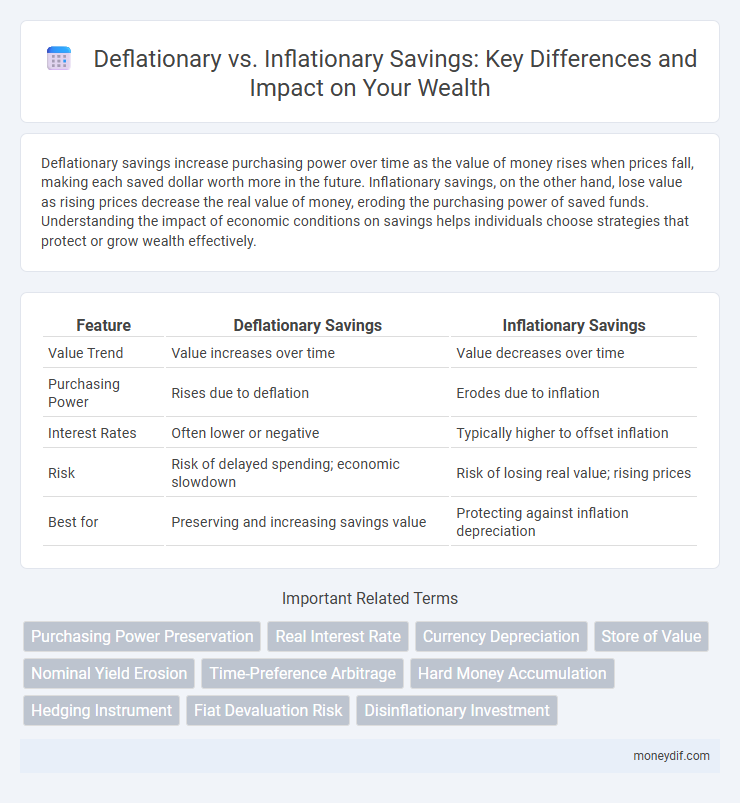

Deflationary savings increase purchasing power over time as the value of money rises when prices fall, making each saved dollar worth more in the future. Inflationary savings, on the other hand, lose value as rising prices decrease the real value of money, eroding the purchasing power of saved funds. Understanding the impact of economic conditions on savings helps individuals choose strategies that protect or grow wealth effectively.

Table of Comparison

| Feature | Deflationary Savings | Inflationary Savings |

|---|---|---|

| Value Trend | Value increases over time | Value decreases over time |

| Purchasing Power | Rises due to deflation | Erodes due to inflation |

| Interest Rates | Often lower or negative | Typically higher to offset inflation |

| Risk | Risk of delayed spending; economic slowdown | Risk of losing real value; rising prices |

| Best for | Preserving and increasing savings value | Protecting against inflation depreciation |

Understanding Deflationary vs Inflationary Savings

Deflationary savings increase in value as prices decline, allowing consumers to purchase more with the same amount of money, while inflationary savings lose purchasing power due to rising prices. Understanding the impact of deflation on savings highlights the benefits of holding cash or fixed income assets during periods of falling prices, whereas inflationary savings require strategies like investment in real assets or inflation-protected securities to preserve value. Monitoring economic indicators such as the Consumer Price Index (CPI) and deflationary trends is essential for optimizing savings growth and maintaining financial stability.

Key Differences Between Deflationary and Inflationary Savings

Deflationary savings increase in real value as prices decline, allowing consumers to purchase more goods over time, while inflationary savings lose purchasing power due to rising prices. Deflationary environments often lead to delayed spending and higher savings rates, contrasting with inflationary conditions where savings diminish unless interest rates outpace inflation. Key differences include the impact on consumer behavior, the real value of saved funds, and the economic implications of fluctuating price levels on purchasing power.

How Inflation Impacts Your Savings

Inflation erodes the purchasing power of your savings by increasing the cost of goods and services over time, leading to a decline in real value if your savings do not grow at the same rate. Deflationary savings benefit from increased purchasing power as prices fall, but risk delayed consumption and economic stagnation. Understanding how inflation impacts interest rates and investment returns is crucial for maintaining the value of your savings portfolio.

The Benefits of Deflationary Savings

Deflationary savings increase purchasing power as the value of money rises over time, allowing savers to buy more goods and services with the same amount of currency. Unlike inflationary savings, where currency value erodes and reduces real wealth, deflationary savings preserve capital by strengthening the currency's worth. This enhances financial security and encourages disciplined saving habits, benefiting long-term wealth accumulation.

Risks and Challenges of Inflationary Savings

Inflationary savings face the risk of eroding purchasing power over time, as rising prices diminish the real value of stored funds. Savers encounter challenges such as reduced returns on fixed-interest accounts and the necessity to seek higher-yield, often riskier investments to outpace inflation. Inflation volatility further complicates financial planning, increasing uncertainty in achieving long-term savings goals.

Strategies for Protecting Savings in an Inflationary Economy

In an inflationary economy, protecting savings requires strategies such as investing in assets with returns exceeding inflation rates, like Treasury Inflation-Protected Securities (TIPS) and real estate. Diversifying into commodities and inflation-indexed bonds helps preserve purchasing power by offsetting the eroding effect of rising prices. Maintaining liquidity for emergency funds while allocating a portion of savings to inflation-resistant vehicles ensures long-term financial stability.

