Survivorship benefits provide ongoing financial support to a designated beneficiary or spouse after the pension holder's death, ensuring continued income. Death benefits refer to a lump-sum payment or series of payments made to heirs or beneficiaries upon the pension holder's passing. While survivorship benefits maintain regular pension income, death benefits offer immediate financial assistance to cover expenses or inheritance.

Table of Comparison

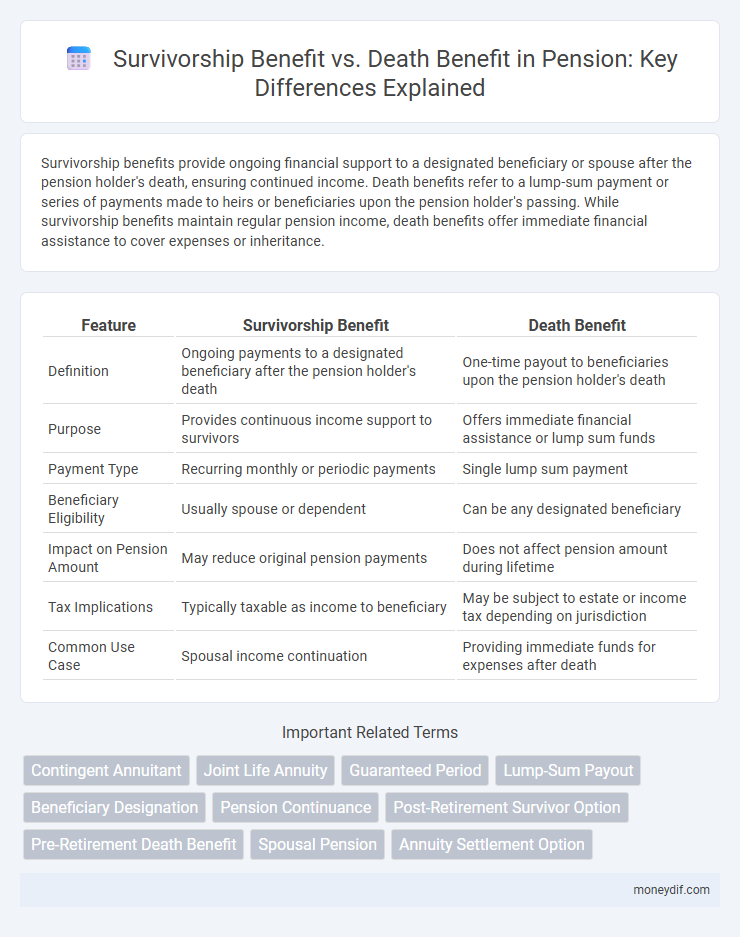

| Feature | Survivorship Benefit | Death Benefit |

|---|---|---|

| Definition | Ongoing payments to a designated beneficiary after the pension holder's death | One-time payout to beneficiaries upon the pension holder's death |

| Purpose | Provides continuous income support to survivors | Offers immediate financial assistance or lump sum funds |

| Payment Type | Recurring monthly or periodic payments | Single lump sum payment |

| Beneficiary Eligibility | Usually spouse or dependent | Can be any designated beneficiary |

| Impact on Pension Amount | May reduce original pension payments | Does not affect pension amount during lifetime |

| Tax Implications | Typically taxable as income to beneficiary | May be subject to estate or income tax depending on jurisdiction |

| Common Use Case | Spousal income continuation | Providing immediate funds for expenses after death |

Overview of Survivorship Benefits and Death Benefits

Survivorship benefits provide ongoing pension payments to eligible beneficiaries after the pension holder's death, ensuring financial support for spouses or dependents. Death benefits typically include a lump-sum payout or fixed payments to designated beneficiaries, distinct from recurring survivorship income. Both benefits serve crucial roles in pension planning by securing financial stability for survivors, but survivorship benefits emphasize continuous income, whereas death benefits focus on immediate financial assistance.

Key Differences Between Survivorship and Death Benefits

Survivorship benefits provide ongoing pension payments to a designated beneficiary, typically a spouse, after the pension holder's death, ensuring financial stability for the survivor. Death benefits, in contrast, refer to a lump-sum payment or a final distribution made to beneficiaries upon the pension holder's death, not necessarily guaranteeing continuous income. The key difference lies in the payment structure: survivorship benefits offer continuous support, while death benefits are generally a one-time payout.

Eligibility Criteria for Survivorship and Death Benefits

Survivorship benefits typically require the pensioner to have been receiving the pension and the beneficiary to be legally recognized as a spouse or dependent at the time of the pensioner's death. Death benefits eligibility often extends to designated beneficiaries, including next of kin or estate representatives, regardless of pension receipt status. Documentation such as marriage certificates, dependency proof, or beneficiary designation forms are essential for validating eligibility for both survivorship and death benefits.

How Survivorship Benefits Work in Pension Plans

Survivorship benefits in pension plans provide ongoing payments to a designated beneficiary, typically a spouse, ensuring financial security after the pension holder's death. These benefits often continue for the lifetime of the survivor, unlike a one-time death benefit which is a lump sum paid immediately following death. Pension survivorship options are crucial for retirees seeking to protect their spouse's income, and the specific terms depend on the pension plan's rules and election at retirement.

