An escrow account is a secure holding place for funds managed by a third party, typically used in real estate or loan transactions to ensure payment obligations are met. A sinking fund, on the other hand, is a reserve fund set aside by a company or individual to gradually repay debt or replace assets over time. Understanding the differences helps savers choose the right method for managing future financial responsibilities and reducing risk.

Table of Comparison

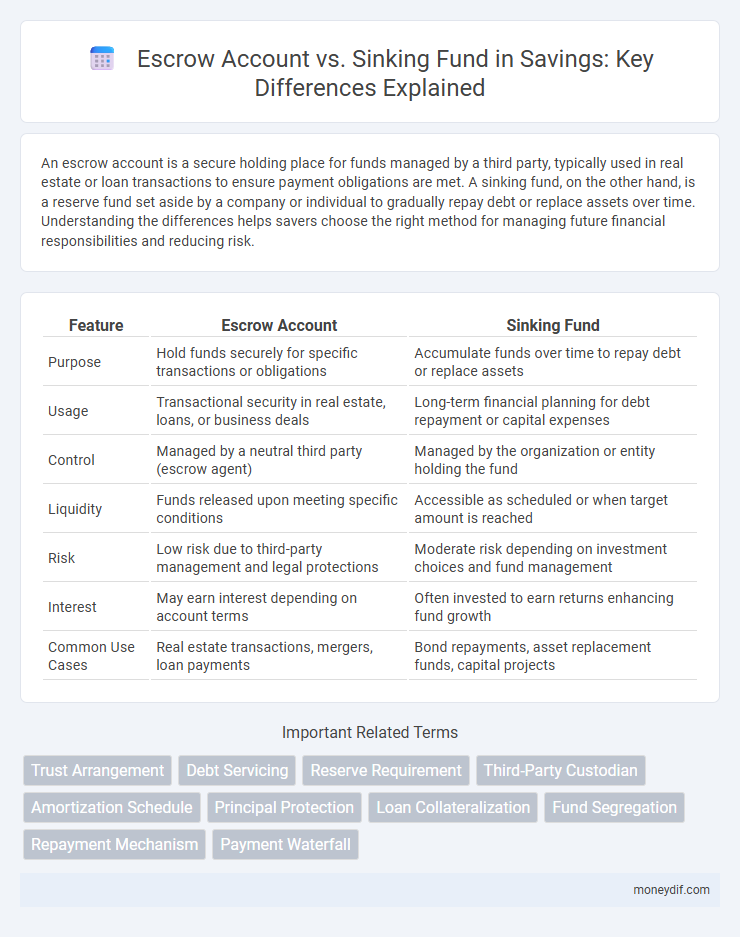

| Feature | Escrow Account | Sinking Fund |

|---|---|---|

| Purpose | Hold funds securely for specific transactions or obligations | Accumulate funds over time to repay debt or replace assets |

| Usage | Transactional security in real estate, loans, or business deals | Long-term financial planning for debt repayment or capital expenses |

| Control | Managed by a neutral third party (escrow agent) | Managed by the organization or entity holding the fund |

| Liquidity | Funds released upon meeting specific conditions | Accessible as scheduled or when target amount is reached |

| Risk | Low risk due to third-party management and legal protections | Moderate risk depending on investment choices and fund management |

| Interest | May earn interest depending on account terms | Often invested to earn returns enhancing fund growth |

| Common Use Cases | Real estate transactions, mergers, loan payments | Bond repayments, asset replacement funds, capital projects |

Understanding Escrow Accounts

An escrow account is a financial arrangement where a third party holds and regulates payment of funds to ensure security during transactions, commonly used in real estate and loan agreements. This account protects both buyers and sellers by holding funds until all contractual conditions are met, reducing risk of default or fraud. Unlike sinking funds, which are reserved for future debt repayment, escrow accounts specifically safeguard transactions by temporarily holding money.

What Is a Sinking Fund?

A sinking fund is a reserve account established by an individual or organization to set aside money over time for a specific future expense or debt repayment. Unlike an escrow account, which holds funds temporarily during a transaction, a sinking fund systematically accumulates savings to ensure sufficient capital is available when needed. This financial strategy helps manage long-term liabilities and reduces the risk of liquidity issues by spreading out contributions evenly.

Key Differences Between Escrow Accounts and Sinking Funds

An escrow account is a third-party-held fund used to secure specific transactions, typically protecting buyers and sellers during real estate deals or loan payments, while a sinking fund is a company-managed reserve set aside to repay debt or replace assets over time. Escrow accounts are conditional and released only when predetermined contract terms are met, offering transactional security, whereas sinking funds are accumulated gradually and managed internally for long-term financial planning and debt management. The main difference lies in escrow's role in transaction assurance versus sinking funds' focus on systematic asset or debt funding.

How Escrow Accounts Work in Savings

Escrow accounts in savings function as secure holding accounts managed by a neutral third party to ensure funds are used specifically for agreed-upon purposes, such as mortgage payments or tax obligations. These accounts help savers allocate money systematically, reducing the risk of mismanagement and providing transparency in financial transactions. Regular contributions to escrow accounts facilitate disciplined saving habits and protect both lenders and borrowers in real estate and other financial agreements.

Purpose and Benefits of Sinking Funds

Sinking funds are specifically designed to set aside money over time for a future expense or debt repayment, enabling better financial planning and reducing the risk of large lump-sum payments. Unlike escrow accounts, which primarily hold funds for third-party transactions or contingencies, sinking funds empower individuals or organizations to accumulate savings systematically for anticipated liabilities. This strategic approach enhances cash flow management and ensures funds are readily available when obligations arise.

