Micro-savings involve setting aside small amounts of money regularly, which can accumulate over time to build a financial cushion without causing significant strain on daily budgets. Macro-savings refer to larger, less frequent deposits aimed at long-term goals such as retirement or major investments, offering more substantial growth potential through compound interest. Balancing micro-savings with macro-savings strategies ensures steady financial progress and enhanced security.

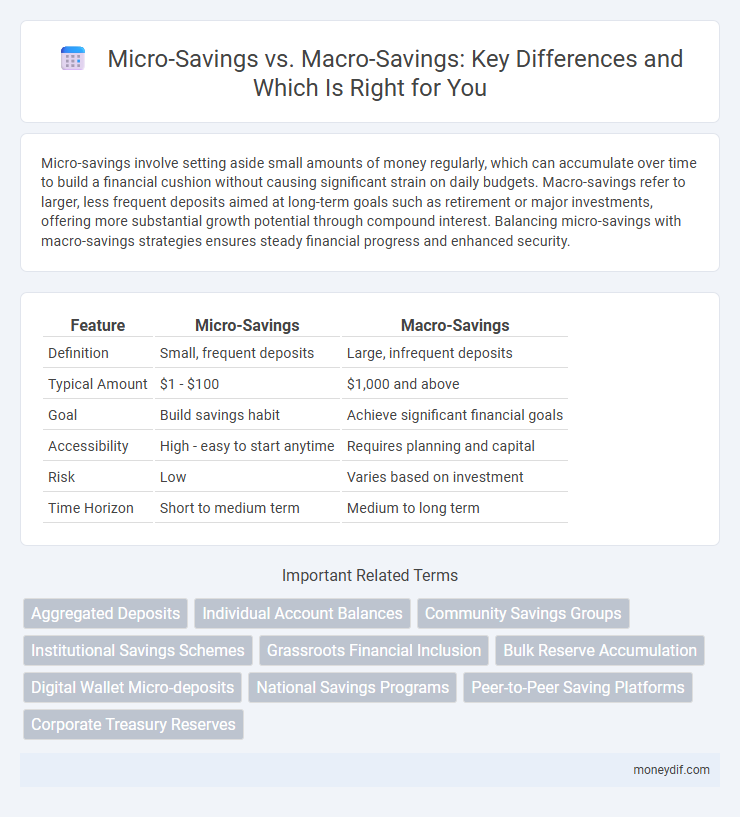

Table of Comparison

| Feature | Micro-Savings | Macro-Savings |

|---|---|---|

| Definition | Small, frequent deposits | Large, infrequent deposits |

| Typical Amount | $1 - $100 | $1,000 and above |

| Goal | Build savings habit | Achieve significant financial goals |

| Accessibility | High - easy to start anytime | Requires planning and capital |

| Risk | Low | Varies based on investment |

| Time Horizon | Short to medium term | Medium to long term |

Understanding Micro-savings: Small Steps, Big Impact

Micro-savings involve setting aside small amounts of money regularly, which can accumulate significantly over time and build a strong financial foundation. This approach promotes consistent saving habits, making it easier to manage cash flow and avoid financial stress. Emphasizing micro-savings empowers individuals to achieve long-term financial goals through manageable, incremental contributions.

What Are Macro-savings? Building Large Financial Buffers

Macro-savings refer to substantial amounts of money accumulated over time to create significant financial buffers that support long-term goals such as retirement, buying a home, or funding education. These savings involve strategic planning, consistent contributions, and often include investments in assets like stocks, bonds, or real estate to grow wealth. Building macro-savings ensures financial security and resilience against major unexpected expenses or economic downturns.

Key Differences Between Micro-savings and Macro-savings

Micro-savings involve small, frequent deposits that accumulate over time, typically managed through digital platforms or informal methods, targeting low-income individuals aiming for short-term financial goals. Macro-savings refer to large, less frequent deposits often handled by formal financial institutions, focusing on long-term wealth building and investment strategies for higher-income groups. Key differences include the scale of savings, frequency of deposits, accessibility, and the financial instruments used to manage and grow these funds.

Benefits of Micro-savings for Everyday Life

Micro-savings enable individuals to build a financial cushion through small, regular deposits, making saving accessible and manageable without disrupting daily expenses. These incremental savings enhance financial resilience by covering unexpected costs and reducing reliance on credit. Emphasizing micro-savings promotes consistent saving habits that contribute to long-term financial stability and improved money management in everyday life.

