A sweep account automatically transfers excess funds into higher-interest investments, maximizing returns without manual effort, while a linked account requires manual transfers between checking and savings to manage funds. Sweep accounts optimize cash flow by minimizing idle balances, whereas linked accounts offer straightforward control but may miss out on potential interest gains. Choosing between them depends on the preference for automation versus direct account management in savings strategies.

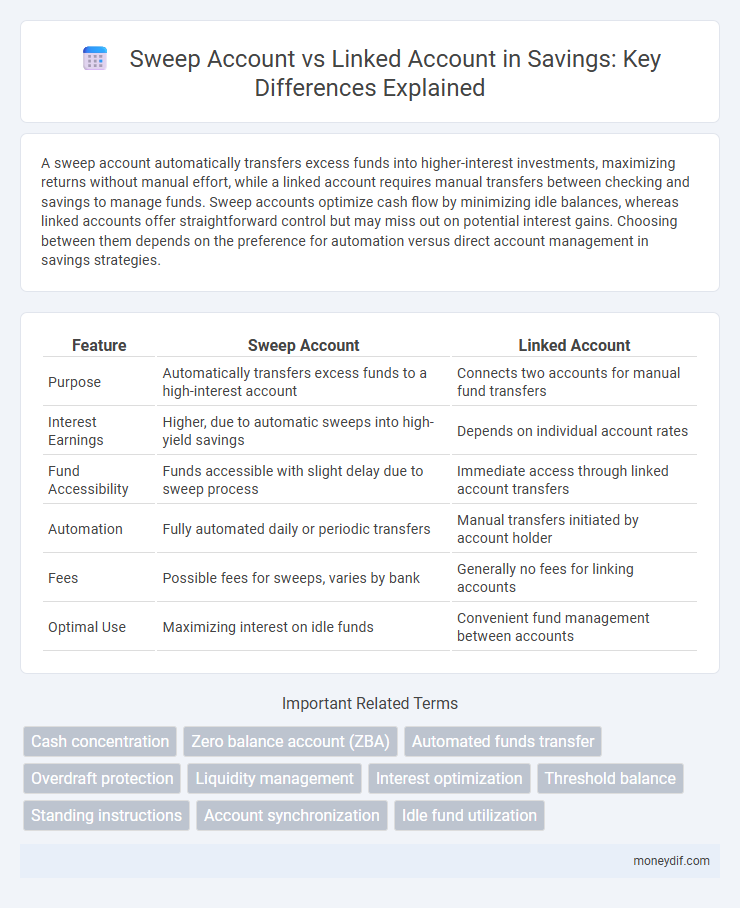

Table of Comparison

| Feature | Sweep Account | Linked Account |

|---|---|---|

| Purpose | Automatically transfers excess funds to a high-interest account | Connects two accounts for manual fund transfers |

| Interest Earnings | Higher, due to automatic sweeps into high-yield savings | Depends on individual account rates |

| Fund Accessibility | Funds accessible with slight delay due to sweep process | Immediate access through linked account transfers |

| Automation | Fully automated daily or periodic transfers | Manual transfers initiated by account holder |

| Fees | Possible fees for sweeps, varies by bank | Generally no fees for linking accounts |

| Optimal Use | Maximizing interest on idle funds | Convenient fund management between accounts |

Understanding Sweep Accounts: An Overview

Sweep accounts automatically transfer excess funds from a primary account to a higher-interest savings or investment account, optimizing cash flow and maximizing returns. These accounts reduce idle balances, ensuring funds are efficiently utilized while maintaining liquidity for daily transactions. Linked accounts connect a savings account to a checking account, enabling overdraft protection and easy transfers but typically lack the automated fund optimization features of sweep accounts.

What Is a Linked Account?

A linked account is a financial account connected to a primary account, enabling seamless transfers and consolidated management of funds. Unlike a sweep account, which automatically transfers excess balances to optimize interest earnings, a linked account requires manual transfers for managing liquidity. Linked accounts enhance flexibility by providing easy access to funds across multiple accounts without automatic movement of money.

Key Differences Between Sweep and Linked Accounts

Sweep accounts automatically transfer excess funds from a primary account to a high-interest savings or investment account, maximizing earnings without manual intervention. Linked accounts connect multiple bank accounts, allowing easy transfers and overdraft protection but do not typically offer automatic optimization of balances. The key difference lies in sweep accounts actively managing funds to boost returns, whereas linked accounts primarily facilitate seamless access and liquidity between accounts.

Interest Earnings: Sweep vs Linked Accounts

Sweep accounts automatically transfer excess funds into higher-interest savings or investment accounts, maximizing interest earnings by optimizing idle balances. Linked accounts often require manual transfers and typically offer lower interest rates, resulting in less efficient growth of savings. Utilizing sweep accounts enhances liquidity while ensuring higher returns compared to standard linked savings options.

Liquidity and Access to Funds Comparison

Sweep accounts automatically transfer excess funds from checking to savings to optimize liquidity while maintaining easy access, reducing idle cash without sacrificing availability. Linked accounts provide direct transfer capabilities between checking and savings but may require manual movement of funds, potentially delaying immediate access. Sweep accounts enhance cash flow efficiency by balancing interest earnings with instant fund availability, whereas linked accounts prioritize simple access at the expense of automatic liquidity management.

Risk Management: Which Is Safer?

