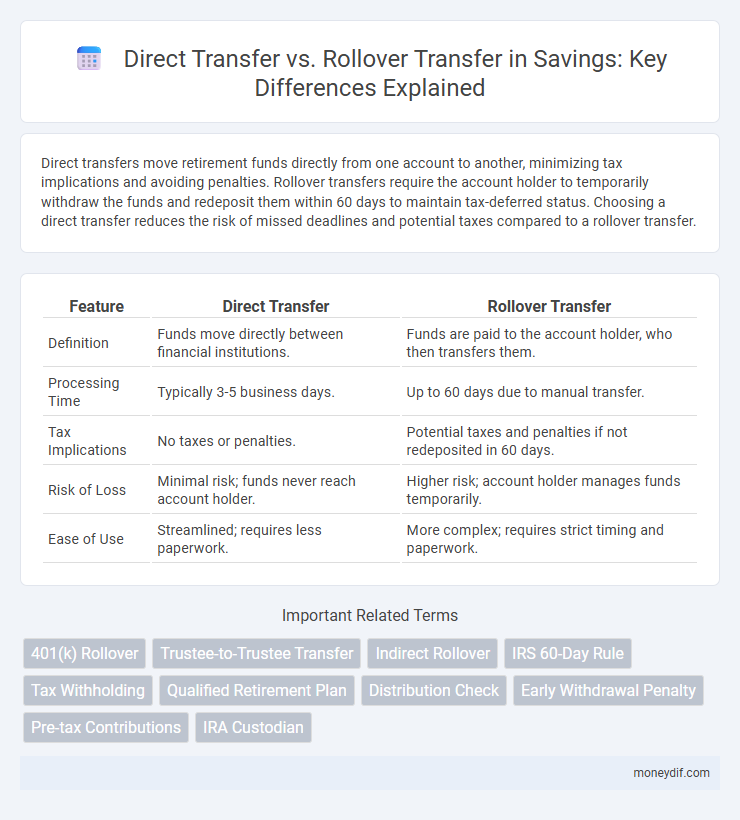

Direct transfers move retirement funds directly from one account to another, minimizing tax implications and avoiding penalties. Rollover transfers require the account holder to temporarily withdraw the funds and redeposit them within 60 days to maintain tax-deferred status. Choosing a direct transfer reduces the risk of missed deadlines and potential taxes compared to a rollover transfer.

Table of Comparison

| Feature | Direct Transfer | Rollover Transfer |

|---|---|---|

| Definition | Funds move directly between financial institutions. | Funds are paid to the account holder, who then transfers them. |

| Processing Time | Typically 3-5 business days. | Up to 60 days due to manual transfer. |

| Tax Implications | No taxes or penalties. | Potential taxes and penalties if not redeposited in 60 days. |

| Risk of Loss | Minimal risk; funds never reach account holder. | Higher risk; account holder manages funds temporarily. |

| Ease of Use | Streamlined; requires less paperwork. | More complex; requires strict timing and paperwork. |

Understanding Direct Transfers in Savings Accounts

Direct transfers in savings accounts involve moving funds directly between financial institutions without the account holder taking possession of the money, ensuring a seamless and secure transfer process. This method minimizes tax implications and avoids potential withholding penalties compared to rollovers, which typically require the account holder to temporarily handle the funds. Understanding direct transfers is crucial for maintaining the tax-advantaged status of savings accounts like IRAs and avoiding unnecessary delays or errors in fund movement.

What Is a Rollover Transfer?

A rollover transfer involves moving funds from one retirement account to another without incurring taxes or penalties, provided the transfer occurs within 60 days. It allows savers to consolidate retirement savings while maintaining the tax-deferred status of their accounts. This type of transfer differs from a direct transfer, which moves funds directly between financial institutions without the account holder handling the money.

Key Differences Between Direct and Rollover Transfers

Direct transfers move funds directly from one retirement account to another without touching the account holder, minimizing tax implications and avoiding penalties. Rollover transfers involve withdrawing funds personally before depositing them into a new account, which must be completed within 60 days to prevent taxes and penalties. Direct transfers offer greater security and convenience, while rollovers provide flexibility but carry higher risk if deadlines are missed.

Advantages of Direct Transfers for Savers

Direct transfers offer savers enhanced security by moving funds directly between financial institutions without involving the account holder, reducing the risk of errors or unauthorized access. These transfers also streamline the process, eliminating IRS withholding taxes that can apply to rollovers taken as distributions. Savers benefit from immediate fund availability, ensuring continuous tax-deferred growth and avoiding potential penalties or delays often associated with rollover transfers.

Benefits of Choosing a Rollover Transfer

A rollover transfer allows savers to move retirement funds from one account to another without triggering taxes or penalties, preserving the full value of their savings. This method maintains the tax-advantaged status of retirement accounts like IRAs and 401(k)s while providing flexibility to consolidate funds for better management. Investors benefit from continued tax-deferred growth and simplified record-keeping, enhancing long-term savings efficiency.

Tax Implications: Direct vs. Rollover Transfers

Direct transfers between retirement accounts avoid immediate tax consequences by moving funds directly from one custodian to another, preserving the tax-deferred status of the savings. Rollover transfers, if not completed within 60 days, can trigger taxable income and potential early withdrawal penalties. Understanding IRS rules on rollovers ensures savers minimize tax liabilities and maintain retirement funds' growth potential.

