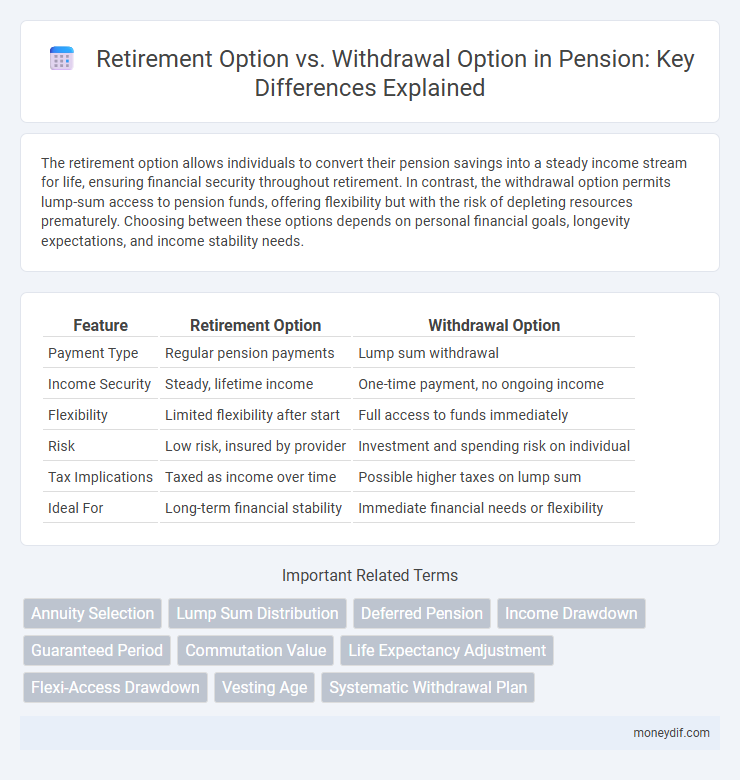

The retirement option allows individuals to convert their pension savings into a steady income stream for life, ensuring financial security throughout retirement. In contrast, the withdrawal option permits lump-sum access to pension funds, offering flexibility but with the risk of depleting resources prematurely. Choosing between these options depends on personal financial goals, longevity expectations, and income stability needs.

Table of Comparison

| Feature | Retirement Option | Withdrawal Option |

|---|---|---|

| Payment Type | Regular pension payments | Lump sum withdrawal |

| Income Security | Steady, lifetime income | One-time payment, no ongoing income |

| Flexibility | Limited flexibility after start | Full access to funds immediately |

| Risk | Low risk, insured by provider | Investment and spending risk on individual |

| Tax Implications | Taxed as income over time | Possible higher taxes on lump sum |

| Ideal For | Long-term financial stability | Immediate financial needs or flexibility |

Understanding Retirement Options in Pension Plans

Retirement options in pension plans determine how beneficiaries receive their benefits, typically as a lifetime annuity or a lump-sum withdrawal. Choosing a lifetime retirement option provides steady income throughout retirement, ensuring financial stability and protection against outliving savings. In contrast, the withdrawal option allows access to a full or partial lump sum, offering flexibility but requiring careful management to avoid depleting funds prematurely.

Key Features of Withdrawal Options

Withdrawal options in pension plans allow retirees to access their funds as lump sum payments, partial withdrawals, or systematic withdrawals, providing flexibility in managing retirement income. These options often offer immediate liquidity without requiring annuitization, enabling retirees to tailor their cash flow according to personal needs and market conditions. Tax implications vary depending on the withdrawal method and jurisdiction, making it crucial to understand the tax treatment to optimize net retirement income.

Comparing Retirement and Withdrawal Options

Retirement option allows pensioners to receive a regular income stream throughout their retirement years, ensuring financial stability and long-term support. Withdrawal option offers lump-sum payments, providing immediate access to funds but risking faster depletion of retirement savings. Comparing these options highlights the trade-off between steady income security and flexibility in managing pension assets.

Eligibility Criteria for Each Option

Retirement Option eligibility typically requires individuals to meet a minimum age threshold, often between 55 and 60 years, along with a minimum service period or contribution duration, commonly 10 to 20 years. Withdrawal Option eligibility usually applies to contributors who have not reached the retirement age but wish to access their pension funds after a shorter service period, frequently allowing partial or full fund withdrawal upon resignation or termination. Specific criteria vary by pension scheme but generally include age limits, service duration, and employment status to qualify for either option.

