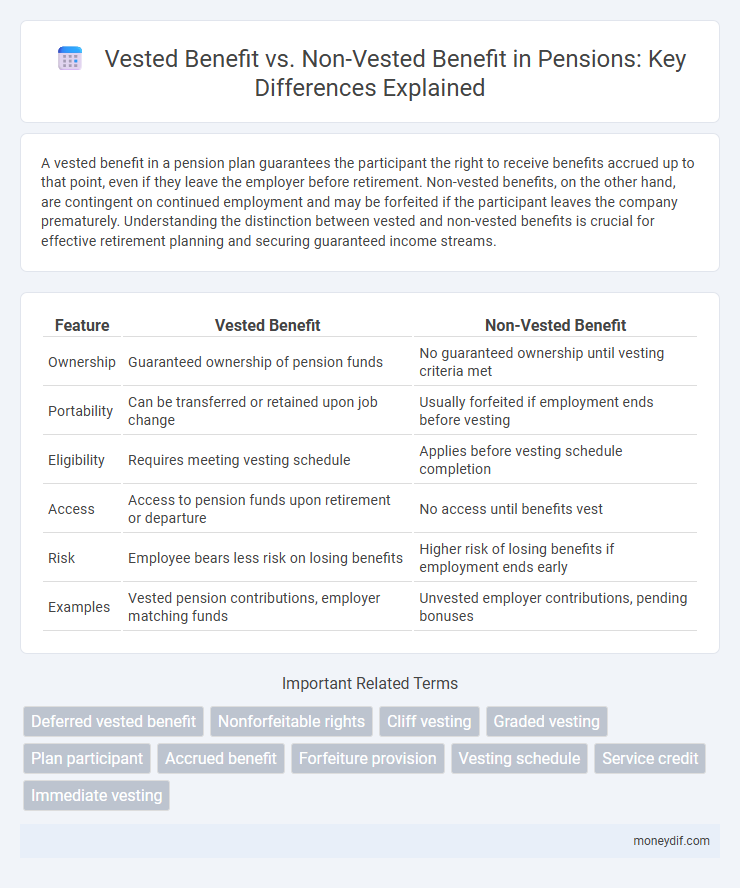

A vested benefit in a pension plan guarantees the participant the right to receive benefits accrued up to that point, even if they leave the employer before retirement. Non-vested benefits, on the other hand, are contingent on continued employment and may be forfeited if the participant leaves the company prematurely. Understanding the distinction between vested and non-vested benefits is crucial for effective retirement planning and securing guaranteed income streams.

Table of Comparison

| Feature | Vested Benefit | Non-Vested Benefit |

|---|---|---|

| Ownership | Guaranteed ownership of pension funds | No guaranteed ownership until vesting criteria met |

| Portability | Can be transferred or retained upon job change | Usually forfeited if employment ends before vesting |

| Eligibility | Requires meeting vesting schedule | Applies before vesting schedule completion |

| Access | Access to pension funds upon retirement or departure | No access until benefits vest |

| Risk | Employee bears less risk on losing benefits | Higher risk of losing benefits if employment ends early |

| Examples | Vested pension contributions, employer matching funds | Unvested employer contributions, pending bonuses |

Introduction to Vested and Non-Vested Pension Benefits

Vested pension benefits refer to the portion of a retirement plan that an employee has earned and is entitled to keep, even if they leave the employer before retirement age. Non-vested benefits are contributions or earnings within a pension plan that an employee forfeits if they discontinue their employment prior to meeting specific vesting criteria. Understanding the distinction between vested and non-vested benefits is crucial for effective retirement planning and maximizing pension income security.

Defining Vested Benefits: What It Means for Employees

Vested benefits refer to the portion of a pension plan that employees have earned and are entitled to receive regardless of future employment status, ensuring financial security after leaving a job. Non-vested benefits, in contrast, represent the contributions or earnings employees have not yet fully earned and may forfeit if they leave the employer before meeting specific service requirements. Understanding vested benefits helps employees plan retirement income by clarifying which pension funds are guaranteed and which are contingent on continued service.

Understanding Non-Vested Benefits in Pension Plans

Non-vested benefits in pension plans refer to the portion of an employee's retirement benefits that are not fully owned until certain conditions, such as a minimum period of service, are met. These benefits are subject to forfeiture if the employee leaves the company before meeting the vesting requirements, meaning they may lose eligibility to claim the associated pension funds. Understanding the distinction between vested and non-vested benefits is crucial for employees to accurately assess their retirement savings and plan their financial future.

How Vesting Schedules Work in Pension Schemes

Vesting schedules in pension schemes determine when employees gain non-forfeitable rights to their pension benefits, distinguishing between vested and non-vested benefits. Vested benefits refer to the portion of the pension that an employee owns outright and can claim even after leaving the employer, while non-vested benefits are contingent on continued employment until specific conditions or timeframes are met. Common vesting schedules include cliff vesting, where full ownership occurs after a set period, and graded vesting, providing incremental ownership over several years.

