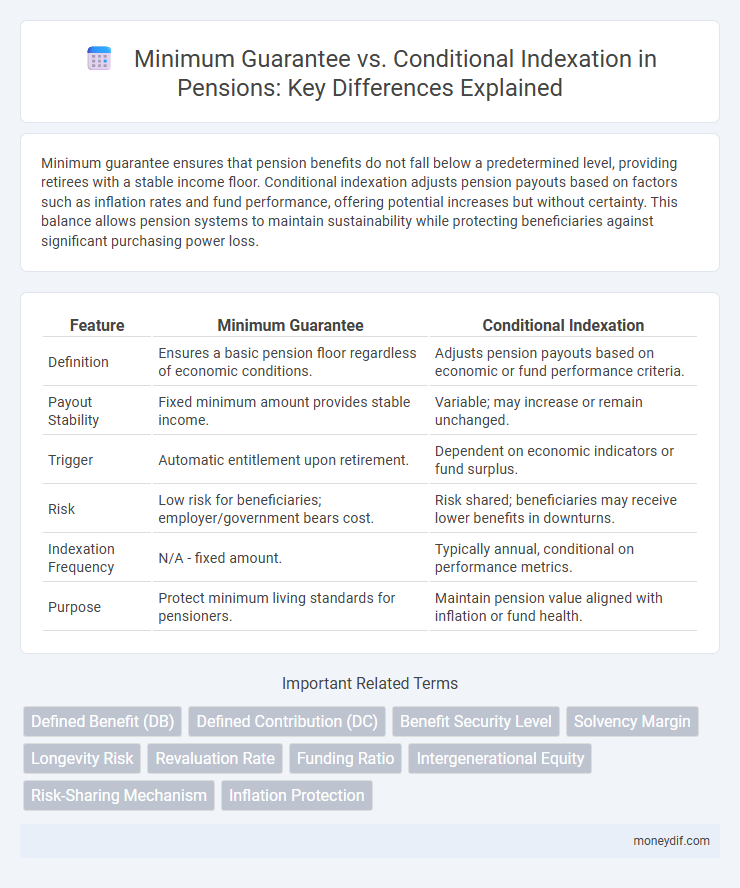

Minimum guarantee ensures that pension benefits do not fall below a predetermined level, providing retirees with a stable income floor. Conditional indexation adjusts pension payouts based on factors such as inflation rates and fund performance, offering potential increases but without certainty. This balance allows pension systems to maintain sustainability while protecting beneficiaries against significant purchasing power loss.

Table of Comparison

| Feature | Minimum Guarantee | Conditional Indexation |

|---|---|---|

| Definition | Ensures a basic pension floor regardless of economic conditions. | Adjusts pension payouts based on economic or fund performance criteria. |

| Payout Stability | Fixed minimum amount provides stable income. | Variable; may increase or remain unchanged. |

| Trigger | Automatic entitlement upon retirement. | Dependent on economic indicators or fund surplus. |

| Risk | Low risk for beneficiaries; employer/government bears cost. | Risk shared; beneficiaries may receive lower benefits in downturns. |

| Indexation Frequency | N/A - fixed amount. | Typically annual, conditional on performance metrics. |

| Purpose | Protect minimum living standards for pensioners. | Maintain pension value aligned with inflation or fund health. |

Understanding Minimum Guarantee in Pension Plans

Minimum guarantee in pension plans ensures a fixed baseline payment to retirees, providing financial security regardless of market fluctuations. This guaranteed amount protects beneficiaries from inflation risks by setting a floor, while conditional indexation adjusts benefits based on economic conditions or plan performance, allowing potential increases without risking reductions. Understanding the minimum guarantee helps retirees evaluate the stability of their pension income compared to variable components like conditional indexation.

What is Conditional Indexation?

Conditional indexation in pensions refers to the adjustment of pension benefits based on specific economic factors such as inflation rates or financial market performance. Unlike minimum guarantee schemes that ensure a baseline pension amount regardless of economic shifts, conditional indexation allows pensions to increase only when predefined conditions, like positive returns or inflation thresholds, are met. This approach aims to balance pensioners' purchasing power with the sustainability of pension funds.

Key Differences Between Minimum Guarantee and Conditional Indexation

Minimum guarantee ensures a fixed pension amount regardless of inflation or economic conditions, providing predictable retirement income security. Conditional indexation adjusts pension benefits based on economic factors such as inflation rates or funding status, leading to variable increases that depend on financial sustainability. Key differences lie in the certainty of payments under minimum guarantee versus the performance-linked adjustments characteristic of conditional indexation.

Advantages of Minimum Guarantee for Retirees

Minimum guarantee pensions provide retirees with a stable and predictable income, protecting them from inflation and market volatility. This security ensures a consistent standard of living regardless of economic fluctuations or fund performance. Retirees benefit from peace of mind knowing their pension will not fall below a set threshold, unlike conditional indexation which depends on variable economic conditions.

