Annual Percentage Yield (APY) reflects the real rate of return on an investment by including the effect of compounding interest, whereas Annual Percentage Rate (APR) represents the simple interest rate without compounding. Understanding the difference between APY and APR is crucial for maximizing savings, as APY provides a more accurate picture of potential earnings over time. Savers should compare APY values when choosing savings accounts to ensure they benefit from the highest effective yield.

Table of Comparison

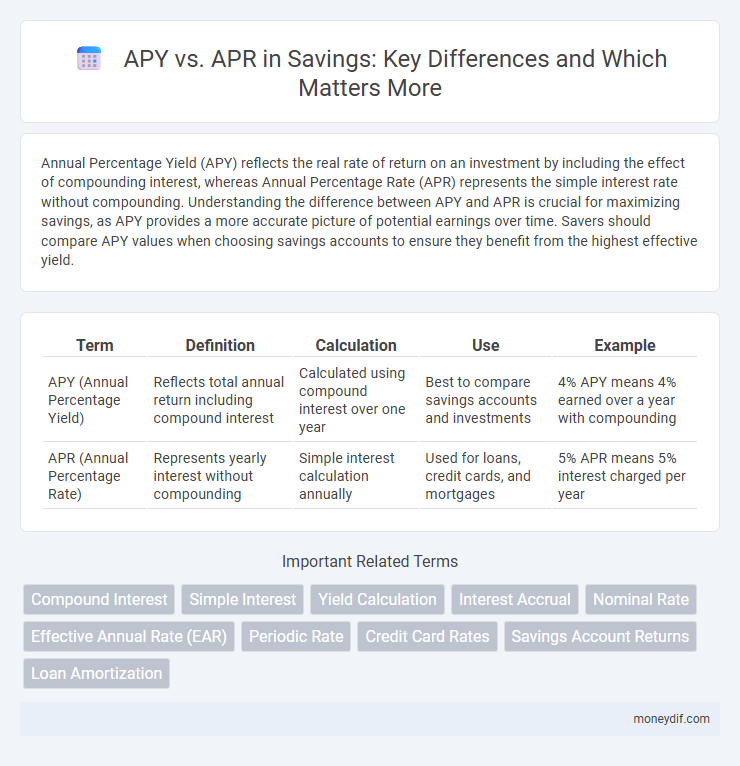

| Term | Definition | Calculation | Use | Example |

|---|---|---|---|---|

| APY (Annual Percentage Yield) | Reflects total annual return including compound interest | Calculated using compound interest over one year | Best to compare savings accounts and investments | 4% APY means 4% earned over a year with compounding |

| APR (Annual Percentage Rate) | Represents yearly interest without compounding | Simple interest calculation annually | Used for loans, credit cards, and mortgages | 5% APR means 5% interest charged per year |

Understanding APY and APR: Key Differences

APY (Annual Percentage Yield) reflects the actual earned interest on savings, accounting for compound interest, while APR (Annual Percentage Rate) denotes the yearly cost of borrowing or interest without compounding. APY provides a more accurate measure of the growth potential of savings accounts or investments, making it essential for comparing yields. Understanding the distinction between APY and APR helps savers optimize returns and make informed financial decisions.

How APY Impacts Your Savings Growth

APY (Annual Percentage Yield) accounts for compound interest, showing the true annual return on savings by including interest earned on previously accrued interest. APR (Annual Percentage Rate) reflects simple interest without compounding, making APY a more accurate measure of growth potential for savings accounts or investments. Choosing accounts with higher APY maximizes wealth accumulation over time by leveraging compounding effects.

APR Explained: What It Means for Your Finances

APR, or Annual Percentage Rate, represents the yearly cost of borrowing money, including interest and fees, expressed as a percentage. Understanding APR is crucial for comparing loan offers and managing personal finances, as it reflects the true cost beyond the nominal interest rate. Unlike APY, which accounts for compound interest, APR provides a straightforward measure of loan expense, helping consumers make informed decisions.

APY vs APR: Which Matters More for Savers?

APY (Annual Percentage Yield) reflects the actual interest earned on savings, including compound interest, making it more relevant for savers comparing accounts. APR (Annual Percentage Rate) measures simple interest without compounding and is commonly used for loans, thus less impactful on savings growth. Savers should prioritize APY to maximize returns and accurately assess interest earnings over time.

Calculating Returns: APY versus APR in Practice

Annual Percentage Yield (APY) reflects the total interest earned on an investment or savings account, including compounding effects, making it a more accurate measure of actual returns over a year. Annual Percentage Rate (APR) shows the simple interest earned or paid without compounding, often used for loans or credit calculations. Comparing APY and APR in practice reveals that higher compounding frequency increases APY, resulting in greater effective returns than indicated by APR alone.

Compounding Interest: Why APY Often Shows Higher Returns

APY (Annual Percentage Yield) accounts for compounding interest, meaning it calculates the effect of earning interest on both the initial principal and the accumulated interest over time. APR (Annual Percentage Rate) reflects only the simple interest rate without compounding, providing a lower return estimate. Compounding frequency, such as daily or monthly, significantly boosts APY, resulting in higher effective yields compared to APR.

