A Certificate of Deposit (CD) offers higher interest rates with fixed terms, making it ideal for savers who won't need immediate access to their funds. In contrast, a Money Market Account (MMA) provides more flexibility by allowing limited withdrawals and check-writing features, usually with variable interest rates. Choosing between a CD and an MMA depends on whether prioritizing higher returns or liquidity is more important for your savings goals.

Table of Comparison

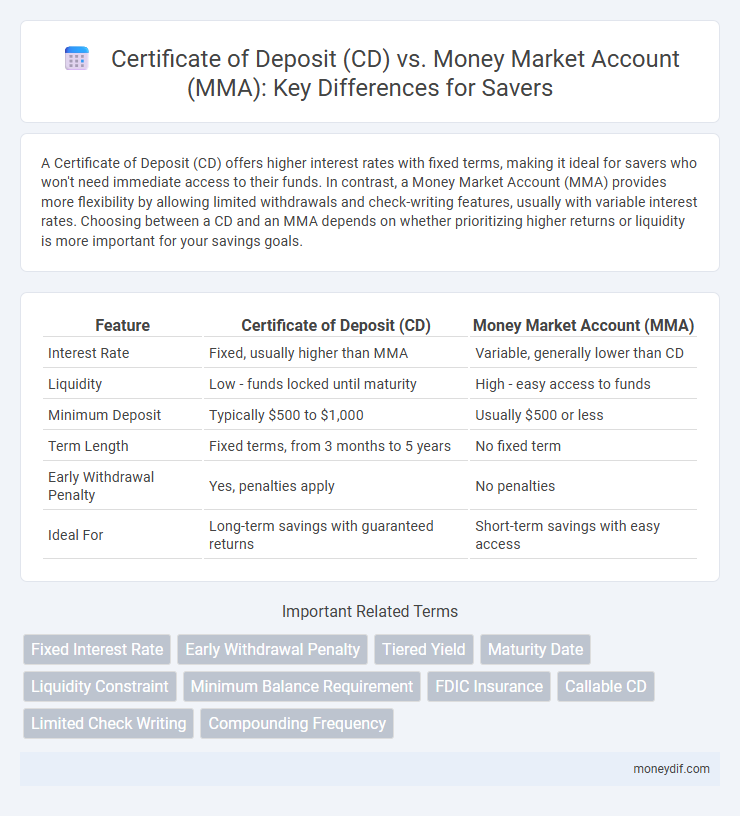

| Feature | Certificate of Deposit (CD) | Money Market Account (MMA) |

|---|---|---|

| Interest Rate | Fixed, usually higher than MMA | Variable, generally lower than CD |

| Liquidity | Low - funds locked until maturity | High - easy access to funds |

| Minimum Deposit | Typically $500 to $1,000 | Usually $500 or less |

| Term Length | Fixed terms, from 3 months to 5 years | No fixed term |

| Early Withdrawal Penalty | Yes, penalties apply | No penalties |

| Ideal For | Long-term savings with guaranteed returns | Short-term savings with easy access |

Certificate of Deposit vs Money Market Account: An Overview

Certificate of Deposit (CD) offers a fixed interest rate with a predetermined term, providing predictable returns but limited liquidity due to early withdrawal penalties. Money Market Account (MMA) combines higher interest rates than regular savings accounts with check-writing privileges, offering more flexibility and easier access to funds. Comparing CD versus MMA involves balancing higher guaranteed yields against the need for liquidity and access to funds.

Key Features of CDs and MMAs

Certificates of Deposit (CDs) offer fixed interest rates and predetermined terms, typically ranging from a few months to several years, with penalties for early withdrawal. Money Market Accounts (MMAs) provide higher liquidity, allowing limited check-writing and withdrawals, while offering variable interest rates often linked to market conditions. Both options are FDIC-insured, but CDs generally yield higher returns due to locked-in rates, whereas MMAs prioritize accessibility and flexibility.

Interest Rates: Which Account Offers Better Returns?

Certificates of Deposit (CDs) typically offer higher fixed interest rates compared to Money Market Accounts (MMAs), making them more attractive for savers seeking predictable returns over a set term. Money Market Accounts often provide variable rates that may be lower but allow greater liquidity and access to funds. Evaluating current annual percentage yields (APYs) and considering investment duration is essential to determine which account yields better returns based on individual financial goals.

Liquidity and Access to Funds Comparison

Certificates of Deposit (CDs) typically have lower liquidity due to fixed terms, requiring early withdrawal penalties that limit immediate access to funds. Money Market Accounts (MMAs) offer higher liquidity with easier access to funds, usually allowing multiple monthly transactions without penalties. For savers prioritizing quick access and flexibility, MMAs provide a better solution compared to the restrictive withdrawal conditions of CDs.

Minimum Balance Requirements: CD vs MMA

A Certificate of Deposit (CD) typically requires a fixed minimum balance that can range from $500 to $10,000 depending on the financial institution, with penalties for early withdrawal. Money Market Accounts (MMAs) often have lower minimum balance requirements, usually around $1,000, offering more liquidity without early withdrawal penalties. Choosing between a CD and an MMA often hinges on the depositor's ability to maintain these minimum balances while balancing access to funds.

Safety and FDIC Insurance Protection

Certificates of Deposit (CDs) and Money Market Accounts (MMAs) both offer FDIC insurance protection up to $250,000 per depositor, per insured bank, ensuring principal safety. CDs typically provide fixed interest rates with guaranteed returns over a set term, minimizing market risk but limiting liquidity. Money Market Accounts offer more flexible access to funds with variable interest rates, maintaining FDIC coverage while balancing safety and accessibility.

