Pensionable salary refers to the portion of an employee's earnings that is considered when calculating pension benefits, typically including base pay and eligible bonuses. Non-pensionable salary includes compensation elements like overtime, allowances, or certain bonuses that do not factor into pension calculations. Understanding the distinction between pensionable and non-pensionable salary is crucial for accurate retirement planning and estimating future pension income.

Table of Comparison

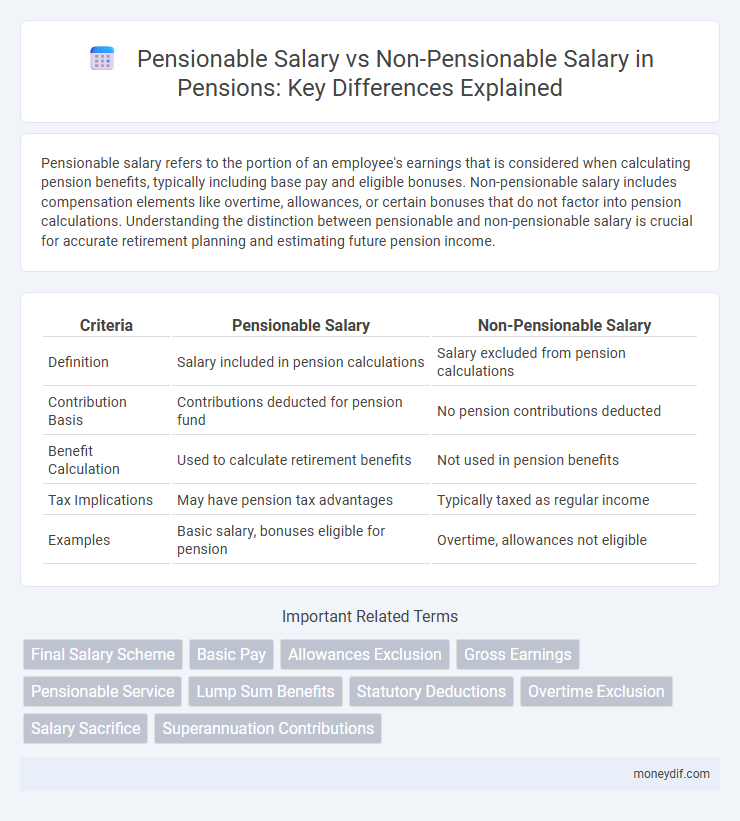

| Criteria | Pensionable Salary | Non-Pensionable Salary |

|---|---|---|

| Definition | Salary included in pension calculations | Salary excluded from pension calculations |

| Contribution Basis | Contributions deducted for pension fund | No pension contributions deducted |

| Benefit Calculation | Used to calculate retirement benefits | Not used in pension benefits |

| Tax Implications | May have pension tax advantages | Typically taxed as regular income |

| Examples | Basic salary, bonuses eligible for pension | Overtime, allowances not eligible |

Understanding Pensionable Salary

Pensionable salary refers to the portion of an employee's earnings that is considered when calculating pension contributions and future retirement benefits, including base pay and eligible bonuses, excluding overtime or one-time payments. Understanding pensionable salary is crucial because it directly impacts the amount contributed to the pension fund and the eventual pension payout. Differentiating between pensionable and non-pensionable salary ensures accurate benefit projections and financial planning for retirement.

Defining Non-Pensionable Salary

Non-pensionable salary refers to the portion of an employee's earnings that is excluded from pension calculations and contributions. This typically includes bonuses, overtime pay, and other variable allowances that do not form part of the regular contractual wages. Understanding the distinction between pensionable and non-pensionable salary is crucial for accurate pension benefit projections and compliance with pension scheme rules.

Key Differences: Pensionable vs Non-Pensionable Salary

Pensionable salary refers to the portion of an employee's earnings that is considered when calculating pension contributions and benefits, typically including basic pay, overtime, and certain allowances. Non-pensionable salary encompasses earnings not factored into pension calculations, such as bonuses, commissions, and reimbursements. The key difference lies in eligibility for pension contributions; only pensionable salary impacts retirement fund accumulation and subsequent pension payouts.

Components Included in Pensionable Salary

Pensionable salary includes basic wages, overtime pay, bonuses, allowances, and commissions that form the basis for pension contributions and benefits calculation. Non-pensionable salary components typically exclude one-time payments, reimbursements, or fringe benefits not regularly received, ensuring only consistent earnings impact pension accrual. Accurate classification of salary components is essential for precise pension fund valuation and employee retirement planning.

What Falls Under Non-Pensionable Salary?

Non-pensionable salary typically includes bonuses, overtime pay, allowances, and other variable earnings that do not form part of the regular base salary or guaranteed compensation. These components are excluded from pension calculations because they are not considered consistent earnings and may fluctuate significantly. Understanding what falls under non-pensionable salary is crucial for accurate pension planning and forecasting retirement benefits.