Deflationary Assets: Safe Havens for Savers

Deflationary assets, such as high-quality government bonds and certain cryptocurrencies, serve as safe havens for savers by preserving or increasing purchasing power during periods of falling prices. These assets typically gain value when the general price level declines, counteracting the erosion of savings faced with inflationary environments. Investors prioritize deflationary savings vehicles to protect capital and stabilize real returns amid economic uncertainty and deflationary pressures.

Long-Term Growth: Deflationary vs Inflationary Savings

Deflationary savings preserve purchasing power by increasing the real value of held assets over time, making them ideal for long-term growth amid declining prices. Inflationary savings face erosion of value as rising prices diminish the real returns, necessitating higher nominal gains to maintain equivalent wealth. Strategic allocation in deflationary assets can enhance capital appreciation during prolonged periods of economic contraction.

Historical Performance: Savings in Deflation vs Inflation

Historical performance of savings during deflationary periods reveals increased purchasing power as prices decline, allowing savers to retain or grow their real value. Conversely, inflationary savings face erosion of purchasing power due to rising prices, necessitating higher interest rates to maintain real returns. Data from the Great Depression and Japan's Lost Decade illustrate how deflation benefits cash holders, while the 1970s US inflation era underscores the challenges of preserving savings value amid inflation.

Choosing the Right Savings Approach for Your Financial Goals

Choosing between deflationary and inflationary savings depends on your financial goals and economic environment. Deflationary savings increase in purchasing power as prices fall, ideal for preserving capital in stable or declining markets, while inflationary savings require strategies that outpace rising prices to maintain value. Evaluating factors like interest rates, inflation trends, and risk tolerance ensures the selection of a savings approach that aligns with long-term wealth preservation and growth objectives.

Important Terms

Purchasing Power Preservation

Purchasing power preservation involves maintaining the value of money over time, which becomes challenging during deflationary and inflationary periods. Deflationary savings increase purchasing power as prices fall, whereas inflationary savings erode purchasing power due to rising prices, making investment strategies crucial for long-term financial security.

Real Interest Rate

Real interest rate adjusts nominal interest to inflation, reflecting true purchasing power gains on savings; in deflationary environments, real rates rise as price levels fall, incentivizing savings by increasing future value. Conversely, inflationary savings suffer diminished real returns as rising prices erode the actual value of money saved, making borrowing cheaper and savings less attractive.

Currency Depreciation

Currency depreciation can lead to inflationary savings as the reduced purchasing power encourages spending rather than holding onto money, while deflationary savings increase the real value of money, promoting hoarding and reducing consumption. In deflationary environments, currency appreciation occurs, enhancing savings value but slowing economic activity compared to inflationary periods where depreciation erodes savings but stimulates demand.

Store of Value

Store of Value assets preserve purchasing power over time by resisting inflation's erosive effects, making deflationary savings more attractive as they increase in value relative to fiat currencies. Inflationary savings lose real value as rising prices diminish the worth of held funds, emphasizing the importance of selecting financial instruments that safeguard wealth against currency depreciation.

Nominal Yield Erosion

Nominal yield erosion occurs when deflationary savings erode the real value of returns by reducing nominal interest rates, contrasting with inflationary savings where nominal yields may appear higher but real returns decline due to rising prices. Understanding the impact of deflation on nominal yields highlights the risk of negative real returns even when nominal rates are positive, emphasizing the importance of factoring inflation expectations into savings and investment decisions.

Time-Preference Arbitrage

Time-preference arbitrage exploits the differential between deflationary savings, which increase in real value over time due to purchasing power gains, and inflationary savings, which erode value as prices rise. Investors leverage assets with varying inflation expectations to maximize returns by shifting capital from inflationary environments to deflationary storage options like cryptocurrencies or deflation-linked bonds.

Hard Money Accumulation

Hard money accumulation promotes deflationary savings by preserving purchasing power through assets like gold and cryptocurrencies with limited supply, countering the eroding effects of inflationary savings tied to fiat currencies subject to monetary expansion. This accumulation strategy emphasizes long-term wealth retention, leveraging scarcity and sound money principles to mitigate risks posed by inflation-driven currency devaluation.

Hedging Instrument

Hedging instruments, such as inflation-indexed bonds and deflation swaps, are essential for protecting savings against the risks posed by deflationary and inflationary environments. In deflationary savings scenarios, instruments that gain value as prices fall safeguard purchasing power, while inflationary savings benefit from hedges tied to rising price indices to preserve capital value.

Fiat Devaluation Risk

Fiat currency devaluation risk increases as inflationary savings erode purchasing power, prompting investors to seek assets that preserve value over time. Deflationary savings, by contrast, benefit from increased currency value but can discourage spending and investment, impacting economic growth and financial stability.

Disinflationary Investment

Disinflationary investment strategies focus on asset allocation that preserves capital during periods of falling inflation rates, often balancing deflationary savings--characterized by increased purchasing power and cautious spending--with inflationary savings, which typically involve higher spending and reduced real value of money. Investors prioritize low-risk instruments like government bonds and high-quality fixed income to protect against deflationary pressures while managing exposure to inflation-linked assets to hedge against future inflation spikes.

Deflationary savings vs Inflationary savings Infographic

moneydif.com

moneydif.com