Advantages of Macro-savings for Long-term Goals

Macro-savings provide significant advantages for long-term goals by enabling larger capital accumulation and benefiting from compound interest over extended periods. These savings strategies often involve higher-yield investment vehicles such as bonds, mutual funds, or retirement accounts, which enhance wealth growth potential. Consistent macro-saving habits support financial stability, helping individuals achieve major objectives like homeownership, education funding, or retirement planning.

Challenges Associated with Micro-savings

Micro-savings face significant challenges such as the difficulty in maintaining consistent saving habits due to low income levels and limited financial literacy among users. High transaction costs and limited access to formal financial institutions also hinder the effectiveness of micro-savings programs. These barriers reduce the potential for micro-savings to accumulate into substantial financial security compared to macro-savings.

Common Obstacles in Macro-savings Strategies

Macro-savings strategies often face obstacles such as insufficient financial literacy, high living expenses, and inconsistent income streams, which hinder long-term wealth accumulation. Large-scale savings plans may also encounter challenges like economic volatility and limited access to investment opportunities. Overcoming these barriers requires targeted education, budget optimization, and diversified saving instruments to enhance financial resilience.

Micro-savings Tools and Apps: Making Saving Easier

Micro-savings tools and apps simplify the saving process by enabling users to save small amounts frequently, often through automatic transfers or rounding up everyday purchases. Popular platforms like Acorns, Digit, and Qapital integrate with bank accounts to help users build savings effortlessly without large upfront deposits. These digital solutions leverage behavioral finance principles to encourage consistent saving habits, making financial goals more attainable for individuals with limited disposable income.

When to Choose Micro-savings vs Macro-savings

Micro-savings are ideal for individuals seeking to build an emergency fund or maintain daily financial flexibility by saving small amounts frequently. Macro-savings suit long-term financial goals such as retirement, purchasing property, or funding education, requiring larger, disciplined contributions over time. Choosing between micro and macro savings depends on the urgency, amount, and purpose of the financial goal.

Integrating Micro and Macro-savings for Financial Security

Integrating micro-savings and macro-savings strategies enhances financial security by balancing immediate liquidity with long-term growth. Micro-savings, involving frequent small deposits, build disciplined saving habits and provide emergency funds, while macro-savings focus on larger, strategic investments like retirement accounts and property. This combined approach ensures both short-term financial resilience and sustainable wealth accumulation, optimizing overall financial stability.

Important Terms

Aggregated Deposits

Aggregated deposits reflect the combined total of micro-savings from individual households and macro-savings from corporate and institutional investors, highlighting the diverse sources of financial capital within an economy.

Individual Account Balances

Individual account balances in micro-savings typically remain low and frequent, promoting incremental financial growth, whereas macro-savings accounts generally hold larger sums accumulated over extended periods, emphasizing long-term wealth building. Micro-savings benefit from high transaction frequency and accessibility, while macro-savings focus on substantial capital accumulation with potentially higher interest rates.

Community Savings Groups

Community Savings Groups foster micro-savings by enabling members to pool small, regular contributions that accumulate into accessible funds for individual or collective needs. These groups contrast with macro-savings strategies by emphasizing localized, grassroots financial empowerment rather than large-scale institutional capital accumulation.

Institutional Savings Schemes

Institutional savings schemes enhance financial inclusion by providing tailored micro-savings options for low-income individuals while supporting macro-savings goals through large-scale institutional funds.

Grassroots Financial Inclusion

Grassroots financial inclusion empowers low-income individuals through micro-savings, fostering economic stability and bridging gaps often overlooked by traditional macro-savings systems.

Bulk Reserve Accumulation

Bulk reserve accumulation refers to the strategic gathering of large financial reserves aimed at ensuring long-term economic stability, typically associated with macro-savings held by governments or large institutions. Micro-savings involve smaller, frequent contributions by individuals or households that collectively support bulk reserve growth, bridging everyday financial management with substantial economic buffers.

Digital Wallet Micro-deposits

Digital wallet micro-deposits facilitate incremental micro-savings by enabling users to deposit small amounts frequently, contrasting macro-savings which involve larger, less frequent deposits for long-term financial goals.

National Savings Programs

National Savings Programs enhance financial inclusion by promoting micro-savings among low-income individuals and encouraging macro-savings to support large-scale economic growth.

Peer-to-Peer Saving Platforms

Peer-to-peer saving platforms facilitate micro-savings by enabling small, frequent contributions among users, contrasting with traditional macro-savings that involve larger, less frequent deposits typically managed by centralized financial institutions.

Corporate Treasury Reserves

Corporate treasury reserves strategically balance micro-savings from operational cash flows and macro-savings derived from large-scale financial planning to optimize liquidity and risk management.

Micro-savings vs Macro-savings Infographic

moneydif.com

moneydif.com