Anti-franking and anti-avoidance provisions play crucial roles in pension regulation by ensuring that tax benefits are appropriately allocated and misuse is prevented. Anti-franking rules aim to limit the ability to claim franking credits improperly, safeguarding the pension fund's tax integrity. Anti-avoidance measures are designed to detect and block strategies that artificially reduce tax liabilities, maintaining fairness in pension taxation frameworks.

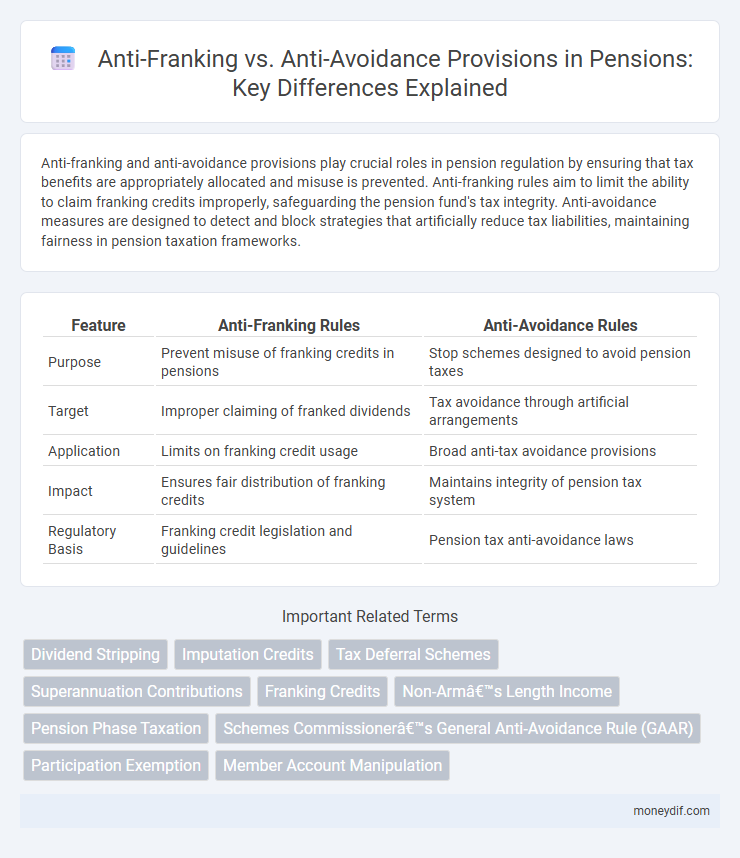

Table of Comparison

| Feature | Anti-Franking Rules | Anti-Avoidance Rules |

|---|---|---|

| Purpose | Prevent misuse of franking credits in pensions | Stop schemes designed to avoid pension taxes |

| Target | Improper claiming of franked dividends | Tax avoidance through artificial arrangements |

| Application | Limits on franking credit usage | Broad anti-tax avoidance provisions |

| Impact | Ensures fair distribution of franking credits | Maintains integrity of pension tax system |

| Regulatory Basis | Franking credit legislation and guidelines | Pension tax anti-avoidance laws |

Understanding Anti-Franking in Pension Systems

Anti-franking rules in pension systems prevent investors from reclaiming excess franking credits, ensuring that tax benefits are distributed fairly and not exploited. Unlike anti-avoidance provisions designed to curb tax evasion through legal loopholes, anti-franking specifically targets the misuse of dividend imputation credits in retirement savings accounts. Understanding anti-franking helps pension holders optimize their tax outcomes while complying with regulations on dividend tax credits.

Key Principles of Anti-Avoidance Measures

Anti-avoidance measures in pension schemes are designed to prevent tax evasion by targeting arrangements that deliberately exploit loopholes to reduce tax liabilities. These principles emphasize substance over form, assessing the economic reality of transactions rather than their legal structure to counteract artificial or contrived schemes. Unlike anti-franking rules that address dividend imputation, anti-avoidance provisions focus on identifying and nullifying arrangements lacking genuine economic purpose aimed primarily at obtaining tax benefits.

How Anti-Franking Rules Impact Pension Benefits

Anti-franking rules affect pension benefits by limiting the tax advantages of franking credits that funds pass on to beneficiaries, reducing the overall return on investments. These rules ensure that pension funds do not use excess franking credits to unduly lower tax liabilities within the fund, preserving the integrity of pension taxation. Anti-avoidance measures complement this by preventing schemes that artificially inflate franking credits to maximize pension payouts, ensuring fair taxation for retirees.

The Purpose of Anti-Avoidance in Pensions

The purpose of anti-avoidance rules in pensions is to prevent individuals from exploiting tax benefits through schemes designed primarily for tax reduction rather than genuine retirement savings. These provisions ensure pension funds maintain their integrity by disallowing artificial arrangements that circumvent applicable tax laws. By contrast, anti-franking rules specifically target the improper utilization of franking credits, whereas anti-avoidance measures broadly address all forms of tax evasion within pension contributions and withdrawals.

Comparing Anti-Franking and Anti-Avoidance Provisions

Anti-franking provisions in pension schemes aim to prevent the double taxation of earnings by adjusting tax credits attached to franked dividends, ensuring equitable tax treatment for pension fund beneficiaries. Anti-avoidance provisions, on the other hand, target tax strategies that exploit loopholes or artificial arrangements to reduce tax liabilities, safeguarding the integrity of pension fund taxation. Comparing these, anti-franking provisions focus on correctly attributing tax credits, while anti-avoidance rules serve as broader measures to counteract tax evasion and aggressive tax planning within pension funds.