Key Differences Between Vested and Non-Vested Benefits

Vested benefits in a pension plan guarantee the employee permanent entitlement to the accrued funds, regardless of future employment status, while non-vested benefits depend on meeting specific conditions, such as continued service or reaching a certain age. Vested benefits become the employee's property after a defined vesting period, ensuring security and predictability in retirement planning. Non-vested benefits, on the other hand, may be forfeited if the employee leaves the company before fulfilling those conditions, posing higher risks for retirement security.

Legal Implications of Vested and Non-Vested Pension Rights

Vested pension benefits represent legally enforceable rights that employees have accrued and cannot be forfeited, ensuring guaranteed future payouts irrespective of employment status. Non-vested benefits, however, remain contingent on continued service and may be forfeited if the employee leaves before meeting specific eligibility criteria, reflecting limited legal protection. Courts typically uphold vested rights as contractual obligations, whereas non-vested benefits are subject to plan rules and discretion, influencing pension plan disputes and employee entitlements.

Impact of Employment Termination on Pension Vesting

Vested benefits represent the portion of a pension that an employee is entitled to keep even after employment termination, ensuring guaranteed retirement income. Non-vested benefits depend on continued employment and are forfeited if the employee leaves before meeting vesting criteria, impacting total pension accumulation. The timing and conditions of employment termination critically influence whether pension benefits become vested, affecting long-term financial security for retirees.

Vested vs Non-Vested Benefits: Employer and Employee Perspectives

Vested benefits refer to the portion of a pension plan that an employee has earned and is entitled to retain even after leaving the employer, whereas non-vested benefits typically represent employer contributions or matching funds that require the employee to meet specific service requirements before ownership. From the employer's perspective, non-vested benefits act as an incentive to retain employees and control pension liabilities, while vested benefits are recognized as a firm financial commitment. Employees prioritize vested benefits as guaranteed retirement income, contrasting with non-vested benefits which may be forfeited if vesting conditions are unmet.

Maximizing Your Pension: Strategies to Achieve Full Vesting

Maximizing your pension involves understanding the distinction between vested and non-vested benefits, as vested benefits guarantee ownership of employer contributions after a specified period. To achieve full vesting, consistently meeting service requirements and remaining with your employer until the vesting period is complete are essential strategies. Reviewing your pension plan's vesting schedule and consulting with a financial advisor can help optimize your retirement benefits and secure long-term financial stability.

Frequently Asked Questions About Pension Vesting

Vested benefits in a pension plan refer to the portion of the retirement benefits that an employee has earned and cannot be forfeited, even if they leave the employer before retirement. Non-vested benefits are the parts of the pension that depend on future service or conditions and may be lost if the employee departs early. Frequently asked questions about pension vesting often address eligibility requirements, the vesting schedule, and the impact of job changes on pension entitlements.

Important Terms

Deferred vested benefit

Deferred vested benefits represent retirement plan benefits that employees have earned and are entitled to receive at a future date, contrasting with non-vested benefits which employees forfeit if they leave the employer before meeting vesting requirements.

Nonforfeitable rights

Nonforfeitable rights refer to employees' entitlements to benefits that cannot be lost, distinguishing vested benefits as those guaranteed after meeting specific criteria, whereas non-vested benefits remain conditional and subject to forfeiture upon terminating employment. Vested benefits, typically accrued in defined contribution or defined benefit plans, ensure guaranteed payout, while non-vested benefits provide potential future value dependent on continued service.

Cliff vesting

Cliff vesting grants employees full ownership of vested benefits after a specified period, while non-vested benefits remain the employer's property until that threshold is reached.

Graded vesting

Graded vesting ensures employees gradually earn ownership of retirement benefits, distinguishing vested benefits they fully own from non-vested benefits subject to forfeiture.

Plan participant

Plan participants are entitled to vested benefits that are legally guaranteed upon meeting specific criteria, while non-vested benefits remain contingent on continued participation or other conditions.

Accrued benefit

Accrued benefits represent the total earned retirement rights, while vested benefits are the portion guaranteed to the employee regardless of future service, and non-vested benefits are contingent on continued employment or meeting specific conditions.

Forfeiture provision

Forfeiture provisions determine whether unvested benefits are returned to the plan or employer upon termination, while vested benefits remain with the employee regardless of employment status. Non-vested benefits are subject to forfeiture, reducing the plan's liabilities, whereas vested benefits represent a legally protected claim for the employee.

Vesting schedule

A vesting schedule determines the timeline over which employees gain full ownership of their benefits, distinguishing vested benefits that employees can access from non-vested benefits that are forfeitable if employment ends early.

Service credit

Service credit determines eligibility for vested benefits, which guarantee entitlement to retirement benefits, whereas non-vested benefits depend on continued employment and may be forfeited upon leaving the job.

Immediate vesting

Immediate vesting grants employees full ownership of vested benefits at the start, distinguishing them from non-vested benefits that require continued service to earn.

Vested benefit vs Non-vested benefit Infographic

moneydif.com

moneydif.com