The flat benefit formula provides a fixed pension amount based on a predetermined rate, offering simplicity and predictability in retirement income. In contrast, the unit benefit formula calculates pension benefits by multiplying a set accrual rate by years of service and final average salary, allowing for benefits that reflect earnings history and service length. This approach typically results in higher benefits for employees with longer tenure and higher wages, aligning retirement income more closely with career earnings.

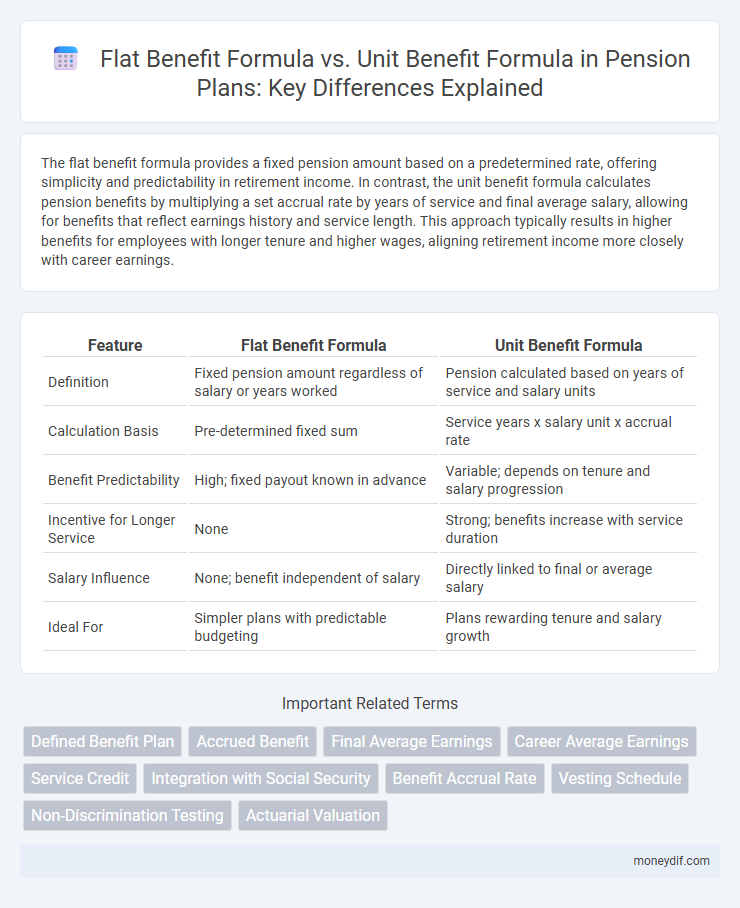

Table of Comparison

| Feature | Flat Benefit Formula | Unit Benefit Formula |

|---|---|---|

| Definition | Fixed pension amount regardless of salary or years worked | Pension calculated based on years of service and salary units |

| Calculation Basis | Pre-determined fixed sum | Service years x salary unit x accrual rate |

| Benefit Predictability | High; fixed payout known in advance | Variable; depends on tenure and salary progression |

| Incentive for Longer Service | None | Strong; benefits increase with service duration |

| Salary Influence | None; benefit independent of salary | Directly linked to final or average salary |

| Ideal For | Simpler plans with predictable budgeting | Plans rewarding tenure and salary growth |

Overview of Pension Benefit Formulas

Pension benefit formulas are primarily categorized into flat benefit and unit benefit formulas, each defining retirement income differently. The flat benefit formula provides a fixed monetary amount regardless of salary history, making it predictable but less sensitive to individual earnings. In contrast, the unit benefit formula calculates benefits based on a percentage of salary multiplied by years of service, offering tailored retirement income that reflects career earnings and tenure.

What is a Flat Benefit Formula?

A Flat Benefit Formula in pension plans provides a predetermined fixed benefit amount, typically based on a specific dollar amount or a flat percentage of salary, regardless of years of service or earnings history. This method offers simplicity and predictability, making it straightforward for participants to understand their retirement benefits. It contrasts with the Unit Benefit Formula, which calculates benefits based on factors such as years of service and salary, providing a more individualized payout.

What is a Unit Benefit Formula?

A Unit Benefit Formula calculates pension benefits based on a fixed amount assigned per year of service or per salary unit, providing a direct correlation between tenure and retirement income. This approach contrasts with the Flat Benefit Formula, which offers a predetermined pension regardless of individual salary history or service length. The Unit Benefit Formula ensures that employees with longer service or higher earnings receive proportionally larger retirement benefits.

Key Differences: Flat vs Unit Benefit Formulas

Flat benefit formulas provide retirees with a fixed pension amount regardless of salary history, ensuring simplicity and predictability in retirement income. Unit benefit formulas calculate pensions based on a percentage of an employee's salary and years of service, offering benefits that scale with earnings and tenure. The key difference lies in how benefits are determined: flat formulas offer uniform payouts while unit formulas deliver individualized retirement income closely tied to career earnings.

How Each Formula Impacts Retirement Income

The Flat Benefit Formula provides a fixed retirement income regardless of salary history, ensuring predictable and stable benefits for retirees. The Unit Benefit Formula calculates retirement income based on years of service and a percentage of the final salary, allowing for benefits that increase with career earnings and length of employment. This results in retirement income that is more closely aligned with an individual's earnings trajectory, often leading to higher benefits for long-term employees.

