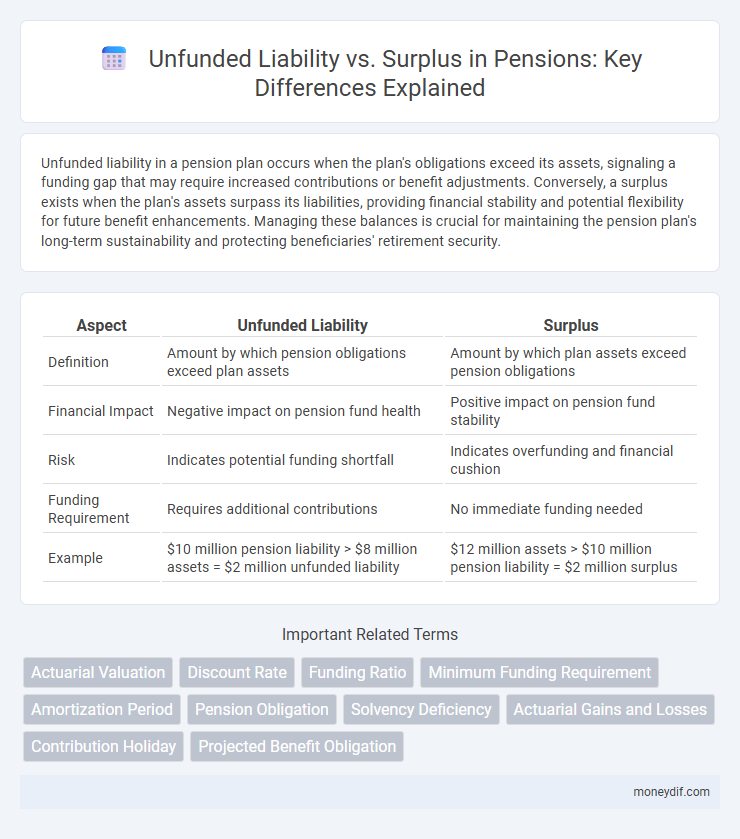

Unfunded liability in a pension plan occurs when the plan's obligations exceed its assets, signaling a funding gap that may require increased contributions or benefit adjustments. Conversely, a surplus exists when the plan's assets surpass its liabilities, providing financial stability and potential flexibility for future benefit enhancements. Managing these balances is crucial for maintaining the pension plan's long-term sustainability and protecting beneficiaries' retirement security.

Table of Comparison

| Aspect | Unfunded Liability | Surplus |

|---|---|---|

| Definition | Amount by which pension obligations exceed plan assets | Amount by which plan assets exceed pension obligations |

| Financial Impact | Negative impact on pension fund health | Positive impact on pension fund stability |

| Risk | Indicates potential funding shortfall | Indicates overfunding and financial cushion |

| Funding Requirement | Requires additional contributions | No immediate funding needed |

| Example | $10 million pension liability > $8 million assets = $2 million unfunded liability | $12 million assets > $10 million pension liability = $2 million surplus |

Understanding Unfunded Pension Liabilities

Unfunded pension liabilities represent the gap between a pension plan's promised benefits and the assets set aside to cover those obligations, creating a financial shortfall that governments or corporations must address. This liability arises when current and projected pension payouts exceed the value of the pension fund's assets, often influenced by factors like lower-than-expected investment returns, demographic changes, or adjustments in actuarial assumptions. Understanding unfunded liabilities is critical for policymakers and stakeholders to ensure long-term fiscal sustainability and to develop strategies for reducing pension debt.

Defining Pension Surplus

Pension surplus occurs when a pension plan's assets exceed its projected liabilities, indicating financial health and stability. This surplus can provide opportunities for enhanced benefits, reduced employer contributions, or increased funding flexibility. Accurate actuarial valuation is critical to identifying surplus and managing long-term pension obligations effectively.

Causes of Unfunded Liabilities in Pension Plans

Unfunded liabilities in pension plans primarily arise from inaccurate actuarial assumptions, such as underestimated life expectancy or wage growth, leading to higher-than-expected benefit payments. Market volatility and lower-than-expected investment returns reduce the assets available to cover future obligations, exacerbating funding shortfalls. Changes in plan design, early retirements, and insufficient contributions further contribute to the growth of unfunded pension liabilities.

Factors Leading to Pension Surplus

Pension surplus occurs when a plan's assets exceed its projected liabilities, driven by factors such as higher-than-expected investment returns, lower inflation rates, and favorable demographic changes like increased employee longevity or lower retirement rates. Precise actuarial assumptions and stringent funding policies also contribute to sustaining a pension surplus by reducing the risk of underfunding. Effective management strategies and strong economic conditions further enhance the likelihood of maintaining a pension surplus over time.

