Actuarial gain occurs when actual pension plan outcomes, such as investment returns or demographic experience, are more favorable than expected, reducing the plan's liabilities. Actuarial loss arises when these outcomes are worse than anticipated, increasing the plan's obligations and funding requirements. Understanding these variances is critical for accurate pension plan valuation and risk management.

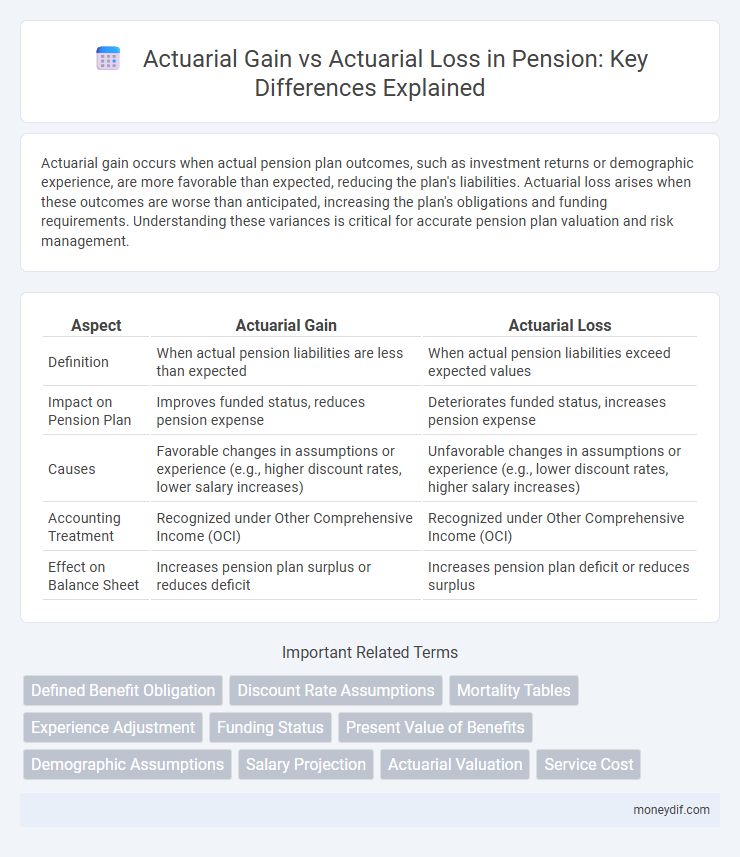

Table of Comparison

| Aspect | Actuarial Gain | Actuarial Loss |

|---|---|---|

| Definition | When actual pension liabilities are less than expected | When actual pension liabilities exceed expected values |

| Impact on Pension Plan | Improves funded status, reduces pension expense | Deteriorates funded status, increases pension expense |

| Causes | Favorable changes in assumptions or experience (e.g., higher discount rates, lower salary increases) | Unfavorable changes in assumptions or experience (e.g., lower discount rates, higher salary increases) |

| Accounting Treatment | Recognized under Other Comprehensive Income (OCI) | Recognized under Other Comprehensive Income (OCI) |

| Effect on Balance Sheet | Increases pension plan surplus or reduces deficit | Increases pension plan deficit or reduces surplus |

Understanding Actuarial Gains and Losses in Pension Plans

Actuarial gains in pension plans occur when actual experience, such as employee longevity or investment returns, is more favorable than assumed, resulting in a surplus that strengthens the plan's funding status. Conversely, actuarial losses arise from unfavorable deviations like lower investment returns or increased life expectancy, which increase the pension liability and funding deficit. Understanding these gains and losses is critical for accurate pension valuation and effective risk management, ensuring long-term plan sustainability.

Key Differences Between Actuarial Gain and Actuarial Loss

Actuarial gain occurs when the actual pension plan experience is more favorable than expected, leading to a decrease in the pension liability; actuarial loss arises when actual experience is worse than anticipated, increasing the pension liability. Key differences include that actuarial gains reduce the defined benefit obligation, while actuarial losses have the opposite effect, increasing the obligation and pension expense. These variations typically result from differences in assumptions about discount rates, employee turnover, mortality rates, and salary growth.

Causes of Actuarial Gains in Pension Valuations

Actuarial gains in pension valuations primarily arise from favorable deviations in demographic assumptions, such as lower-than-expected mortality rates or improved employee turnover patterns. Financial factors, including higher-than-anticipated investment returns on pension plan assets, also contribute significantly to actuarial gains. These positive variances reduce the pension liability, enhancing the plan's funded status and financial stability.

Common Factors Leading to Actuarial Losses

Common factors leading to actuarial losses in pensions include lower-than-expected investment returns, higher inflation rates increasing future liabilities, and unexpected demographic changes such as longer life expectancies or early retirements. Other significant contributors are underestimations in salary growth rates and inaccuracies in mortality or turnover assumptions. Actuarial losses negatively impact the funded status of pension plans, increasing the sponsor's future contribution requirements.