Impact on Retirement Benefits

Pensionable salary directly influences the calculation of retirement benefits, as contributions and eventual payouts are based on this amount, whereas non-pensionable salary does not contribute to the pension fund. Earnings classified as non-pensionable, such as bonuses or overtime in some schemes, reduce the overall pensionable earnings, potentially lowering retirement income. Understanding the distinction between these salary components is crucial for accurate retirement planning and maximizing future benefits.

How Employers Classify Salary Types

Employers classify salary types by distinguishing between pensionable and non-pensionable salary based on eligibility for pension contributions and benefits. Pensionable salary typically includes base pay, bonuses, and allowances directly tied to employment, whereas non-pensionable salary covers overtime, commissions, and benefits not subject to pension plan contributions. This classification affects the calculation of pension entitlements and determines the amount deducted for retirement savings.

Tax Implications for Both Salary Types

Pensionable salary is subject to contributions that qualify for tax relief, reducing taxable income and enhancing retirement benefits, whereas non-pensionable salary is fully taxable without tax-advantaged benefits. Contributions deducted from pensionable salary often lower an individual's annual tax liability by maximizing allowable thresholds under pension schemes. Non-pensionable earnings increase taxable income without corresponding pension contributions, potentially resulting in higher income tax payments and reduced long-term retirement savings.

Common Misconceptions About Pensionable Earnings

Pensionable salary refers to the portion of an employee's earnings that qualify for pension contributions and benefits, excluding bonuses, overtime, or certain allowances often mistaken as pensionable. A common misconception is that total gross income automatically counts toward pension calculations, but non-pensionable salary elements do not affect pension accruals or final benefits. Understanding the distinction between pensionable and non-pensionable earnings is crucial for accurate retirement planning and maximizing pension entitlements.

Maximizing Your Pension Benefits

Maximizing your pension benefits requires a clear understanding of pensionable salary versus non-pensionable salary, as pension contributions and final benefits are calculated based on the pensionable earnings. Pensionable salary typically includes base salary, regular bonuses, and other compensation elements explicitly defined in the pension scheme, while non-pensionable salary includes overtime pay, one-off bonuses, and other irregular earnings excluded from pension calculations. Focusing on increasing pensionable salary components and confirming which earnings count towards pensionable salary helps to optimize overall pension entitlements and future retirement income.

Important Terms

Final Salary Scheme

Final Salary Scheme calculates retirement benefits based on pensionable salary, excluding non-pensionable salary components from the pension calculation.

Basic Pay

Basic Pay serves as the foundation for calculating Pensionable salary, which includes regular wages that qualify for pension contributions and benefits, whereas Non-pensionable salary consists of earnings excluded from pension calculations such as bonuses or overtime. Accurate differentiation between Pensionable and Non-pensionable salary ensures proper pension fund allocation and compliance with retirement benefit policies.

Allowances Exclusion

Allowances exclusion determines which portions of an employee's compensation are excluded from the pensionable salary, directly impacting the calculation between pensionable salary and non-pensionable salary.

Gross Earnings

Gross earnings include both pensionable salary, which contributes to retirement benefits, and non-pensionable salary, which does not affect pension calculations.

Pensionable Service

Pensionable service determines the period during which an employee's pensionable salary, excluding non-pensionable salary components, is used to calculate retirement benefits.

Lump Sum Benefits

Lump sum benefits are calculated based on the pensionable salary, which excludes non-pensionable salary components such as bonuses or overtime, ensuring that retirement payouts reflect only the fixed, regular earnings subject to pension contributions. Non-pensionable salary does not impact lump sum calculations, preserving the integrity of defined benefit schemes and aligning with pension fund actuarial assumptions.

Statutory Deductions

Statutory deductions on pensionable salary typically include mandatory contributions such as social security and pension fund contributions, which directly affect retirement benefits, while non-pensionable salary is generally excluded from such pension-related deductions and often only subjected to income tax and other statutory withholdings. Understanding the distinction between pensionable and non-pensionable salary is crucial for accurate payroll management and ensuring compliance with pension regulations.

Overtime Exclusion

Overtime exclusion determines whether extra hours worked are included in pensionable salary calculations, impacting employees' future pension benefits by differentiating between pensionable and non-pensionable earnings.

Salary Sacrifice

Salary sacrifice arrangements reduce pensionable salary by redirecting a portion of gross pay into pension contributions, enhancing retirement savings while lowering taxable income. Non-pensionable salary includes earnings that do not count towards pension calculations, so sacrificing these amounts does not impact pension benefits accrued.

Superannuation Contributions

Superannuation contributions are typically calculated based on an employee's pensionable salary, which includes regular wages and allowances that qualify for retirement benefits, excluding non-pensionable salary components such as overtime or bonuses. Understanding the distinction between pensionable and non-pensionable salary is crucial for accurate superannuation fund calculations and ensuring compliance with regulatory standards.

Pensionable salary vs Non-pensionable salary Infographic

moneydif.com

moneydif.com