised benefits under normal conditions. The Solvency Ratio assesses the plan's capacity to meet obligations in a worst-case scenario, often using more conservative assumptions and considering immediate settlement costs. Key differences lie in the purpose, assumptions, and risk sensitivity, with the Funding Ratio focusing on ongoing plan health and the Solvency Ratio emphasizing financial stability under distress.

Importance of Funding Ratio for Pension Plans

The Funding Ratio measures the financial health and long-term sustainability of a pension plan by comparing its assets to its liabilities, serving as a critical indicator for trustees and regulators. Unlike the Solvency Ratio, which evaluates the ability to meet obligations in a hypothetical wind-up scenario, the Funding Ratio reflects ongoing operational viability and helps in making informed decisions about contribution levels and benefit adjustments. Maintaining a robust Funding Ratio ensures pension plans remain adequately funded to meet future obligations, safeguarding retirees' benefits and fostering trust among stakeholders.

Role of Solvency Ratio in Pension Security

The solvency ratio plays a critical role in pension security by measuring a pension plan's ability to meet its long-term liabilities using current assets under a stress scenario. Unlike the funding ratio, which evaluates assets relative to liabilities based on accounting assumptions, the solvency ratio provides a stricter, market-based assessment that reflects the plan's financial stability during economic downturns. Pension regulators rely on solvency ratios to ensure plans maintain sufficient reserves to protect beneficiaries from underfunding risks.

Calculating Funding Ratio: Methods and Metrics

Calculating the Funding Ratio involves dividing the pension plan's assets by its liabilities, reflecting the plan's financial health and ability to meet future obligations. Common methods include market value accounting, which uses current asset prices, and actuarial value accounting, which smooths asset values over time to reduce volatility. Accurate metrics such as discounted liabilities, expected asset returns, and asset-liability matching are critical for assessing the plan's funding status and guiding effective pension management.

How to Determine the Solvency Ratio in Pensions

The solvency ratio in pensions is determined by comparing the pension plan's total assets to its total liabilities, specifically considering the present value of future pension obligations discounted at a risk-free or low-risk interest rate. Accurate actuarial valuations and up-to-date financial data are essential to calculate the present value of liabilities, ensuring that the solvency ratio reflects the plan's ability to meet long-term obligations. This ratio provides a realistic measure of pension plan health, as it accounts for potential market volatility and the time value of money.

Implications of Low Funding and Solvency Ratios

Low funding and solvency ratios in pension plans signal insufficient assets relative to liabilities, increasing the risk of underpayment or delayed benefits for retirees. These ratios directly impact the plan's financial health, potentially leading to higher contribution requirements from sponsors and reduced plan stability. Regulatory scrutiny intensifies as these metrics fall, prompting the need for corrective actions to restore long-term pension solvency.

Regulatory Standards for Pension Ratios

Pension regulatory standards require maintaining both funding and solvency ratios above specified thresholds to ensure long-term financial health and beneficiary protection. The funding ratio measures plan assets relative to liabilities under accounting principles, while the solvency ratio assesses the ability to meet obligations if the plan were terminated. Regulators often mandate higher solvency ratio targets to address risks of underfunding and guarantee pension promises under adverse conditions.

Strategies to Improve Pension Funding and Solvency Ratios

Enhancing pension funding and solvency ratios involves adopting robust asset-liability management strategies, such as diversifying investment portfolios and implementing dynamic hedging techniques to mitigate market risks. Increasing contribution rates and adjusting benefit formulas align liabilities with available assets, ensuring long-term plan sustainability. Regular stress testing and actuarial reviews enable early identification of funding gaps, prompting timely strategic adjustments to maintain financial health.

Important Terms

Actuarial Valuation

Actuarial valuation assesses pension plan liabilities using the funding ratio to measure assets against accrued obligations, while the solvency ratio evaluates the plan's ability to meet liabilities under a buyout scenario.

Discount Rate

The discount rate significantly impacts the funding ratio by determining the present value of future liabilities, influencing the perceived sufficiency of assets to cover obligations. A higher discount rate generally improves the funding ratio but may distort the solvency ratio by underestimating long-term risks and future cash flow requirements.

Asset-Liability Matching

Asset-liability matching improves funding ratios by aligning asset cash flows with liability obligations, thereby enhancing solvency ratios and reducing the risk of underfunding.

Going Concern Basis

The Going Concern Basis assumes ongoing operations affecting the Funding Ratio by focusing on long-term liabilities, whereas the Solvency Ratio evaluates immediate financial stability by comparing assets to short-term obligations.

Solvency Test

The Solvency Test assesses a pension plan's financial health by comparing its Funding Ratio, which measures the plan's assets against its liabilities on a going-concern basis, to its Solvency Ratio that evaluates the ability to meet obligations if the plan were wound up immediately. A higher Funding Ratio indicates ongoing viability, while the Solvency Ratio reflects the plan's immediate capacity to cover all liabilities, often requiring more conservative assumptions.

Minimum Funding Requirement

The Minimum Funding Requirement mandates pension plans maintain a Funding Ratio above a regulatory threshold to ensure solvency ratios reflect the plan's ability to meet long-term liabilities.

Deficit Recovery Plan

The Deficit Recovery Plan aims to restore the Funding Ratio to a target level above 100% by addressing shortfalls identified through comparisons with the Solvency Ratio to ensure long-term financial stability.

Technical Provisions

Technical provisions represent the insurer's liability valuation critical for calculating the funding ratio, while the solvency ratio measures the insurer's overall financial health by comparing available capital to required regulatory capital.

Wind-up Ratio

Wind-up Ratio measures the proportion of assets available at plan termination relative to liabilities, offering a practical assessment of a pension plan's ability to settle obligations immediately. It differs from the Funding Ratio, which reflects ongoing funding status, and the Solvency Ratio, which evaluates the plan's ability to meet liabilities under regulatory valuation assumptions.

Pension Plan Sustainability

The sustainability of pension plans is critically assessed by comparing the Funding Ratio, which measures assets against liabilities under standard assumptions, with the Solvency Ratio, reflecting the ability to meet obligations under adverse market conditions.

Funding Ratio vs Solvency Ratio Infographic

moneydif.com

moneydif.com