Suitability for Different Employee Groups

The Flat Benefit Formula provides a fixed payout regardless of salary or service length, making it suitable for lower-wage employees or those with shorter tenure who need predictable retirement income. The Unit Benefit Formula calculates benefits based on salary and years of service, offering greater rewards for longer service and higher salaries, ideal for mid- to high-level employees with stable career paths. Employers often select the formula best aligned with workforce demographics to balance equity and cost-effectiveness in pension planning.

Advantages of Flat Benefit Formula

The Flat Benefit Formula offers simplicity and predictability by providing a fixed pension amount regardless of salary variations, ensuring easy budgeting for both employers and employees. It fosters equity by delivering the same benefit level to all participants, reducing complexity associated with calculating benefits based on individual earnings. Administrative costs are generally lower, making it a cost-effective option for pension plan sponsors.

Advantages of Unit Benefit Formula

The Unit Benefit Formula offers greater flexibility by linking pension benefits directly to individual earnings and years of service, ensuring fairer and more accurate retirement income. It better rewards longer tenure and higher salaries, enhancing employee motivation and retention. This formula adapts to career progression, promoting equitable distribution of benefits across diverse workforce profiles.

Risks and Considerations for Employers

Employers face distinct risks with flat benefit and unit benefit pension formulas, primarily concerning cost predictability and employee equity. Flat benefit formulas expose employers to financial strain during workforce changes due to uniform payouts regardless of tenure, risking unsustainable liabilities. Unit benefit formulas, while promoting fairness by linking benefits to salary and service, may increase administrative complexity and escalate costs if salary growth exceeds projections.

Choosing the Right Formula for Your Pension Plan

Selecting the right pension formula depends on the organization's goals and workforce characteristics, with the flat benefit formula offering a fixed retirement amount regardless of salary, ideal for simplicity and budgeting. The unit benefit formula calculates benefits based on salary and years of service, providing more tailored retirement income that rewards longer tenure and higher earnings. Evaluating factors such as employee demographics, financial sustainability, and desired retirement security ensures the pension plan aligns with long-term objectives.

Important Terms

Defined Benefit Plan

A Defined Benefit Plan using a Flat Benefit Formula provides retirees a fixed, predetermined amount regardless of salary history, while the Unit Benefit Formula calculates benefits based on a percentage of the employee's earnings and years of service, offering a more tailored retirement income. The choice between Flat Benefit and Unit Benefit Formulas significantly impacts the predictability of retirement income and the funding requirements for the pension plan sponsor.

Accrued Benefit

The Accrued Benefit under the Flat Benefit Formula provides a predetermined fixed amount regardless of salary history, while the Unit Benefit Formula calculates Accrued Benefits based on a percentage of the employee's earnings and years of service.

Final Average Earnings

The Final Average Earnings method calculates retirement benefits by averaging salary over a specified period, favoring the Unit Benefit Formula which multiplies this average by a predefined accrual rate per year of service for precise pension calculations.

Career Average Earnings

Career Average Earnings calculate pension benefits based on the average salary earned throughout an employee's working life, making the Flat Benefit Formula a fixed payout approach, whereas the Unit Benefit Formula provides benefits proportional to each year of service multiplied by a specific accrual rate.

Service Credit

Service Credit determines pension eligibility and benefit calculations in retirement plans, playing a crucial role in both Flat Benefit Formula and Unit Benefit Formula methods. The Flat Benefit Formula provides a fixed monthly amount based on total service credited, while the Unit Benefit Formula calculates benefits by multiplying years of service credit by a set unit value and final salary, making service credits directly impact the pension amount.

Integration with Social Security

The integration with Social Security adjusts pension benefits by subtracting a portion of the Social Security benefits to prevent overcompensation, commonly applied in both flat benefit and unit benefit formulas. In the flat benefit formula, integration typically reduces a fixed pension amount based on estimated Social Security benefits, while the unit benefit formula integrates by decreasing benefits proportionally to the years of service and salary, aligning total retirement income with Social Security provisions.

Benefit Accrual Rate

Benefit Accrual Rate in a Flat Benefit Formula provides a fixed amount regardless of service length, whereas in a Unit Benefit Formula, it increases proportionally based on years of service or compensation units.

Vesting Schedule

The vesting schedule determines the timeline for employees to earn full pension rights, impacting the accrual under Flat Benefit Formulas which provide fixed benefits versus Unit Benefit Formulas that calculate benefits based on salary and service units.

Non-Discrimination Testing

Non-Discrimination Testing ensures that pension plans with Flat Benefit Formulas do not disproportionately favor highly compensated employees compared to those with Unit Benefit Formulas by evaluating benefit accruals and contributions across employee groups.

Actuarial Valuation

Actuarial valuation compares Flat Benefit and Unit Benefit formulas by assessing their impact on pension liabilities, with Flat Benefits providing fixed payouts and Unit Benefits linking benefits to years of service or salary metrics.

Flat Benefit Formula vs Unit Benefit Formula Infographic

moneydif.com

moneydif.com