Risks and Drawbacks of Conditional Indexation

Conditional indexation in pensions exposes retirees to significant risks such as reduced purchasing power during economic downturns or periods of low inflation, as benefits may not increase adequately to match rising living costs. This uncertainty can lead to financial insecurity, especially for older beneficiaries reliant on fixed incomes. Unlike minimum guarantee schemes that ensure a baseline pension level, conditional indexation creates variability that may undermine long-term retirement stability.

Impact on Pension Fund Sustainability

Minimum Guarantee ensures a fixed baseline pension benefit, protecting retirees from market volatility but potentially increasing long-term liabilities for pension funds. Conditional Indexation adjusts benefits based on the fund's financial health, helping maintain sustainability by avoiding automatic, unfunded pension increases. Pension funds balancing these mechanisms can better align payout commitments with funding status, reducing the risk of insolvency.

How Economic Conditions Affect Indexation Methods

Minimum Guarantee ensures a fixed pension increase regardless of economic fluctuations, protecting retirees during downturns but potentially limiting growth in strong economies. Conditional Indexation adjusts pension benefits based on economic indicators like inflation rates or wage growth, allowing flexible responses aligned with fiscal health but risking reduced increases in weak economies. Economic conditions such as inflation, GDP growth, and fiscal sustainability critically determine the effectiveness and stability of these indexation methods in pension systems.

Case Studies: Minimum Guarantee vs Conditional Indexation

Case studies comparing Minimum Guarantee and Conditional Indexation in pensions reveal distinct impacts on retirees' income stability and purchasing power. Minimum Guarantee schemes ensure a fixed baseline pension, protecting against inflation but may result in higher long-term financial liabilities for pension funds. Conditional Indexation adjusts benefits based on fund performance, offering potential growth but with increased risk of reduced payouts during economic downturns.

Choosing the Right Pension Approach for Security

Minimum Guarantee ensures a fixed baseline pension income, providing predictable financial security regardless of market fluctuations. Conditional Indexation adjusts pension benefits based on economic performance, offering potential growth but with inherent risks linked to inflation and investment returns. Selecting the right pension approach depends on balancing guaranteed stability against the possibility of enhanced benefits to match changing economic conditions.

Future Trends in Pension Plan Design

Future trends in pension plan design emphasize a shift from minimum guarantee schemes to conditional indexation models that adjust benefits based on economic and demographic factors. Conditional indexation links pension increases to factors such as inflation rates, fund performance, and longevity improvements, promoting sustainability and reducing fiscal burden. This dynamic approach aims to balance retirees' purchasing power with the financial stability of pension funds amid evolving market conditions and aging populations.

Important Terms

Defined Benefit (DB)

Defined Benefit (DB) pension plans balance Minimum Guarantee, ensuring a baseline payout, with Conditional Indexation, which adjusts benefits based on funding status and economic conditions to protect retirees' income.

Defined Contribution (DC)

Defined Contribution (DC) plans with Minimum Guarantee ensure a baseline retirement benefit regardless of market performance, whereas Conditional Indexation adjusts benefits based on fund returns or inflation rates.

Benefit Security Level

Benefit Security Level varies significantly between Minimum Guarantee and Conditional Indexation; Minimum Guarantee ensures a fixed, non-reducible return protecting beneficiaries against market volatility, while Conditional Indexation adjusts benefits based on economic factors, potentially increasing payouts but with variable security. Pension funds prioritizing benefit security often favor Minimum Guarantee to provide stable income, while Conditional Indexation offers growth potential linked to inflation or investment performance.

Solvency Margin

Solvency margin requirements ensure insurers maintain sufficient capital to cover policyholder risks, with minimum guarantee posing higher capital strain due to fixed benefit commitments. Conditional indexation adjusts benefits based on insurer performance or economic conditions, potentially lowering the solvency margin by reducing guaranteed liabilities.

Longevity Risk

Longevity risk increases when minimum guarantees limit flexibility compared to conditional indexation, which adjusts benefits based on actual mortality and market conditions.

Revaluation Rate

Revaluation Rate adjusts the value of annuities or pension benefits based on inflation or predefined criteria to maintain purchasing power, playing a critical role in the balance between Minimum Guarantee and Conditional Indexation methods. Minimum Guarantee ensures a fixed, non-negative increase in benefits regardless of economic conditions, while Conditional Indexation ties benefit adjustments to economic or fund performance, often resulting in variable revaluation rates.

Funding Ratio

The funding ratio balances the minimum guarantee liabilities against conditional indexation obligations to assess pension plan sustainability and solvency risk.

Intergenerational Equity

Intergenerational equity in pension systems balances the minimum guarantee's protection for current retirees with conditional indexation's adjustment to economic conditions, ensuring fairness across generations.

Risk-Sharing Mechanism

Risk-sharing mechanisms balance financial uncertainties by combining Minimum Guarantee provisions with Conditional Indexation to adjust payouts based on actual performance metrics.

Inflation Protection

Inflation protection balances minimum guarantee ensuring principal preservation against conditional indexation offering growth linked to inflation rates.

Minimum Guarantee vs Conditional Indexation Infographic

moneydif.com

moneydif.com