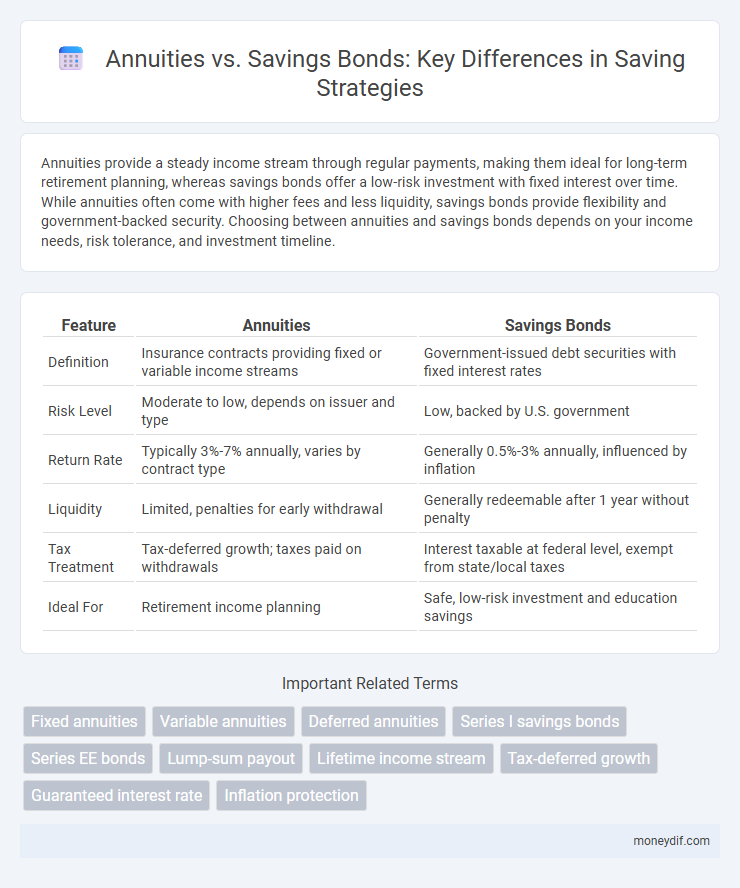

Annuities provide a steady income stream through regular payments, making them ideal for long-term retirement planning, whereas savings bonds offer a low-risk investment with fixed interest over time. While annuities often come with higher fees and less liquidity, savings bonds provide flexibility and government-backed security. Choosing between annuities and savings bonds depends on your income needs, risk tolerance, and investment timeline.

Table of Comparison

| Feature | Annuities | Savings Bonds |

|---|---|---|

| Definition | Insurance contracts providing fixed or variable income streams | Government-issued debt securities with fixed interest rates |

| Risk Level | Moderate to low, depends on issuer and type | Low, backed by U.S. government |

| Return Rate | Typically 3%-7% annually, varies by contract type | Generally 0.5%-3% annually, influenced by inflation |

| Liquidity | Limited, penalties for early withdrawal | Generally redeemable after 1 year without penalty |

| Tax Treatment | Tax-deferred growth; taxes paid on withdrawals | Interest taxable at federal level, exempt from state/local taxes |

| Ideal For | Retirement income planning | Safe, low-risk investment and education savings |

Understanding Annuities and Savings Bonds

Annuities provide a steady income stream through contracts with insurance companies, often used for retirement planning, while savings bonds are government-issued securities that offer fixed interest over time. Understanding the differences in risk, liquidity, and tax implications is crucial when choosing between annuities and savings bonds for long-term savings. Annuities typically involve higher fees and less liquidity compared to the more flexible and low-risk nature of savings bonds.

Key Differences Between Annuities and Savings Bonds

Annuities provide a contract-based investment with periodic payments, often offering tax-deferred growth and guaranteed income streams, whereas savings bonds are government-issued debt securities that earn fixed interest over a set term. Annuities typically involve higher fees and complexity compared to the low-risk, low-fee nature of savings bonds, which are backed by the U.S. Treasury. Key differences include liquidity constraints, risk profiles, and income predictability, with annuities catering to retirement income planning and savings bonds focusing on secure, steady capital preservation.

How Annuities Work

Annuities function as financial contracts sold by insurance companies that provide periodic payments in exchange for an initial lump sum or series of payments, offering a steady income stream, often for retirement. The principal grows tax-deferred, allowing earnings to accumulate without immediate tax consequences until withdrawal. Unlike savings bonds, which typically yield interest based on government-set rates, annuities feature customizable payout options, including fixed, variable, or indexed returns tailored to risk tolerance and financial goals.

