Normal cost represents the annual expense attributed to pension benefits earned by employees during the current year, reflecting ongoing service accruals. Past service cost arises from changes in pension plans that grant benefits for service periods before the amendment date, often resulting in a one-time expense recognized immediately or amortized over time. Distinguishing between normal cost and past service cost is essential for accurate pension accounting and financial reporting.

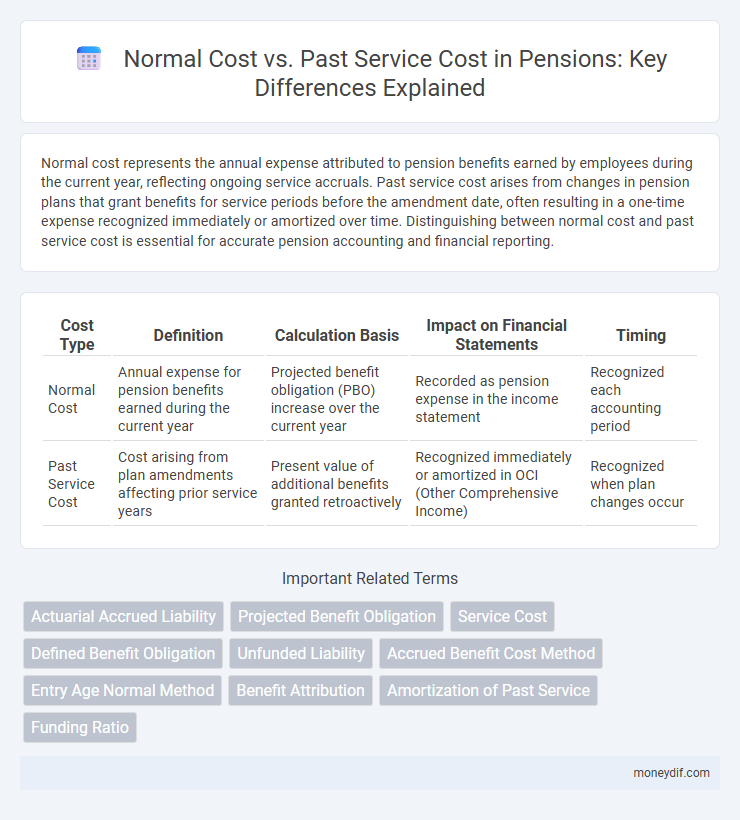

Table of Comparison

| Cost Type | Definition | Calculation Basis | Impact on Financial Statements | Timing |

|---|---|---|---|---|

| Normal Cost | Annual expense for pension benefits earned during the current year | Projected benefit obligation (PBO) increase over the current year | Recorded as pension expense in the income statement | Recognized each accounting period |

| Past Service Cost | Cost arising from plan amendments affecting prior service years | Present value of additional benefits granted retroactively | Recognized immediately or amortized in OCI (Other Comprehensive Income) | Recognized when plan changes occur |

Understanding Pension Costs: An Overview

Normal cost represents the present value of benefits earned by employees during the current year, reflecting ongoing pension expense and funding requirements. Past service cost arises from retroactive plan amendments or benefit improvements for service rendered before the current period, necessitating immediate recognition in pension liabilities. Accurate differentiation of these costs is essential for effective pension budgeting, financial reporting, and compliance with accounting standards such as IAS 19 or ASC 715.

Defining Normal Cost in Pension Plans

Normal cost in pension plans represents the present value of benefits earned by employees during the current service period, calculated annually to determine ongoing funding requirements. It excludes obligations from prior service periods, which are accounted for separately as past service cost. Accurate estimation of normal cost is critical for maintaining the plan's funded status and ensuring sustainable pension liabilities over time.

Past Service Cost: Meaning and Significance

Past service cost represents the increase in a pension plan's obligation due to changes in benefits for employee service rendered in prior periods, often resulting from plan amendments or curtailments. It reflects the present value of additional benefits granted for past employment, impacting the employer's pension liability and financial statements immediately. Understanding past service cost is crucial for accurate accounting under IFRS and US GAAP, ensuring transparency in pension expense recognition.

Key Differences Between Normal Cost and Past Service Cost

Normal cost represents the annual expense of pension benefits earned by employees during the current period, reflecting ongoing service costs. Past service cost arises from retroactive changes to pension plans, such as plan amendments or benefit improvements, and is typically recognized immediately or amortized over time. Key differences include timing of recognition, with normal cost recorded annually and past service cost related to prior periods, affecting pension liabilities and expense patterns distinctly.

Calculation Methods for Normal Cost

Normal cost is calculated using the projected unit credit method, which allocates pension benefits earned in the current period by estimating future salary increases and service years. It incorporates actuarial assumptions such as discount rates, mortality rates, and turnover probabilities to determine the present value of benefits accrued during the year. This contrasts with past service cost, which measures the increase in pension liability due to plan amendments affecting prior periods.

