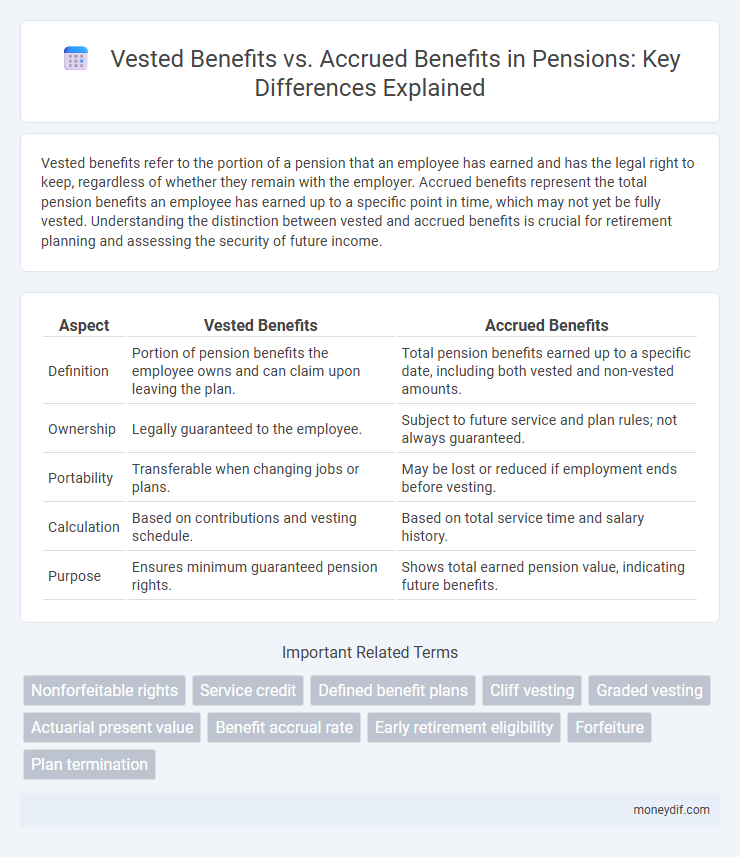

Vested benefits refer to the portion of a pension that an employee has earned and has the legal right to keep, regardless of whether they remain with the employer. Accrued benefits represent the total pension benefits an employee has earned up to a specific point in time, which may not yet be fully vested. Understanding the distinction between vested and accrued benefits is crucial for retirement planning and assessing the security of future income.

Table of Comparison

| Aspect | Vested Benefits | Accrued Benefits |

|---|---|---|

| Definition | Portion of pension benefits the employee owns and can claim upon leaving the plan. | Total pension benefits earned up to a specific date, including both vested and non-vested amounts. |

| Ownership | Legally guaranteed to the employee. | Subject to future service and plan rules; not always guaranteed. |

| Portability | Transferable when changing jobs or plans. | May be lost or reduced if employment ends before vesting. |

| Calculation | Based on contributions and vesting schedule. | Based on total service time and salary history. |

| Purpose | Ensures minimum guaranteed pension rights. | Shows total earned pension value, indicating future benefits. |

Understanding Vested Benefits in Pension Plans

Vested benefits in pension plans represent the portion of a participant's retirement savings that they have earned and are entitled to keep, regardless of future employment status. These benefits contrast with accrued benefits, which include all earned pension rights up to a certain point but may not be fully guaranteed if the participant leaves the plan early. Understanding that vested benefits secure participant rights to pension funds enhances retirement planning and ensures financial stability after employment changes.

What Are Accrued Benefits?

Accrued benefits refer to the portion of pension benefits that an employee has earned based on their service and salary up to a specific point in time, regardless of whether they have fully vested. These benefits represent the value of the pension entitlement accrued during the employment period, calculated using factors such as years of service and average earnings. Unlike vested benefits, accrued benefits may be forfeited if the employee leaves the plan before meeting vesting requirements.

Key Differences Between Vested and Accrued Benefits

Vested benefits represent the portion of a pension plan that an employee has earned the right to keep, regardless of future employment, while accrued benefits are the total pension benefits accumulated up to a specific date, including both vested and non-vested amounts. Key differences include that vested benefits are legally protected and guaranteed upon leaving the employer, whereas accrued benefits may include amounts forfeited if the employee leaves before vesting. Understanding these distinctions impacts retirement planning and informs decisions about job changes or early withdrawals.

How Vested Benefits Impact Retirement Security

Vested benefits guarantee a pension plan member retains ownership of their accumulated retirement funds even if they change jobs, directly enhancing retirement security by ensuring continuous fund growth and protection. Unlike accrued benefits, which represent the total amount earned up to a point, vested benefits legally secure the member's right to those funds, preventing forfeiture due to employment changes. This legal ownership strengthens financial stability in retirement by safeguarding a dependable income stream regardless of career interruptions or changes.

Calculating Accrued Benefits: Methods and Examples

Calculating accrued benefits involves determining the pension amount earned by an employee up to a specific point based on salary history and years of service, using formulas such as the unit credit method or projected benefit method. The unit credit method calculates benefits by crediting each year's service proportionally, while the projected benefit method estimates future salary increases to forecast the eventual pension. For example, an employee with 10 years of service at a final salary of $60,000 might have accrued benefits valued at 2% per year, resulting in an annual pension of $12,000 under a defined benefit plan.

