Section 401(a) plans are employer-established retirement savings plans typically used by government agencies and non-profits, offering flexible contribution limits and investment options. Section 403(b) plans serve employees of public schools and certain tax-exempt organizations, featuring tax-deferred contributions primarily through annuities or mutual funds. Understanding these distinctions helps employees choose the right plan for maximizing retirement savings and tax benefits.

Table of Comparison

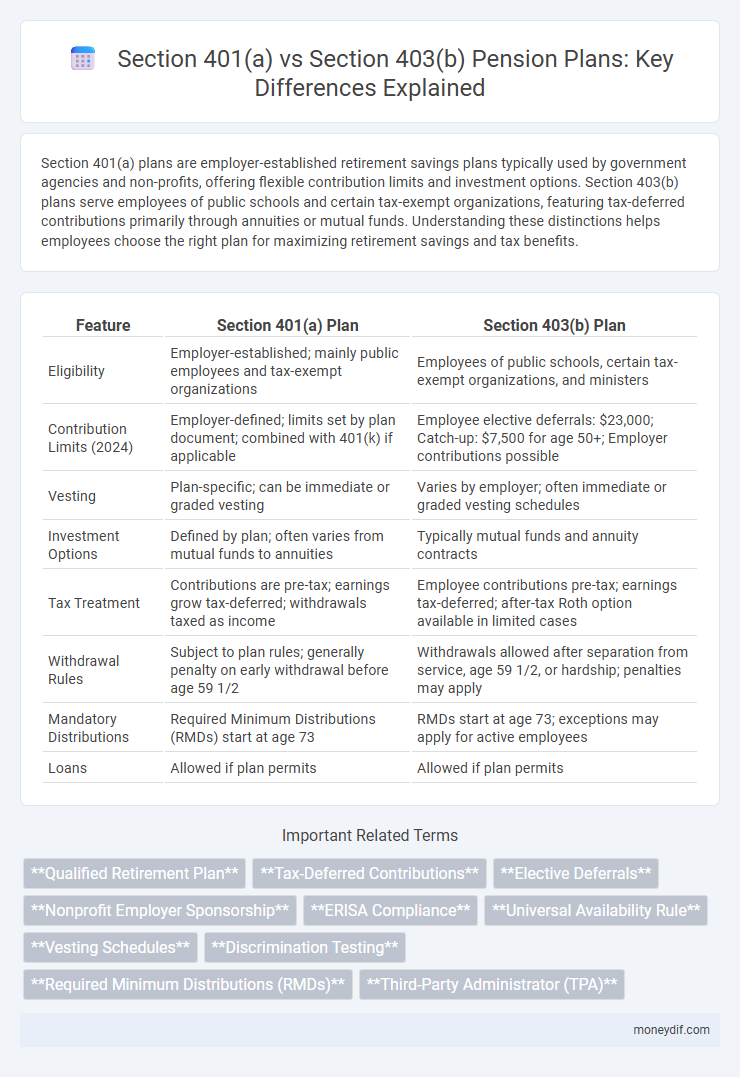

| Feature | Section 401(a) Plan | Section 403(b) Plan |

|---|---|---|

| Eligibility | Employer-established; mainly public employees and tax-exempt organizations | Employees of public schools, certain tax-exempt organizations, and ministers |

| Contribution Limits (2024) | Employer-defined; limits set by plan document; combined with 401(k) if applicable | Employee elective deferrals: $23,000; Catch-up: $7,500 for age 50+; Employer contributions possible |

| Vesting | Plan-specific; can be immediate or graded vesting | Varies by employer; often immediate or graded vesting schedules |

| Investment Options | Defined by plan; often varies from mutual funds to annuities | Typically mutual funds and annuity contracts |

| Tax Treatment | Contributions are pre-tax; earnings grow tax-deferred; withdrawals taxed as income | Employee contributions pre-tax; earnings tax-deferred; after-tax Roth option available in limited cases |

| Withdrawal Rules | Subject to plan rules; generally penalty on early withdrawal before age 59 1/2 | Withdrawals allowed after separation from service, age 59 1/2, or hardship; penalties may apply |

| Mandatory Distributions | Required Minimum Distributions (RMDs) start at age 73 | RMDs start at age 73; exceptions may apply for active employees |

