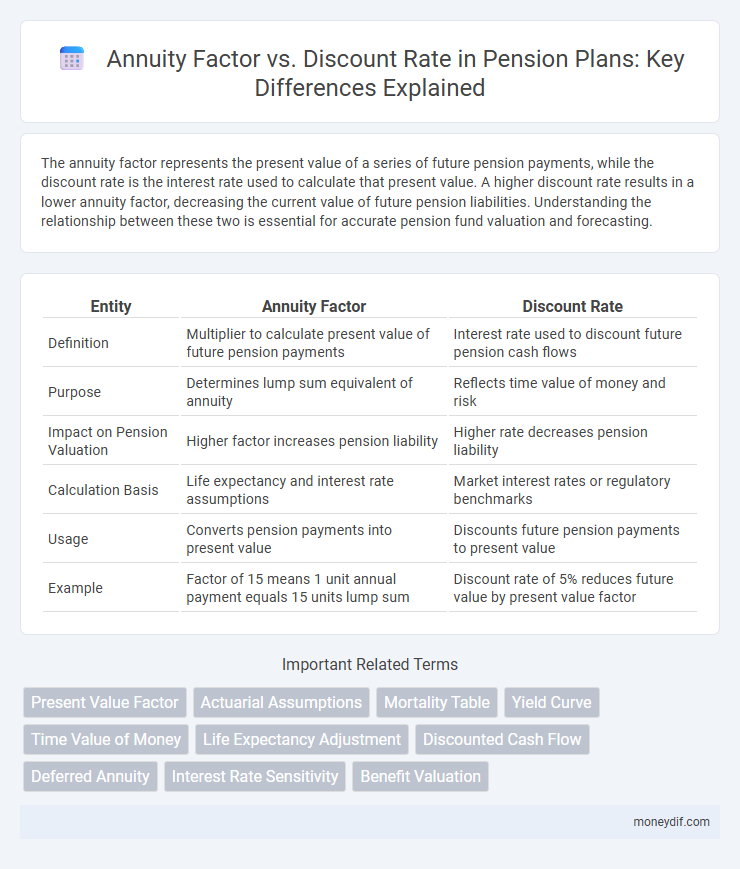

The annuity factor represents the present value of a series of future pension payments, while the discount rate is the interest rate used to calculate that present value. A higher discount rate results in a lower annuity factor, decreasing the current value of future pension liabilities. Understanding the relationship between these two is essential for accurate pension fund valuation and forecasting.

Table of Comparison

| Entity | Annuity Factor | Discount Rate |

|---|---|---|

| Definition | Multiplier to calculate present value of future pension payments | Interest rate used to discount future pension cash flows |

| Purpose | Determines lump sum equivalent of annuity | Reflects time value of money and risk |

| Impact on Pension Valuation | Higher factor increases pension liability | Higher rate decreases pension liability |

| Calculation Basis | Life expectancy and interest rate assumptions | Market interest rates or regulatory benchmarks |

| Usage | Converts pension payments into present value | Discounts future pension payments to present value |

| Example | Factor of 15 means 1 unit annual payment equals 15 units lump sum | Discount rate of 5% reduces future value by present value factor |

Introduction to Pension Valuation

Annuity factor represents the present value of a series of future pension payments discounted at a specific rate, reflecting the time value of money in pension valuation. The discount rate is a critical assumption used to calculate the present value of pension liabilities, directly impacting the annuity factor and overall pension plan funding status. Understanding the relationship between annuity factor and discount rate allows actuaries to accurately assess pension obligations and determine appropriate funding strategies.

Understanding Annuity Factors

Annuity factors represent the present value of a series of future pension payments, calculated using a specific discount rate that reflects the time value of money and risk. A higher discount rate decreases the annuity factor, reducing the present value of future pension liabilities, while a lower discount rate increases it. Understanding the relationship between annuity factors and discount rates is crucial for accurately assessing pension plan obligations and funding requirements.

What Is a Discount Rate?

A discount rate is the interest rate used to determine the present value of future pension payments, reflecting the time value of money and risk associated with those payments. It plays a critical role in calculating the annuity factor, which converts a series of future pension benefits into a single present value amount. Precise estimation of the discount rate directly impacts pension liabilities and funding requirements.

Key Differences Between Annuity Factor and Discount Rate

The annuity factor represents the present value of a series of future annuity payments, serving as a multiplier to calculate the lump sum equivalent of retirement income streams. The discount rate is the interest rate used to determine the present value of future cash flows, reflecting the time value of money and risk associated with those payments. While the annuity factor aggregates the value of payments over time, the discount rate is the critical input that influences how future values are discounted to the present.

