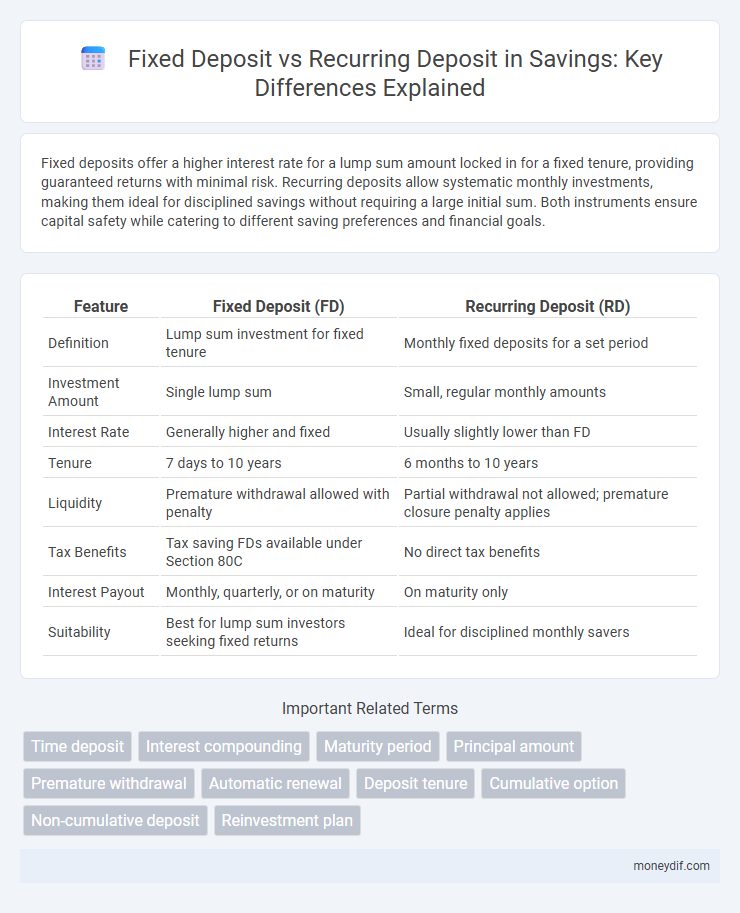

Fixed deposits offer a higher interest rate for a lump sum amount locked in for a fixed tenure, providing guaranteed returns with minimal risk. Recurring deposits allow systematic monthly investments, making them ideal for disciplined savings without requiring a large initial sum. Both instruments ensure capital safety while catering to different saving preferences and financial goals.

Table of Comparison

| Feature | Fixed Deposit (FD) | Recurring Deposit (RD) |

|---|---|---|

| Definition | Lump sum investment for fixed tenure | Monthly fixed deposits for a set period |

| Investment Amount | Single lump sum | Small, regular monthly amounts |

| Interest Rate | Generally higher and fixed | Usually slightly lower than FD |

| Tenure | 7 days to 10 years | 6 months to 10 years |

| Liquidity | Premature withdrawal allowed with penalty | Partial withdrawal not allowed; premature closure penalty applies |

| Tax Benefits | Tax saving FDs available under Section 80C | No direct tax benefits |

| Interest Payout | Monthly, quarterly, or on maturity | On maturity only |

| Suitability | Best for lump sum investors seeking fixed returns | Ideal for disciplined monthly savers |

Understanding Fixed Deposits and Recurring Deposits

Fixed deposits (FDs) offer a lump sum investment with a fixed interest rate for a predetermined tenure, providing higher returns compared to regular savings accounts. Recurring deposits (RDs) allow individuals to invest a fixed amount monthly, promoting disciplined saving habits while earning interest similar to FDs. Both options secure principal amounts and accrue compound interest, making them suitable for risk-averse investors seeking steady income.

Key Features of Fixed Deposits

Fixed deposits offer a fixed interest rate for a predetermined tenure, providing higher returns compared to regular savings accounts. They feature a lump-sum investment with a guaranteed maturity amount, making them ideal for risk-averse investors seeking capital protection. Unlike recurring deposits, fixed deposits do not require monthly contributions, simplifying investment management and ensuring consistent growth over the term.

Key Features of Recurring Deposits

Recurring deposits require regular monthly contributions, promoting disciplined savings habits with a fixed tenure and interest rate, which is usually compounded quarterly. They provide the flexibility to choose the deposit amount and tenure, making them ideal for individuals with a steady monthly income aiming for a specific financial goal. Pre-mature withdrawal of recurring deposits may attract penalties, but the fixed interest rate offers a predictable return compared to fluctuating market rates.

Interest Rate Comparison: FD vs RD

Fixed deposits (FDs) typically offer higher interest rates compared to recurring deposits (RDs), making them a preferred choice for investors seeking maximum returns on lump-sum investments. The interest rates on FDs fluctuate between 5.5% to 7.5% annually, depending on the bank and tenure, while RDs usually provide slightly lower rates, ranging from 5% to 7%. Investors prioritizing consistent savings with moderate returns often opt for RDs, while those with substantial funds prefer FDs for better interest earnings.

Flexibility and Tenure Options

Fixed deposits offer a fixed tenure ranging from 7 days to 10 years, providing higher interest rates but limited flexibility before maturity. Recurring deposits allow monthly contributions for periods between 6 months and 10 years, offering more flexible savings options with easy withdrawal in some banks. Choosing between fixed and recurring deposits depends on individual cash flow needs and preferred investment horizon.