| Loans | Allowed if plan permits | Allowed if plan permits |

Introduction to Section 401(a) and Section 403(b) Plans

Section 401(a) plans are employer-established retirement programs subject to specific Internal Revenue Code regulations, designed to provide tax-deferred retirement savings primarily for public sector and nonprofit employees. Section 403(b) plans, also known as tax-sheltered annuities, cater to employees of public schools, certain tax-exempt organizations, and ministers, offering tax-deferred contributions and investment options. While both plans enable tax-advantaged retirement savings, Section 401(a) plans often have employer contributions that are mandatory or based on a formula, whereas Section 403(b) plans emphasize employee elective deferrals with optional employer contributions.

Key Features of Section 401(a) Plans

Section 401(a) plans offer employer-established qualified retirement savings options with customizable contribution requirements, often used by government and nonprofit organizations. These plans allow for mandatory employee contributions, employer matching, and flexible vesting schedules, enhancing participant control and plan design. Unlike Section 403(b) plans, Section 401(a) plans typically provide broader investment choices and stricter nondiscrimination testing, ensuring equitable benefits across employees.

Key Features of Section 403(b) Plans

Section 403(b) plans primarily serve employees of public schools and certain tax-exempt organizations, allowing tax-deferred contributions similar to 401(k) plans. These plans feature employer-sponsored retirement savings options with tax advantages on both employee contributions and potential earnings until withdrawal. Unlike Section 401(a) plans, 403(b) plans often permit only elective deferrals and may include annuity contracts or mutual funds as investment choices.

Eligible Employers for 401(a) and 403(b) Plans

Section 401(a) plans are typically established by government entities, educational institutions, and non-profit organizations offering qualified retirement programs to their employees. Section 403(b) plans are specifically designed for employees of public schools, tax-exempt organizations under IRC 501(c)(3), and certain ministers, providing tax-deferred retirement savings. Understanding eligible employers for 401(a) plans includes government units and non-profit employers, while 403(b) plans target non-profit educational and religious organizations.

Contribution Limits and Funding Rules

Section 401(a) plans feature employer-determined contribution limits, often with mandatory employee participation and flexibility in funding sources, including employer and employee contributions subject to annual IRS nondiscrimination testing. Section 403(b) plans, primarily for employees of public schools and tax-exempt organizations, have higher elective deferral limits, currently $22,500 for 2024 with an additional $7,500 catch-up for those age 50 or older, but rely predominantly on employee contributions with employer contributions being discretionary. Funding rules for 401(a) plans require adherence to defined contribution or defined benefit protocols under ERISA, whereas 403(b) plans are subject to fewer funding restrictions but must comply with IRS limits on contributions to maintain tax-qualified status.

Vesting Schedules and Employee Rights

Section 401(a) plans typically feature employer-determined vesting schedules, often with a graded or cliff vesting system, whereas Section 403(b) plans generally offer more flexible vesting rules, sometimes allowing immediate vesting of employee contributions. Employees in 403(b) plans have rights to both elective deferrals and employer contributions, while 401(a) plans may restrict access to employer contributions until vesting criteria are met. Understanding the differences in vesting schedules and participant rights is crucial for maximizing retirement benefits under each plan type.

Tax Advantages and Implications

Section 401(a) plans offer employer-sponsored retirement savings with tax-deferred growth and mandatory employee contributions, often benefiting public sector and nonprofit employees through pre-tax contributions. Section 403(b) plans also provide tax-deferred growth but focus on contributions from employees and employers in tax-exempt organizations, with the added advantage of potential catch-up contributions for employees with long service. Both plans allow for tax-deferred earnings, but differences in contribution limits, eligible employers, and withdrawal rules create distinct tax implications for retirement planning.

Investment Options and Flexibility

Section 401(a) plans typically offer a broader range of investment options including mutual funds, stocks, and bonds managed by the employer or plan provider, allowing for customizable retirement portfolios. In contrast, Section 403(b) plans primarily focus on annuities and mutual funds with investment choices often limited to options selected by the employer, which may restrict flexibility. Employees seeking diverse investment opportunities and control over asset allocation may find Section 401(a) plans provide greater adaptability compared to the more standardized offerings in Section 403(b) plans.