When to Use an Escrow Account

Use an escrow account when managing funds that require third-party oversight to ensure contract compliance, such as in real estate transactions or loan payments. Escrow accounts are ideal for securing deposits and disbursing funds only after specific conditions are met, providing protection for both buyers and sellers. This controlled environment reduces risks and ensures transparency in financial agreements.

Ideal Scenarios for Creating a Sinking Fund

A sinking fund is ideal for saving systematically toward future large expenses or debt repayment, allowing for gradual accumulation without financial strain. It works best for planned purchases like home renovations, vehicle replacement, or bond redemption, where predictable periodic contributions ensure sufficient funds when needed. Unlike escrow accounts tied to specific transactions or obligations, sinking funds offer flexibility and control over timing and amount of withdrawals.

Pros and Cons: Escrow Accounts vs Sinking Funds

Escrow accounts offer secure third-party management of funds, ensuring payments are made only when contract conditions are met, which reduces risk but may involve higher fees and limited flexibility. Sinking funds allow for gradual accumulation of savings for future expenses or debt repayment, providing more control and interest-earning potential but requiring disciplined contributions and effective tracking. Choosing between escrow accounts and sinking funds depends on the need for security versus flexibility and control over the saving process.

Saving Strategies: Choosing Between Escrow and Sinking Fund

Escrow accounts and sinking funds serve distinct savings strategies for managing future financial obligations, with escrow accounts holding funds securely for specific transactions such as property taxes or insurance payments. Sinking funds involve setting aside money gradually to pay off debt or large expenses over time, promoting disciplined savings for scheduled liabilities. Choosing between them depends on the predictability of the expense and the need for legal or transactional security versus flexible, long-term saving goals.

Which Option Suits Your Financial Goals?

An escrow account secures funds for specific transactions, ensuring payment safety and legal compliance, ideal for short-term goals like property purchases. A sinking fund accumulates money gradually to pay off long-term debts or replace assets, fitting long-term financial planning and debt management. Assess your timeline, risk tolerance, and purpose to determine whether the controlled disbursement of an escrow or the systematic savings of a sinking fund aligns better with your financial objectives.

Important Terms

Trust Arrangement

Trust arrangements involving escrow accounts ensure the secure holding of funds by a neutral third party until contract conditions are met, providing transactional assurance and reducing counterparty risk. In contrast, sinking funds systematically accumulate capital over time to repay debt or replace assets, emphasizing long-term financial planning rather than immediate transaction security.

Debt Servicing

Debt servicing through an escrow account ensures scheduled payments are automatically collected and disbursed, providing transparency and reducing default risk. In contrast, a sinking fund accumulates reserves over time, allowing borrowers to manage long-term debt repayment strategically while potentially benefiting from interest earnings on accumulated funds.

Reserve Requirement

Reserve requirements dictate the minimum funds a financial institution must hold, often influencing the management of escrow accounts and sinking funds; escrow accounts securely hold funds for specific obligations, while sinking funds are dedicated reserves for debt repayment. Effective reserve management ensures liquidity and financial stability by segregating funds to meet contractual obligations and future liabilities.

Third-Party Custodian

A Third-Party Custodian holds and safeguards assets in an Escrow Account, ensuring secure and neutral management of funds during transactions, while a Sinking Fund is managed internally by a company to systematically set aside money for future debt repayment. Unlike the Escrow Account, which facilitates trust between parties during a deal, the Sinking Fund focuses on long-term financial planning and debt reduction.

Amortization Schedule

An amortization schedule outlines periodic loan repayments showing principal and interest allocation, while an escrow account holds funds for future expenses like taxes and insurance, ensuring timely payments without borrower default risk; a sinking fund differs by accumulating reserves over time specifically for debt repayment or asset replacement. Comparing these, escrow accounts manage ongoing operational costs, and sinking funds focus on long-term liability reduction, both impacting the effective amortization strategy and financial planning.

Principal Protection

Principal protection through an escrow account involves holding funds with a neutral third party to ensure payment security and risk mitigation, whereas a sinking fund accumulates reserves over time to repay debt or replace assets, providing systematic financial planning for principal repayment. Escrow accounts offer immediate principal safeguarding during transactions, while sinking funds focus on long-term financial stability and scheduled principal reduction.

Loan Collateralization

Loan collateralization often involves securing assets through an escrow account or a sinking fund, where an escrow account holds funds managed by a third party to ensure loan repayment, while a sinking fund accumulates resources systematically for eventual debt redemption. The escrow account provides direct collateral control and immediate liquidation capability, whereas the sinking fund offers a structured, long-term repayment strategy reducing default risk.

Fund Segregation

Fund segregation involves separating assets to ensure accountability and legal protection, with escrow accounts holding funds temporarily for specific transactions under third-party management, while sinking funds accumulate reserves systematically over time to repay debt or replace assets. Escrow accounts provide conditional release based on contract terms, whereas sinking funds focus on long-term financial planning and risk mitigation.

Repayment Mechanism

A repayment mechanism through an escrow account ensures funds are securely held and disbursed for debt servicing only when specific conditions are met, enhancing creditor protection. In contrast, a sinking fund accumulates periodic payments over time to repay debt principal or interest, promoting structured financial discipline and reducing refinancing risk.

Payment Waterfall

The payment waterfall allocates cash flows in a predefined order, prioritizing escrow account distributions for specific obligations before directing excess funds to a sinking fund designed for long-term principal repayment. Escrow accounts secure immediate liabilities such as taxes and insurance, while sinking funds accumulate reserves to systematically retire debt over time.

Escrow Account vs Sinking Fund Infographic

moneydif.com

moneydif.com