Impact of Unfunded Liabilities on Stakeholders

Unfunded liabilities in pension systems create significant financial risks for taxpayers, employees, and retirees by increasing the burden on future budgets and potentially reducing benefits. Stakeholders face uncertainty as governments may need to raise taxes, cut services, or reduce retirement payouts to address growing pension deficits. A sustained unfunded liability undermines trust in pension security and can destabilize municipal finances, impacting economic growth and public sector workforce morale.

Consequences of Pension Surplus for Plan Sponsors

A pension surplus occurs when a plan's assets exceed its liabilities, providing plan sponsors with opportunities to reduce future contributions or improve benefit conditions. This financial cushion enhances the sponsor's balance sheet strength and potentially lowers the cost of capital by signaling reduced pension risk to investors. However, managing a surplus requires careful regulatory compliance and strategic planning to avoid unintended tax implications or benefit restrictions.

Strategies to Address Unfunded Liabilities

Addressing unfunded pension liabilities requires strategic approaches such as increasing employer and employee contributions, adjusting actuarial assumptions, and implementing benefit reforms to improve long-term fiscal sustainability. Governments and pension funds often utilize bond issuance or pension obligation bonds to bridge funding gaps while preserving plan solvency. Enhancing investment returns through diversified portfolios and adopting responsible risk management also play critical roles in reducing unfunded liabilities over time.

Managing and Allocating Pension Surpluses

Managing pension surpluses requires strategic allocation to enhance fund stability while addressing unfunded liabilities. Optimal surplus utilization includes reinvesting in diversified assets, funding additional benefits, or reducing future contributions, ensuring long-term sustainability. Accurate actuarial assessments and regulatory compliance are critical for effective pension fund governance and risk management.

Case Studies: Unfunded Liability vs Surplus

Case studies highlight significant contrasts between pension plans with unfunded liabilities and those with surpluses, revealing the impact on financial stability and beneficiary security. Plans like the California Teachers' Retirement System demonstrate challenges faced due to large unfunded liabilities, affecting funding ratios and long-term sustainability. Conversely, pension funds in states like Wisconsin exhibit surpluses that provide greater flexibility in benefits enhancement and reduce the need for increased employer contributions.

Future Outlook: Balancing Pension Funding

Unfunded pension liabilities represent a significant challenge, indicating the gap between promised benefits and current asset reserves, while surpluses reflect a positive funding status ensuring greater financial stability. Accurate actuarial projections and prudent investment strategies are critical to balancing these disparities and securing pension plan sustainability. Policymakers must prioritize ongoing contributions and risk management to maintain equilibrium and protect beneficiaries' future income.

Important Terms

Actuarial Valuation

Actuarial valuation quantifies pension plan unfunded liabilities and surpluses to assess financial health and funding status.

Discount Rate

The discount rate directly impacts the valuation of unfunded liabilities or surpluses, determining the present value of future obligations and influencing funding strategies for pension plans.

Funding Ratio

A funding ratio above 100% indicates a surplus where plan assets exceed liabilities, while a ratio below 100% reflects an unfunded liability showing insufficient assets to cover obligations.

Minimum Funding Requirement

The Minimum Funding Requirement mandates that pension plans maintain sufficient contributions to cover unfunded liabilities and prevent surplus deficits, ensuring long-term financial stability.

Amortization Period

The amortization period significantly impacts how unfunded liabilities are managed, with longer periods reducing annual payment amounts but increasing total interest costs, whereas shorter periods accelerate the elimination of deficits and enhance funded status. Surplus funds can be strategically applied to shorten the amortization period, improving overall pension plan solvency and reducing future financial risks.

Pension Obligation

Pension obligations with unfunded liabilities indicate a funding shortfall posing financial risks, while a surplus reflects a pension plan's excess assets over its projected liabilities.

Solvency Deficiency

Solvency deficiency occurs when unfunded liabilities exceed surplus, indicating insufficient assets to cover future obligations.

Actuarial Gains and Losses

Actuarial gains and losses directly affect unfunded liabilities and surpluses by altering pension plan funding status and financial obligations.

Contribution Holiday

Contribution holidays occur when an employer temporarily suspends pension contributions due to a plan's surplus exceeding actuarial liabilities, whereas unfunded liability requires increased contributions to address funding deficits.

Projected Benefit Obligation

The Projected Benefit Obligation (PBO) represents the present value of pension benefits earned by employees, which can result in either an unfunded liability when plan assets are insufficient or a surplus when assets exceed the PBO. An unfunded liability indicates a funding shortfall requiring additional contributions, while a surplus reflects excess plan assets that may reduce future funding requirements.

Unfunded Liability vs Surplus Infographic

moneydif.com

moneydif.com