Liquidity and Withdrawal Rules

Fixed deposits offer higher interest rates but restrict liquidity by locking funds for a fixed tenure, with premature withdrawal often incurring penalties. Recurring deposits provide greater flexibility by allowing regular monthly contributions and partial withdrawals without significant penalties. Understanding withdrawal rules and liquidity differences is essential for optimizing savings based on financial goals and cash flow needs.

Risk and Safety Factors

Fixed deposits offer higher safety with guaranteed returns backed by banks and fixed interest rates, minimizing risk for conservative investors. Recurring deposits carry similar safety due to bank guarantees but involve periodic contributions, offering flexibility but slightly higher risk related to missed payments or premature withdrawal penalties. Both options are considered low-risk, but fixed deposits provide stronger protection against market volatility and default.

Tax Implications for FD and RD

Fixed deposits attract Tax Deducted at Source (TDS) if interest income exceeds Rs40,000 annually, while recurring deposits are taxed similarly as per the individual's income tax slab. Interest earned on both FD and RD is added to the investor's total income and taxed accordingly, with no exemptions available. Senior citizens can benefit from a higher TDS exemption limit of Rs50,000 on fixed deposit interest income, but recurring deposits follow standard taxation norms.

Who Should Choose Fixed Deposits?

Fixed deposits are ideal for individuals seeking a guaranteed, higher interest rate with a lump sum investment and a fixed tenure. Retirees or salaried professionals aiming for capital protection and steady returns often prefer fixed deposits due to predictable maturity value and minimal risk. Those who have disposable income and do not require liquidity before maturity benefit most from fixed deposits compared to recurring deposits.

Who Should Opt for Recurring Deposits?

Individuals with a fixed monthly income seeking disciplined savings benefit from recurring deposits, as these accounts allow regular contributions over a specific tenure, maximizing interest accumulation. Recurring deposits suit salaried professionals, students, and small investors aiming to build a corpus without a lump sum initial investment. This savings option offers flexibility and steady growth, ideal for financial planning with moderate risk tolerance.

Important Terms

Time deposit

Time deposits, including fixed deposits and recurring deposits, offer secure investment options with guaranteed returns based on a fixed interest rate over a specified term. Fixed deposits involve lump-sum investments held for a set period, while recurring deposits require regular monthly contributions, both providing financial discipline and interest income.

Interest compounding

Interest compounding on fixed deposits typically occurs quarterly or annually, allowing the principal to grow faster due to higher compounding frequency and fixed tenure. In contrast, recurring deposits compound interest on monthly contributions, making them suitable for systematic savings but usually yielding lower overall compound interest compared to fixed deposits.

Maturity period

Fixed deposits typically offer a fixed maturity period ranging from 7 days to 10 years, allowing investors to select tenure based on their financial goals, whereas recurring deposits generally have a maturity period between 6 months and 10 years, requiring monthly contributions throughout the tenure. The maturity amount in fixed deposits is paid as a lump sum at the end, while recurring deposits pay the accumulated amount plus interest after the completion of the specified tenure.

Principal amount

The principal amount in a fixed deposit is a lump sum invested at the start of the tenure, earning a fixed interest rate until maturity, whereas in a recurring deposit, the principal accumulates gradually through periodic monthly installments, also earning fixed interest. Fixed deposits offer a larger initial principal and fixed tenure, while recurring deposits focus on disciplined savings with the principal building over time.

Premature withdrawal

Premature withdrawal from a fixed deposit typically incurs a penalty interest rate reduction, often around 0.5% to 1%, while recurring deposits may have lower or no penalties depending on the bank's policy. Fixed deposits offer higher interest rates for full term commitments, whereas recurring deposits provide flexibility for monthly contributions but may yield lower returns and face penalties if withdrawn early.

Automatic renewal

Automatic renewal in fixed deposits allows the principal and interest to be reinvested for the same tenure at the prevailing interest rate, ensuring uninterrupted growth, whereas recurring deposits typically require fresh deposits every month, and automatic renewal options may not be available, emphasizing the fixed deposit's advantage for seamless reinvestment. Choosing between fixed and recurring deposits depends on liquidity needs and investment discipline, with fixed deposits offering hassle-free automatic renewal and recurring deposits promoting systematic savings without automatic rollovers.

Deposit tenure

Deposit tenure for Fixed Deposits typically ranges from 7 days to 10 years, offering higher interest rates for longer terms with a one-time lump-sum investment. Recurring Deposits generally have flexible tenures between 6 months and 10 years, allowing periodic monthly deposits that accumulate interest over the chosen period.

Cumulative option

The cumulative option in fixed deposits allows interest to compound and get paid at maturity, leading to higher returns compared to recurring deposits where interest is typically paid out monthly or quarterly. Fixed deposits with cumulative interest are ideal for investors seeking a lump sum payout, while recurring deposits suit those preferring periodic interest income with smaller, regular investments.

Non-cumulative deposit

A non-cumulative deposit in fixed deposits means interest is paid out periodically without compounding, whereas recurring deposits typically accumulate interest that compounds quarterly, enhancing the maturity amount. Fixed deposits with non-cumulative interest suits investors seeking regular income, while recurring deposits focus on disciplined savings with compounded returns.

Reinvestment plan

Reinvestment plans in fixed deposits allow interest to be compounded and added to the principal at maturity, maximizing returns through cumulative growth, whereas recurring deposits involve regular monthly contributions with interest compounded quarterly, promoting disciplined savings with steady accumulation. Choosing between fixed deposit reinvestment and recurring deposit depends on liquidity needs and investment horizon, as fixed deposits lock funds for a fixed period while recurring deposits offer flexibility with incremental deposits.

Fixed deposit vs Recurring deposit Infographic

moneydif.com

moneydif.com