Early Withdrawal Penalties and Restrictions

Certificate of Deposit (CD) accounts impose strict early withdrawal penalties, often forfeiting several months' interest or a portion of the principal, making funds inaccessible without financial loss before maturity. Money Market Accounts (MMA) provide greater liquidity with fewer restrictions on withdrawals, allowing limited transactions per month without penalties. Choosing between CDs and MMAs depends on whether you prioritize higher interest rates with limited access or flexible withdrawals with moderate returns.

Best Use Cases for CDs and MMAs

Certificates of Deposit (CDs) are best used for fixed-term savings goals where higher interest rates outweigh limited liquidity, making them ideal for emergency funds or planned future expenses with a defined timeline. Money Market Accounts (MMAs) offer greater flexibility and easier access to funds, making them suitable for managing short-term savings while earning interest, especially when maintaining liquidity is a priority. Both options provide FDIC insurance, but choosing between them depends on the balance between interest yield and access to funds.

Fees Associated with CDs and Money Market Accounts

Certificate of Deposit (CD) fees typically include early withdrawal penalties that reduce interest earnings if funds are accessed before the maturity date, while Money Market Accounts (MMAs) often impose monthly maintenance fees unless a minimum balance is maintained. CDs generally avoid monthly fees, making them cost-effective for long-term savings, whereas MMAs provide more liquidity but may generate fees that impact overall returns. Understanding these fee structures helps optimize savings strategies by aligning account selection with individual financial goals and liquidity needs.

How to Choose Between a CD and a Money Market Account

Choosing between a Certificate of Deposit (CD) and a Money Market Account (MMA) depends on your liquidity needs and interest rate preferences. CDs typically offer higher fixed interest rates for a set term but require funds to be locked in, while MMAs provide more flexible access to funds with variable rates that may fluctuate. Evaluate your financial goals, considering whether you prioritize guaranteed returns with limited access or more liquid assets with potential rate changes.

Important Terms

Fixed Interest Rate

A fixed interest rate on a Certificate of Deposit (CD) guarantees a set return over a specified term, making it ideal for investors seeking predictable income without rate fluctuations. In contrast, Money Market Accounts (MMAs) typically offer variable interest rates that may change based on market conditions, providing more liquidity but less rate stability compared to CDs.

Early Withdrawal Penalty

Early withdrawal penalties on Certificates of Deposit (CDs) typically involve forfeiting a specified number of months' interest, potentially reducing principal if withdrawn early, while Money Market Accounts (MMAs) generally allow easier access to funds without penalties but may have transaction limits and lower fixed interest rates. Comparing liquidity and penalty structures, CDs offer higher interest earnings locked over a term versus MMAs' flexible access with fewer or no withdrawal penalties.

Tiered Yield

Tiered yield structures in Certificates of Deposit (CDs) and Money Market Accounts (MMAs) offer varying interest rates based on account balance thresholds, with CDs typically providing higher fixed rates for larger deposits locked in over a set term. MMAs feature flexible access and tiered interest that often increases with higher balances, but generally yields remain lower compared to the guaranteed returns of tiered-rate CDs.

Maturity Date

The maturity date on a Certificate of Deposit (CD) is the fixed date when the principal and interest are paid out, typically ranging from a few months to several years, with early withdrawal penalties applying before this date. Money Market Accounts (MMAs) do not have a maturity date, offering more liquidity and allowing access to funds at any time without penalties.

Liquidity Constraint

Liquidity constraints affect investors choosing between a Certificate of Deposit (CD) and a Money Market Account (MMA), as CDs often have fixed terms and penalties for early withdrawal, reducing immediate access to funds, whereas MMAs offer higher liquidity with easier access to cash and fewer withdrawal restrictions. Understanding the trade-off between the typically higher interest rates of CDs and the flexible, liquid nature of MMAs is crucial for managing short-term financial needs and optimizing returns.

Minimum Balance Requirement

Minimum balance requirements for Certificates of Deposit (CDs) typically range from $500 to $1,000, often influencing interest rates and early withdrawal penalties, while Money Market Accounts (MMAs) usually demand higher minimum balances, frequently around $2,500 to $10,000, to avoid monthly fees and maintain tiered interest rates. Understanding these minimum thresholds is crucial for optimizing returns and managing liquidity between fixed-term CDs and more flexible MMAs.

FDIC Insurance

FDIC insurance covers Certificate of Deposit (CD) and Money Market Account (MMA) deposits up to $250,000 per depositor, per insured bank, ensuring principal protection in case of bank failure. CDs typically offer a fixed interest rate and maturity date, while MMAs provide more liquidity with variable rates and check-writing privileges, both benefiting from FDIC-backed security.

Callable CD

Callable CDs offer higher interest rates than standard Certificates of Deposit (CDs) but carry the risk of early redemption by the issuer, which can limit potential earnings compared to Money Market Accounts (MMAs) that provide more liquidity and flexible access to funds. Unlike MMAs, Callable CDs lock in funds for a set term but may be called before maturity, making them suitable for investors seeking higher yields with moderate risk tolerance.

Limited Check Writing

Limited check writing on Money Market Accounts (MMAs) provides flexible access to funds with a modest number of transactions allowed per month, unlike Certificates of Deposit (CDs) which restrict withdrawals until maturity to avoid penalties. This distinction makes MMAs preferable for liquidity and limited check-writing, while CDs offer higher interest rates with limited or no check-writing features.

Compounding Frequency

Compounding frequency directly impacts the interest earned on a Certificate of Deposit (CD) versus a Money Market Account (MMA), with CDs often compounding interest quarterly or monthly, leading to higher returns over fixed terms. Money Market Accounts typically compound interest daily or monthly, providing more liquidity but potentially lower overall yields compared to CDs.

Certificate of Deposit (CD) vs Money Market Account (MMA) Infographic

moneydif.com

moneydif.com