Impact of Actuarial Assumptions on Pension Outcomes

Actuarial gains occur when actual pension plan experience is more favorable than expected, often due to lower mortality rates or higher asset returns, improving the plan's funded status. Actuarial losses arise from unfavorable deviations such as higher-than-anticipated inflation or wage growth, increasing future pension liabilities and funding requirements. Changes in actuarial assumptions like discount rates and demographic predictions directly affect pension valuation, influencing both employer contributions and benefit obligations.

Accounting for Actuarial Gains and Losses under IFRS and GAAP

Actuarial gains arise when pension plan assets exceed expectations or when actuarial assumptions about liabilities prove conservative, resulting in decreased pension obligations. IFRS requires recognizing actuarial gains and losses in other comprehensive income, avoiding immediate profit or loss impact, whereas GAAP allows for amortization of actuarial gains and losses through pension expense over time using the corridor method. Accurate accounting under both standards ensures precise pension liability valuations and informs stakeholders of the financial health of pension plans.

Effect of Actuarial Changes on Pension Funding Status

Actuarial gain occurs when actual pension plan experience is more favorable than expected, improving the pension funding status by reducing the projected benefit obligation or increasing plan assets. Conversely, actuarial loss arises from unfavorable deviations such as lower discount rates or higher longevity assumptions, leading to a decline in funded status and an increase in pension liabilities. These actuarial changes impact an organization's balance sheet and require adjustments to pension expense and funding contributions under accounting standards.

Managing Volatility from Actuarial Gains and Losses

Managing volatility from actuarial gains and losses is critical in pension plan accounting to ensure financial stability and accurate liability assessment. Actuarial gains occur when actual experience is more favorable than expected assumptions, while actuarial losses arise from unfavorable deviations, both impacting pension expense and funding status. Employing smoothing techniques and adjusting actuarial assumptions regularly helps mitigate fluctuations and maintain consistent pension expense recognition.

Actuarial Gain vs. Loss: Implications for Employers and Employees

Actuarial gain occurs when actual pension plan performance exceeds expected outcomes, improving funding status and reducing employer contribution requirements, while actuarial loss results from underperformance, increasing liabilities and potential costs. Employers benefit from actuarial gains through lower expense volatility and enhanced financial stability but face higher funding demands and pension expense spikes during losses. Employees' retirement security strengthens with actuarial gains due to more robust pension fund health, whereas actuarial losses may cause benefit adjustments or reduced plan sustainability.

Strategies to Minimize Actuarial Losses in Pension Schemes

Effective strategies to minimize actuarial losses in pension schemes include regularly reviewing and updating actuarial assumptions such as mortality rates, salary growth, and discount rates to reflect current trends. Implementing risk management techniques, like hedging interest rate and longevity risks through financial instruments or reinsurance, helps stabilize pension liabilities. Employer contributions should be calibrated to fund deficits prudently and maintain the plan's solvency, reducing the likelihood of significant actuarial losses.

Important Terms

Defined Benefit Obligation

Defined Benefit Obligation fluctuates based on actuarial gains, which decrease liabilities, and actuarial losses, which increase liabilities in pension accounting.

Discount Rate Assumptions

Discount rate assumptions critically influence the measurement of actuarial gains and losses by affecting the present value of pension liabilities and future benefit obligations. Variations in the discount rate can lead to significant actuarial gains when actual experience is better than expected, or actuarial losses if the experience proves worse, impacting pension fund valuations and financial statements.

Mortality Tables

Mortality tables provide essential data for calculating actuarial gain or loss by comparing expected versus actual mortality rates within insurance and pension plan valuations.

Experience Adjustment

Experience adjustment reflects the difference between actual and expected actuarial outcomes, resulting in either an actuarial gain when actual experience is more favorable or an actuarial loss when it is less favorable.

Funding Status

Funding status improves with actuarial gains and deteriorates with actuarial losses, directly impacting pension plan liabilities and surplus levels.

Present Value of Benefits

Actuarial gain increases the Present Value of Benefits by reflecting lower-than-expected liabilities, whereas actuarial loss decreases it due to higher-than-expected obligations.

Demographic Assumptions

Demographic assumptions impact actuarial gain or loss by influencing the accuracy of predicted mortality, disability, and turnover rates, which directly affect pension and insurance liability valuations.

Salary Projection

Salary projection models incorporate actuarial gain and loss to adjust future salary estimates based on deviations between expected and actual experience, enhancing accuracy in financial forecasting. Actuarial gains occur when actual salary expenses are lower than projected, whereas actuarial losses reflect higher-than-expected payouts, impacting long-term liability assessments and compensation planning.

Actuarial Valuation

Actuarial valuation assesses pension plan liabilities by comparing expected and actual experience, resulting in actuarial gains when actual experience is more favorable than expected and actuarial losses when it is less favorable. These gains and losses arise from demographic changes, financial assumptions, and investment returns impacting the value of pension obligations.

Service Cost

Service cost reflects the present value of benefits earned by employees during a period, and actuarial gains or losses arise from changes in actuarial assumptions or experience deviations affecting pension obligations. Actuarial gains reduce the service cost by lowering the projected benefit obligation, while actuarial losses increase the liability, thereby raising the overall pension expense recognized in financial statements.

Actuarial gain vs Actuarial loss Infographic

moneydif.com

moneydif.com