How Past Service Cost is Determined

Past service cost is determined by calculating the present value of benefits attributed to employee service before the current measurement date. Actuarial assumptions, including discount rates, salary growth, and employee turnover, are applied to estimate the obligation for vested and non-vested benefits. This cost reflects the increase in pension liabilities due to plan amendments or initiations affecting prior service periods.

Impact on Pension Funding: Normal vs Past Service Cost

Normal cost represents the annual expense required to fund pension benefits earned by employees in the current year, directly affecting the ongoing pension funding requirements. Past service cost arises from changes in pension plan benefits attributable to service rendered in prior periods, leading to immediate increases in pension liabilities and a corresponding impact on funding levels. A focus on normal cost ensures stable, predictable contributions, while past service cost demands accelerated funding adjustments to maintain pension plan solvency.

Accounting Standards for Pension Costs

Normal cost represents the present value of benefits earned by employees during the current period based on actuarial assumptions, while past service cost arises from plan amendments that grant retroactive benefits. Accounting standards like IAS 19 and ASC 715 require immediate recognition of past service cost in pension expense, whereas normal cost is recognized systematically over the service period. Proper distinction and measurement of these components ensure accurate pension liability reporting and expense recognition in financial statements.

Implications for Employers and Employees

Normal cost represents the annual expense employers allocate to fund pension benefits earned by employees during the current year, directly impacting the company's operational budget and cash flow. Past service cost arises from changes to pension plans affecting benefits earned in prior periods, requiring immediate recognition and often resulting in significant additional liabilities for employers. Employees benefit from stable normal cost contributions ensuring ongoing accrual of retirement benefits, while past service cost adjustments can enhance or reduce their accrued rights, influencing overall retirement security.

Managing and Reporting Pension Costs

Normal cost represents the present value of benefits earned by employees during the current year, while past service cost arises from changes in pension plan benefits for service already rendered. Effective management of pension costs requires accurate allocation between these components to reflect ongoing obligations and adjustments from plan amendments. Transparent reporting ensures stakeholders understand the impact of current service costs and retroactive changes on the pension liability.

Important Terms

Actuarial Accrued Liability

Actuarial accrued liability represents the present value of benefits earned by employees up to a specific point, distinguishing obligations from past service cost, which covers benefits attributed to employee service before the valuation date. Normal cost, in contrast, reflects the annual expense for benefits accrued during the current year, providing a forward-looking measure of pension obligations.

Projected Benefit Obligation

Projected Benefit Obligation measures the total pension liability, where normal cost represents the present value of benefits earned during the current period, and past service cost reflects the cost of benefits granted for employee service before the current period.

Service Cost

Normal cost represents the current expense recognized for employee benefits earned during the current period, while past service cost refers to the retrospective expense associated with changes in pension benefits resulting from plan amendments affecting prior periods. Accurate measurement of these costs is critical for proper actuarial valuation and financial reporting under accounting standards such as IAS 19 or ASC 715.

Defined Benefit Obligation

Defined Benefit Obligation (DBO) increases with past service cost due to retroactive benefits, while normal cost represents the present value of benefits earned during the current period.

Unfunded Liability

Unfunded liability arises when a pension plan's accumulated past service cost exceeds the assets set aside, creating a gap between vested benefits and available funds. Normal cost reflects the annual expense to fund future service benefits, while past service cost represents the present value of benefits earned for service prior to the valuation date, directly impacting the unfunded liability balance.

Accrued Benefit Cost Method

The Accrued Benefit Cost Method determines pension liabilities by allocating costs based on the benefits earned to date, distinguishing normal cost as the expense for services rendered during the current period and past service cost as the expense related to benefits granted for employee service in prior periods. This method emphasizes measuring pension obligations and costs with respect to employee service years, ensuring an accurate reflection of financial obligations for both ongoing and previously granted benefits.

Entry Age Normal Method

The Entry Age Normal Method allocates the normal cost evenly over an employee's expected service period, resulting in a consistent annual expense reflecting the cost of benefits accrued each year. Past service cost, in contrast, arises from retroactive plan amendments and is recognized immediately or amortized separately, impacting the total pension liability distinct from the ongoing normal cost.

Benefit Attribution

Benefit attribution distinguishes normal cost, which represents the expense of benefits earned during the current period, from past service cost, which reflects the expense of benefits vested for service rendered in prior periods.

Amortization of Past Service

Amortization of past service costs refers to the systematic allocation of the cost arising from plan amendments affecting employee benefits accrued in prior periods, distinct from the normal cost which represents the present value of benefits earned during the current period. While normal cost is recognized annually as part of pension expense, past service cost is amortized over a specified period to reflect its impact gradually on the pension liability and expense.

Funding Ratio

The funding ratio measures a pension plan's assets relative to its liabilities, with normal cost representing the present value of benefits earned during the current period and past service cost reflecting liabilities from benefits earned in prior periods. A balanced funding ratio ensures that current contributions cover the normal cost while addressing unfunded past service costs to maintain long-term plan solvency.

Normal cost vs Past service cost Infographic

moneydif.com

moneydif.com