Role of Annuity Factors in Pension Calculations

Annuity factors play a crucial role in pension calculations by converting a series of future pension payments into their present value, reflecting the time value of money. They are derived using the discount rate, which adjusts for the interest rate and risk associated with future cash flows. Accurate determination of annuity factors ensures precise valuation of pension liabilities and funding requirements.

Impact of Discount Rates on Pension Liabilities

The discount rate directly influences the annuity factor by determining the present value of future pension liabilities, with higher discount rates reducing the annuity factor and thus lowering the recorded pension obligation. Pension liabilities increase as discount rates decrease, reflecting a greater present value of expected payouts. Accurate discount rate selection is critical for pension fund solvency assessments and financial reporting.

How to Select an Appropriate Discount Rate

Selecting an appropriate discount rate for pension annuity calculations requires analyzing market interest rates, expected inflation, and the plan's risk profile to ensure accurate present value estimation. The annuity factor, which converts future pension payments into a lump sum, heavily depends on this discount rate, influencing funding requirements and liability valuations. Actuaries typically balance long-term government bond yields with corporate bond spreads to reflect the pension plan's investment horizon and credit risk.

Practical Applications in Pension Planning

Annuity factor determines the present value of future pension payments by converting a stream of expected cash flows into a lump sum, essential for accurate pension liability calculations. The discount rate, reflecting the time value of money and investment risk, directly influences the annuity factor and thus the valuation of pension obligations. In pension planning, optimizing the discount rate ensures realistic fund estimates, aiding in risk management and regulatory compliance.

Common Mistakes in Applying Annuity Factors and Discount Rates

Common mistakes in applying annuity factors and discount rates include using inconsistent discount rates that do not reflect the pension plan's risk profile or prevailing market conditions, leading to inaccurate liability valuations. Misinterpreting annuity factors by failing to adjust for the timing of cash flows or ignoring mortality assumptions can result in significant errors in pension cost estimations. Employing overly simplistic discount rates instead of robust, market-based rates undermines the precision of pension fund assessments and may distort funding strategies.

Summary: Best Practices for Pension Valuation

Annuity factor and discount rate are critical components in pension valuation, directly impacting the accuracy of present value calculations for future pension liabilities. Using a lower discount rate increases the present value of pension obligations, reflecting a more conservative funding approach, whereas higher discount rates reduce liability estimates but may underestimate long-term costs. Best practices recommend aligning discount rates with high-quality corporate bond yields and carefully selecting annuity factors that reflect realistic mortality and interest rate assumptions to ensure reliable pension funding and risk management.

Important Terms

Present Value Factor

The Present Value Factor (PVF) measures the current worth of a future sum discounted at a specific rate, while the Annuity Factor calculates the present value of a series of equal payments over time; both factors inversely vary with the discount rate, where higher discount rates reduce the PVF and Annuity Factor values. Understanding the relationship between the Present Value Factor and the Annuity Factor is crucial for accurate financial modeling, investment analysis, and determining loan payments.

Actuarial Assumptions

Annuity factors inversely correlate with discount rates, as higher discount rates reduce the present value of future annuity payments under common actuarial assumptions.

Mortality Table

The annuity factor decreases as the discount rate increases, reflecting the mortality table's impact on the expected present value of future payments.

Yield Curve

The yield curve's shape directly impacts the annuity factor by influencing discount rates used to calculate present values of future cash flows.

Time Value of Money

The Time Value of Money concept emphasizes that a dollar today is worth more than a dollar in the future due to its earning potential, which is quantified through the annuity factor that discounts future cash flows based on the discount rate. A higher discount rate decreases the annuity factor, reflecting lower present values of future annuity payments, while a lower discount rate increases the annuity factor, indicating higher present values.

Life Expectancy Adjustment

Life expectancy adjustment significantly influences the annuity factor calculation by altering the discount rate's impact on the present value of future payments.

Discounted Cash Flow

The Discounted Cash Flow (DCF) method uses the Annuity Factor, calculated as (1 - (1 + discount rate)^-n) / discount rate, to determine the present value of a series of future cash flows discounted at the specified rate.

Deferred Annuity

Deferred annuity values increase as the discount rate decreases due to the inverse relationship between the annuity factor and discount rate in present value calculations.

Interest Rate Sensitivity

Interest rate sensitivity significantly impacts the annuity factor, as small changes in the discount rate inversely affect the present value of future cash flows. An increase in the discount rate reduces the annuity factor, lowering the valuation of fixed annuities and emphasizing the importance of accurately estimating discount rates for investment decisions.

Benefit Valuation

Benefit valuation depends on accurately calculating the annuity factor, which inversely varies with the discount rate used to determine the present value of future cash flows.

Annuity Factor vs Discount Rate Infographic

moneydif.com

moneydif.com