Sweep accounts automatically transfer excess funds into higher-interest investments, minimizing idle cash but exposing funds to market fluctuations and potential liquidity risks. Linked accounts provide direct access to checking accounts with immediate fund availability, reducing exposure to market volatility but offering lower interest returns. For risk management, linked accounts are generally safer due to guaranteed access and FDIC insurance coverage, while sweep accounts carry higher financial risk despite better growth potential.

Automation Features and User Convenience

Sweep accounts automate the transfer of excess funds between checking and savings to maximize interest earnings without manual intervention. Linked accounts provide seamless access between multiple accounts, offering convenience for transfers but often require user initiation. Sweep accounts prioritize automation to optimize savings efficiency, while linked accounts emphasize easy access and flexible funds management.

Fees and Maintenance Costs Explained

Sweep accounts typically incur higher fees due to automatic transfers between checking and savings to maintain minimum balances, while linked accounts often have lower maintenance costs as they simply connect existing accounts without frequent movements. Sweep accounts may charge transaction or service fees each time funds are swept, whereas linked accounts usually avoid these fees but might impose penalties for overdrafts or insufficient funds. Choosing between the two depends on frequency of transfers and sensitivity to fee structures, with sweep accounts appealing to those seeking automated balance optimization despite potential higher costs.

Suitability: Who Should Choose Which Account?

Sweep accounts suit businesses and high-net-worth individuals who need automatic transfers to optimize cash flow and maximize interest on idle funds. Linked accounts work well for everyday users seeking seamless access between checking and savings without complex automation. Choosing depends on the need for automated fund management versus simple transactional convenience.

Making the Right Choice: Sweep or Linked Account?

Choosing between a sweep account and a linked account depends on your savings goals and cash flow needs. Sweep accounts automatically transfer excess funds into higher-interest investments, maximizing returns without sacrificing liquidity, while linked accounts offer easy transfers between checking and savings but typically lack automated investment features. Prioritize a sweep account if optimizing interest earnings is your priority; opt for a linked account to maintain straightforward access and manual control over transfers.

Important Terms

Cash concentration

Cash concentration optimizes liquidity by automatically transferring funds from multiple accounts into a single master account, often utilizing sweep accounts that move excess balances overnight to maximize interest or reduce borrowing costs. Linked accounts provide a simpler, manual or limited-transfer setup connecting checking and savings accounts for basic fund movement without the automated consolidation benefits of cash concentration or sweep mechanisms.

Zero balance account (ZBA)

Zero Balance Account (ZBA) automates fund management by maintaining a zero balance and transferring funds from a master account to cover transactions, enhancing cash flow efficiency. Unlike Linked Accounts, which merely share funds between separate accounts, ZBA integrates with Sweep Accounts to dynamically shift surplus funds, maximizing liquidity while minimizing idle cash across multiple accounts.

Automated funds transfer

Automated funds transfer enables seamless movement of money between a sweep account and a linked account, optimizing cash flow management by automatically transferring excess funds to interest-bearing sweep accounts while maintaining liquidity in linked checking accounts. This system reduces manual intervention, enhances liquidity utilization, and ensures funds are efficiently allocated based on predefined thresholds set by the account holder or financial institution.

Overdraft protection

Overdraft protection commonly utilizes sweep accounts to automatically transfer funds from a linked account, such as a savings or checking account, to cover transactions exceeding the available balance. Sweep accounts optimize cash flow by minimizing overdraft fees through real-time fund transfers, whereas linked accounts provide a more manual or static backup option with potentially delayed availability of funds.

Liquidity management

Liquidity management involves optimizing cash flow by efficiently utilizing sweep accounts, which automatically transfer excess funds to higher-interest accounts, compared to linked accounts that provide manual control over fund transfers between primary and secondary accounts. Sweep accounts enhance short-term liquidity by maximizing interest earnings and reducing idle balances, while linked accounts offer greater flexibility but may require more active monitoring and management.

Interest optimization

Interest optimization between sweep accounts and linked accounts hinges on maximizing returns by automatically transferring excess funds; sweep accounts often provide higher interest rates by moving surplus balances into interest-bearing investment options, while linked accounts offer convenience and liquidity with typically lower interest benefits. Businesses and individuals seeking to enhance cash flow efficiency should analyze daily balance thresholds, transaction frequency, and interest compounding methods to determine the best solution for optimizing earnings.

Threshold balance

Threshold balance in a sweep account determines the minimum or maximum balance before funds are automatically transferred to or from a linked account to optimize cash flow and maximize interest earnings. Unlike linked accounts, which provide direct access for transactions, sweep accounts actively manage funds to maintain the threshold balance and improve liquidity management.

Standing instructions

Standing instructions automate scheduled fund transfers between accounts, enhancing financial management efficiency. Sweep accounts automatically transfer excess funds to maximize interest earnings, while linked accounts allow manual or standing instruction-driven transfers without automatic balance sweeps.

Account synchronization

Account synchronization between Sweep accounts and Linked accounts enables automated fund transfers and real-time balance updates, ensuring accurate financial management across platforms. Sweep accounts optimize liquidity by automatically moving excess funds to Linked accounts, which serve as primary transaction points for everyday expenses and payments.

Idle fund utilization

Idle fund utilization improves cash management by automatically transferring surplus balances from a linked account to a sweep account, optimizing interest earnings and minimizing idle cash. Sweep accounts systematically invest excess funds into higher-yield instruments, whereas linked accounts facilitate easy fund transfers without necessarily enhancing interest income.

Sweep account vs Linked account Infographic

moneydif.com

moneydif.com