Qualified savings accounts, such as 401(k)s and IRAs, offer tax advantages like tax-deferred growth or tax-free withdrawals, making them ideal for long-term retirement planning. Non-qualified savings accounts do not have these tax benefits but provide more flexibility with contributions and withdrawals at any time without penalties. Understanding the differences between qualified and non-qualified savings helps individuals optimize their financial strategies based on their goals and tax situations.

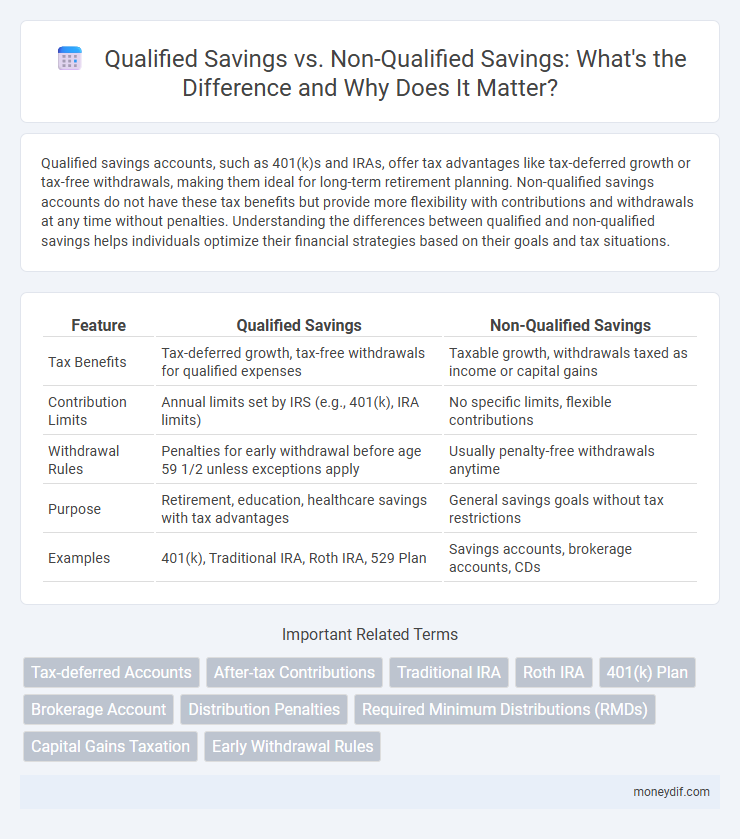

Table of Comparison

| Feature | Qualified Savings | Non-Qualified Savings |

|---|---|---|

| Tax Benefits | Tax-deferred growth, tax-free withdrawals for qualified expenses | Taxable growth, withdrawals taxed as income or capital gains |

| Contribution Limits | Annual limits set by IRS (e.g., 401(k), IRA limits) | No specific limits, flexible contributions |

| Withdrawal Rules | Penalties for early withdrawal before age 59 1/2 unless exceptions apply | Usually penalty-free withdrawals anytime |

| Purpose | Retirement, education, healthcare savings with tax advantages | General savings goals without tax restrictions |

| Examples | 401(k), Traditional IRA, Roth IRA, 529 Plan | Savings accounts, brokerage accounts, CDs |

Understanding Qualified vs Non-Qualified Savings

Qualified savings accounts, such as 401(k)s and IRAs, offer tax advantages like tax-deferred growth or tax-free withdrawals when used for specific purposes, complying with IRS regulations. Non-qualified savings accounts include regular savings or brokerage accounts, where earnings are subject to taxes annually, and withdrawals are not restricted by age or purpose. Understanding the differences helps in optimizing tax benefits and withdrawal flexibility, crucial for effective financial planning.

Key Features of Qualified Savings Accounts

Qualified savings accounts, such as IRAs and 401(k)s, offer tax-deferred growth, allowing investments to compound without immediate tax consequences. Contributions may be tax-deductible depending on the account type and income level, enhancing long-term savings potential. Withdrawals are often subject to specific rules and penalties, but qualified distributions for retirement or other approved uses can be tax-free or taxed at a lower rate.

Key Features of Non-Qualified Savings Accounts

Non-qualified savings accounts offer flexible contributions without annual limits and permit withdrawals at any time without penalties, unlike qualified accounts bound by IRS regulations. Interest earned is subject to ordinary income tax annually, providing no upfront tax advantages or tax-deferred growth. These accounts are ideal for individuals seeking liquidity and investment options beyond retirement-specific constraints.

Tax Advantages of Qualified Savings

Qualified savings plans, such as 401(k)s and IRAs, offer significant tax advantages including tax-deferred growth and potential tax deductions on contributions. Earnings in these accounts are not taxed until withdrawal, allowing investments to compound more efficiently over time. Non-qualified savings lack these benefits, making them subject to immediate income taxes on earnings and no upfront deduction opportunities.

Tax Implications of Non-Qualified Savings

Non-qualified savings accounts are subject to income tax on earnings such as interest, dividends, and capital gains, which can reduce overall returns. Unlike qualified savings plans, contributions to non-qualified accounts are made with after-tax dollars and do not offer tax deferral or tax-free growth benefits. Tax implications also include potential state taxes and the need to report all investment income annually to the IRS, increasing administrative complexity.

Contribution Limits: Qualified vs Non-Qualified

Qualified savings accounts, such as 401(k)s and IRAs, have strict annual contribution limits set by the IRS, with 2024 limits at $23,000 for 401(k) plans including catch-up contributions and $6,500 for IRAs. Non-qualified savings accounts, like regular brokerage or savings accounts, do not have contribution restrictions, allowing unlimited deposits but without the tax advantages of qualified plans. Understanding these contribution limits helps maximize tax benefits while managing savings growth effectively.