Legal Framework Governing Pension Anti-Franking

The legal framework governing pension anti-franking provisions aims to prevent the improper reduction of taxable pension income through artificial tax credits, ensuring taxpayers do not exploit franking credits to minimize tax liabilities unfairly. Anti-franking rules typically restrict pension funds and recipients from claiming undue imputation credits, preserving the integrity of the superannuation tax system. These statutes differ from anti-avoidance laws, which broadly target any schemes designed to evade tax obligations, whereas anti-franking specifically addresses the misuse of franking credits within pension arrangements.

Common Strategies to Address Pension Avoidance

Common strategies to address pension avoidance focus on Anti-Franking mechanisms that prevent the improper use of franking credits to reduce tax liabilities and Anti-Avoidance rules designed to counteract artificial arrangements aimed at exploiting pension tax concessions. Regulatory frameworks typically include targeted compliance measures, such as detailed reporting requirements and audits, to detect and deter schemes like income splitting or artificial asset transfers that undermine pension fund integrity. Employers and trustees often implement robust governance policies and transparency protocols to ensure adherence to pension regulations and maintain equitable tax outcomes.

Real-World Examples: Anti-Franking vs Anti-Avoidance

Anti-Franking rules target pension strategies that artificially inflate franking credits to reduce tax liabilities, as seen in cases where retirees use dividend imputation to claim excessive tax refunds. Anti-Avoidance provisions address broader schemes designed to exploit loopholes for tax deferral or evasion, such as income splitting arrangements between pension funds and beneficiaries. Real-world enforcement, exemplified by decisions from the Australian Taxation Office, illustrates a stricter crackdown on both fraudulent franking credit claims and complex avoidance structures undermining pension tax integrity.

Challenges in Enforcing Anti-Avoidance and Anti-Franking

Challenges in enforcing anti-avoidance and anti-franking provisions in pension schemes stem from the complexity of tax legislation and the sophisticated strategies employed by taxpayers to exploit loopholes. Anti-avoidance rules require continuous updates to address evolving schemes, while anti-franking defenses must balance preventing tax evasion without discouraging legitimate financial planning. Regulatory bodies face difficulties in monitoring, auditing, and proving intent in both contexts, complicating effective enforcement and compliance assurance.

Future Trends in Pension Anti-Avoidance and Anti-Franking

Future trends in pension anti-avoidance and anti-franking emphasize enhanced regulatory frameworks designed to curb aggressive tax avoidance schemes and improper franking credit claims. Emerging technologies like blockchain and AI-powered analytics enable authorities to detect complex pension fund manipulations with greater accuracy and speed. Increased global coordination among tax authorities is expected to strengthen enforcement and reduce loopholes exploited in cross-border pension arrangements.

Important Terms

Dividend Stripping

Dividend stripping strategies often trigger anti-franking credit rules and anti-avoidance provisions to prevent investors from exploiting tax refunds through artificial dividend transactions.

Imputation Credits

Imputation credits in the Australian tax system prevent double taxation by allowing shareholders to offset corporate tax already paid against their income tax liabilities, while anti-franking rules restrict excessive utilization of these credits to curb tax avoidance. Anti-avoidance measures target schemes exploiting imputation credits, ensuring the integrity of tax benefits and maintaining equitable tax distribution.

Tax Deferral Schemes

Tax deferral schemes often trigger anti-franking rules designed to prevent double taxation, while anti-avoidance provisions target arrangements that exploit these schemes to unlawfully reduce tax liabilities.

Superannuation Contributions

Superannuation contributions are regulated to prevent tax avoidance through Anti-Avoidance rules and to ensure compliance with Anti-Franking provisions limiting improper franking credit claims.

Franking Credits

Franking credits, designed to prevent double taxation on dividends, are regulated through anti-franking and anti-avoidance provisions to ensure companies cannot misuse these credits to reduce tax liabilities improperly.

Non-Arm’s Length Income

Non-Arm's Length Income triggers Anti-Franking and Anti-Avoidance rules to prevent income manipulation and ensure proper tax treatment of related-party transactions.

Pension Phase Taxation

Pension phase taxation is impacted by anti-franking and anti-avoidance rules designed to prevent tax exploitation through excess franking credits during retirement income streams. The Australian Taxation Office enforces these measures to ensure compliance with superannuation laws, limiting the use of franking credits in pension phase to reduce tax avoidance opportunities.

Schemes Commissioner’s General Anti-Avoidance Rule (GAAR)

The Schemes Commissioner's General Anti-Avoidance Rule (GAAR) targets aggressive tax planning schemes by preventing artificial avoidance of taxes, distinguishing between legitimate anti-franking measures and unlawful tax avoidance strategies.

Participation Exemption

Participation exemption rules eliminate double taxation on dividends and capital gains from qualifying subsidiaries, while anti-franking measures prevent taxpayers from exploiting foreign tax credits through artificial structures. Anti-avoidance provisions work alongside these rules to deter aggressive tax planning and ensure that participation exemptions are not abused to unjustly reduce taxable income.

Member Account Manipulation

Member Account Manipulation exploits loopholes to circumvent Anti-Franking provisions while anti-avoidance rules target broader tax scheme abuses to ensure compliance.

Anti-Franking vs Anti-Avoidance Infographic

moneydif.com

moneydif.com