Common Mistakes to Avoid During Transfers

Avoiding common mistakes during direct and rollover transfers is crucial for preserving savings and maintaining tax advantages. Failing to initiate a direct transfer can lead to unintentional distributions subject to taxes and early withdrawal penalties, while incorrect rollover timing may result in missed tax deadlines or double taxation. Ensuring accurate account information and adhering to IRS guidelines prevent costly transfer errors and secure seamless retirement fund management.

Which Transfer Method Suits Your Savings Goals?

Direct transfers move funds directly between financial institutions, minimizing tax risks and penalties, making them ideal for long-term savings growth and retirement plans. Rollover transfers involve withdrawing the funds first, which may trigger taxes and potential penalties if not completed within 60 days, suitable for investors needing short-term access or flexibility. Evaluating your savings goals, liquidity needs, and tax implications will help determine the best transfer method for optimizing your financial strategy.

Step-by-Step Guide: How to Execute Each Transfer

To execute a direct transfer, start by contacting your current financial institution to obtain the necessary transfer forms, then provide details of the receiving account, and authorize the transfer, which typically takes 3-7 business days. For a rollover transfer, initiate a distribution request from your original retirement account, deposit the funds into the new account within 60 days to avoid tax penalties, and complete any required paperwork for the receiving plan administrator. Both methods require careful documentation to ensure compliance with IRS rules and to maintain tax-deferred status.

Frequently Asked Questions on Savings Transfers

Direct transfer moves retirement savings directly between financial institutions, avoiding tax penalties and keeping funds invested without interruption. Rollover transfer requires the account holder to temporarily manage the funds before depositing into a new account, with a 60-day deadline to avoid taxes and potential penalties. Investors frequently ask about timing, tax implications, and eligibility criteria for both methods to maximize savings efficiency.

Important Terms

401(k) Rollover

A 401(k) rollover is the process of moving retirement savings from one plan to another, with direct transfers involving funds moving directly between accounts without touching the account holder, minimizing tax risks. Rollover transfers can involve the account holder receiving the distribution and then depositing it into a new plan within 60 days, which carries potential tax withholding and penalties if not completed timely.

Trustee-to-Trustee Transfer

Trustee-to-Trustee Transfer involves moving retirement funds directly from one financial institution to another, minimizing tax implications and avoiding early withdrawal penalties. Unlike Rollover Transfers, where the account holder briefly holds the funds before redepositing, Direct Transfers ensure seamless asset movement, reducing the risk of tax withholding and maintaining the account's tax-deferred status.

Indirect Rollover

Indirect rollover involves withdrawing funds from a retirement account and then redepositing them into another within 60 days to avoid taxes, whereas direct transfer moves assets between accounts without the investor ever taking possession, minimizing tax risks and penalties. Choosing direct transfer over rollover transfer ensures seamless fund movement, reduces the chance of missing the 60-day deadline, and preserves the tax-deferred status of retirement savings.

IRS 60-Day Rule

The IRS 60-Day Rule mandates that taxpayers complete a rollover transfer within 60 days to avoid taxes and penalties, ensuring funds from retirement accounts like IRAs are reinvested timely. Direct transfers between financial institutions bypass this timeframe, allowing seamless movement of assets without triggering the 60-day countdown or tax consequences.

Tax Withholding

Tax withholding on direct transfers involves funds moving directly from one retirement account to another without the owner receiving the money, typically avoiding mandatory withholding taxes. In rollover transfers where the account owner receives the funds first, failure to complete the rollover within 60 days results in the distribution being subject to income tax withholding and potential early withdrawal penalties.

Qualified Retirement Plan

A Qualified Retirement Plan allows participants to move retirement assets through a Direct Transfer, which moves funds directly between financial institutions without tax consequences, or a Rollover Transfer, where the account holder receives the funds temporarily and must deposit them into another qualified plan within 60 days to avoid taxes and penalties. Understanding the distinctions helps investors maintain tax-deferred status and avoid mandatory withholding or early distribution penalties.

Distribution Check

Distribution checks issued during a Direct Transfer bypass tax withholding by moving funds directly between retirement accounts, preserving the account's tax-deferred status. Rollover Transfers require the recipient to deposit the distribution within 60 days to avoid taxes and potential penalties, making timely handling critical.

Early Withdrawal Penalty

Early withdrawal penalties typically apply when funds are withdrawn from retirement accounts before age 59 1/2, whereas direct transfers and rollover transfers avoid these penalties by moving assets between qualified accounts without triggering taxable events. Direct transfers move funds directly between financial institutions, ensuring no tax withholding, while rollover transfers involve the account holder temporarily receiving funds before redepositing within 60 days to maintain penalty-free status.

Pre-tax Contributions

Pre-tax contributions moved via direct transfer preserve tax-deferred status by transferring funds directly between retirement accounts without triggering taxable events or penalties. Rollover transfers, while also maintaining tax advantages, require careful adherence to IRS guidelines to avoid taxes and potential early withdrawal penalties within a 60-day window.

IRA Custodian

An IRA custodian facilitates both Direct Transfers and Rollover Transfers, where Direct Transfers move funds directly between retirement accounts without triggering taxes or penalties, while Rollovers require the account holder to receive the funds before redepositing within 60 days to avoid tax consequences. Understanding IRS rules governing custodians ensures compliant transfers and preserves tax advantages.

Direct Transfer vs Rollover Transfer Infographic

moneydif.com

moneydif.com