How Savings Bonds Operate

Savings bonds are government-issued debt securities that allow investors to loan money to the government in exchange for fixed interest over a set period. They increase in value over time through interest accrual, which is typically tax-deferred until redemption or maturity. Unlike annuities, savings bonds offer low-risk returns backed by the full faith and credit of the issuing government, making them a secure savings vehicle.

Risk Comparison: Annuities vs Savings Bonds

Annuities carry higher risk due to market fluctuations and potential insurance company insolvency, whereas savings bonds offer virtually risk-free government-backed security. Savings bonds provide fixed interest rates and guaranteed principal protection, making them ideal for conservative investors seeking stable returns. Evaluating risk tolerance is crucial when choosing between the variable income of annuities and the low-risk nature of savings bonds.

Interest Rates and Returns

Annuities offer fixed or variable interest rates that can provide steady income over time, often with higher returns than traditional savings bonds. Savings bonds typically have lower risk and guaranteed, but modest, interest rates backed by the U.S. Treasury, resulting in more conservative returns. Comparing these options depends on an investor's risk tolerance, with annuities potentially delivering higher long-term yields while savings bonds emphasize safety and liquidity.

Liquidity and Accessibility

Annuities typically have limited liquidity, often imposing surrender charges or penalties for early withdrawals, which can restrict access to funds before maturity. Savings bonds offer greater accessibility by allowing partial redemptions after a minimum holding period, typically one year, with full liquidity after five years without penalties. Investors seeking flexible access to their funds often prefer savings bonds due to these liquidity advantages.

Tax Implications of Both Options

Annuities offer tax-deferred growth, meaning taxes on earnings are postponed until withdrawals begin, which can result in higher taxable income during retirement. Savings bonds like Series EE and I bonds provide tax benefits by allowing interest to accumulate tax-free until redemption, and may be exempt from state and local taxes. Understanding these differences in tax treatment is crucial for optimizing after-tax returns and aligning investments with long-term financial goals.

Which Is Better for Long-Term Savings?

Annuities offer guaranteed income streams and tax deferral, making them ideal for long-term retirement planning with steady payouts. Savings bonds provide low-risk investment with tax benefits on federal interest, but they typically yield lower returns compared to annuities over extended periods. Choosing between annuities and savings bonds depends on individual goals for income stability versus liquidity and growth potential in long-term savings.

Choosing the Right Option for Your Financial Goals

Annuities provide a steady income stream, making them ideal for long-term retirement planning and predictable cash flow needs. Savings bonds offer lower risk with tax advantages and flexibility, perfect for conservative investors seeking secure, government-backed returns. Assess your risk tolerance, investment horizon, and income requirements to determine whether the guaranteed income of annuities or the stability of savings bonds aligns better with your financial goals.

Important Terms

Fixed annuities

Fixed annuities offer guaranteed interest rates and steady income streams, making them a stable alternative to savings bonds that typically provide lower but government-backed returns. Unlike savings bonds, fixed annuities often have longer lock-in periods and tax-deferred growth, appealing to investors seeking predictable retirement income.

Variable annuities

Variable annuities offer tax-deferred growth and the potential for higher returns through investment in sub-accounts, compared to the fixed interest payments of savings bonds. Unlike savings bonds, variable annuities provide lifetime income options and customizable investment choices, but they often involve higher fees and market risk.

Deferred annuities

Deferred annuities offer tax-deferred growth and guaranteed lifetime income, making them a more secure long-term retirement option compared to savings bonds, which provide fixed interest but lack income longevity features.

Series I savings bonds

Series I Savings Bonds offer inflation-protected returns with tax advantages, making them a low-risk alternative to traditional annuities for long-term savings and income planning.

Series EE bonds

Series EE bonds offer fixed interest rates guaranteed to double in value in 20 years, providing a low-risk alternative to annuities for long-term savings growth.

Lump-sum payout

A lump-sum payout from annuities provides immediate access to a large amount of money, often after a series of scheduled payments, whereas savings bonds offer interest accumulation over time with redemption flexibility but typically do not provide structured periodic payments. Annuities are designed for long-term income generation and tax deferral, while savings bonds focus on capital preservation and steady, low-risk growth.

Lifetime income stream

Lifetime income streams from annuities provide guaranteed periodic payments for life, whereas savings bonds offer fixed interest returns without lifelong income assurance.

Tax-deferred growth

Tax-deferred growth in annuities allows investment earnings to compound without immediate taxation, often yielding higher long-term returns compared to savings bonds, which are taxed annually on interest income.

Guaranteed interest rate

Guaranteed interest rates on annuities typically exceed those offered by U.S. Savings Bonds, providing more predictable long-term growth for retirement income.

Inflation protection

Annuities offer stronger inflation protection than savings bonds by providing potential cost-of-living adjustments and lifetime income streams that maintain purchasing power over time.

Annuities vs Savings bonds Infographic

moneydif.com

moneydif.com