Understanding Death Benefits in Pension Schemes

Death benefits in pension schemes provide financial support to the beneficiaries after the pension holder's death, ensuring continued income or lump-sum payments. These benefits are distinct from survivorship benefits, which specifically guarantee ongoing pension payments to eligible survivors, typically a spouse or dependent. Understanding the structure and eligibility criteria of death benefits is crucial for maximizing protection and financial security for beneficiaries within pension plans.

Tax Implications of Survivorship vs. Death Benefits

Survivorship benefits in pensions typically continue tax-deferred until the beneficiary withdraws funds, potentially resulting in lower immediate tax liability compared to lump-sum death benefits, which are often subject to income tax in the year received. Death benefits paid as a lump sum may trigger higher tax rates or accelerated taxation, depending on the plan and payout timing. Understanding these distinctions is crucial for effective estate planning and minimizing tax burdens on surviving pension beneficiaries.

Choosing Between Survivorship and Death Benefit Options

Choosing between survivorship and death benefit options in pension planning hinges on the intended financial security for beneficiaries. Survivorship benefits ensure continued income to a surviving spouse or designated beneficiary, while death benefits provide a lump sum payment upon the pension holder's death. Evaluating factors such as dependent needs, longevity, and cash flow preferences can guide optimal selection between these benefits.

Impact on Beneficiaries: Survivorship vs. Death Benefit

Survivorship benefits provide ongoing income to designated beneficiaries after the pension holder's death, ensuring financial stability for spouses or dependents. Death benefits typically offer a one-time lump sum payment to heirs, which may help cover immediate expenses but do not guarantee continued support. The choice between survivorship and death benefits directly impacts long-term financial security and estate planning for pension beneficiaries.

Pension Payout Structures: Survivorship and Death Benefits

Pension payout structures often include survivorship benefits, which provide continued income to a designated beneficiary after the pensioner's death, ensuring financial stability for spouses or dependents. Death benefits, in contrast, typically offer a lump-sum payment or remaining pension balance to beneficiaries, serving as a one-time financial support rather than ongoing income. Understanding the differences between survivorship and death benefits is crucial for selecting a pension option that aligns with retirement goals and family needs.

Frequently Asked Questions: Survivorship vs. Death Benefit

Survivorship benefits in pensions provide ongoing payments to a surviving spouse or dependent after the retiree's death, whereas death benefits typically consist of a one-time lump sum paid to beneficiaries. Frequently asked questions often address eligibility criteria, the difference in payout amounts, and tax implications for both benefits. Understanding whether to choose survivorship benefits or death benefits depends on financial needs and the specific pension plan's provisions.

Important Terms

Contingent Annuitant

A contingent annuitant ensures the continuation of survivorship benefits by receiving payments after the primary annuitant's death, whereas a death benefit typically provides a one-time lump sum to beneficiaries.

Joint Life Annuity

Joint Life Annuities provide regular income payments until both annuitants pass away, focusing on survivorship benefits that ensure financial support for the surviving partner. Unlike death benefits that pay out a lump sum upon the first annuitant's death, survivorship benefits extend income continuity, reducing the risk of income loss for the surviving individual.

Guaranteed Period

The Guaranteed Period in survivorship benefits ensures continued payments for a set time even if both annuitants pass away, contrasting with the Death Benefit which provides a lump sum to beneficiaries upon the death of an annuitant. This period protects against loss of income, whereas the Death Benefit focuses on asset transfer.

Lump-Sum Payout

Lump-sum payouts in survivorship benefits provide a consolidated payment to surviving beneficiaries, contrasting with death benefits that distribute funds upon the insured's death, often affecting tax implications and financial planning strategies.

Beneficiary Designation

Beneficiary designation determines whether Survivorship Benefits continue to a surviving spouse or Death Benefits are paid out as a lump sum to designated heirs.

Pension Continuance

Pension Continuance ensures ongoing payments to surviving beneficiaries through Survivorship Benefits, whereas Death Benefits provide a lump-sum payout upon the pensioner's death.

Post-Retirement Survivor Option

The Post-Retirement Survivor Option guarantees a Survivorship Benefit providing ongoing income to a beneficiary after the retiree's death, whereas the Death Benefit offers a lump-sum payment or distinct financial compensation to heirs upon the retiree's passing.

Pre-Retirement Death Benefit

Pre-Retirement Death Benefit provides financial support to beneficiaries if the insured dies before retirement, typically complementing the Survivorship Benefit, which ensures continued income for surviving dependents after the policyholder's death. Unlike the Death Benefit paid out upon the death of the insured at any time, the Pre-Retirement Death Benefit specifically focuses on protection before retirement, offering a safety net that secures family income and covers outstanding obligations.

Spousal Pension

Spousal pension primarily provides survivorship benefits, ensuring continuous income to the surviving spouse after the retiree's death, whereas death benefits typically refer to a lump-sum payment or specific financial aid given to beneficiaries upon the pensioner's passing. The survivorship benefit focuses on long-term financial security for spouses, while death benefits offer immediate financial support.

Annuity Settlement Option

The Annuity Settlement Option with Survivorship Benefit ensures continued payments to a beneficiary after the annuitant's death, while the Death Benefit provides a lump sum payout to heirs upon the annuitant's demise.

Survivorship Benefit vs Death Benefit Infographic

moneydif.com

moneydif.com