Vesting Schedules: Immediate vs. Gradual

Vested benefits represent the portion of a pension that an employee owns outright, regardless of continued employment, while accrued benefits relate to the total pension rights earned up to a certain date. Vesting schedules determine when these benefits become non-forfeitable, with immediate vesting granting full ownership upon meeting specific criteria and gradual vesting incrementally increasing ownership over time. Employers often implement graded vesting schedules, such as 20% vesting after one year with full vesting at five years, to balance employee retention and retirement security.

Legal Rights: Protecting Your Vested Benefits

Vested benefits represent the portion of a pension that an employee has earned and legally owns, regardless of their continued employment, providing strong protection under pension law. Accrued benefits indicate the total pension amount accumulated up to a certain point but may be subject to forfeiture if vesting criteria are not met. Legal protections ensure that vested benefits cannot be diminished or taken away, safeguarding employees' retirement security.

Early Termination: What Happens to Accrued and Vested Benefits?

Upon early termination, vested benefits represent the portion of a pension that an employee has legally earned and retains the right to receive even after leaving the company, ensuring guaranteed future payouts. Accrued benefits reflect the total value of pension benefits accumulated to date based on service and salary but may be subject to forfeiture if not fully vested. Employers must clearly outline the vesting schedule and payout options to determine the exact amount an employee can claim upon early separation from the pension plan.

Maximizing Pension Wealth: Strategies for Employees

Maximizing pension wealth requires understanding the distinction between vested benefits, which are the guaranteed pension components employees retain regardless of job changes, and accrued benefits, representing the total value of pension earned up to a specific date. Employees should prioritize strategies like continuing contributions to increase accrued benefits while ensuring their vested rights are protected, enabling higher long-term pension payouts. Regularly reviewing pension statements and consulting financial advisors can optimize decisions about job tenure and contribution levels to boost overall retirement wealth.

Common Misconceptions About Vested and Accrued Pension Benefits

Vested benefits refer to the portion of a pension plan that an employee has earned the right to keep, regardless of continued employment, while accrued benefits represent the total pension value accumulated up to a certain point. A common misconception is that accrued benefits are immediately accessible, but access is typically restricted until vesting rules are met. Another misunderstanding is that vested benefits equal the full pension payout, when in fact they often represent only a guaranteed minimum portion based on service and contributions.

Important Terms

Nonforfeitable rights

Nonforfeitable rights refer to vested benefits that employees have earned and cannot lose, even if they leave the company, while accrued benefits are the total pension or retirement benefits accumulated to date, which may include non-vested components subject to forfeiture. The distinction is crucial in retirement plans, as vested benefits guarantee employees a secured portion of their retirement funds, whereas accrued benefits represent the overall entitlement that may adjust depending on vesting schedules and employment duration.

Service credit

Service credit directly impacts vested benefits, which are the rights employees earn to retain employer-contributed funds after a specified period; accrued benefits represent the total value of pension or retirement benefits accumulated, including both vested portions and those still contingent on continued service. Understanding the distinction between vested benefits and accrued benefits is crucial for accurately evaluating retirement plan entitlements and future financial security.

Defined benefit plans

Defined benefit plans provide accrued benefits representing the total retirement benefits earned to date, while vested benefits guarantee the portion of accrued benefits a participant is entitled to receive regardless of continued employment.

Cliff vesting

Cliff vesting grants employees full ownership of all accrued benefits at a specific time, contrasting with gradual vesting where benefits accrue progressively.

Graded vesting

Graded vesting allows employees to earn ownership of retirement benefits progressively over time, distinguishing vested benefits--which employees have earned and are entitled to keep--from accrued benefits, which represent the total benefits accumulated but not yet fully owned. This system ensures a gradual transfer of retirement fund rights, typically increasing the vested percentage as an employee meets specific service milestones.

Actuarial present value

Actuarial present value quantifies vested benefits as legally secured future payments, whereas accrued benefits represent the portion of pension entitlement earned up to a given date, reflecting an employee's accumulated rights regardless of vesting status.

Benefit accrual rate

The benefit accrual rate determines the pace at which employees accumulate vested benefits, distinguishing the guaranteed retirement funds from total accrued benefits including conditional entitlements.

Early retirement eligibility

Vested benefits guarantee early retirement eligibility by securing non-forfeitable claims, whereas accrued benefits represent the total earned but may be subject to plan rules affecting withdrawal timing.

Forfeiture

Forfeiture occurs when unvested benefits are lost due to termination, whereas accrued benefits represent the total earned benefits, both vested and unvested, accumulated over time.

Plan termination

Plan termination triggers the distribution of vested benefits, which represent the non-forfeitable amounts participants have earned, while accrued benefits reflect the total value accumulated, including non-vested portions subject to forfeiture. During termination, only vested benefits are guaranteed to be paid out, as accrued benefits encompass rights that may be lost if they have not yet vested.

Vested benefits vs Accrued benefits Infographic

moneydif.com

moneydif.com