Withdrawal Rules and Penalties

Section 401(a) plans typically allow tax-deferred contributions with penalties on withdrawals taken before age 59 1/2, including a 10% early withdrawal penalty besides income tax. Section 403(b) plans also impose a 10% early withdrawal penalty if distributions occur before age 59 1/2, but may offer exceptions such as separation from service after age 55 or certain hardship withdrawals. Both plan types require minimum distributions starting at age 73, with penalties for failure to withdraw the required amounts on time.

Choosing Between 401(a) and 403(b): Which is Right for You?

Choosing between a Section 401(a) plan and a Section 403(b) plan depends on your employment sector and retirement goals. Section 401(a) plans are typically employer-established retirement accounts for government and nonprofit employees with customizable contribution limits, whereas Section 403(b) plans cater primarily to employees of public schools and tax-exempt organizations, offering tax-deferred growth with employee salary deferrals. Evaluating employer match options, contribution flexibility, and vesting schedules will help determine which plan aligns best with your financial future.

Important Terms

Qualified Retirement Plan

Section 401(a) Plans are employer-sponsored qualified retirement plans compliant with IRS regulations, offering tax-deferred growth and typically used by private-sector employers, while Section 403(b) Plans serve employees of public schools and certain tax-exempt organizations, providing similar tax advantages but with distinct contribution limits and investment options. Both plans facilitate retirement savings with pre-tax contributions, but Section 403(b) Plans often include unique annuity contracts or mutual funds tailored for nonprofit and educational sectors.

Tax-Deferred Contributions

Tax-deferred contributions in Section 401(a) plans allow employer-sponsored retirement savings with pre-tax dollars and potential employer matching, while Section 403(b) plans primarily serve employees of public schools and tax-exempt organizations with similar tax advantages but often include investment restrictions and different contribution limits.

Elective Deferrals

Elective deferrals in Section 401(a) plans, typically used by private employers, allow pre-tax employee contributions subject to annual IRS limits, while Section 403(b) plans, designed for employees of public schools and tax-exempt organizations, also permit elective deferrals but often include different catch-up contribution rules and investment options.

Nonprofit Employer Sponsorship

Nonprofit employer sponsorship of retirement benefits typically involves Section 403(b) plans, which are tax-sheltered annuities specifically designed for nonprofit employees, whereas Section 401(a) plans offer customizable defined contribution options often used by governmental and nonprofit entities for structured retirement savings.

ERISA Compliance

Section 401(a) plans are employer-sponsored retirement plans subject to strict ERISA compliance requirements including fiduciary duties, contribution limits, and mandatory reporting, while Section 403(b) plans, primarily for public education and non-profit employees, also fall under ERISA but have distinct rules regarding eligibility and plan administration. Both plan types require adherence to ERISA standards to ensure participant protections, but Section 403(b) plans often provide more flexible contribution strategies and investment options.

Universal Availability Rule

The Universal Availability Rule mandates that employers offering Section 403(b) plans must allow all eligible employees to participate, unlike Section 401(a) plans which can restrict eligibility based on specific employee classifications.

Vesting Schedules

Section 401(a) plans typically feature employer-determined vesting schedules that may be either graded or cliff, whereas Section 403(b) plans often follow the same vesting requirements when subject to employer contributions, aligning with ERISA guidelines.

Discrimination Testing

Discrimination testing evaluates whether Section 401(a) plans, which are qualified retirement plans, disproportionately favor highly compensated employees compared to Section 403(b) plans, often used by non-profit organizations. Section 401(a) plans are subject to more stringent nondiscrimination rules under IRS regulations, while Section 403(b) plans may have different testing requirements depending on employer eligibility and plan structure.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) for Section 401(a) plans and Section 403(b) plans are governed by IRS rules requiring account holders to begin withdrawals by April 1 following the year they reach age 73, with specific differences in rollover options and employer plan provisions affecting distribution timing and taxation.

Third-Party Administrator (TPA)

Third-Party Administrators (TPAs) play a critical role in managing compliance and regulatory requirements for both Section 401(a) qualified retirement plans and Section 403(b) tax-sheltered annuity plans by handling plan recordkeeping, nondiscrimination testing, and reporting obligations.

Section 401(a) Plan vs Section 403(b) Plan Infographic

moneydif.com

moneydif.com