Tax Implications: Retirement vs Withdrawal

Retirement options typically allow pension holders to receive regular income distributions, which are often taxed as ordinary income at the individual's applicable tax rate, potentially resulting in more manageable tax liabilities over time. Withdrawal options, on the other hand, may involve lump-sum payments that can trigger higher immediate tax burdens due to larger taxable amounts recognized in a single year. Strategic tax planning is essential to minimize penalties and optimize the timing of distributions under both retirement and withdrawal pension scenarios.

Flexibility of Pension Fund Access

Retirement Option allows pensioners to receive regular income payments while maintaining partial access to their pension fund, offering controlled flexibility. Withdrawal Option provides immediate full access to the pension fund, enabling lump-sum withdrawal but eliminating future income streams. Choosing between these options depends on individual financial needs and the desired balance between ongoing income and liquidity.

Impact on Long-Term Financial Security

Retirement options typically provide a steady income stream, enhancing long-term financial security by ensuring consistent cash flow throughout retirement. Withdrawal options allow greater flexibility but risk depleting funds prematurely, potentially jeopardizing financial stability in later years. Choosing a retirement option can mitigate longevity risk, while withdrawal options require disciplined management to maintain sustained support.

Withdrawal Limits and Conditions

Retirement options in pension plans typically allow for structured monthly payouts, whereas withdrawal options provide lump-sum access but are often subject to strict limits and conditions set by the pension provider or governing regulations. Withdrawal limits commonly include caps on the total amount that can be withdrawn within specific timeframes, with conditions that may require the account holder to maintain a minimum balance to preserve future benefits. Understanding these constraints is essential for pension holders to maximize their retirement funds while ensuring long-term financial security.

Advantages and Disadvantages of Both Options

Retirement options typically provide a steady income stream for life, ensuring financial security and budgeting ease but may limit access to lump-sum funds, potentially restricting immediate liquidity. Withdrawal options offer flexibility to access funds as needed, allowing for customized spending and estate planning, yet they carry the risk of depleting savings prematurely without guaranteed income. Evaluating both options involves balancing the need for consistent income against the desire for financial flexibility and control.

Choosing the Right Option for Your Retirement Goals

Selecting the retirement option or withdrawal option depends on your long-term financial needs and risk tolerance. Retirement options provide structured income streams ensuring consistent cash flow throughout retirement, while withdrawal options offer flexibility in lump-sum access but require careful management to avoid premature depletion. Evaluating factors such as life expectancy, inflation, and market volatility helps optimize your pension strategy aligned with your retirement goals.

Important Terms

Annuity Selection

Choosing the annuity retirement option offers guaranteed lifetime income, while the withdrawal option provides flexible access to funds but lacks long-term income security.

Lump Sum Distribution

Lump Sum Distribution offers immediate access to retirement funds, while the Retirement Option typically provides structured periodic payments, and the Withdrawal Option allows flexible, partial access to the account balance.

Deferred Pension

Choosing the retirement option in a deferred pension plan ensures a steady income stream after retirement, whereas the withdrawal option provides a lump sum payment that may impact long-term financial security.

Income Drawdown

Income Drawdown offers a flexible Retirement Option that allows gradual pension access while the Withdrawal Option provides lump-sum distributions from the pension fund.

Guaranteed Period

The Guaranteed Period in retirement plans ensures a fixed income duration, making the Retirement Option preferable for lifetime payouts while the Withdrawal Option offers flexible but non-guaranteed disbursements.

Commutation Value

Commutation value is the lump sum amount an employee can receive by surrendering a portion of the future pension under the retirement option, whereas the withdrawal option allows the employee to take the entire accumulated pension fund as a single payment without opting for a regular pension. Choosing commutation reduces the monthly pension but provides immediate liquidity, while withdrawal option terminates pension benefits entirely in exchange for a one-time payout.

Life Expectancy Adjustment

Life expectancy adjustment influences retirement planning by optimizing the balance between guaranteed income from retirement options and flexible access offered by withdrawal options.

Flexi-Access Drawdown

Flexi-Access Drawdown allows retirees to flexibly withdraw pension funds as income while retaining the option to leave the remaining funds invested, offering a retirement-focused alternative to lump-sum withdrawal options.

Vesting Age

Choosing the withdrawal option at vesting age provides immediate access to funds, while the retirement option defers benefits to maximize long-term financial security.

Systematic Withdrawal Plan

A Systematic Withdrawal Plan (SWP) in retirement allows investors to regularly withdraw a fixed amount from their mutual fund investments, balancing between the Retirement Option that offers steady income and the Withdrawal Option that provides flexible, ad-hoc access to funds.

Retirement Option vs Withdrawal Option Infographic

moneydif.com

moneydif.com