Withdrawal Rules and Penalties

Qualified savings accounts, such as 401(k) and IRAs, allow tax-advantaged growth but impose strict withdrawal rules, typically penalizing early withdrawals before age 59 1/2 with a 10% penalty plus income tax. Non-qualified savings accounts have no age restrictions or penalties on withdrawals, providing greater flexibility but lacking tax-deferral or tax-free growth benefits. Understanding the penalties associated with early disbursements in qualified accounts is crucial for optimizing long-term savings strategies.

Choosing the Right Account for Your Goals

Qualified savings accounts, such as IRAs and 401(k)s, offer tax advantages like tax-deferred growth or tax-free withdrawals, making them ideal for long-term retirement planning. Non-qualified savings accounts provide more flexibility with no contribution limits or withdrawal restrictions, suitable for short-term goals or emergency funds. Selecting the right account depends on your financial objectives, time horizon, and tax considerations to maximize growth and access.

Common Examples of Qualified and Non-Qualified Savings

Qualified savings typically include retirement accounts such as 401(k)s, IRAs, and Roth IRAs, which offer tax advantages for long-term retirement planning. Non-qualified savings encompass regular savings accounts, brokerage accounts, and certificates of deposit (CDs), which do not provide special tax benefits but offer more accessible funds. Understanding the distinction between these savings types helps optimize tax efficiency and liquidity based on financial goals.

Comparing Growth Potential and Flexibility

Qualified savings accounts, such as 401(k) plans and IRAs, offer tax-advantaged growth potential with contributions and earnings growing tax-deferred or tax-free, which can significantly enhance long-term wealth accumulation. Non-qualified savings accounts, like regular brokerage or savings accounts, provide greater flexibility with no contribution limits or withdrawal restrictions but lack the tax benefits, resulting in potentially lower net growth. Investors must weigh the trade-off between the disciplined, tax-efficient growth of qualified savings versus the unrestricted access and simpler management of non-qualified savings.

Important Terms

Tax-deferred Accounts

Tax-deferred accounts, such as 401(k) plans and traditional IRAs, allow investments to grow without immediate taxation, providing significant benefits compared to non-qualified savings accounts where earnings are taxed annually. Qualified savings accounts must meet IRS requirements for preferential tax treatment, while non-qualified accounts offer more flexible contributions but lack these specific tax advantages.

After-tax Contributions

After-tax contributions to qualified savings plans, such as 401(k) or Roth IRAs, grow tax-deferred or tax-free depending on the account type, offering potential long-term tax advantages compared to non-qualified savings where earnings are typically taxed annually. Non-qualified savings accounts, like brokerage accounts, allow more flexible access to funds but do not receive the same tax benefits or contribution limits as qualified plans.

Traditional IRA

A Traditional IRA offers tax-deferred growth on contributions, qualifying as a retirement account with pre-tax savings that reduce taxable income. Unlike non-qualified savings accounts, Traditional IRAs have contribution limits and required minimum distributions (RMDs), ensuring qualified funds are used for retirement purposes.

Roth IRA

Roth IRA contributions are made with after-tax dollars, making withdrawals of contributions qualified savings that are tax-free and penalty-free at any time, while earnings become tax-free only if withdrawals meet qualified distribution rules such as age 59 1/2 and a five-year holding period. Non-qualified savings in Roth IRAs refer to earnings withdrawn before meeting these conditions, which may incur taxes and penalties.

401(k) Plan

A 401(k) plan is a qualified savings vehicle offering tax-deferred growth and contribution limits set by the IRS, typically $23,000 for individuals under 50 in 2024, while non-qualified savings accounts do not have such restrictions but lack tax advantages. Qualified savings in a 401(k) also benefit from employer matching and potential tax deductions, contrasting with non-qualified accounts where withdrawals are taxed as regular income without penalties or contribution limits.

Brokerage Account

A brokerage account allows investors to buy and sell securities with funds that can be used for both qualified savings, such as IRAs and 401(k)s that offer tax advantages, and non-qualified savings, which have no special tax status and are subject to capital gains taxes. Managing investments within qualified accounts can optimize tax efficiency and retirement planning, while non-qualified brokerage accounts provide greater flexibility and liquidity without contribution limits.

Distribution Penalties

Distribution penalties apply when withdrawals are made from Non-qualified Savings before age 59 1/2, typically incurring a 10% early withdrawal tax; Qualified Savings accounts such as Roth IRAs or 401(k)s have specific rules that may allow penalty-free distributions if conditions are met. Understanding these differences is crucial for optimizing tax efficiency and avoiding unnecessary penalties on early savings access.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) apply primarily to qualified savings accounts like traditional IRAs and 401(k)s, mandating withdrawals starting at age 73 to avoid penalties. Non-qualified savings accounts, such as regular brokerage accounts, are not subject to RMD rules and allow flexible access to funds without mandatory distribution schedules.

Capital Gains Taxation

Capital Gains Taxation on qualified savings benefits from lower tax rates imposed on long-term investments held in retirement accounts like IRAs and 401(k)s, whereas non-qualified savings face standard capital gains tax rates on short-term and long-term gains depending on the holding period. Qualified savings defer taxes until withdrawal, often at reduced rates, while non-qualified savings incur capital gains taxes annually upon asset sales.

Early Withdrawal Rules

Early withdrawal rules for qualified savings accounts such as 401(k)s and IRAs typically impose penalties and income taxes if funds are accessed before age 59 1/2, unless specific exceptions apply. Non-qualified savings accounts, like standard brokerage or savings accounts, allow penalty-free early withdrawals but may trigger capital gains taxes depending on the investments withdrawn.

Qualified Savings vs Non-qualified Savings Infographic

moneydif.com

moneydif.com