Choosing Savings Accounts: APY Comparison Tips

When choosing savings accounts, prioritize APY as it reflects the true annual return including compound interest, unlike APR which only shows simple interest rates. Compare APYs across multiple banks to identify the highest yielding accounts, ensuring your savings grow faster over time. Pay close attention to compounding frequency and any fees that could affect the effective APY and overall savings growth.

Common Misconceptions About APY and APR

Many savers mistakenly believe APR (Annual Percentage Rate) and APY (Annual Percentage Yield) represent the same interest rates, but APR excludes compounding effects while APY includes them, showing true earned interest. Confusion often arises when comparing savings accounts or loans solely based on APR, ignoring how APY better reflects account growth over time. Understanding that APY accounts for compound interest is crucial for accurately assessing potential earnings.

How Banks Advertise APY and APR

Banks advertise APY (Annual Percentage Yield) to highlight the total interest earned on savings accounts, including compound interest, making it appear more attractive to potential customers. APR (Annual Percentage Rate) is often used in loan and credit products to show the yearly cost of borrowing without accounting for compounding. By emphasizing APY in marketing, banks effectively promote the growth potential of savings while APR provides a standardized measure for borrowing costs.

Maximizing Savings: Strategies Using APY and APR

Maximizing savings requires understanding the key differences between APY (Annual Percentage Yield) and APR (Annual Percentage Rate); APY accounts for compound interest, making it crucial for evaluating savings account growth, while APR reflects simple interest used for loan costs. Prioritizing high-APY accounts allows savers to benefit from interest compounding, significantly boosting returns over time. Evaluating APR on loans helps avoid excessive interest payments, preserving capital to invest in high-APY savings vehicles.

Important Terms

Compound Interest

Compound interest significantly increases investment growth by reinvesting earnings, which is captured more accurately by the Annual Percentage Yield (APY) compared to the Annual Percentage Rate (APR), as APY accounts for compounding effects while APR represents simple interest without compounding. Understanding the difference between APY and APR is crucial for evaluating loans, savings accounts, and investment products to optimize returns or costs effectively.

Simple Interest

Simple interest is calculated only on the principal amount, making it a straightforward method for determining interest costs or earnings, unlike APR and APY which incorporate compounding effects. APY (Annual Percentage Yield) reflects the actual annual return including compound interest, while APR (Annual Percentage Rate) represents the yearly cost of borrowing without compounding.

Yield Calculation

Yield calculation distinguishes APY (Annual Percentage Yield) from APR (Annual Percentage Rate) by factoring in compound interest, with APY representing the actual return on an investment over a year including compounding effects, while APR reflects the simple annual interest without compounding. Accurate yield assessment requires understanding that APY gives a more comprehensive measure of investment growth, essential for comparing savings accounts, loans, or other financial products.

Interest Accrual

Interest accrual refers to the process by which interest accumulates on a principal amount over time, with APY (Annual Percentage Yield) reflecting the total earned interest including compounding effects, while APR (Annual Percentage Rate) indicates the simple interest rate without compounding. Understanding the difference between APY and APR is essential for accurately comparing investment returns and loan costs, as APY provides a more comprehensive measure of actual earnings or expenses.

Nominal Rate

Nominal rate refers to the stated interest rate on a loan or investment, excluding the effects of compounding, while APY (Annual Percentage Yield) accounts for compound interest, reflecting the true annual return. APR (Annual Percentage Rate) includes fees and costs, representing the total cost of borrowing annually but does not incorporate compounding like APY does.

Effective Annual Rate (EAR)

Effective Annual Rate (EAR) quantifies the actual annual return on an investment or loan after accounting for compounding periods, making it a more accurate measure than Annual Percentage Rate (APR), which excludes compounding effects. Annual Percentage Yield (APY) is essentially synonymous with EAR, as both represent the true yearly interest earned, allowing investors to compare financial products effectively.

Periodic Rate

Periodic Rate refers to the interest rate applied to each compounding period within a year, essential for calculating the Annual Percentage Yield (APY), which reflects the actual annual return including compounding effects. Unlike the Annual Percentage Rate (APR), which represents a simple interest rate without compounding, the Periodic Rate directly influences how APY grows over time by accumulating interest more frequently.

Credit Card Rates

Credit card rates are primarily expressed through the Annual Percentage Rate (APR), which reflects the yearly cost of borrowing without compounding, whereas the Annual Percentage Yield (APY) includes compound interest and is more relevant for savings or investment accounts. Understanding the difference between APR and APY helps consumers compare credit card offers accurately, focusing on APR for credit purchases and cash advances to assess true borrowing costs.

Savings Account Returns

Savings account returns are typically expressed using Annual Percentage Yield (APY), which accounts for compound interest, providing a more accurate reflection of earnings compared to Annual Percentage Rate (APR) that only represents simple interest. Understanding the difference between APY and APR is crucial for comparing savings products effectively, as APY indicates the true growth of the investment over time.

Loan Amortization

Loan amortization calculates the gradual repayment of principal and interest over time, impacting the total amount paid throughout the loan term. Understanding the difference between APY (Annual Percentage Yield) and APR (Annual Percentage Rate) is crucial, as APR reflects the loan's nominal interest rate including fees, while APY accounts for compound interest, influencing the effective cost of borrowing in amortized loans.

APY vs APR Infographic

moneydif.com

moneydif.com